Assessment of the investment value of the company

The initiator of interactions with potential investors usually pursues two alternative goals. The first of them is caused by the intention to strengthen the company's position in the market, develop it and open up new opportunities for the growth of revenue, profits, and capitalization. The second goal is related to the difficult decision to sell the entire business or a controlling stake. Then the current owner enters the market in search of a strategic investor who, under certain conditions, begins to be interested in the investment value of the company.

Types of business value from the perspective of the owner and investor

As usual, I propose to enter the conceptual field to improve the quality of consideration of the subject of the topic. The concepts of a strategic investor and business value are important to us. Let me remind you that a strategic investor should be understood as a person (natural or legal) who sets himself the goal of acquiring the ownership of a business or buying a controlling stake in an enterprise in order to gain absolute control over its activities.

A strategic investor intends to become the sole or majority owner of the company of interest. In this case, the organizational and legal form of the enterprise does not matter. It can be a public or non-public joint stock company or a limited liability company. By the value of the company, we mean a complex criterion for assessing the results of business management from the standpoint of efficiency for its current owner and potential investor.

The cost issue usually arises when the business strategy changes radically, for example, when the positioning of the main owners or when the company's lifecycle is at a critical juncture. Intermediate characteristics for the valuation of certain aspects of the company's activities are:

- gross revenue;

- gross and net profit;

- cost of manufactured products;

- liquidity;

- capital turnover, etc.

For the purposes of this article, we will operate with three types of business values: market, investment and fair. In Western financial and management methodology, various types of values will be distinguished, each of which serves its own, clearly specialized purposes. Among them, the main ones are the following types of values.

- Real market value.

- Fair market value.

- Investment value.

- Fundamental or intrinsic value.

- The cost of continuing business.

- Liquidation value.

- Accounting or book value.

The real market valuation differs from the fair one in that according to the first option, the company usually manages to quickly sell on the existing market. According to the second option, a certain average value is calculated that can be accepted by all interested parties, from government bodies to small shareholders. The fundamental price is determined through an in-depth assessment of all the internal characteristics of the business and external market factors. We will consider the investment value in the next section, but with other values, more or less everything is clear from their name. Further, a group of basic methodological approaches to business valuation is offered to your attention.

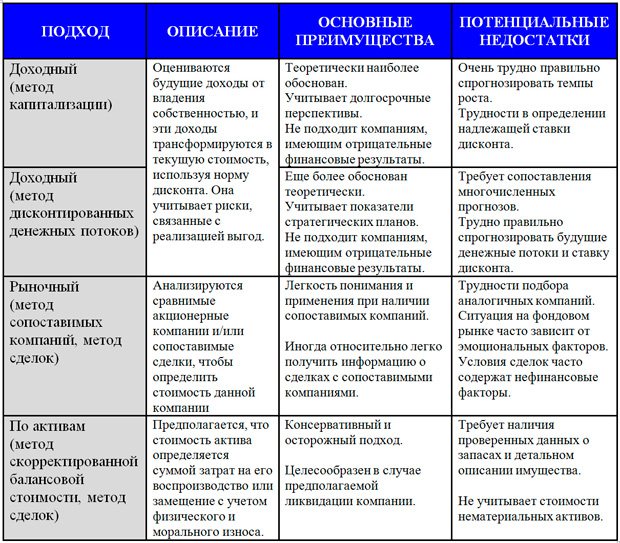

Approaches to business valuation

Appointment of the investment value of the company

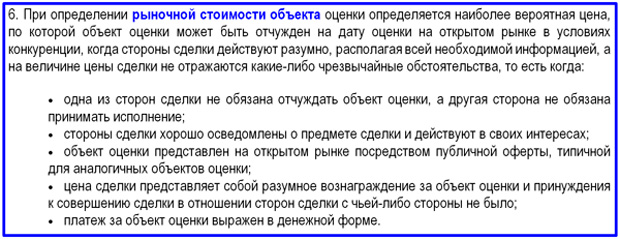

In my opinion, when it comes, on the one hand, about the sale of the entire business or a controlling stake, and on the other, about strategic investments, the approach to the appraised value needs to be narrowed down and somewhat transformed, based on the realities of the potential transaction and the interests of the parties. In the practice of Russian conditions, there is no absolute market for the sale of a business. The stock market is not suitable for these purposes. As a rule, deals of this type are considered by two or three buyers at best. Let's turn to the state policy in the field of valuation. The federal standard FSO No. 2 sets out the conditions for determining the market value of an object. Below is an extract from Article 6 of this standard.

Extract from Article 6 FSO No. 2

If we simplify the perception of market value as much as possible, it can be understood as the most probable value of the price from all the opportunities that the market forms. However, the very concept of probability requires a representative set of supply and demand, while there is no need to talk about a sufficient number of such phenomena. The conditions set by the standard assume the publicity of the offer, good knowledge of the market parties. However, in practice, all these actions are similar to some kind of imitation, when the content is in the service of a given form.

The investment value of a company is assessed in the individualized interests of a specific person (group of persons) in the context of certainty of the strategic investor's goals for using the object of a possible transaction. In essence, we can talk about the maximum value of the business valuation, above which the deal loses its meaning for the investor. When, in the course of negotiations and bargaining between the buyer and the seller of the company, there is a cross between market and investment value, fair value appears. Consider the main reasons for strategic in our country.

- The strategic need for vertical business integration with the purchase of enterprises that correspond to the missing technological links.

- Development of oligopolies and monopolies by getting rid of competitors at the time of their purchase.

- Acquisition of undervalued assets, especially profitable during periods of crisis failures.

- Increase in capitalization of own business due to internal restructuring of total assets.

- Implementation of a diversification strategy around clients by entering related markets.

- Increasing the “entrance ticket” to the market, stability and market capacity due to business enlargement.

- Acquisition of new technologies, including marketing and management.

- Getting a variety of synergistic effects.

Since the value of effects can significantly exceed market value, the investment value is often higher than the market price. Such overshooting of the market base is usually due to a set of synergies that are anticipated as a consequence of a potential deal.

Despite the fact that the market for selling a business in Russia is, to put it mildly, specific, transactions are nevertheless made. This market is not yet civilized, and certainly not highly organized. The Russian Society of Appraisers has existed since 1993. Nevertheless, this institution has great development prospects, which is hampered by typical Russian problems that prevent the economy as a whole from developing. There are professionals in this area, there are good techniques and groundwork available. And therefore, improvements will not be long in coming when the general rise begins.

Discounted payback period

Discounted payback period Methodological aspects of project management

Methodological aspects of project management Scrum development methodology

Scrum development methodology