IFRS, dipifr

Do you know what discounting means? If you are reading this article, then you have already heard this word. And if you haven’t yet fully understood what it is, then this article is for you. Even if you are not going to take the Dipifr exam, but just want to understand this issue, after reading this article, you can clarify for yourself concept of discounting.

This article, in accessible language, talks about What is discounting? It shows the technique of calculating discounted value using simple examples. You will learn what a discount factor is and learn how to use

The concept and formula of discounting in accessible language

To make it easier to explain the concept of discounting, let's start from the other end. Or rather, let’s take an example from life that is familiar to everyone.

Example 1. Imagine that you went to the bank and decided to make a deposit of $1,000. Your 1000 dollars deposited in the bank today, at a bank rate of 10%, will be worth 1100 dollars tomorrow: the current 1000 dollars + interest on the deposit 100 (= 1000 * 10%). In total, after a year you will be able to withdraw $1,100. If we express this result through a simple mathematical formula, we get: $1000*(1+10%) or $1000*(1.10) = $1100.

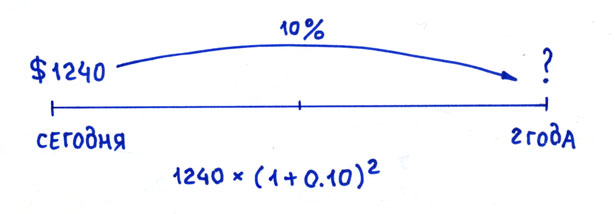

In two years, the current $1,000 will become $1,210 ($1,000 plus first year interest $100 plus second year interest $110=1100*10%). The general formula for increasing the contribution over two years: (1000*1.10)*1.10 = 1210

Over time, the amount of the contribution will continue to grow. To find out what amount is due to you from the bank in a year, two, etc., you need to multiply the deposit amount by the multiplier: (1+R) n

- where R is the interest rate, expressed in fractions of a unit (10% = 0.1)

- N – number of years

In this example, 1000 * (1.10) 2 = 1210. It is obvious from the formula (and from life too) that the deposit amount after two years depends on the bank interest rate. The larger it is, the faster the contribution grows. If the bank interest rate were different, for example, 12%, then after two years you would be able to withdraw approximately $1,250 from the deposit, and if we calculate more precisely, 1,000 * (1.12) 2 = 1,254.4

In this way, you can calculate the amount of your contribution at any point in time in the future. Calculating the future value of money in English is called “compounding”. This term is translated into Russian as “extension” or by tracing paper from English as “compounding”. Personally, I prefer the translation of this word as “increment” or “increase”.

The meaning is clear - over time, the cash deposit increases due to the increment (growth) of annual interest. In fact, the entire banking system of the modern (capitalist) model of the world order, in which time is money, is built on this.

Now let's look at this example from the other end. Let's say you need to repay a debt to your friend, namely: in two years you need to pay him $1210. Instead, you can give him $1,000 today, and your friend will deposit this amount in the bank at an annual rate of 10% and in two years withdraw exactly the required amount of $1,210 from the bank deposit. That is, these two cash flows: $1000 today and $1210 in two years - equivalent each other. It doesn't matter what your friend chooses - these are two equal possibilities.

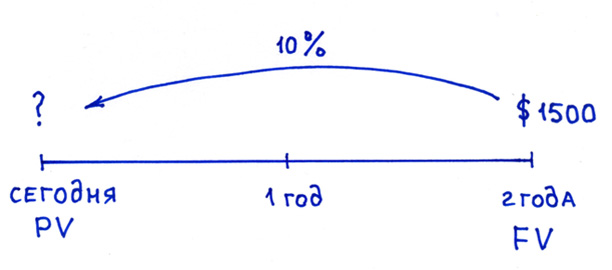

EXAMPLE 2. Let's say in two years you need to make a payment in the amount of $1,500. What will this amount be worth today?

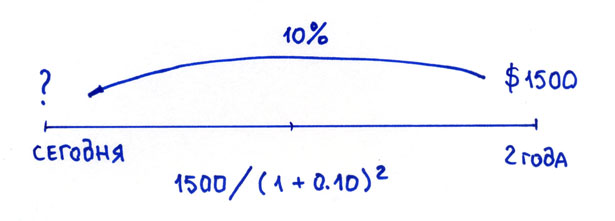

To calculate today's value, you need to go from the opposite: $1500 divided by (1.10)2, which will be equal to approximately $1240. This process is called discounting.

To calculate today's value, you need to go from the opposite: $1500 divided by (1.10)2, which will be equal to approximately $1240. This process is called discounting.

In simple terms, then discounting is determining the present value of a future amount of money (or more correctly, a future cash flow).

If you want to find out how much a sum of money you either receive or plan to spend in the future will cost today, then you need to discount that future amount at a given interest rate. This bet is called "discount rate". In the last example, the discount rate is 10%, $1,500 is the amount of payment (cash outflow) in 2 years, and $1,240 is the so-called discounted value future cash flow. In English, there are special terms to denote today's (discounted) and future value: future value (FV) and present value (PV). In the example above, $1500 is the future value of FV and $1240 is the present value of PV.

When we discount, we go from the future to today.

Discounting

When we build up, we move from today to the future.

Extension

The formula for calculating the present value or discounting formula for this example is: 1500 * 1/(1+R) n = 1240.

In general, the mathematical formula will be: FV * 1/(1+R) n = PV. It is usually written like this:

PV = FV * 1/(1+R) n

Coefficient by which future value is multiplied 1/(1+R)n called a discount factor from the English word factor meaning “coefficient, multiplier”.

In this discounting formula: R is the interest rate, N is the number of years from a date in the future to the current moment.

Thus:

- Compounding or Increment is when you go from today's date to the future.

- Discounting or Discounting is when you go from the future to today.

Both “procedures” allow us to take into account the effect of changes in the value of money over time.

Of course, all these mathematical formulas immediately make the average person feel sad, but the main thing is to remember the essence. Discounting is when you want to know the present value of a future amount of money (that you will need to spend or receive).

I hope that now that you have heard the phrase “concept of discounting,” you can explain to anyone what is meant by this term.

Is present value the discounted value?

In the previous section we found out that

Discounting is the determination of the present value of future cash flows.

Isn’t it true that in the word “discounting” you hear the word “discount” or discount in Russian? And indeed, if you look at the etymology of the word discount, then already in the 17th century it was used in the meaning of “deduction for early payment,” which means “discount for early payment.” Even then, many years ago, people took into account the time value of money. Thus, one more definition can be given: discounting is the calculation of a discount for prompt payment of bills. This “discount” is a measure of the time value of money.

Discounted value is the present value of the future cash flow (i.e., the future payment minus the “discount” for prompt payment). It is also called present value, from the verb “to bring.” In simple words, present value is future amount of money given to the current moment.

To be precise, discounted and present value are not absolute synonyms. Because you can bring not only the future value to the current moment, but also the current value to some point in the future. For example, in the very first example, we can say that $1,000 discounted to the future (two years from now) at a 10% interest rate is equal to $1,210. That is, I want to say that present value is a broader concept than discounted value.

By the way, in English there is no such term (present value). This is our, purely Russian invention. In English there is the term present value (current value) and discounted cash flows (discounted cash flows). And we have the term present value, and it is most often used in the sense of “discounted” value.

Discount table

I already mentioned a little higher discounting formula PV = FV * 1/(1+R) n, which can be described in words as:

Present value equals future value multiplied by a factor called the discount factor.

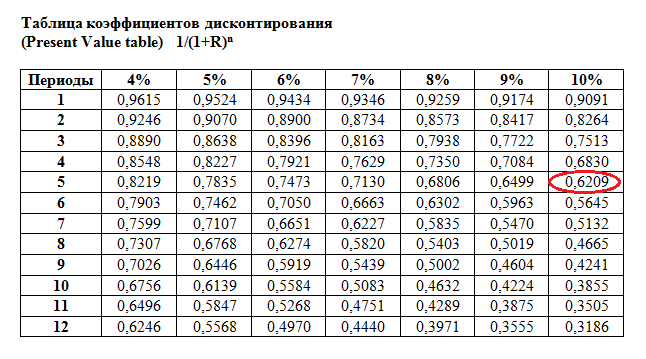

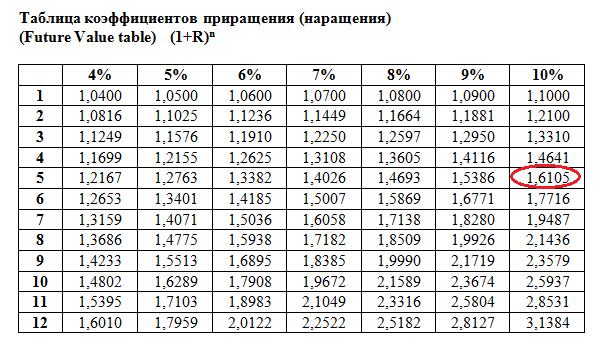

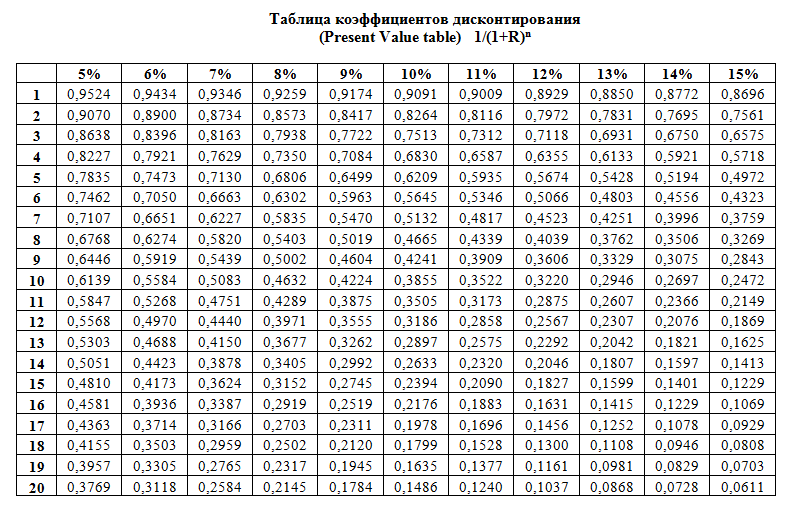

The discount factor 1/(1+R) n, as can be seen from the formula itself, depends on the interest rate and the number of time periods. In order not to calculate it each time using the discounting formula, use a table showing the values of the coefficient depending on the percentage of the rate and the number of time periods. It is sometimes called a "discount table", although this is not the correct term. This discount factor table, which are calculated, as a rule, accurate to the fourth decimal place.

Using this table of discount factors is very simple: if you know the discount rate and the number of periods, for example, 10% and 5 years, then at the intersection of the corresponding columns you will find the coefficient you need.

Example 3. Let's look at a simple example. Let's say you need to choose between two options:

- A) get $100,000 today

- B) or $150,000 in one amount exactly in 5 years

What to choose?

If you know that the bank rate on 5-year deposits is 10%, then you can easily calculate what the amount of $150,000 due in 5 years is equal to today.

The corresponding discount factor in the table is 0.6209 (the cell at the intersection of the 5 years row and the 10% column). 0.6209 means that 62.09 cents received today equals $1 received in 5 years (at 10% interest). Simple proportion:

So $150,000*0.6209 = 93.135.

93,135 is the discounted (present) value of the amount of $150,000 to be received in 5 years.

It's less than $100,000 today. In this case, a bird in the hand is really better than a pie in the sky. If we take $100,000 today and put it on deposit in a bank at 10% per annum, then in 5 years we will receive: 100,000*1.10*1.10*1.10*1.10*1.10 = 100,000*( 1.10) 5 = $161,050. This is a more profitable option.

To simplify this calculation (calculating future value given today's value), you can also use a coefficient table. By analogy with the discount table, this table can be called a table of increment (accretion) factors. You can build such a table yourself in Excel if you use the formula to calculate the increment factor: (1+R)n.

From this table it can be seen that $1 today at a rate of 10% will cost $1.6105 in 5 years.

From this table it can be seen that $1 today at a rate of 10% will cost $1.6105 in 5 years.

Using such a table, it will be easy to calculate how much money you need to put in the bank today if you want to receive a certain amount in the future (without replenishing the deposit). A slightly more complicated situation arises when you not only want to deposit money today, but also intend to add a certain amount to your deposit every year. How to calculate this, read the next article. It is called annuity formula.

A philosophical digression for those who have read this far

Discounting is based on the famous postulate "time is money". If you think about it, this illustration has a very deep meaning. Plant an apple tree today and in a few years your apple tree will grow and you will be picking apples for years to come. And if you don’t plant an apple tree today, then in the future you will never try apples.

All we need is to decide: to plant a tree, start our own business, take the path leading to the fulfillment of our dreams. The sooner we begin to act, the greater the harvest we will get at the end of the journey. We need to turn the time we have in our lives into results.

“The seeds of flowers that will bloom tomorrow are planted today.” That's what the Chinese say.

If you dream about something, don't listen to those who discourage you or question your future success. Don't wait for a lucky coincidence of circumstances, start as early as possible. Turn the time of your life into results.

Large table of discount rates (opens in a new window):

Investing means investing free financial resources today in order to obtain stable cash flows in the future. How not to make a mistake and not only return the invested funds, but also get a profit from the investment?

This article provides not only the formula and definition of IRR, but there are examples of calculations of this indicator (in Excel, graphical) and interpretation of the results obtained. Two examples from life that every person encounters

At its core, the discount rate when analyzing investment projects is the interest rate at which the investor attracts financing. How to calculate it?

Discounted payback period

Discounted payback period Methodological aspects of project management

Methodological aspects of project management Scrum development methodology

Scrum development methodology