What is a discount factor and how to calculate it

The most important step on the way to your own business is the development of a business plan. Being a guide to action aimed at achieving economic benefits, the business plan necessarily contains an expense item in which financial managers recommend including a discount rate.

But as practice shows, many novice entrepreneurs not only avoid using this parameter, but are also unaware of its existence.

What is a discount factor, how to calculate this indicator and what explains the need for its presence in a business plan?

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to know how to solve exactly your problem - contact the online consultant form on the left or call

8 (499) 350-44-96

It's fast and free!

concept

Entrepreneurs who plan to develop their business and move towards the financial well-being of the enterprise should master the concept of "discount factor".

What it is? In the language of financial analysis, this term refers to bringing the company's future earnings to their present value.

The reduction process itself is called “discounting” in economics, and the rate used to calculate the indicator is called the discount rate.

Today, this indicator has been used in almost every field of economics and finance. It can be easily used to determine the effectiveness of a business project, it is able to predict the financial success of a particular organization.

When developing a cost line in a business plan, it is difficult to do without a discount factor, as it will help you calculate the necessary capital investment or choose an alternative option to avoid unnecessary expenses.

Calculation

To determine the value of cash flows in the future, it is necessary to multiply the amount of expected receipts by the discount factor. How to find this indicator?

To calculate the discount, use the following formula:

Kd=1/(1+i)n;

Where n is the time during which it is planned to make a profit.

The value i denotes the discount rate. It is also known as the "discount rate". This is a variable indicator that depends on many factors. The rate is a percentage that expresses the return on investment.

Each individual case has its own interest rate.. So, as a given value, the refinancing rate, the percentage of return on the deposit, inflation, the loan interest rate, the estimated profitability of the project, and so on can be used.

In the course of calculations, the result is always less than one. The discount factor shows how much one unit of currency from a certain period of time is worth, given to the current date.

Discount rate

In the process of calculating the discount factor, one of the most important tasks is the calculation of the discount rate, since the final assessment of the profitability of the investment project depends on this.

The rate itself is an object of interest for the investor, because from the point of view of profitability, an investment with a higher discount rate should attract him more than any other with similar risk factors.

To make discounting, it is necessary to carry out the calculation according to this coefficient formula.

It is worth considering the fact that the rate reflects the level of return on investments, taking into account certain risks, as well as time costs. What does the discount rate include:

- rising inflation;

- indicator reflecting the level of investment risk;

- the minimum rate of return that an investor can expect in any case.

As already mentioned, various rates are used to calculate the discount rate, the choice of which depends on the given situation. The interest on deposits or the rate of return on bonds is just the basis, the “risk-free rate”, which is taken to be adjusted for some risks and time factors.

The formula for calculating the discount rate:

Discount rate = risk-free rate + risks

Various factors are taken as risks, under the influence of which the investment of funds in a particular project becomes unsafe. This list includes:

Risks of illiquidity of a new project:

- risks specific to any industry;

- personnel errors;

- country-specific issues.

The more accurately the discount rate is determined, the more likely it is to get the desired return on the project.

Calculation example

For greater clarity and a better understanding of the concept of "discount factor", it is worth giving an example of calculating the indicator using the formula.

Suppose an investor plans to receive from any investment an amount of $ 100,000 in 5 years. What is this amount equal to today?

To perform discounting, it is necessary to calculate according to the formula Kd=1/(1+i)n. If we take a discount rate of 10%, we can get the following value: kd=1(1+10%)5=0.6209. This means that one dollar of the estimated amount in five years, given to the current date, is equal to 62.09 cents.

Therefore, $100,000 in five years is $62,090 today at 10%. In other words, $62,090 is the present value of $100,000.

Table

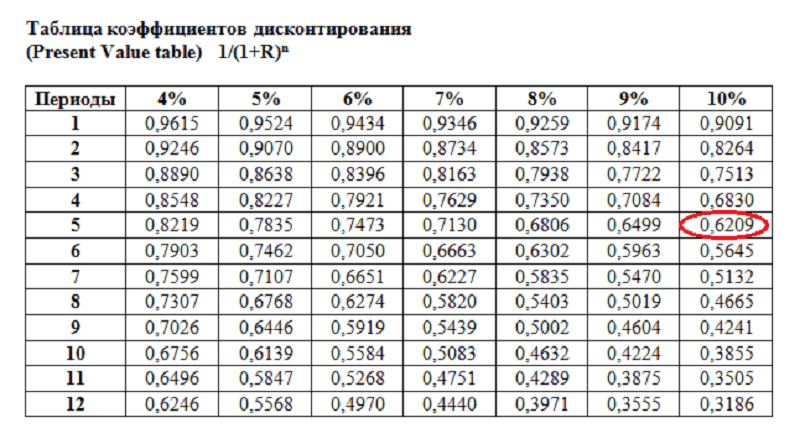

Based on the formula for calculating the coefficient, we can conclude that its value depends on the number of periods and the discount rate. To save time and not to calculate the discount every time, it is customary to use the so-called discount factor table.

The table gives data with an accuracy of ten thousandths.

Using it is quite simple - you just need to know the original discount rate and the estimated period for calculation. The desired discount value can be found at the intersection of the columns of these values.

The principle of using the table easy to understand with an example. Suppose an investor has a choice:

- Get 12,000 euros today.

- Get 15,000 euros in 3 years.

The calculation of the discount according to the table will help you make the right choice. To do this, you need to find out what the amount of 15,000 euros receivable in 3 years equals to the current date. To make calculations, you will have to find out the average interest on bank foreign currency deposits issued for a 3-year period.

If we assume that the deposit rate is 10%, we can determine the discount factor:

X \u003d 0.7513 * 15000 / 1 \u003d 11269.5 euros. This amount is the present value of the €15,000 receivable in 3 years. That is, 15,000 euros given on the current date is cheaper than the amount of 12,000 euros taken today. Accordingly, the investor from the task should use the first offer.

By analogy with the discount table, you can use increment table. It works just the opposite - it shows the nominal value of current income in the future period.

Advantages and disadvantages of discount

The benefit of determining the discount factor is obvious: the indicator translates the value of future cash flows into the present moment and helps to assess the degree of risk.

At the same time, the coefficient has some disadvantages:

- difficulty in forecasting investment projects;

- inability to take into account external factors, such as adverse weather conditions.

Despite the identified shortcomings, the discount factor is an indispensable way to assess the attractiveness of a business idea.

Discounted payback period

Discounted payback period Methodological aspects of project management

Methodological aspects of project management Scrum Development Methodology

Scrum Development Methodology