Construction budgeting as a management tool

In a changing market, the issues of effective management of company resources are being raised more and more acutely.

Management of a package of investment projects is the main task facing the business of construction and development companies in Moscow and other large cities of the Russian Federation. Budgeting in construction is a necessary control over the effectiveness of projects. We need to get rid of or freeze ineffective projects, diversify existing ones. To make the right decision, you need a system that allows you to carry out a multivariate analysis of the situation. For construction companies, a complex organizational structure is natural, and the cost estimate requires a legal basis for pricing. This fact significantly complicates the collection of initial data. Therefore, the first place is the question of developing a budgetary model, which includes the organizational structure of the company, the structure of planning analysts, regulations for the formation of budgets and processing of primary information.

The question arises in the choice of a software product that could ensure the functioning of a complex budget model in the conditions of vertically integrated companies. It is clear that the budget of a construction organization in Excel is unrealistic, since the functionality of the product for these purposes is simply not enough. Excel works well for small companies, simple projects with a limited set of analytical cuts.

The consolidation of these diverse projects into one consolidated budget generally turns into a non-trivial task with a poorly predictable result. The same can be said about trying to link data from different diverse systems into one. The degree of detail is lost, the volume of manual adjustments increases, which undoubtedly leads to a decrease in the reliability of the data, and, as a consequence, to a loss of control.

It is necessary to create a system for budgeting in construction, which would allow consolidating project data into a single multidimensional model, and provide multivariate analysis capabilities when generating reports. At the same time, any, even the most effective planning tool is only half of the business management system. To make managerial decisions, a system is needed that would make it possible to quickly compare planned indicators with actual data, enabling management to make decisions on business management in a timely manner.

The project budget in development should be strictly linked to the work schedule, contracts, estimate documentation. At the same time, when analyzing the profitability of the project, it is necessary to take into account the general economic part of the costs, which affects the final financial result of the company.

Budgeting, as a management tool in construction, assumes that budgeting begins with drawing up a company's business plan. The planning horizon, due to the specifics of the business in this area, cannot be short-term. The optimal planning horizon is 3-5 years. At the first stage, both budgets for existing and new projects are formed.

First, planning is done in physical terms, then they are assessed and the financial indicators of the project are formed. Planning is carried out in the context of planning items. The sum indicators for these items are the limits for the expenditure of funds in the project budget.

Based on the budget data of each project, a planned schedule for the development of project costs is formed. This schedule, in its essence, is a project schedule, which allows, among other things, to plan the loading of resources on the project. Is it possible to build a payment schedule based on this information? - most likely not, since the payment schedule primarily depends on the terms of mutual settlements with counterparties.

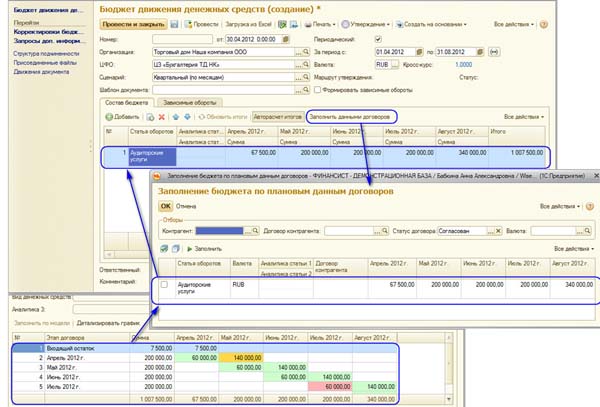

On the other hand, by registering in the system the terms of settlements under contracts with counterparties and linking these calculations with work by stages of the work schedule, it is possible to form a planned cash flow budget, which cannot but interest investors. This interconnection will make it possible to effectively control both the execution of work and plan the expenditure of funds. In fact, the formation of a planned cash flow budget is the second stage of planning.

The third stage is the stage of mastering the budget. At the same time, it is important to control that all costs incurred are recorded in the project planning system. At this stage, it is very important to correctly assign the work to the corresponding work on the project schedule. At this stage, a plan-fact analysis is carried out and managerial adjustments to the company's activities are formed.

Budgeting in a design or construction organization has its own specifics. For companies conducting several projects at the same time in Moscow or other regions of Russia, as a rule, difficulties arise with the correct attribution of general economic costs to specific projects. The problem arises of choosing the method by which the distribution will be made. There is no universal formula, but the most effective approach is to separate the economic indicators of projects separately from general business costs (direct costing). At the same time, general operating costs do not affect the profitability of the project, but are used to calculate economic indicators for the company as a whole. Accordingly, economic indicators are divided into:

- profitability on projects - used to make key decisions on projects.

- profitability of the company - used to manage the company as a whole.

The advantages of this approach are that the economic indicators of projects are not distorted by the amount of fixed costs and the methodology for their distribution among projects. Decisions on projects will be more balanced and cost control will be more efficient.

One of the drawbacks is the requirement that the owners of a company implementing several investment projects determine a set of planned profitability indicators for projects that would cover current fixed costs and provide profit in the expected volume.

Such approaches to the formation of budgets allow you to analyze the project at any stage of its implementation, as well as reduce risks. It becomes possible for a manager to make economically balanced management decisions, including a timely exit from a deliberately unprofitable project.

Discounted payback period

Discounted payback period Methodological aspects of project management

Methodological aspects of project management Scrum development methodology

Scrum development methodology