Main sources of investment financing

Even the best business plan needs a careful selection of sources of financing for an investment project. Funds are sought in a variety of places - they are taken from the state, banks, companies and even private individuals. However, not all of these sources of finance are beneficial for the entrepreneur. Therefore, each investor should understand well how he will finance his project, and where it is best to get money for this.

What are funding sources

There are quite a few definitions of this concept, and one of the most successful is the following. Sources of investment financing are all possible channels for finding funds that an investor can receive to develop his project on certain conditions or (less often) without them (for example, his own savings). Regardless of the ways of finding finance, each firm receives them to make investments.

These investments are aimed at solving several problems that can be combined into 2 groups:

- The main goal is the development of the project at the stage of its startup or at any stage of the existence of the enterprise.

- Additional tasks are related to maintaining the business in a normal state. Such a goal arises during unfavorable periods, when the project does not pay for itself for some time, therefore additional funding is required.

Before proceeding with the search for funds, the investor must analyze the current situation and answer a few questions:

- the exact amount required;

- the purpose of obtaining it;

- is it possible to do without this money at this stage;

- possible sources;

- acceptable and unacceptable terms of borrowing (if it is supposed to take a loan);

- risks associated with non-return (full or partial, as well as violation of the return deadlines);

- the justification of the investment (what profit can the investment give in the future);

- alternative solutions in case of refusal of financing (what to do if the bank or other companies refused to provide a loan).

Source classification

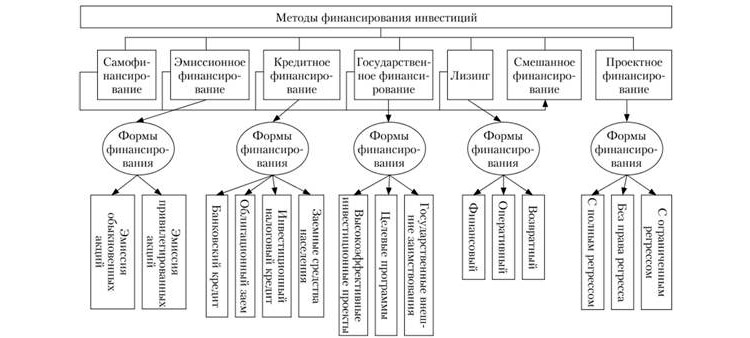

There are many reasons for classifying sources of financing for investments in an enterprise. They are divided depending on the form of ownership, duration of use and other criteria.

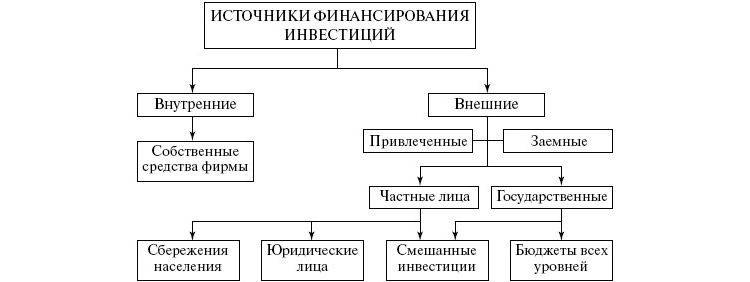

External and internal

This is the most obvious comparison parameter, because regardless of the methods of finding funds, they can be found either in the company or outside it. Domestic sources of investment financing include the following channels:

- Net profit. Each company, like an individual, always has a choice between saving "extra" funds or investing them in their own development. The strategy depends on inflation expectations, tax rates, market conditions and other factors.

- Financing of the investment project is also carried out by optimizing costs. The company can redistribute its resources, purchase more productive equipment in order to save on its maintenance, electricity and other payments. The released funds can also be used to invest in business development.

- The depreciation fund consists of deductions for depreciation. These funds are used to maintain and repair equipment. They are necessarily included in the cost of production, so they are guaranteed to be returned to the investor after a certain time.

- Another internal channel is reserve funds, which are usually formed at the stage of project creation. The initial investment should always take into account this item of expenditure, since unexpected expenses often arise. However, the reserve fund can be considered as one of the last measures, because it is always risky to leave the project without a reserve of funds.

- Also, money can be taken from the authorized capital, the share of one or another participant (these funds are pledged during the formation of the company).

- Finally, funds can be obtained as a result of additional income from previously made investments. Then the company reinvests them, continuing to increase its profits.

The most diverse are not internal, but external sources. They are usually combined into 2 groups:

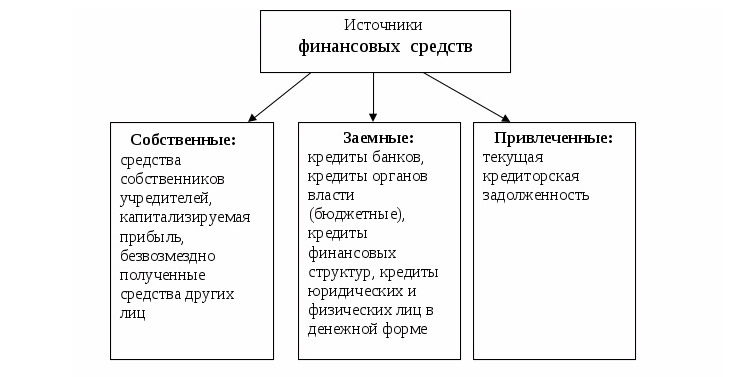

- Borrowed funds are one of the most common ways to raise funds. Loans are provided by banks, individuals, the state (loans with state support). Certain amounts can also be borrowed from partner companies (for example, to defer any payment and put the money in another direction). Also, an enterprise can issue (issue) its bonds - securities that are purchased by creditors who have the right to repay the debt and interest on it within a predetermined period. Similar papers are issued by various states.

- Funds raised, unlike loans, are not subject to mandatory repayment, but they are also provided under certain conditions. The firm can issue its shares and receive funds from their sale. Government funds in the form of subsidies, subsidies, and other forms of support are also used as borrowed funds. Another channel is the gratuitous provision of partner funds for targeted investment. The return of such money is possible only if sufficient income is received from the investments made.

Internal sources are preferred over external ones. They are always available, and their use is actually free (no need to pay a loan interest). But most often, such methods of financing are significantly limited, so the company is forced to resort to raising funds from outside. In practice, the use of mixed sources is often observed, i.e. receiving money simultaneously from their reserves and through other channels.

Direct and indirect

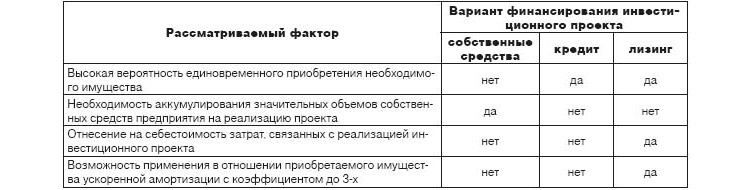

All the described ways of obtaining funds (both external and internal) can be classified as direct sources, since specific amounts are received directly. Along with them, there are also indirect funding channels. There are 3 such methods:- - this is the name of obtaining equipment, raw materials or vehicles on credit for a certain monthly fee. After the end of payments, the lessee has the right to re-register the property into his own ownership. This method can be attributed to borrowed sources, however, it has its own specifics, since the equipment or mechanisms, as a result, go to the company. Subsequently, they themselves become a source of investment, because with their help the company receives additional profit.

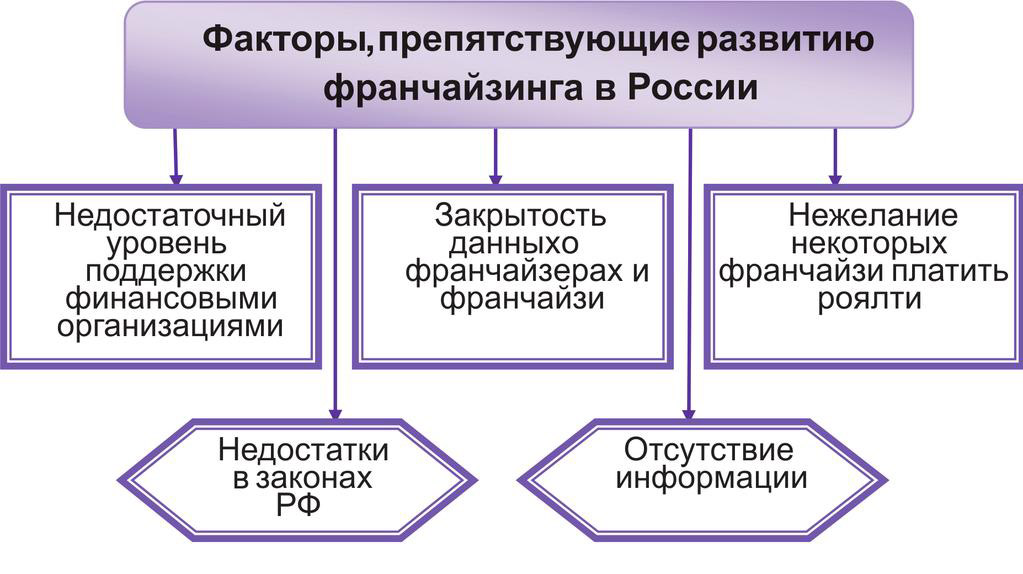

- - in this case, the buyer acquires the right to the intellectual property of the seller. These can be works of art (literary, musical, architectural, etc.), patents, results of scientific research. As a result, the new owner has the right to use the intellectual property indefinitely. A private type of franchising is the purchase of a franchise business. Usually a well-known brand and work technology is acquired.

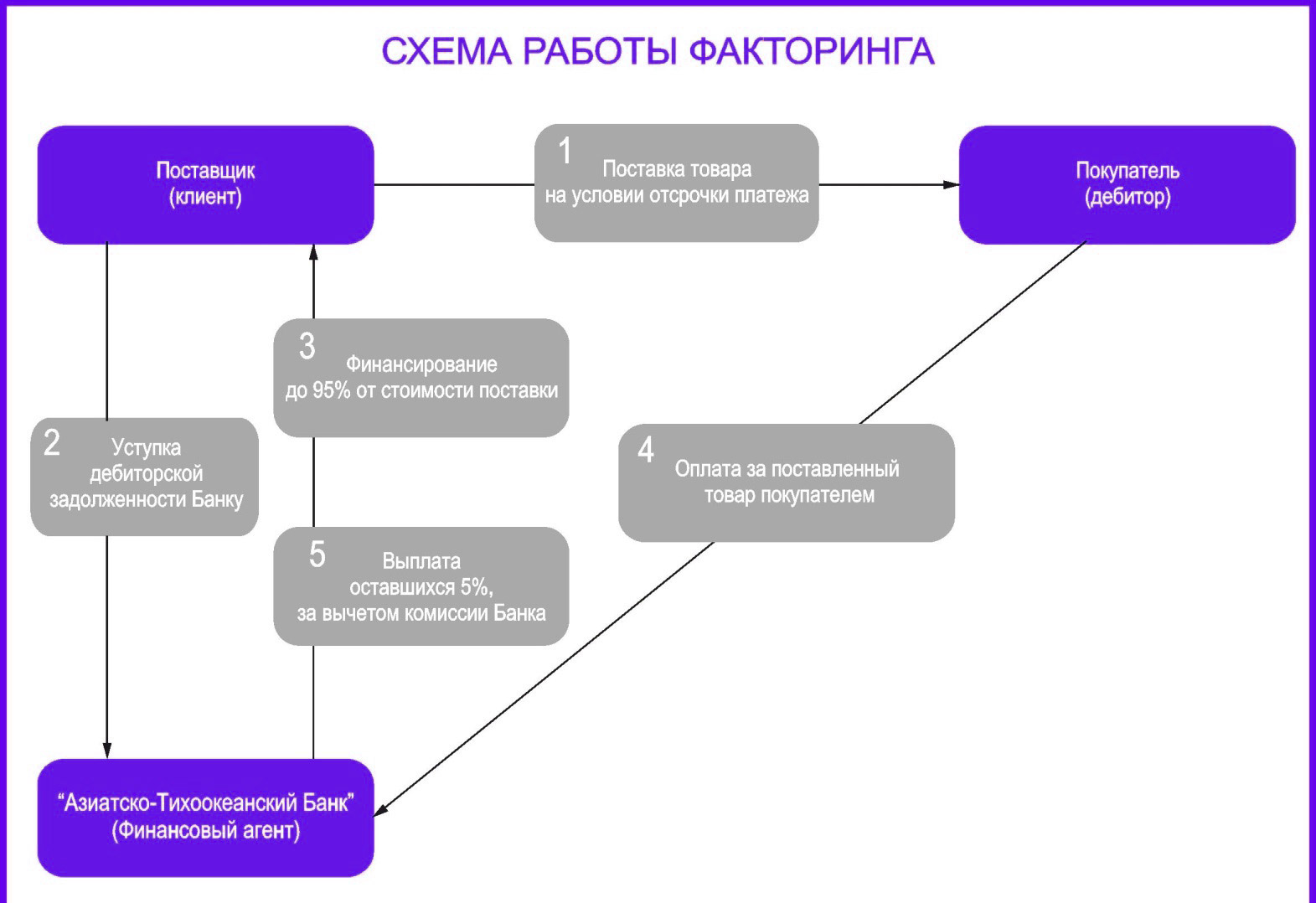

- - sale of receivables to a specialized company, which subsequently becomes a creditor and works to obtain funds in its favor. In fact, this phenomenon is similar to how banks sell overdue debts to collection companies working to collect them.

These methods of obtaining finance are called indirect because they do not bring money directly, but they contribute to making a profit in the foreseeable future. For example, the purchase of equipment on lease or the sale of receivables frees up part of the company's own funds, which can be reallocated to other business purposes.

By duration of use

A very important practical classification criterion is the duration of resource use. From this point of view, the following groups can be distinguished:

- Short-term funds that are realized within a few months or 1-2 years. They go to solve urgent problems - repayment of salaries, loans, rent, services of suppliers. Such expenses must be obtained from the most accessible sources. These can be loans from banks, a loan from partners (deferred payments), as well as any own funds (profit, reserve fund, etc.).

- Medium-term funds are designed to cover the costs that will arise in the coming years (from 2 to 5 years). These can be depreciation costs associated with the maintenance and repair of equipment, the cost of expanding production, advertising costs, etc. For such costs, several sources of financing can be selected at once. This may be the expected net profit in the near future, government subsidies, loans.

- Finally, long-term costs are focused on the long term (4-5 years or more). They are more difficult to predict, so they require careful analysis of the situation. Such costs are covered by several inexpensive sources at once. For example, a company anticipates costs in advance and issues its shares and bonds, planning their sale several years in advance at once.

By form of ownership

Funds can be obtained:

- from own reserves;

- from private sources (loans, leasing, franchising, etc.);

- through government support;

- by attracting foreign capital.

The investor must constantly search for funds for the possibility of making profitable investments. When planning, you need to correctly predict the expected profit and possible risks. At the same time, there should be several sources at once, so that the possibility of an alternative choice is always preserved.

Discounted payback period

Discounted payback period Methodological aspects of project management

Methodological aspects of project management Scrum Development Methodology

Scrum Development Methodology