The organization's stakeholder system and its impact on strategy

Interested partyperson or group with an interest in the performance or success of an organization

Its main property can be considered not that it meets two standards at once, but that it is aimed at a balanced satisfaction of the needs of both consumers and society. In particular, such a system should contain mechanisms for resolving conflicts when the needs of these two stakeholders conflict with each other. I would like to point out right away that we are not necessarily talking about the traditional five groups of stakeholders (customers, suppliers, staff, owners, society). In fact, each organization must independently determine its own list of stakeholders, which reflects its mission and value system. A possible algorithm for constructing a list of stakeholders is as follows: first, find an answer to the question "to meet whose expectations the organization was created, who should benefit from the existence of the organization?" The answer will determine the list of targeted stakeholders of the organization. At the next stage, they look for an answer to the question: "whose expectations does the organization have to meet in order to ensure its development and the ability to consistently satisfy the target stakeholders?" In this case, the answer will be determined by the “resource” stakeholders. It is desirable that both questions be considered by the top management team of the organization, because the answer to them significantly affects the strategy of the organization (including the strategy for the development of the management system and the integration of new components into it).

With this approach, it may turn out that the individual list of stakeholders may differ significantly from the traditional list of five groups. In particular:

Some of the traditional stakeholders can be individually listed into several different stakeholders with fundamentally different expectations, which are more convenient to consider separately (for example, for the editorial board of the magazine, the interested party “consumers” can be divided into readers and advertisers; for a higher education institution, consumers can share students, parents of students and employers);

· New stakeholders may appear that combine the characteristics of several traditional stakeholders (for example, dealers have characteristics of both consumers and suppliers; graduate students at the university - both employees and consumers);

· Fundamentally new stakeholders may appear, which are difficult to attribute to any of the traditional groups (for example, franchising organizations, subsidiaries, manufacturers of related products, etc.).

Having developed a list of the main stakeholders of the organization, it is possible for each of them to determine the most important groups of its expectations, which affect its satisfaction and the decision to continue cooperation with the organization. As a result, the organization receives a table similar to the one below (we emphasize once again that such a table will be individual for each organization).

| Interested party | Key expectations |

| Shareholders | Share price |

| Dividends per share | |

| Preservation of property | |

| The ability to obtain information about the activities of the organization | |

| Consumers | Quality of products and services |

| Deadlines | |

| Price | |

| Suppliers | Volumes and forecasting of orders |

| Price and settlement procedure | |

| Development of partnerships | |

| Staff | Social security |

| Work safety | |

| Personal development opportunity | |

| Interesting job, the opportunity to attract | |

| Psychological climate | |

| Population of the city where the enterprise is located | Payment of taxes |

| No negative impact on the environment | |

| Charitable and social activities | |

| Openness, availability of information |

The presence of such a table helps to better understand the place of the organization in the world, to determine its strategy, in particular, to determine the sequence of steps to expand the scope of the documented management system. What we integrate: the sequence of expansion of the integrated control system

21. Criterion for choosing an investor, economic return on investment

Investments - placement of capital for the purpose of making a profit. Investment is an integral part of the modern economy. Investments differ from loans in the degree of risk for the investor (lender) - the loan and interest must be repaid within the agreed timeframe, regardless of the profitability of the project, investments (invested capital) are returned and generate income only in profitable projects. If the project is unprofitable, investments may be lost in whole or in part.

Investments - cash, securities, other property, including property rights, other rights that have a monetary value, invested in objects of entrepreneurial and (or) other activities in order to make a profit and (or) achieve another useful effect

Investor selection criterion

1. Does the investor have experience and expertise in the field and in the market to which your startup is addressed?

2. What resources does an investor have that can be useful for the development of your startup, besides money? There is a lot of money in the venture capital market now, but not enough capital. There is a huge difference between the two. I assure you that expertise, investor connections and the ability to reach partners and potential customers are much more important for a startup (especially in the early stages).

3. Analyze the investor's past investments: which of them were in a similar area or market and how are they developing now? Investor Success Stories?

4. Does the investor have experience of exits? If the investor was able to sell the project to a strategist or investor of a higher rank, you may be able to go the same way.

5. If there is an opportunity to communicate with other companies / entrepreneurs that were invested by this investor, find out what level of support was provided by the investor.

6. Does the investor agree to join the startup board of directors? This determines the level of support and his involvement in the project.

7. Calculate the net worth of the investor. You will most likely not be able to pinpoint the exact figure, but it is important to understand if the investor has enough funds to support you. For example, according to Western standards, an investor should have liquid assets 7-10 times higher than the amount of investment in the project. So, if you are looking for $ 50 thousand, then the angel should have liquid assets for $ 500 thousand - that is, it can be easily converted to cash in the short term. This is important because when choosing an investor, you are ideally choosing the one who will make your business stronger. And if an investor lives in constant fear of losing his invested money, this may not always have a productive effect on the development of a startup. That is, it is very important to find out as reliably as possible that the investor "can afford" investment in your project.

8. How can a partnership with an investor affect your reputation? It is one thing to find a compromise in order to develop a business, it is another to give up your values and principles for money. The second path is not worth taking. Don't discount the reputational risks, consider: will you have problems attracting subsequent rounds of investment if you enter into a deal with the investor of your choice?

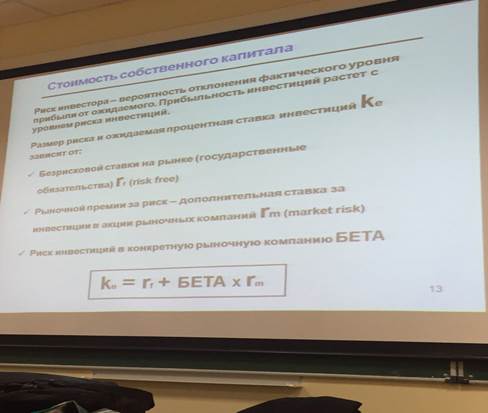

22. Model of the cost of equity of the company

The cost of capital is understood as the income that investments must bring in order for them to justify themselves from the investor's point of view. The cost of capital is expressed as the percentage rate (or fraction of a unit) of the amount of capital invested in a business that the investor must pay during the year to use his capital. An investor can be a creditor, owner (shareholder) of an enterprise or the enterprise itself. In the latter case, the company invests its own capital, which was formed during the period preceding the new capital investments and therefore belongs to the owners of the company. In any case, you have to pay for the use of capital, and the cost of capital is the measure of this payment.

The cost of equity is the rate of return that investors expect from an investment in a firm's equity capital. Risk and return models require risk-free rates and risk premium (CAPM model) or multiple premiums (APM model and multifactorial model), the approach to the definition of which was presented in the previous chapter. In addition, these models require knowledge of the firm's exposure to market risk, expressed in the form of beta. These inputs are used to obtain an estimate of the expected return on the equity investment:

Expected return = risk-free rate + odds beta (risk premium).

This expected return for equity investors includes the compensation for the market risk inherent in the investment as well as the cost of equity. In this section, we will focus on assessing the firm's beta. Although much of this discussion focuses on the CAPM model, its conclusions can be extended to the arbitrage pricing model and the multivariate model.

(http://bizplan-uz.ru/theory/business_estimation/520/)

Discounted payback period

Discounted payback period Methodological aspects of project management

Methodological aspects of project management Scrum development methodology

Scrum development methodology