Drawing up an investment business plan

Investment business plan. Development and execution of an investment business plan

It is an integral part of business planning as a continuous process of organization development. An investment business plan or project is a documented manifestation of an investment initiative of an economic entity, which provides for the investment of capital in a specific object of real investment, aimed at the implementation of certain investment goals determined in time and obtaining planned specific results.

In this case, the main source of capital is an external investor who is unfamiliar with the enterprise or the proposed investment idea and requires a high level of detail of the issues of interest to him.

The investment business plan is used for lending needs and is submitted to the bank for consideration by the credit committee as confirmation of the economic feasibility of the project,

issued by professional consultants.

An investment (or credit) business plan in itself is not a guarantee of obtaining borrowed funds, since the bank still credits the project, and not the document describing it. In such a business plan, issues of interest to the bank are disclosed in detail: a financial plan, a qualitative analysis of risks, a calculation of the project's profitability, and its integral indicators. Currently, no bank will accept a project for consideration if a business plan that meets the standards adopted in Russian credit institutions is not attached to the borrower's package of documents.

The need to develop an investment business plan by Russian enterprises was caused by a number of reasons:

■ adaptation of foreign experience in the development of investment projects to domestic conditions. This determined the mandatory typing of the methodology and documentation used in the business area;

■ the use of personal computers, which determined the need and possibility of creating software for the development and analysis of investment projects. Commercial and standard functional programs, as well as programs prepared by the project developers themselves, are used in many calculations;

■ evaluation of the business plan by the owners of financial resources or their borrowers and lenders in terms of return on investment and profit or other positive effect.

The business plan evaluates the prospective situation both inside and outside of it. It is the most compact document that allows the entrepreneur not only to make an informed decision, but also to indicate what and when should be done in order to meet the expectations regarding the effectiveness of the project. The approval and viability of the project depends on the correctness of the document. A business plan answers the questions: is the idea really that good; Who is the target audience for the new product/service? will this product (service) find a buyer; who will you have to compete with?

For medium-term and long-term projects, the development of business plans is a central stage in investment planning. Its main content is the formation of the main components of the project and its preparation for implementation. The main content of this stage includes the following types of work:

■ development of the concept and further development of the main content of the project (resources - limitations - result);

■ establishing business contacts and in-depth study of the participants' goals;

■ structural planning;

■ organization and conduct of tenders, conclusion of contracts with key contractors;

■ Obtaining approval to continue work.

For short-term small-scale or local projects that do not require significant costs and very short implementation periods, the business plan combines all the stages and work performed in the pre-investment phase.

To develop a development strategy for a large enterprise, a corporate (global) business plan is drawn up.

When developing a business plan, you must first decide: what is the purpose of developing a business plan. These goals may be:

■ to understand for themselves the degree of reality of achieving the indicated results in the completed project or technical condition;

■ convince colleagues of the reality of achieving certain qualitative or quantitative indicators of the proposed project;

■ prepare public opinion for corporatization of the enterprise according to the proposed scheme, which the authors consider optimal;

■ prove to a certain circle of people the expediency of restructuring work and reorganizing an existing or creating a new enterprise;

■ attract attention and increase the interest of a potential investor.

Enterprises operating in a stable situation and producing a product for a sufficiently stable market develop a business plan aimed at improving production and finding ways to reduce costs. These enterprises constantly provide for measures to modernize their products and draw them up in the form of local business plans.

Venture capital firms that manufacture high-risk products systematically work on business plans for the development of new types of products, the transition to technologies, and the so-called.

If an enterprise, having outlined a significant increase in the production of traditional products or the development of new technology, does not have sufficient capacities for their production, then it can go by attracting capital investments or searching for new partners.

In this case, the business plan is used when looking for investors, creditors, sponsorship investments. To do this, a one- or two-page business plan summary can be prepared, which allows investors, lenders and other partners to see the important features and benefits of the project. This document is called a business proposal. It is used in negotiations with potential investors and future partners.

Drawing up an investment business plan

The business plan must be presented in a form that allows the interested person to get a clear idea of the essence of the case and the degree of interest in his participation in it. The volume and degree of specification of the sections of the plan are determined by the specifics and scope of the enterprise. It should be written simply and clearly and have a clear structure, such as the one recommended by the Russian Ministry of Economic Development:

1. Introduction.

2. Overview of the state of the industry (production) to which the enterprise belongs.

3. Description of the project.

4. Production plan for the implementation of the project.

5. Plan for marketing and sales of products.

6. Organizational plan for the implementation of the project.

7. Financial plan for the implementation of the project.

8. Evaluation of the economic efficiency of costs incurred during the implementation of the project.

Let's take a closer look at the contents of each section. The introductory part of the business plan includes:

■ title page;

■ summary;

■ confidentiality memorandum.

The title page contains the name of the enterprise - the initiator of the project, the name of the project, the place and time of its development.

The summary is a summary of the essence of the investment project. This is a document that reveals all the attractiveness and the need for the implementation of a particular goal. It should be short and arouse the interest of the reader. The summary is compiled last, as it summarizes all the information contained in the project. The summary provides data that should allow a potential investor to understand what is at stake, what is the estimated cost and profitability of the project.

The confidentiality memorandum is drawn up in order to warn those who get acquainted with the business plan of the confidentiality of the information contained therein. The memorandum may contain a reminder that the reader assumes responsibility and guarantees non-disclosure of the information contained in the plan without the prior consent of the author. The memorandum may contain requests for the return of the business plan and a prohibition on copying the material.

Development of an investment business plan

Now let's proceed directly to the development of an investment business plan, it should begin with an overview of the state of the industry (production) to which the enterprise belongs, designed to solve two main tasks:

1) study the state and development trends of the industry as an investment object;

2) to carry out a forecast of the volume of production of products and services that an enterprise can produce in a competitive environment.

To solve the first task in the business plan, it is advisable to give a retrospective analysis of the current state of affairs in the industry, the development of the industry over the previous 5-10 years, describe possible trends in the development of the industry as a whole, relevant industries in the regions where it is planned to sell products abroad.

To solve the second problem, it is necessary to describe the main competitors in the regional, domestic and foreign markets in the following positions:

■ product range and sales;

■ the markets in which they operate and their shares in those markets;

■ competitiveness of their products;

■ pricing policy and sales policy;

■ state of the production base.

The analysis of these data will allow you to determine the competitive advantages of your company or identify its shortcomings, determine the methods of competition with competing enterprises. The results of the analysis will be one of the criteria on the basis of which a potential investor will be able to judge the company's ability to compete successfully with similar companies.

The description of the project is to briefly and clearly state the essence and main provisions of the project. This section covers the following topics:

■ what the enterprise does or will do (data on the size and prospects of the enterprise, profile of activity, features of the goods and services produced, and other information providing the competitive advantages of this enterprise are provided);

■ what is the expected demand for the expected goods and services, the forecast of their implementation for several years (here are the main trends in the market development, weaknesses of competing enterprises, plans for growth and expansion of activities);

■ the amount of income from the sale of products or the provision of services, the amount of costs and gross profit, the level of profitability, the payback period of investments (in this part of the business plan, the economics of the enterprise should be presented: data but profit, expected profitability, return on invested capital, break-even and excess of cash receipts over payments);

■ how much money should be invested in the project for its implementation (briefly indicate the amount of necessary financing and directions for the use of capital);

■ why the enterprise will be successful in quickly penetrating new markets for goods and services (this section indicates the competitive advantages of the enterprise in this period and possible advantages after the implementation of the proposed project, weaknesses of competitors and other conditions).

In terms of production information is provided on the security of the investment project from the production and technological side. In the production plan, you need to do the following:

■ state the goals of the enterprise's long-term strategy;

■ describe the structure of the planned production, its raw materials base and technological scheme of the production process, sources of energy, heat, water supply;

■ provide data on the staffing of production, the program of training and retraining of personnel;

■ describe the plan for bringing the enterprise to full design capacity;

■ provide information on the status of work on the project and the possibilities of production.

To characterize the status of work on the project, you must specify the following data:

■ the degree of development of the products intended for production;

■ legal support of the project;

■ work performed according to the project;

■ availability of production facilities;

■ the need to purchase equipment;

■ name of suppliers, terms of delivery and cost of equipment;

■ types of energy sources;

■ description of the raw material base;

■ characteristics of the production infrastructure (including internal and external transport);

■ the environmental situation in terms of discharges into the water basin and emissions into the air.

Marketing and sales plan is one of the most significant and complex in a business plan. The results of market research are the basis for the development of a long-term marketing and pricing strategy for an enterprise, its current policy. They determine the needs for human and material resources.

In view of the importance and complexity of this section, it is advisable to prepare it in the first place and at the same time to check the data on the market, its volumes and growth rates from additional, alternative sources.

Market research in the business plan includes three blocks:

1. Analysis of the demand for goods and services in the selected market and its development trends.

2. Description of the market structure, its main segments, analysis of forms and methods of marketing.

3. Research of conditions of a competition on the segments of the market chosen for work.

All subsequent sections of the plan depend on the sales estimates made in this section. The volume of sales of goods and services, predicted as a result of the performed market research, has a direct impact on the production plan, marketing plan and the amount of invested capital that the company will need. The data obtained during the analysis of the competitive environment largely predetermine the sales strategy and pricing strategy of the enterprise in the selected market segments.

In the organizational plan of the project implementation the structure and policy of management are described, a brief description of the composition of the management team is given. When describing the organizational structure of an enterprise, one should consider:

■ the main divisions of the enterprise and its functions:

■ distribution of duties of management personnel;

■ methods of interaction between departments;

■ interest of the enterprise in the final results;

■ new types of work arising from the goals of the enterprise;

■ the necessary qualifications of the personnel.

The business plan provides detailed data for each head of the enterprise, the largest shareholders, members of the project development team, and the managed area of work.

Financial plan for project implementation is prepared after the marketing plan and production plan are prepared. When developing it, one should take into account the divergence of interests of the participants in the investment project. The financial plan should include a brief overview of the conditions in which the enterprise will operate. It should contain data such as sales, gross profit, equipment costs, labor and other costs, as well as a detailed operational analysis of income and expenses, forming the net profit of the enterprise. This will form a complete picture of the profitability of the enterprise. This section of the business plan can only be drawn up after the scope (borders) of the project, as well as contingencies and inflation, have been determined.

The framework (boundaries) of the project implies the definition of:

■ all activities to be presented at the plant site;

■ additional operations related to production, extraction of natural resources, wastewater treatment and emissions;

■ external transport and warehouses for raw materials and finished products;

■ external complementary activities (housing, vocational training, general education programs, construction of recreational facilities).

Unforeseen expenses are divided into material and financial. Tangible contingencies relate to the accuracy of forecasting sales, project requirements, materials, and services. In order to avoid losses, the design cost of the object includes a reserve of unforeseen costs in the amount of 5 to 10% of the estimated cost of the object.

Financial contingencies are related to inflation, changes in the base lending rate and other factors.

Accounting for inflation is carried out using the following data:

■ the general index of domestic ruble inflation, determined taking into account the systematically corrected working forecast of the course of inflation;

■ forecasts of the ruble exchange rate;

■ external inflation forecasts;

■ forecasts of changes in time in prices for products and resources (including gas, oil, energy resources, equipment, construction and installation works, raw materials, certain types of material resources), as well as forecasts of changes in the level of average wages and other indicators for the future;

■ forecast of tax rates, duties, refinancing rates of the Central Bank of the Russian Federation and other financial standards of state regulation.

Using the above data, it is necessary to investigate the effect of inflation on price indicators, on the need for financing, and on the need for working capital.

Drawing up a financial plan takes place in several stages.

Stage 1- forecast of sales volumes. The sales volumes and value of sales in the respective markets for each year are calculated.

Stage 2- Calculation of costs for products and services sold. Calculations are made on the basis of the forecast of sales volumes, current regulations, pricing policy and terms of sale.

Stage 3 - description of counterparties, their reliability, distribution of contracts in time, costs for counterparties.

Stage 4- calculation of provision with raw materials, energy, water (technical and drinking), spare parts and operating materials for the first five years, as well as provision with labor resources.

5 stage - forecast of costs (conditionally constant, conditionally variable and total) but for years.

Stage 6 - calculation of the planned profit. The plan of expected profit is drawn up, the net profit or loss is calculated for each year.

Stage 7- Analysis of the point of critical volume of sales. Critical volume is revenue that accurately covers the operating costs of producing products and services. This amount of revenue is called the break-even point. It is necessary to analyze the critical volume of production.

Stage 8 - description of funding sources. When describing sources of funding, the following scheme is used:

■ sources of resource formation:

Own funds,

Borrowed funds;

■ after-tax profit distribution policy:

The share of profit directed to the accumulation fund,

Payment of dividends (terms and interest);

■ measures to control consumer payments, financial policy in relation to credit insurance;

■ performance evaluation criteria;

■ methods of insurance.

If it is planned to use a loan to finance the project, then the business plan provides a calculation of the procedure and terms for obtaining and repaying the loan, as well as paying interest payments.

As a result of the calculations carried out in the business plan, three basic forms of financial statements are compiled: a profit statement, a cash flow statement and a balance sheet.

The income statement illustrates the ratio of income received in the course of the production activities of the enterprise (project) during the period of the project, with the costs incurred in the same period and related to the receipt of income. Profit report is required to assess the effectiveness of current (economic) activities. An analysis of the ratio of income and expenses makes it possible to assess the reserves for increasing the project's equity capital, as well as to calculate the values of various tax payments and dividends.

The cash flow statement provides information on the formation of sources of financial resources and the use of these financial resources. The sources of funds in the project can be: an increase in equity through the issuance of new shares, an increase in debt through loans and the issuance of bonds, proceeds from the sale of products and other expenses. In the event of share repurchases or losses from other sales and non-operating activities, negative values may appear in the relevant positions.

The main areas of use of funds are connected, firstly, with investments in fixed assets and with the replenishment of working capital; secondly, with the implementation of current production (operational) activities; thirdly, with the servicing of external debt (payment of interest and debt repayment); fourthly, with settlements with the budget (tax payments) and, finally, with the payment of dividends.

An important point is that not all current costs of the project act as an outflow of funds, but only operating expenses and current interest payments. Depreciation deductions, being one of the cost items, are a source of financing for fixed assets. Therefore, the amount of free cash flow of the project is equal to the sum of net profit and depreciation charges for a specified period of time. Repayment of external debt is carried out at the expense of free cash, and not from profits.

In the balance sheet, for the sake of convenience of analysis, in design practice, the balance sheet is used in the aggregated, i.e. in an enlarged form. The purpose of the investment project balance is to illustrate the dynamics of changes in the structure of the project property (assets) and sources of its financing (liabilities). The balance sheet provides an opportunity to calculate the generally accepted indicators of the financial condition of the project, liquidity assessment, turnover ratios, agility, overall solvency, etc.

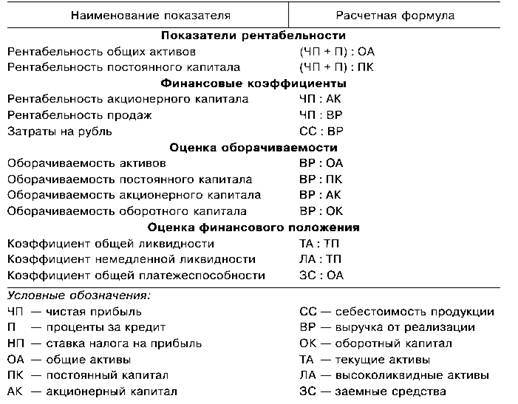

In the course of its implementation, an investment project must ensure an acceptable return on invested capital and maintain a stable financial condition. The successful solution of these problems is carried out on the basis of the analysis of a number of coefficients. The list of coefficients is determined by the specifics of the project, the most commonly used coefficients are presented in Table 1.

Table 1

When assessing the financial viability of investment projects, financial ratios are calculated that characterize each planning period, then the ratios are analyzed over time and trends in their change are identified.

Evaluation of the economic efficiency of the costs incurred during the implementation of the project, occupies a central place in the process of substantiation and selection of possible options for investing in operations with real assets.

When developing this section of the business plan, it is necessary to use the Guidelines for the evaluation of investment projects and their selection for financing, developed by the Ministry of Economic Development of Russia.

■ efficiency of the project as a whole;

■ effectiveness of participation in the project.

The effectiveness of the project as a whole is evaluated in order to determine the potential attractiveness of the project for possible participants and search for sources of funding. It includes:

■ social (socio-economic) efficiency, taking into account the socio-economic consequences of the project for society as a whole;

■ commercial efficiency, taking into account the financial implications of the project implementation for the participant implementing the investment project.

The effectiveness of participation in the project is determined in order to verify the feasibility of the investment project and the interest in it of all its participants. The effectiveness of participation in the project includes:

■ efficiency of participating enterprises;

■ efficiency of investing in the company's shares (for shareholders of joint-stock companies);

■ the effectiveness of participation in the project of structures of a higher level in relation to the participating enterprises (national economic, regional, sectoral);

■ budget efficiency.

Evaluation of the effectiveness of the project is carried out in two stages.

At the first stage, the performance indicators of the project as a whole are calculated. For local projects, only their commercial effectiveness is evaluated and, if it turns out to be acceptable, it is recommended to proceed directly to the second stage of evaluation.

For socially significant projects, their social effectiveness is evaluated first of all. With an unsatisfactory public assessment, such projects are not recommended for implementation and cannot qualify for state support.

If their social effectiveness is sufficient, their commercial effectiveness is evaluated. In case of insufficient commercial efficiency of a socially significant project, it is recommended to consider the possibility of using various forms of its support, which would increase the commercial efficiency of the project to an acceptable level.

Investment business plan financing scheme

The second stage is to develop a financing scheme. At this stage, the composition of the participants is specified and the financial feasibility and effectiveness of participation in the project of each of them is determined.

To calculate the efficiency, it is proposed to use a number of indicators based on both simple (static) and complex (dynamic) calculation methods. All costs and revenues from the implementation of the project during the billing period are presented in the form of cash inflows and outflows. The result of the outflow of funds is the flow of real money, which is the balance of outflow and inflow for the billing period. Accounting for the time factor in determining and analyzing the results of the project at each stage is carried out by discounting cash flows, i.e. bringing their multi-temporal values to the current current value. The main standard used in discounting is the discount rate. There are the following discount rates: commercial, project participant, social and budgetary.

Consider the main indicators used to calculate the effectiveness of an investment project.

Net income (NP, Net Value, NV) represents the difference between the accumulated cash income for the project and the accumulated costs, i.e. net income is the balance of accumulated cash income. Net income can be calculated using the formula

![]()

Where NV- net income;

R - income by years generated by investments; 1C - investments by years; k = 1, 2, 3 ... P - the number of standard project implementation periods (legs, months).

For a project to be recognized as effective, it is necessary that the net income be a positive value.

Net present value (NPV, integral effect, Net Present Value, NPV) represents the difference between the accumulated discounted income on the project and the accumulated discounted investment, in other words, the net present value is the balance of the accumulated discounted income.

NPV used to compare future receipts and investment costs.

![]()

Where GRU - net discounted income;

R - income by years generated by investments; g - discount rate: k = 1, 2, 3 ... P - number of standard project implementation periods (years, months); 1C - the amount of the one-time investment.

If the project involves not a one-time investment, but a consistent investment of resources over P years, then the formula looks like

![]()

If NPV > Oh, then the project can be accepted.

NPV= Oh, the project is neither profitable nor unprofitable.

NPV< Oh, the project should be rejected.

If NPV positive, then the project provides an opportunity to receive additional income in excess of a certain discount factor. If NPV negative, this means that the projected cash receipts do not provide a minimum standard profit and return on invested capital. If NPV close to zero, this means that the profit is barely secured.

This indicator belongs to the category of absolute. It shows how much the value of the company's assets increases from the implementation of this investment project. The more NPV, the better the characteristics of the project. This indicator is additive in time, i.e. NPV different projects can be summarized. This is an important property that allows you to use it in the analysis of the optimality of the investment portfolio.

NPV takes into account the life of the project - all income and expenses at all stages.

Internal rate of return (IRR, Internal Rate of Return, IRR) is such a discount rate at which the discounted value of real money inflows is equal to the discounted value of outflows, i.e. at r = IRR, NPV= 0.

economic sense IRR in that this indicator characterizes the maximum allowable relative level of costs that can be associated with this project. For example, if the project is financed entirely by a loan from a commercial bank, then the value IRR shows the upper limit of the acceptable level of the bank interest rate, the excess of which will make the project unprofitable.

If IRR > CK, then the project can be considered and accepted if IRR > CK, then the project is unacceptable if IRR= CK, you can make any decision (CK - cost of invested capital).

Calculated IRR by choosing a discount rate at which NPV equals zero. If NPV is positive, a higher discount rate is used. If NPV is negative (at the next discount rate), then IRR must be between these two values. The accuracy of the calculation is inversely proportional to the length of the interval. If NPV is equal to zero, then the value of the firm does not increase, but does not fall either. That's why IRR also called a test discount.

With help IRR you can weed out unprofitable projects or rank them according to the degree of profitability. It also serves as an indicator of the level of risk. The more IRR exceeds the cost of capital, the greater the margin of safety of the project and the less terrible market fluctuations and errors in estimating the amount of future cash receipts.

Simple payback period (Payback period, RR) - This is the period from the initial moment of investment to the moment of payback. The initial moment is indicated in the design task. The payback moment is the earliest period of time in the billing period, after which the current net income NV becomes and remains non-negative.

The calculation algorithm depends on the uniformity of the distribution of projected income. If income is distributed evenly over the years, then the payback period is calculated by dividing the one-time costs by the amount of annual income. If the profit is unevenly distributed over the years, then the payback period is calculated by directly counting the number of years during which the investment will be repaid with cumulative income.

Payback period including discounting (DPP)- this is the period from the initial moment to the moment of payback, taking into account discounting. The payback moment, taking into account discounting, is the earliest point in time in the billing period, after which the net present value becomes and remains non-negative in the future. The algorithm for calculating this indicator is the same as in determining the simple payback period, only indicators of the reduced cash flow are used.

The need for additional financing (PF) is the maximum value of the absolute value of the negative accumulated balance from investment and operating activities. The PF value shows the minimum amount of external financing of the project required to ensure its financial feasibility. Therefore, PF is also called risk capital. It should be borne in mind that the real volume of external financing does not have to coincide with the PF and, as a rule, exceeds it due to the need to service the debt.

The need for additional financing, taking into account the discount (DFT) - the maximum value of the absolute value of the negative accumulated discounted balance from investment and operating activities. The value of the DFT shows the minimum discounted amount of external financing of the project required to ensure its financial feasibility.

Profitability index of costs - the ratio of the amount of cash inflows (accumulated receipts) to the amount of cash outflows (accumulated payments).

The discounted cost return index is the ratio of the sum of discounted cash inflows to the sum of discounted cash outflows.

Investment return index (IR) - the ratio of the sum of cash flow elements from operating activities to the absolute value of the sum of cash flow elements from investment activities. It is equal to the ratio of net income increased by one (NP, YU) to the accumulated investment. This indicator is calculated by the formula

where ID - index of return on investment; CHD - net income; 1C - investments according to the years of the investment cycle;

Discounted investment yield index (DII) is the ratio of the sum of discounted cash flow elements from operating activities to the absolute value of the discounted sum of cash flow elements from investment activities. NDI is equal to the ratio of net present value increased by one (NPV, NRU) to the accumulated discounted investment. This indicator can be calculated using the formula

![]()

where IDI - index of profitability of discounted investments; YRU - net discounted income;

1C - investments by years of the investment cycle; G - discount rate;

To accept the project for consideration, it is necessary that the cost and investment indices be greater than one. Profitability indices characterize the return of the project on invested capital. The indices are greater than one if the net income and net present value of the project are positive.

When calculating the efficiency, it is recommended to take into account the uncertainty, i.e. incompleteness and inaccuracy of information about the conditions for the implementation of the project and the risk, i.e. the possibility of occurrence of such conditions that will lead to negative consequences for all or individual project participants. Project performance indicators calculated taking into account uncertainty and risk factors are called expected.

To assess the sustainability and effectiveness of the project under conditions of uncertainty, it is recommended to use the following methods:

■ an aggregated sustainability assessment;

■ calculation of break-even levels;

■ parameter variation method;

■ assessment of the expected effect, taking into account the quantitative characteristics of uncertainty.

All of these methods, except for the first, involve the development of scenarios for the implementation of the project in the most likely or most dangerous conditions and the assessment of financial consequences. This makes it possible, if necessary, to provide in the project for measures to prevent or redistribute the resulting losses.

The project is considered sustainable if, under all scenarios, it turns out to be effective and financially feasible, and possible adverse effects are eliminated by measures provided for by the organizational and economic mechanism of the project.

Project risk is accounted for by adjusting the discount rate. The inclusion of a risk adjustment is usually done when a project is evaluated under a single implementation scenario. The risk adjustment value takes into account three types of risks associated with the implementation of an investment project:

1) insurance risk;

2) the risk of unreliability of project participants;

3) the risk of non-receipt of the income provided for by the project. The adjustment for each type of risk is not introduced if the investment is insured for the relevant insured event.

The given structure of the business plan is not frozen. Depending on the purpose, scale, complexity of the investment project, the number of sections, their content, the depth of study of the material may change, which will affect the structure and content of the business plan.

The ubiquity of personal computers has led to the use of various computer programs for financial and economic calculations for investment projects. The Russian market currently has a wide range of software packages designed for use at various stages of investment projects. The most popular are the following software products: COMFAR, developed by the UN Industrial Development Organization (C)NIDO); PROJECT-Expert developed by PRO-Invest-Consulting; Alt-Invest, developed by "Alt" and others.

Maxim Onishchenko

Especially for Information Agency "Financial Lawyer"

Discounted payback period

Discounted payback period Methodological aspects of project management

Methodological aspects of project management Scrum Development Methodology

Scrum Development Methodology