Investment dynamics is a significant economic category. Its change and characteristics

They serve as the main driving force that directly affects the increase in production volumes, economic viability. And on a national scale, the state of the investment sphere determines the pace of economic and social development of the country, the technical level of production and its efficiency, competitiveness in world markets, and as a result, the qualitative characteristics of the standard of living of the population. And the investment made in the production of consumer goods, the construction of housing and social and cultural facilities, directly affects the living conditions of the population.

In the Soviet state, when the planned economy reigned, five-year plans and long-term economic development programs regulated the investment process. Modern conditions dictate a broader interpretation of this concept:

"cash, securities, other property, including property rights, other rights having a monetary value, invested in objects of entrepreneurial and (or) other activities in order to make a profit and (or) achieve another beneficial effect" (No. 39- Federal Law of February 25, 1999)

It should be noted that in Russia capital investments invariably remain an important area of investment activity. Investments in fixed assets in Russia represent costs aimed at:

- New construction;

- expansion, reconstruction and technical re-equipment of existing enterprises;

- purchase of machinery, equipment, tools, inventory;

- design and survey work and other costs.

The system of indicators characterizing investments in fixed assets is formed based on the results of current continuous and selective federal statistical observations, as well as a selective survey of the investment activity of organizations engaged in mining, manufacturing, production and distribution of electricity, gas and water. The last one was carried out by Rosstat on October 1, 2016. It was aimed at obtaining as a result information on the investment activity of enterprises and organizations in 2016 and the investment intentions of entrepreneurs for 2017. Respondents were 9.9 thousand organizations that are not small businesses, and 3.9 thousand small businesses. And its results are extended to the entire set of units of statistical observation.

Investments in dynamics

The dynamics of investments serves as a litmus test for investors and various participants in an investment project, clearly showing how promising its further development becomes. It is influenced by various factors. The stable economic growth of the country influences the dynamics, no doubt, positively and guarantees the growth of investments. When the economy grows steadily, without strong fluctuations, the dynamics of investment gradually increases, being a reflection of the general economic situation. The economic crisis invariably entails a decrease in the volume of invested funds and an inevitable drop in dynamics.

Since 1987, when perestroika began in the USSR and some regulations were adopted, opportunities have opened up for an influx of foreign direct investment. Until 2008, there was an increase in investment investments in actual prices. An analysis of investments in fixed capital in comparable prices (adjusted for inflation) shows that real growth has been outlined only since 1999, when the figure varied from 105.3 to 123.8%. A new drop in volumes due to the crisis of 2008-2009. (more about the crisis and its consequences ), occurred in 2009, both in actual and comparable prices. A decrease in investment volumes in comparable prices has also been observed over the past three years.

“Indices of the physical volume of investments in fixed assets are calculated in comparable prices. Average annual prices of the previous year are taken as comparable. Revaluation to the average annual prices of the previous year is carried out with the help of average annual deflator indices.

Source: Rosstat

Today, fixed capital investment accounts for one fifth of the country's gross domestic product (GDP). At the end of 2016, 14,639.8 billion rubles were invested in the country's economy, which is 20.4% of GDP.

Source: Rosstat

More than 80% of the total volume of investments is mastered by organizations of the Russian form of ownership, mostly private. Of the 12,192 billion rubles disbursed by them in 2016, 8,244.0 billion, or 67.6%, went to private enterprises. According to the results of 2016, the share of foreign and joint ventures is 9.2%.

| Total, billion rubles | including property |

|||

|---|---|---|---|---|

| Russian | foreign | joint Russian and foreign |

||

Source: Rosstat

Specific structure of investments

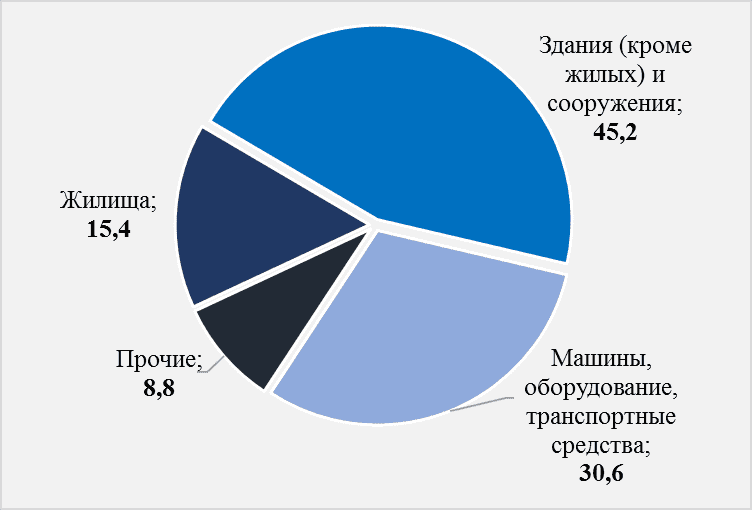

In the structure of investments in fixed capital, the largest share falls on buildings and structures, in recent years it has increased from 43.3% in 2011 to 45.2% in 2016. Almost a third of investments are directed to machinery, equipment and vehicles (30.6% ), in 2011 they were at the level of 37.9%.

Source: Rosstat

Based on sample survey new domestic machines and equipment were purchased by 84% of organizations, imported - 32%. In the secondary market, cars and equipment of domestic production were purchased by 18% of organizations, imported - 5%.

Basically, these were vehicles, complexes and technological lines, separate installations of technological equipment and electronic computers.

Of the total number of surveyed organizations, 16% made their acquisitions on the terms of financial leasing.

Direction of investments in fixed assets

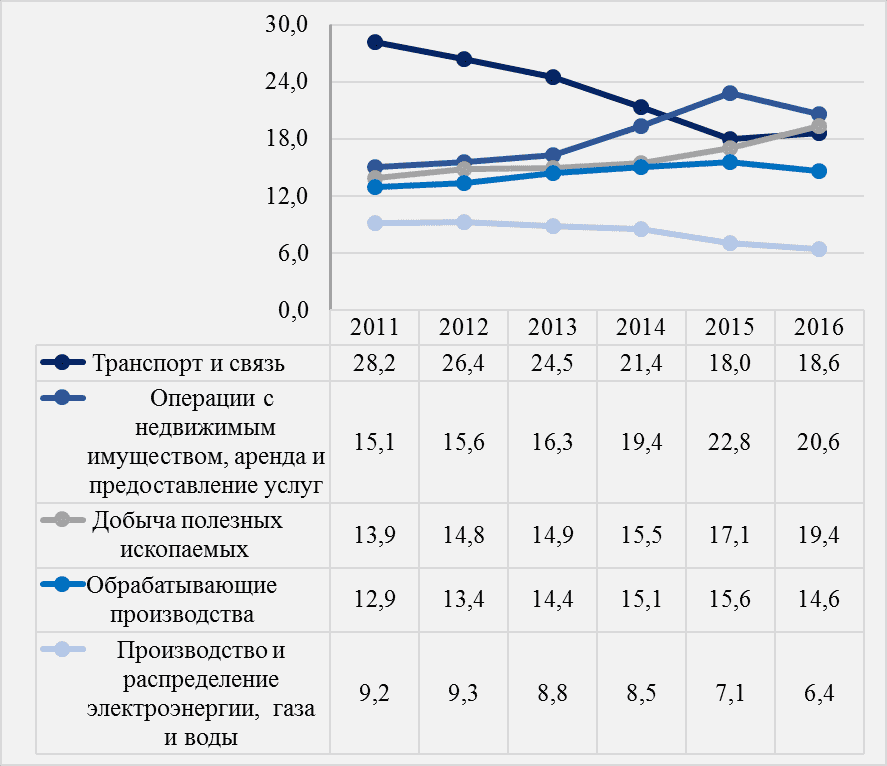

Almost 80% of investments are directed to the development of such activities as real estate transactions, rent and provision of services, mining, transport and communications, manufacturing, and the production and distribution of electricity, gas and water. And this ratio has been maintained over the past few years.

Source: Rosstat

Compared to 2011, investments in fixed assets in comparable prices in such activities as

- production of medical products, measuring instruments, control, management and testing; optical instruments, photo and film equipment; hours;

- production of office equipment and computer technology;

- chemical production.

“The distribution of investments in fixed capital by type of economic activity is carried out in accordance with the OKVED classifier based on the purpose of fixed assets, i.e. the area of activity in which they will operate.”

| 2016 in % to 2011 |

|

|---|---|

| Production of medical products, measuring instruments, control, management and testing; optical instruments, photo and film equipment; hours | |

| Manufacture of office equipment and computer equipment | |

| Chemical production | |

| Operations with real estate | |

| Extraction of crude oil and natural gas; provision of services in these areas | |

| Scientific research and development | |

| Retail trade, except for motor vehicles and motorcycles; repair of household and personal items | |

| Wholesale trade, including trade through agents, except for trade in motor vehicles and motorcycles | |

| Fishing, fish farming |

Source: Rosstat

Investment financing sources

"Calculation of investments in fixed capital by sources of financing is carried out by Rosstat without small businesses and the volume of investments that are not observed by direct statistical methods."

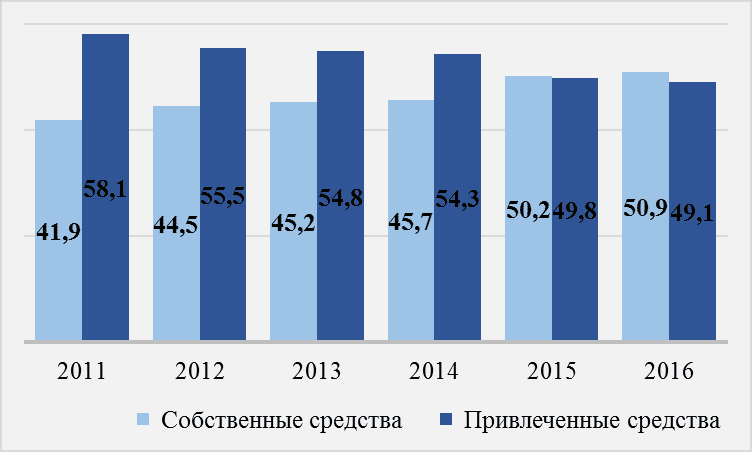

If back in 2011 the use of investment investments occurred to a greater extent at the expense of attracted sources, then by the end of 2016 the situation has changed and the own funds of organizations come to the fore. Today their share is 50.9%.

Source: Rosstat

This is in terms of money.

Discounted payback period

Discounted payback period Methodological aspects of project management

Methodological aspects of project management Scrum Development Methodology

Scrum Development Methodology