What is net present value and how to calculate it

Net Present Income is the present value of the financial flows of the investment plan, taking into account the discount rate, less deposits. The meaning of the value lies in comparing the current price of forthcoming proceeds from the implementation of the project with the investment.

The main purpose this value - to provide a clear idea of the feasibility of investing in a particular investment project.

They often choose between different plans, and not only taking into account the length of the life cycle, but also looking back at the timing of the investment, the size and nature of the credited income from a particular business.

NPV makes it possible to erase deadlines and bring the possible result to one moment. This allows find out the real investment efficiency and the benefits that can be gained from the execution of this project. The investor clearly knows the amount of profit, which means that he confidently gives preference to any of the alternative investments - the one where the NPV is higher.

NPV is widely used in domestic practice and when working in other countries to establish the effectiveness of investment projects.

The need to determine the NPV reproduces the fact that the amount of money that we have at the moment has a greater true value than the same amount that may be in the future. This circumstance is associated with several reasons, in particular:

- inflation, which reduces the true purchasing power of financial assets, especially if they are placed in an interest-free reserve;

- this amount can subsequently be invested in projects, production, making a profit from this;

- there is a risk of partial or absolute non-receipt of the estimated amount.

Calculation

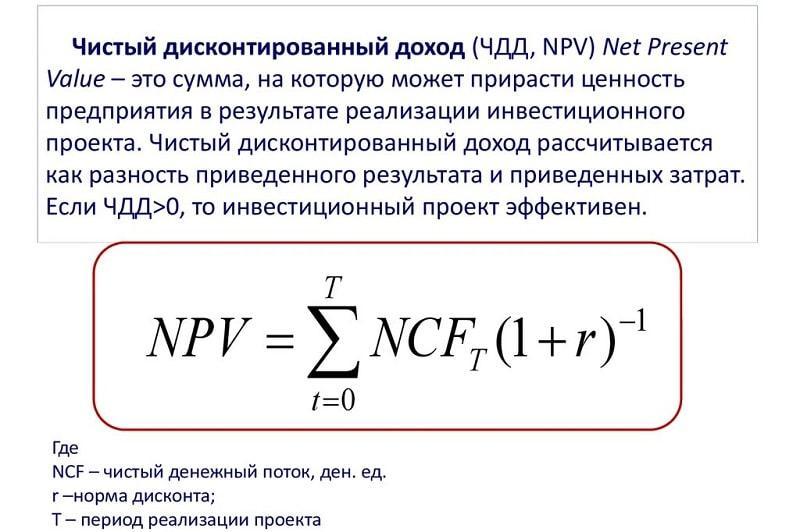

NPV is calculated as the sum of the available results and costs during the whole study period, given to the first step. The calculation assumes that the discount rate is a satisfactory rate of return for the investor for each ruble of invested capital using a safe investment method.

Discount rate must be objectively justified, because the following are taken into account:

- interest on bank deposits;

- average income of liquid securities;

- inflation rate;

- personal assessments of the investor, formed on his knowledge and practical experience;

- the cost of capital investment when the project is financed from multiple sources.

Choosing a project with NPV< 0, инвестор лишится части своих денег.

Determination procedure NPV is as follows:

- The real cost of expenses for the implementation of the project is established - the amount of investment.

- The real value of the expected cash flows from the project is established by calculating the cash injections.

- The present value of all amounts of forthcoming receipts of funds from the project is established due to the discount rate of the time of generation of income.

- The present amount of spending is compared with the total available value of income.

It should be noted that NPV is calculated as the total component of discounted indicators of forthcoming payments, reduced to the current day.

Net Present Income: Calculation Formula

NPV (NPV) = - IC + ƩCFt / (1 + i) t, where t = 1 ... n.

Let's analyze what the components of this formula mean:

- IC- initial investment, in other words, planned investment in the project. They are brought in with a minus sign, this is the investor's spending to implement the idea, which is expected to bring income in the future. Since deposits are often made not at one time, but as needed, they are discounted based on the time interval.

- CFT- cash injections, discounted taking into account time resources. It is defined as the sum of investments and expenses in each period t (varies from 1 to n, where n is the duration of the investment business project).

- i Is the value of the discount rate. It is used to discount the estimated income into a single amount of value at that time.

It has already been said that net present value is considered a typical method performance evaluations a specific project. The indicators of this index affect the attractiveness of the project for the investor.

NPV> 0

As already explained, net present value refers to the methods used to measure project performance. What does the NPV mean if it is more than "0" in the calculation? This situation suggests that with regard to the contribution, this project can be beneficial. However, the final decision on financing is made only after determining the NPV of all projects that participated in the comparison. The choice (other things being equal) should be one, where the NPV is greater.

Sometimes it happens that the discounted income is zero. In other words, taking into account the time factor, the depositor will not lose anything, but he will not be able to earn either. As a rule, such projects are not accepted, only in exceptional cases.

NPV< 0

When calculating the net present value of a business idea results in a minus value, then the investment will not be profitable. So, choosing a project with NPV< 0, инвестор лишится части своих денег. Здесь все решается очень просто – отказывают в финансировании.

Benefits of calculating NPV

The advantage of this value is that it takes into account the value of finance over time as a result of their discounting to a certain period. In addition, NPV allows you to include risks in the calculation during project execution. This is achieved by using different discount rates - the higher the rate, the greater the risk(and vice versa). In general, NPV is a fairly clear indicator to use it to make an informed decision about the need to finance a business project.

The advantage of the NPV value is considered that it measures the modification of the cost of cash injections over time, that is, it helps to take into account inflation.

Disadvantages of NPV

On the other hand, the use of this indicator has certain disadvantages and they are as follows: although discounted cash flows are included in the calculation (and, often, they reflect the magnitude of inflation), they have only expected value and will not vouch for the appointed outcome. In addition, it is often difficult to calculate the discount rate, especially if the valuation involves multidisciplinary projects.

Calculation example

It is possible to calculate the NPV value using an example.

Let's say the cash injections were of the following nature over the years:

Zero year: minus investments -1000,

First year: indicator +200,

Second year: value + 300,

Third year: +700.

For instance, discount rate 12%.

NPV = -1000 / (1+0.12)^0 + 200 / (1+0.12)^1 + 300/(1+0.12)^2 + 700/(1 +0.12)^3 = -1000 + 200* 0,89286 + 300 *0,79719 + 700* 0,71178 = -1000 + 178,57 + 239,16 + 498,25 =

= -84,02 < 0

.

Thus, the project does not generate income, although in a nominal relation the invested money returned (200+ 300 +700> 1000), but in real time their cost decreased.

Economic meaning- it is necessary to bring all cash flows to the present moment (in this case, the zero year) and determine their amount, if the negative result of investments is more than profit, such a project is assigned.

How inflation affects the calculation of NPV

Due to the fact that in some cases fluctuations in inflation cannot be smoothed out in practice, the question arises of how to keep track of inflation when calculating net discounted income. The most famous and simplest solution to this problem is adjusting the discount for the expected inflation rate.

Moreover, the rate is calculated as follows:

R = (1 + r) × J, where:

- R- discount rate that takes into account inflation;

- r- discount;

- J- the amount of inflation.

It turns out that with significant inflation expected for the period of implementation of a business project, profitability after discounting may be less so that the business idea does not become unprofitable.

NPV allows you to include risks in the calculation during project execution

Important notes

NPV is widely used in domestic practice and when working in other countries to establish the effectiveness of investment projects. This gives you a pretty clear idea of your ROI. The advantage of the NPV value is that it measures the modification of the cost of cash injections over time. This helps to take into account circumstances such as inflation, as well as to compare projects that vary in duration and frequency. Despite a number of disadvantages, the value of NPV is the main one in assessing the attractiveness of a business idea, comparison with analogues and competitors.

In order for investments in a particular project to be justified and confirmed by high profitability, reliable baseline data are needed. In other words, such types of plans as production, marketing or financial should display information as close to the upcoming reality as possible.

In particular, the overestimation of the estimated demand, at which the analysis of the situation leads to a positive NPV result, can bring losses to all participants during the project execution.

Simultaneously with the calculation of NPV, it is necessary to calculate the profitability index, which can influence the decision of creditors or investors in favor of an event with the lowest NPV value, but with the maximum safety margin.

Determining the most profitable investment freed from the business, the investor is inclined towards a more profitable project. Based on the calculation of the current NPV, it is more convenient to compare a number of opportunities with various payback times.

Discounted payback period

Discounted payback period Methodological aspects of project management

Methodological aspects of project management Scrum development methodology

Scrum development methodology