Modified Internal Rate of Return - MIRR

From an academic point of view, when evaluating an investment project, preference should be given to the indicator of net present value (NPV), rather than the internal rate of return (IRR). This is due to the fact that when using IRR it is necessary to take into account a number of the limitations given in the previous paragraph. For this purpose, an indicator was developed such as modified internal rate of return(MIRR), which allows you to more accurately assess the profitability of a particular project.

The modified internal rate of return is the discount rate at which the terminal value of the project (the future value of all incoming cash flows) will be reduced to the present moment and will be equal to the present value of all costs (outgoing cash flows) associated with the project.

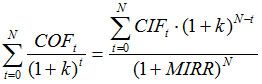

where PV Costs- the present value of the costs associated with the project;

TV- terminal cost of the project;

For convenience of calculations, the equation can be transformed as follows.

where COF t- outgoing cash flow for the period t;

CIF t- incoming cash flow for the period t;

k- discount rate;

N- investment horizon.

In this case, as a rule, the discount rate is the cost of capital raised for the implementation of the project.

To understand the calculation method MIRR Let's consider it with an example.

Example... The company is considering the possibility of implementing an investment project with an initial investment of $ 300,000. and an investment horizon of 5 years. The expected net cash flow (CF) from the project by year is presented in the table.

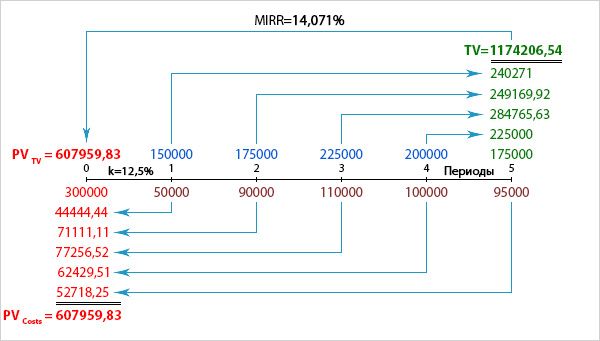

In order to draw up an equation, we need to determine the present value of all outgoing cash flows and the future value of all incoming cash flows (terminal cost of the project), which will schematically look like this.

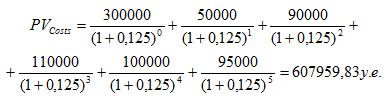

The present value of all outgoing cash flows will be equal to 607,959.83 c.u.

The terminal cost of the project is equal to 1174206.54 USD.

TV = 150000 * (1 + 0.125) 4 + 175000 * (1 + 0.125) 3 + 225000 * (1 + 0.125) 2 + 200000 * (1 + 0.125) 1 + 175000 (1 + 0.125) 0 = 1174206.54 y .e.

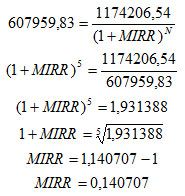

Let's plug the data into the equation and calculate the MIRR.

Thus, in order for the present value of the project terminal value (PVTV) to be equal to the present value of the costs associated with the project, the terminal value must be discounted at a rate of 14.071%, which is the modified internal rate of return.

Advantages and disadvantages

MIRR has a significant advantage over an indicator such as the internal rate of return (IRR). First, when calculating the modified internal rate of return, it is assumed that all cash flows will be reinvested at the discount rate, and not at the IRR of the project. Since the assumption of reinvestment at the cost of capital rate is more correct, MIRR more accurately characterizes its profitability. Second, the modified rate of return can, with some caveats, be used on an equal footing with the net present value (NPV) when evaluating mutually exclusive projects. This is possible if projects have the same initial costs and the same investment horizon.

However, the MIRR is also characterized by the presence of reinvestment risk. Over a long period of time, it is highly unlikely that the reinvestment rate of incoming cash flows will remain unchanged.

Discounted payback period

Discounted payback period Methodological aspects of project management

Methodological aspects of project management Scrum development methodology

Scrum development methodology