The efficiency of using fixed assets in terms of productivity characterizes. Use of fixed assets. Fixed assets chapter

Introduction

1 Theoretical aspects of asset management

1.1 The concept and essence of fixed assets of the enterprise

1.2 Methods for assessing fixed assets and their depreciation

1.3 Indicators characterizing the efficiency of the use of fixed assets

2 Analysis of fixed assets

2.1 Brief technical and economic characteristics of the enterprise

2.2 Analysis of the dynamics and structure of fixed assets

2.3 Analysis of indicators of the effectiveness of the use of fixed assets

3 Reserves for increasing the efficiency of using fixed assets

3.2 Economic evaluation of proposed activities

Conclusion

Bibliography

Application

Introduction

Fixed assets of an enterprise are means of labor that repeatedly participate in the production process and transfer their value to finished products in parts as they wear out.

In the conditions of market relations, such issues concerning fixed assets as the technical level, quality, and reliability of products are brought to the fore, which entirely depends on the qualitative state of technology and its effective use. Improving the technical qualities of labor instruments and equipping workers with them provide the bulk of the growth in the efficiency of the production process.

A more complete use of fixed assets leads to a decrease in the need for the introduction of new production capacities when the volume of production changes, and, consequently, to a better use of the enterprise's profits.

Improving the use of fixed assets also means accelerating their turnover, which significantly contributes to solving the problem of reducing the gap in terms of physical and obsolescence, accelerating the pace of renewal of fixed assets.

Finally, the effective assessment and management of fixed assets is closely related to improving the quality of products, because in conditions of market competition, high-quality products are sold and in demand faster.

Work tasks:

1. Conduct an analysis of fixed assets, including:

1.1 Analyze the dynamics and structure of fixed assets

1.2 Analyze the performance indicators of the use of fixed assets

2. Identify reserves for increasing the efficiency of using fixed assets

3. Give a business case for the proposed activities

The object of the research is the Birobidzhan Furniture Factory Open Joint Stock Company.

The subject of the course project is the process of managing fixed assets at JSC "Birobidzhan Furniture Factory".

When performing the work, the following methods will be used:

Literature analysis

Analysis of Internet sources

Horizontal analysis

Vertical analysis

Deterministic Factor Analysis

Odds comparison

Forecasting

1 Theoretical aspects of asset management

1.1 The concept and essence of fixed assets of the enterprise

To understand the essence of our topic, we need to define what the fixed assets are. Fixed assets are a part of property used as a means of labor in the production of goods, performance of work, provision of services, or for the management needs of the organization for a period exceeding 12 months or a normal operating cycle, which transfers its value to the finished product in parts as it wears out ... We will adhere to this understanding of fixed assets in our future work.

Fixed assets include: land plots and natural resources, buildings, structures, transmission devices, workers and power machines, equipment, measuring and control devices, computers, vehicles, tools, production and household equipment, working, productive and pedigree livestock, as well as perennial plantations.

Fixed assets are classified according to several criteria.

According to their intended purpose, fixed assets are divided into production and non-production. Production fixed assets function in the sphere of material production, repeatedly participate in the production process, gradually wear out and transfer their value to the finished product in parts as they wear out. Non-productive fixed assets do not participate in the production process and are intended for the purposes of non-productive consumption. These include: objects of health care, physical culture and sports, housing and communal services - hostels, residential buildings, clubs, kindergartens, baths, etc. on the balance sheet of the enterprise.

According to the degree of participation in the production process, fixed assets are divided into active and passive. The active part affects the subject of labor, moves it in the production process and exercises control over the course of production (machinery, equipment, vehicles, tools). The passive part creates conditions for the uninterrupted functioning of the active part (buildings, structures, inventory).

Fixed assets are varied in composition. In accordance with the Standard Classification, fixed assets are subdivided into types as follows:

1. Buildings.

2. Structures.

3. Transfer devices.

4. Machinery and equipment (including power machines and equipment; working machines and equipment; measuring and regulating instruments, devices and laboratory equipment; computers; other machinery and equipment).

5. Vehicles.

6. Tool.

7. Production inventory and accessories.

8. Household inventory.

9. Working and productive livestock.

10. Perennial plantings.

11. Capital expenditures for land improvement (excluding structures).

12. Other fixed assets.

By ownership, fixed assets are subdivided into own and leased assets. The first belong to the enterprise and are listed on its balance sheet; the latter were obtained from other enterprises and organizations for temporary use for a fee.

By the nature of participation in the production process, distinguish between active and inactive (in stock or on conservation) fixed assets.

By the nature of participation in the main activity and the method of transferring value to the costs of production and circulation, fixed assets are divided into:

Active (their participation can be measured by the number of hours of work, the amount of work);

Passive (buildings, structures). Their participation in the main activity cannot be measured in any indicators.

Having considered the concept and types of fixed assets, it will be advisable to disclose the methods of their assessment, to understand the concept of "depreciation" and the methods of its accrual.

1.2 Methods for assessing fixed assets and their depreciation

In order to assess fixed assets, several types of their value are used, which differ from each other. The assessment at the initial cost of fixed assets (OFperv) is determined at the time of putting the object into operation as follows:

where C is the price of fixed assets, including packaging;

Zd - delivery costs;

Zu - installation costs;

Zprch - other costs.

The replacement cost characterizes the cost of reproduction of fixed assets in modern conditions, that is, taking into account the achieved level of production development, the achievements of scientific and technological progress and the growth of labor productivity, as well as price increases.

They also distinguish the book value of fixed assets (OFball) - this is the cost at which fixed assets are taken into account at the enterprise. It coincides with either the original (OFperv) or the replacement cost (OFvost):

where is the cost of fixed assets purchased before revaluation;

Cost of fixed assets acquired after revaluation.

The residual value (OFost) characterizes the value that has not yet been transferred to the finished product:

where And is the cost of wear.

The market value of an object included in fixed assets is understood as the most probable price, which, in principle, can take place by agreement between buyers and sellers in the event of the sale of this object in a free competitive market. It is assumed that sellers and buyers act reasonably, without violating the law, the objects of the transaction do not need an urgent sale or purchase, and payment for transactions is made in cash and is not accompanied by additional conditions.

The residual value (OFLQ) is the value of the potential disposal of retired property, plant and equipment.

Amortized cost (OFAM) is the cost of fixed assets that must be transferred to finished products:

In economic calculations, the concept of the average annual cost of fixed assets (OFsr.g) is used:

where OFn is the cost of fixed assets at the beginning of the year;

OFK - the cost of fixed assets at the end of the year;

OFi - the cost of fixed assets at the beginning of the i-th month.

Indicators of movement and efficiency of use of fixed assets

The quantitative characteristics of the reproduction of fixed assets are calculated according to the following principle formula:

OFn + OFv - OFl = OFk, (1.6)

where OFn, OFk - the cost of fixed assets at the beginning and end of the year;

OFv - the cost of the introduced fixed assets;

OFL - the cost of written off fixed assets.

The movement of fixed assets can be characterized using the following ratios:

Update rate

Retirement rate

The renewal ratio shows the proportion of fixed assets introduced in the reporting period. The retirement rate shows the proportion of retired fixed assets. This group of indicators characterizes only the movement of fixed assets and does not say anything about their use.

Having found out with the help of which indicators the value of fixed assets is estimated, we can proceed to consider their depreciation and the transfer of value to the finished product, that is, it is depreciation.

The economic content of depreciation is a loss of value. The following types of wear are distinguished:

Physical (change in physical, mechanical and other properties of fixed assets under the influence of the forces of nature, labor, etc.);

Moral depreciation of the 1st kind (loss of value as a result of the appearance of cheaper similar means of labor);

Moral depreciation of the 2nd kind (loss of value caused by the emergence of more productive means of labor);

Social depreciation (loss of value as a result of the fact that new fixed assets provide a higher level of satisfaction of social requirements);

Environmental deterioration (loss of value as a result of the fact that fixed assets cease to meet new increased requirements for environmental protection, rational use of natural resources, etc.).

Full depreciation is a complete depreciation of fixed assets, when their further exploitation in any conditions is unprofitable or impossible. Depreciation can occur both in the case of work and in the case of inactivity of fixed assets.

The process of transferring the value of fixed assets to finished goods and reimbursement of this value in the process of selling the product is called depreciation. Depreciation deductions - this is a monetary expression of the amount of depreciation, which must correspond to the degree of depreciation of fixed assets.

The amount of depreciation charges depends on the book value of fixed assets and the rates of depreciation charges. The depreciation rate is the established amount of depreciation deductions for a certain period of time for a specific type of fixed assets, expressed, as a rule, as a percentage of the book value. The depreciation rate shows the percentage of annual reimbursement of the cost of fixed assets:

where Na is the depreciation rate;

Te is the number of years of operation.

In some cases, depreciation deductions are made in proportion to the amount of work performed.

Annual depreciation deductions in value terms (Ag) can be calculated using the following formula:

where (On) i - differentiated depreciation rates established for each group of fixed assets;

n is the number of groups of fixed assets.

The residual value of fixed assets (OFost), taking into account depreciation deductions, can be calculated using the following formula:

where Te is the number of years of operation of fixed assets;

(1.12) - depreciation of fixed assets in value terms.

The actual depreciation of fixed assets is extremely difficult to determine, therefore, in the practice of economic calculations, depreciation is taken equal to the amount of depreciation deductions. To assess the degree of depreciation of fixed assets, the depreciation coefficient is used:

Accrual of depreciation deductions is made monthly:

On the fixed assets put into effect, depreciation starts from the first day of the month following the date of entry. Depreciation on written off fixed assets ceases from the first day following the date of writing off the month. The rates of depreciation deductions can be adjusted depending on the specific operating conditions of fixed assets. Depreciation deductions for the full restoration of the active part of fixed assets are made only during their standard service life or the period for which the book value of these funds is fully transferred to costs. For other types of fixed assets - during the entire actual service life.

Depreciation rates for residential buildings are set only for the calculation of depreciation.

Accelerated depreciation is the target method of transferring their book value to costs faster than the standard service life of fixed assets.

Intangible assets include the costs of enterprises for intangible objects used during long-term periods of economic activity and generating income: the right to use land plots, natural resources, patents, licenses, know-how, software products, monopoly rights and privileges, including licenses for certain types activities, organizational expenses (including fees for state registration, brokerage place, etc.), trademarks and trademarks. The price of a firm arises from the purchase of entire operating enterprises. Typically, such businesses are bought and sold at market prices based on their profitability, goodwill, the prestige of their products or services, and some other factors. The excess of the purchase price over the book value of all assets of the enterprise constitutes the price of the goodwill of the company and is accounted for as an intangible object. Intangible assets transfer their value to production costs evenly (monthly) at the rates determined by the enterprise, based on the established period of their use. The useful life of intangible assets can be determined in the following three ways:

1) the useful life coincides with the period of validity of one or another type of intangible assets, which is provided for by the relevant agreement;

2) enterprises independently establish the useful life of intangible assets. The main factor affecting the justification of the rate of depreciation should be the period during which the company is going to use this type of asset to its advantage. It is practically impossible to establish the exact duration of such a period, therefore, both the value of the initial cost of intangible assets and the value of the cost of production can affect the decision-making on this issue;

3) it is not possible to establish the useful life, then the current legislation provides for the establishment of the useful life equal to the life of the enterprise.

1.3 Indicators of the efficiency of the use of fixed assets

The main indicators of the efficiency of the use of fixed assets can be grouped into three groups:

1) Private indicators;

2) Integral indicators, taking into account the cumulative influence of all factors, both extensive and intensive;

3) Generalizing indicators of the use of fixed assets, characterizing various aspects of the use (condition) of fixed assets as a whole for the enterprise.

The particular indicators characterizing the efficiency of the use of fixed assets include indicators of the use of machines and mechanisms in terms of time and productivity. All particular indicators can be divided into two categories: indicators characterizing the extensive use of machinery and equipment, and indicators characterizing the intensity of their use.

To characterize the degree of extensive equipment utilization, the balance of its operating time is studied. It includes:

Calendar fund of time - the maximum possible operating time of the equipment (the number of calendar days in the reporting period is multiplied by 24 hours and by the number of units of installed equipment);

Regime fund of time (the number of units of installed equipment is multiplied by the number of working days of the reporting period and by the number of hours of daily work, taking into account the shift ratio);

Planned fund - equipment operation time according to plan. It differs from the operating time of the equipment being under scheduled repair and modernization;

The actual fund of hours worked.

Comparison of the actual and planned calendar time funds allows you to establish the degree of fulfillment of the plan for putting the equipment into operation in terms of quantity and timing; calendar and operational - the possibility of better use of equipment by increasing the shift ratio, and operational and scheduled - reserves of time by reducing the time spent on repairs.

The indicators of extensive use of fixed assets include:

The coefficient of extensive use of equipment (Kekst), which is defined as the ratio of the actual number of hours of equipment operation (tf) to the number of hours of operation at the rate (tn):

Кext = tf / tн (1.15)

Equipment shift factor (Kcm), which is defined as the ratio of the total number of machine-shift equipment worked out (Dst.cm) to the number of machines that worked in the longest shift (n):

Kcm = Dst.cm / n (1.16)

Equipment load factor (Kzagr), which is defined (simplified) as the ratio of the work shift factor (Kcm) to the planned equipment shift (Kpl):

Kzagr = Kcm / Kpl (1.17)

Intensive use of fixed assets shows the coefficient of intensive use of equipment (Kint), which is defined as the ratio of the actual performance of equipment (Pf) to the standard (Pn):

Kint = Pf / Mon (1.18)

An indicator that takes into account the extensiveness and intensity of the use of fixed assets is the coefficient of integral use of equipment (Kintegr), which is found by the formula:

Kintegr = Kekst Kint (1.19)

To summarize the characteristics of the efficiency of using fixed assets, there are indicators of profitability (the ratio of profit to the average annual value of fixed assets), capital productivity (the ratio of the value of manufactured or sold products after deducting VAT, excise taxes to the average annual value of fixed assets), capital intensity (inverse rate of return on assets) of specific capital investments per ruble of production growth. The relative savings of fixed assets is also calculated:

where OPFo, OPF1 - respectively, the average annual cost of fixed assets in the base and reporting years;

IВП - index of the volume of production.

When calculating the average annual value of funds, not only own, but also leased fixed assets are taken into account and funds that are on conservation, reserve and leased are not included.

The most widely used of the general indicators is the rate of return on assets, which reflects the effectiveness of the use of materialized in the main production assets of labor and characterizes the amount of production per 1 ruble. the cost of fixed assets. (3656)

Return on assets (FOTD) is an indicator of product output per 1 ruble. the cost of fixed assets; is defined as the ratio of the volume of output to the value of fixed assets for a comparable period of time (month, year):

Fotd = V / F, (1.21)

where B is the volume of production

Ф - the cost of fixed assets

It should be noted that the rate of return on assets does not allow to fully assess the degree of use by the organization of the fixed assets at its disposal. The value of the rate of return on assets is in direct proportion to the level of labor productivity.

Capital intensity - an indicator inverse to capital productivity; characterizes the cost of production fixed assets per 1 ruble. products.

Capital intensity is calculated by the formula:

Femk = F / V (1.22)

Capital-labor ratio is an indicator characterizing the equipment of workers of enterprises in the sphere of material production with basic production means. Capital-to-labor ratio is defined as the ratio of the value of fixed assets of an enterprise to the average annual payroll number of employees. The capital-labor ratio is as follows:

Fv = F / H (1.23)

Labor productivity (Pr) can be determined by multiplying the capital productivity indicator (Fotd) by the capital-labor ratio (Fw):

Pr = Fotd Fv (1.24)

The most generalizing indicator of the effectiveness of the use of fixed assets is the return on assets. Its level depends not only on the return on assets, but also on the profitability of the product. The relationship between these indicators can be represented as follows:

where Ropp is the profitability of fixed assets;

P - profit from the sale of products; OPF - the average annual cost of fixed assets; VP and RP - respectively, the cost of manufactured or sold products; FO - return on assets; Rвn, Ppn - profitability of manufactured or sold products.

2 Analysis of fixed assets of JSC "Birobidzhan Furniture Factory"

2.1 Brief technical and economic characteristics

The enterprise OJSC "Birobidzhanskaya furniture factory" (or OJSC "BMF") is a legal entity, has separate property, an independent balance sheet, settlement or other accounts in bank institutions, a seal with its name, letterheads. The enterprise carries out its activities in accordance with the laws and regulations of the Russian Federation, this charter.

The enterprise operates on the basis of business accounting and self-financing and bears responsibility established by the legislation of the Russian Federation for the results of its production, economic and financial activities and the fulfillment of obligations to the property owner, suppliers, consumers, the budget, banks and other legal entities and individuals.

The relationship of the Enterprise with other enterprises, organizations, municipal authorities and citizens is governed by the legislation of the Russian Federation, mutually beneficial agreements and this Charter.

Location of the enterprise: 679016, Birobidzhan, st. Sholem Aleichem 40.

The authorized capital of the enterprise: 12689 thousand rubles.

The objectives of the establishment of the enterprise are the production of furniture products, meeting social needs and making a profit. The activity of JSC “BMF” is based on the principles of economic independence, self-financing and self-sufficiency.

The enterprise sets prices for all types of work performed, services, manufactured and sold products in accordance with the current legislation of the Russian Federation.

The enterprise independently disposes of the results of production activities, the profit received, which remains at the disposal of the enterprise after the payment of mandatory payments and taxes.

Figure 2.1 Management structure of JSC "BMF"

The management structure of OJSC “BMF” is linear and functional. This is a combination of linear and functional organizational structures, built on the basis of a vertical management hierarchy and based on strict subordination of the lower level to the top and functional structure, built on the basis of grouping personnel according to the broad tasks that they perform.

|

Indicators |

Deviation |

|||

|

Revenue from product sales |

||||

|

Cost of marketable products |

||||

|

Gross profit |

||||

|

Product profitability,% |

||||

|

Fixed assets cost |

||||

|

Working capital cost |

||||

|

Return on assets, rub. |

||||

|

Authorized capital |

||||

|

Extra capital |

||||

|

Undestributed profits |

||||

Analyzing the data in the table, we can conclude that the revenue from the sale of the enterprise has decreased. Thus, in comparison with 2007, the proceeds from sales decreased by 7753 thousand rubles or 19.25%. Along with a decrease in sales proceeds, a decrease in the cost of production is observed. Over the same period, the cost of production decreased by 22.97%.

In the reporting period, profit decreased by 2336 thousand rubles or 14.01%.

The value of the company's assets for the reporting period increased: while the value of fixed assets decreased by 5.3%, current assets increased by 8.09%.

With a decrease in sales proceeds, there is a decrease in the efficiency of using fixed assets by 14.67%.

The authorized capital is 12689 thousand rubles, the additional capital is 117 thousand rubles. In the reporting period, there was an increase in the amount of retained earnings by 1,139 thousand rubles or 15.28%.

2.2 Analysis of the dynamics and structure of fixed assets of the Birobidzhan furniture factory

To analyze the dynamics and structure of fixed assets, we need to bring the necessary indicators into a form that is convenient for analysis. The structure of fixed assets includes the following categories:

Constructions

cars and equipment

Vehicles

Other types of fixed assets

Let's group them into a table:

Table 2.1- Types of fixed assets

|

Constructions |

|||

|

cars and equipment |

|||

|

Vehicles |

|||

|

Other types of fixed assets |

|||

From the table we see that the main part of fixed assets is made up of buildings - 8049 thousand rubles. and 6885 thousand rubles. at the beginning and end of 2008, respectively. A smaller share in the amount of 5574 and 6006 thousand rubles. accordingly constitute machinery and equipment as the main production element. Structures at the beginning of the year were equal to 1238 thousand rubles, at the end of the year 1025. The total cost of fixed assets at the beginning of the year amounted to 15479 thousand rubles, at the end of the year 14648 thousand rubles.

To calculate the share of a category in the total amount, the indicator must be correlated with the amount and multiplied by 100%. To calculate the change (dynamics) in thousands of rubles, you need to subtract the same indicator at the beginning of the year from the indicator at the end of the year. You can calculate the relative change (in percent) as follows:

Percentage change in indicator

Ikg - value at the end of the year

Ing - value at the beginning of the year

Using the above method for calculating the dynamics and structure, we got a table of the following form:

Table 2.2 - dynamics and structure of fixed assets

|

the change |

Change of structure |

||||||

|

Constructions |

|||||||

|

cars and equipment |

|||||||

|

Vehicles |

|||||||

|

Other types of fixed assets |

|||||||

As we can see, at the beginning of the year, the main share of fixed assets is made up of buildings - 52%, followed by machinery and equipment - 36.01%, structures occupy the third place in size and make up 8%. The rest of the categories (vehicles and other types of fixed assets) form a smaller share - no more than 4%.

At the end of the year, buildings account for the main share of fixed assets - 47%, machinery and equipment - 41%, structures occupy the third place and account for 7%. The rest of the categories (Vehicles and other types of fixed assets) form a smaller share - 5%.

As of the end of the year, we see that the cost of buildings decreased by 1164 thousand rubles, which is 14.46% of the amount at the beginning of the year and became equal to 6885 thousand rubles.

In turn, the second largest indicator of machinery and equipment increased by 7.75% (or 432 thousand rubles). In the category of "vehicles" there is a decline in the amount of 24 thousand rubles, which is 5.17% of the amount at the beginning of the year. We also observe a negative trend in the article “constructions”, they decreased by 213 thousand rubles or 17.21%.

At the end of the year, there were changes in the structure of fixed assets. The change in the share of the cost of buildings was 5% downward. The share of machinery and equipment in the total structure of fixed assets increased by 4.99%. There is also an increase in the share of vehicles and other types of fixed assets by 0.01% and 1%, respectively. The share of structures decreased by 1%.

It can be noted that the total amount of fixed assets decreased by 831 thousand rubles. In order to see the causes and consequences of this phenomenon, it is necessary to conduct a deeper analysis of fixed assets, namely to analyze the indicators of the effectiveness of their use and calculate the savings.

The dynamics of fixed assets is characterized by such indicators as the renewal rate, retirement rate, depreciation rate, average monthly and average annual depreciation.

Renewal and retirement rates characterize the movement of fixed assets. Refresh rate calculated by the formula

is equal to 0.049. This suggests that the share of fixed assets introduced during the reporting period is 4.9%. The retirement ratio, found as the ratio of the value of retired fixed assets to the value of fixed assets at the beginning of the reporting period, is 0.078, that is, the total amount of fixed assets retired during the reporting period is 7.8% of the total amount of fixed assets at the beginning of the year. These ratios tell us that fixed assets do not "stagnate", but are constantly changing. Obsolete funds are being dropped out and replaced by new ones.

If the funds are constantly becoming obsolete and replaced, then it would be advisable to analyze the depreciation of fixed assets and their depreciation.

Table 2.3 - Depreciation and amortization of fixed assets

|

Types of fixed assets |

PF at the beginning of the year |

PF for con of the year |

Depreciation |

|||

|

Constructions |

||||||

|

cars and equipment |

||||||

|

Vehicles |

||||||

|

Other types of fixed assets |

||||||

To calculate the wear of the fixed object, we will use the formula 1.12, indicated in Chapter I.

For our case, the depreciation will be equal to 15137.01 thousand rubles at the beginning of the year and 14324.36 thousand rubles at the end of the year, which is 812.65 thousand rubles or 5.37% less. Knowing the level of wear, we can calculate the wear factor using the formula 1.13. At the beginning and at the end of 2008, it is equal to 0.978, which suggests that fixed assets are almost worn out, you should think about their renewal or replacement. If the annual change in depreciation was 8%, then we can say that fixed assets will be completely worn out in 2.25 years, which indicates the need for their restoration and renewal. The residual value of fixed assets at the end of the year is RUR 1993,705 thousand.

Average annual depreciation charges amounted to 1227.55 thousand rubles. Average monthly depreciation deductions can be found by the formula:

102.3 (thousand rubles)

2.3 Analysis of indicators of the effectiveness of the use of fixed assets

Having considered the indicators of the movement of fixed assets, we turn to the analysis of indicators of the efficiency of using fixed assets. By the end of the year, the number of machines in operation increased by 2, and the cost of equipment increased by 432 thousand rubles, which means that the company monitors production equipment and purchases new, as well as restores and repairs it if necessary. First, we need to determine the coefficient of extensive use of equipment, that is, the time indicator of use. Equipment operating hours according to the standard 101376 hours per year. The actual fund of the equipment working time amounted to 96768 hours, that is, less than the planned standard by 4608 hours. The equipment extensive utilization rate was 0.95, which indicates its underutilization and deviation from the plan by 5%. This is due to unplanned downtime, breakdowns, interruptions in the supply of materials, loss of staff time and other facts.

At the beginning of the reporting year 2008 and

At the end of 2008,

which suggests the following: the shift ratio has increased, but the enterprise has reserves for the use of equipment, since the actual indicator is less than the standard - (1.6<2) в начале года и (1,7<2) в конце года.

at the beginning of the year and

at the end of the year

Such values of the load factors tell us about the incomplete use of the equipment capacity, but there is an increase in the load factor by 0.05.

The next step in the analysis of the effectiveness of the use of equipment will be the calculation of the coefficient of the intensity of the use of equipment, which shows the ratio of the actual performance to the standard.

at the beginning of the year and

at the end of the year

Actual productivity is 24% lower than the norm at the beginning of the year, and 14% at the end of the year, which indicates an increase in productivity by 10%.

A more general indicator that takes into account the use of equipment in terms of time and productivity is the integral utilization factor. To calculate it, you need to multiply the rate of intensive use by the rate of extensive equipment use. Substituting into the formula we get:

Kintegr = 0.95 * 0.76 = 0.72 at the beginning of the year and

Kintegr = 0.95 * 0.86 = 0.82 at the end of the year.

Hence, we can conclude that the use of equipment has increased by 0.1 or 10% (0.82-0.72).

Accordingly, the equipment of JSC “BMF” was used at the beginning of 2008, taking into account deviations from the working time fund and standard productivity, by only 72%, and at the end of the year by 82%.

Having calculated the efficiency of using the equipment, it will be advisable to find out how fixed assets are used, with savings or not. First, we need to calculate the sales revenue index (IPI), which is equal to the ratio of sales revenue at the beginning of the year to sales revenue at the end of the year. By correlating these two indicators, we received IEP = 1.238. Now let's calculate the relative savings of fixed assets according to the formula:

Savings of fixed assets in 2008 amounted to 4,522.1 thousand rubles. It can be concluded that, despite the incomplete use of production capacity, the enterprise began to use fixed assets more efficiently at the end of the year. The reason for this is such factors as the use of new machines (renewal of production assets), consequently, the second factor will be a decrease in production costs, and, accordingly, an increase in sales proceeds and profits.

Another indicator characterizing the use of fixed assets is the return on assets. It can also be calculated over two (or more) periods. We will take the beginning and the end of the year for analysis. We need to correlate the profit with the value of the funds. In order to calculate the net economic benefit from the activities of the enterprise, we decided to take the net profit for analysis, thereby showing the real profitability.

To analyze the efficiency of the use of fixed assets, we need to calculate the indicators of capital productivity, capital intensity and capital-labor ratio. The capital productivity of JSC "BMF", calculated according to the initial data, is 2.6 at the beginning of the year and 2.2 at the end of the year. We are seeing a decrease in capital productivity, which shows a decrease in the volume of output from each ruble spent by 40 kopecks. The value of capital intensity (inverse indicator), respectively, increased from 0.38 rubles of fixed assets spent per ruble of manufactured products to 0.45 rubles. Such a change in these two indicators indicates a decrease in the efficiency of using fixed assets, because for a comparable amount of fixed assets, there is a decrease in output. The capital-labor ratio at the beginning of 2008 is equal to 212.04 thousand rubles, that is, one employee accounts for 212.04 thousand rubles of fixed assets. In turn, at the end of the year, the capital-labor ratio amounted to 218.63 thousand rubles, that is, one employee accounts for 218.63 thousand rubles of fixed assets. There was a change in the capital-labor ratio in the positive direction by 6.59 thousand rubles (or 0.01%) due to the proportional change in the ratio of the number of employees and the cost of fixed assets.

Summing up, I would like to note that despite the loss of time and incomplete use of production capacity, a decrease in the total cost of fixed assets, an increasing wear of equipment, the enterprise improves its performance, that is, it increases the amount of profit, acquires new machines and equipment, and increases productivity compared to the past. analyzed period. Thus, the efficiency of the use of fixed assets increases, which is confirmed by our analysis.

3 Reserves for increasing the efficiency of using fixed assets

3.1 Identifying reserves

Economic reserves are understood as opportunities to improve the efficiency of an organization through the use of the achievements of scientific and technological progress and advanced experience.

For a better understanding, more complete identification and use of economic reserves are classified according to various criteria.

On a spatial basis, intra-economic, sectoral, regional and national reserves are distinguished.

On-farm reserves include reserves that are identified and can be used only at the analyzed enterprise. They are primarily associated with the prevention of losses and waste of resources.

Industry reserves are those reserves that can only be identified at the industry level, for example, the development of new machine systems, new technologies, improved product designs, the development of new varieties of crops, animal breeds, etc.

Regional reserves can be identified and used within a geographic area (use of local raw materials and fuel, energy resources, centralization of auxiliary industries, regardless of their departmental subordination, etc.).

The elimination of imbalances in the development of various industries, changes in the forms of ownership, the system of management of the national economy, etc. can be attributed to national reserves.

On the basis of time, reserves are divided into unused, current and prospective.

Untapped reserves are missed opportunities to improve production efficiency in relation to the plan or achievements of science and advanced experience over the past periods of time.

Current reserves are understood as opportunities for improving the results of economic activity, which can be realized over the next period (month, quarter, year).

Prospective reserves are usually calculated for a long time. Their use is associated with significant investments, the introduction of the latest achievements of scientific and technological progress, the restructuring of production, a change in production technology, specialization, etc.

Our analysis showed that the company began to use fixed assets more efficiently than in the same comparable period. But he still has reserves to improve the efficiency of the use of fixed assets. Based on the results of the analysis, it is possible to identify areas that should be focused on.

To implement the reserves for increasing the efficiency of the enterprise, I would like to propose the following:

To increase the volume of production and improve the quality of products, replace morally and physically obsolete equipment with new ones. The reserves for the growth of capital productivity and return on assets are an increase in the volume of production and (or) profits, and a decrease in the average annual balances of fixed assets. In turn, the reserve for reducing the average balances of production assets is formed through the sale and lease of unnecessary assets and write-off of unusable assets. Today, the outdated base of technological equipment, the equipment of workplaces with tools and auxiliary materials does not meet the requirements of technology and quality. Consequently, properly selected equipment will solve the problem of increasing the efficiency of the enterprise.

More full use of equipment in order to reduce downtime. Avoidable downtime is a large opportunity cost.

Repair the main buildings and structures. It is important to keep the production halls in good condition.

3.2 Economic evaluation of proposed activities

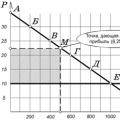

Knowing the profitability of the assets, we can calculate the benefits that the company will receive when introducing new production machines. At the end of 2008, the company's return on assets was 1.06. that is, from one ruble invested in fixed assets, the enterprise receives 1.06 rubles of profit. With the redistribution of net profit in a larger volume for the acquisition and restoration of fixed assets, the enterprise will receive proportionally more profit. Let's calculate the effect of an additional 10% of net profit:

15594*10%*1,06=1652,96

That is, with an investment of 1,559.4 thousand rubles, the company will receive net profit from the use of these funds in the amount of 1,652.96 thousand rubles (provided that the return on assets remains at this level).

Also, the enterprise must strive for the full use of fixed assets. The enterprise, due to downtime, interruptions in work, misses large amounts of profit per year. Let's calculate the additional amount of revenue that the company could receive in a year:

42385.26 thousand rubles. - so much would have been received by JSC "BMF" with 100% use of equipment. From this amount, we subtract the actual revenue received:

42385-40266 = 2119.26 thousand rubles.

If we also take into account the loss in performance, then we get the following:

40266 = 14892.9 thousand rubles

Accordingly, it can be said that the enterprise OJSC "BMF" has reserves to increase profits by increasing the efficiency of the use of fixed assets in the amount of

1652.96 + 14892.9 = 16,545.86 thousand rubles.

To increase revenue and increase profitability, the enterprise needs to take these reserves into account and use them.

Conclusion

In this course work, it was shown that the analysis of fixed assets in the enterprise is necessary in order to identify the factors that influence the inefficient use of fixed assets, and find ways to overcome or mitigate these negative factors.

Improving the efficiency of the use of fixed assets is of great importance in the entire national economy. The solution to this problem means an increase in the production of products necessary for society, an increase in the return of the created production potential and a more complete satisfaction of the needs of the population, an improvement in the balance of equipment in the country, a decrease in the cost of production, an increase in the profitability of production, the company's savings.

A more complete use of fixed assets also leads to a decrease in the need for the introduction of new production capacities when the volume of production changes, and, consequently, to a better use of the enterprise's profit (an increase in the share of deductions from profit to the consumption fund, the direction of most of the accumulation fund for mechanization and automation of technological processes, and etc).

The measures proposed to improve the efficiency of the use of fixed assets can be used at OJSC "Birobidzhan Furniture Factory" in order to increase profits and enhance financial stability.

The work analyzed the dynamics and structure of fixed assets, as well as an analysis of the effectiveness of their use, identified areas of search for reserves, proposed measures to increase the efficiency of using fixed assets. The tasks set for us at the beginning of the work were solved, the goal was achieved.

List of sources used

- Abryutina, M.S. Analysis of the financial and economic activities of the enterprise / Abryutina, M.S., Grachev, A.V .: educational and practical guide - M .: Business and service, 2000.

- Analysis of the economic activity of budgetary organizations: Textbook / D.A. Pankov, E.A. Golovkova, L.V. Pashkovskaya et al. - M .: New knowledge, 2002. –409 p.

- Artemenko, V.G. Financial analysis / Artemenko, V.G., Bellyandir, M.V .. - M .: DIS, 2000.

- Balabanov, A.I. Finance / Balabanov, A.I., Balabanov I.T. - SPb.: Peter, 2002. – 192s.

- Belolipetskiy, V.G. Firm finances: A course of lectures / Ed. I.P. Merzlyakov. - M .: INFRA - M, 1999.

- Blank, I.A. Financial Management: Training Course. - K .: "Nika - Center", 1999.

- Blyakhman, L.S. Economics of the Firm: Textbook. - SPb .: Publishing house of Mikhailov V.A., 1999.

- Bogatko, A.N. Fundamentals of economic analysis of a business entity. - M .: Finance and Statistics, 2001.

- 9. Brigham, Y. Financial management / Brigham, Y., Gapensky, L: Complete course. / Per. from English Ed. V.V. Kovaleva. - SPb., 2000 .-- v. 2 - p. 256 - 402.

- Vakulenko, T.G. Analysis of accounting (financial) statements for making management decisions / Vakulenko, T.G., Fomina, L.F. - M. SPb .: Publishing House "Gerda", 2001.

- Vladimirova, L.P. Forecasting and planning in market conditions: Textbook. - 4th ed., Rev. and add. - M .: 2004. - 400 p.

- Volkov, O. I. Enterprise economy. - M .: INFRA-M, 2001.

- Volkov, O. I. Enterprise Economics / Edited by O.I. Volkov. - M .: Infra - M, 1999.

- Grachev, A.V. Analysis and management of the financial stability of the enterprise: From accounts. accounting for econ .: Teaching.-practical. allowance. - M .: Finpress, 2002. - 208 p.

- Gruzinov, V.P. other. Enterprise economics: Textbook for universities / Edited by V.P. Gruzinov. - M .: Banks and Exchanges, UNITI, 2001.

- Denisov, A. Yu. Economics of enterprise and corporation management / Denisov, A.Yu., Zhdanov, S.A. - M .: "Business and Service" publishing house, 2002.

- Efimova, O. V. The financial analysis. - M .: Accounting, 2002.

- Zhilkina, A.N. Financial planning at the enterprise - M .: Firm "Blagovest-V" LLC, 2004. -248 s.

- Zimin, N.E. Analysis and diagnostics of the financial condition of enterprises: Textbook. settlement / N.E. Zimin. - M .: NKF "EKMOS", 2002.

- Kovalev, A.I. Analysis of the financial condition of the enterprise / Kovalev, A.I., Privalov, V.P. - M .: Center for Economics and Marketing, 2000.

- Kovalev, A.I. Analysis of the financial condition of the enterprise / Kovalev, A.I., Privalov, V.P. - M .: Center for Economics and Marketing, 2001.

- Kovaleva, A.M. Enterprise finance. - M .: Finance and Statistics, 2002.

23. Kovaleva, AM Finance of the company / Kovaleva, AM, Lapusta, MG: Textbook. 2nd

Appendix A

PROFITS AND LOSSES REPORT

|

7901020125/790101001 |

|

Form No. 1 according to OKUD

Date (year, month, day)

__ According to OKPO

Kind of activity furniture making _____________________ According to OKVED

According to OKOPF / OKFS

Limited Liability Company

By OKEI Location (address)

679016 g

|

Index |

During the reporting period |

For the same period of the previous year |

|

|

Income and expenses from ordinary activities Revenue (net) from the sale of goods, products, works, services (net of value added tax, excise taxes and similar mandatory payments) |

|||

|

Cost of goods, products, works and services sold |

|||

|

Gross profit |

|||

|

Business expenses |

|||

|

Administrative expenses |

|||

|

Profit (loss) from sales |

|||

|

Other income and expenses Interest receivable |

|||

|

Percentage to be paid |

|||

|

Income from participation in other organizations |

|||

|

Non-operating income |

|||

|

Non-operating expenses |

|||

|

Profit (loss) before tax |

|||

|

Deferred tax assets |

|||

|

Current income tax |

|||

|

Net profit (loss) of the reporting year |

|||

|

REFERENCE Permanent tax liabilities (assets) |

|||

|

Basic earnings (Loss) per share |

|||

|

Diluted earnings (loss) per share |

Appendix B

|

7901020125/790101001 |

|

BALANCE SHEET

Form No. 1 according to OKUD

Date (year, month, day)

Organization of OJSC "Birobidzhan Furniture Factory" __ According to OKPO

Taxpayer identification number TIN

Kind of activity furniture making _ According to OKVED

Organizational and legal form of ownership

Limited liability company According to OKOPF / OKFS

Measurement unit ________ thous. rub.______

Location (address)

679016 g ... Birobidzhan, st. Sholem Aleichem 40

|

ASSETS |

Indicator code |

At the beginning of the reporting year |

At the end of the reporting year |

||||||

|

FIXED ASSETS |

|||||||||

|

Intangible assets |

|||||||||

|

Fixed assets |

|||||||||

|

Construction in progress |

|||||||||

|

Profitable investments in material assets |

|||||||||

|

Long-term financial investments |

|||||||||

|

Deferred tax assets |

|||||||||

|

Other noncurrent assets |

|||||||||

|

TOTAL for section 1 |

|||||||||

|

CURRENT ASSETS |

|||||||||

|

including: |

|||||||||

|

raw materials, materials and other similar values |

|||||||||

|

animals for growing and fattening |

|||||||||

|

work in progress costs |

|||||||||

|

finished goods and goods for resale |

|||||||||

|

goods shipped |

|||||||||

|

Future expenses |

|||||||||

|

other supplies and costs |

|||||||||

|

Value added tax on acquired assets |

|||||||||

|

Accounts receivable (expected to be paid more than 12 months after the reporting date) |

|||||||||

|

Accounts receivable (due for which payments are expected within 12 months after the reporting date) |

|||||||||

|

including buyers and customers |

|||||||||

|

Short-term financial investments |

|||||||||

|

Cash |

|||||||||

|

Other current assets |

|||||||||

|

TOTAL for section 2 |

|||||||||

|

BALANCE |

|||||||||

|

Indicator code |

At the beginning of the reporting period |

At the end of the reporting period |

|||||||

|

CAPITAL AND RESERVES |

|||||||||

|

Authorized capital |

|||||||||

|

Extra capital |

|||||||||

|

Reserve capital |

|||||||||

|

Retained earnings (uncovered loss) |

|||||||||

|

TOTAL for section 3 |

|||||||||

|

LONG TERM DUTIES |

|||||||||

|

Loans and credits |

|||||||||

|

Deferred tax liabilities |

|||||||||

|

Other long-term liabilities |

|||||||||

|

TOTAL for section 4 |

|||||||||

|

SHORT-TERM LIABILITIES |

|||||||||

|

Loans and credits |

|||||||||

|

Accounts payable |

|||||||||

|

including: suppliers and contractors |

|||||||||

|

indebtedness to the personnel of the organization |

|||||||||

|

indebtedness to state extra-budgetary funds |

|||||||||

|

arrears of taxes and duties |

|||

|

other creditors |

|||

|

Debts to participants (founders) for the payment of income |

|||

|

revenue of the future periods |

|||

|

Provisions for future expenses |

|||

|

Other current liabilities |

|||

|

TOTAL for section 5 |

|||

|

BALANCE |

Appendix B

Distribution of fixed assets by type

|

Constructions |

|||

|

cars and equipment |

|||

|

Vehicles |

|||

|

Other types of fixed assets |

|||

Appendix D

Dynamics of fixed assets

|

Types of fixed assets |

Cheating for the year |

|||||

|

Constructions |

||||||

|

cars and equipment |

||||||

|

Constructions |

||||||

|

cars and equipment |

||||||

|

Vehicles |

||||||

|

Other types of fixed assets |

||||||

- Diyarova Regina Kamilovna, student

- Bashkir State Agrarian University

- CAPACITY

- PROFIT

- FUNCTIONALITY

- GIVING

The article discusses the main indicators reflecting the efficiency of the use of fixed assets, provides formulas for their calculation, gives explanations on them and indicates the ways of the influence of fixed assets on financial results.

- Key features of the reproduction of fixed assets in agricultural organizations

- Accounting of financial results of agricultural organizations

- The essence of financial stability and its main factors

One of the most important factors in increasing the volume of production of enterprises is their provision of fixed assets in the required quantity and range and their fuller and more efficient use.

In the conditions of a market economy and competition, those producers who effectively use their resources, in particular the main means of production, function successfully. Many indicators of the company's activity depend on the efficiency of the use of fixed assets.

Increasing the level of use of fixed assets is one of the most important tasks of enterprise management, since an increase in output, financial capital of an enterprise, and a decrease in production costs depend on their structure and degree of use.

In the system of indicators used to assess the use of fixed assets at the enterprise, there are two main groups:

- generalizing indicators that depend on the entire range of technical, organizational and economic factors and characterize the final result of using fixed assets;

- particular indicators that allow assessing the level of use of fixed assets depending on individual factors (equipment performance, operating time, etc.).

A generalizing assessment of the efficiency of using fixed assets is based on the application of a methodology common for all types of resources, based on the calculation and analysis of indicators of return and capacity.

Return indicators characterize the output of finished products per unit of resource cost. Capacity indicators characterize the cost of resources per ruble of output.

A generalizing indicator of the efficiency of using fixed assets is capital productivity, which is determined by the formula:

Where V is the volume of gross output, thousand rubles; OS - the cost of fixed assets, thousand rubles.

The inverse indicator of capital productivity is capital intensity, which is a costly indicator and is defined as the ratio of the average annual cost of fixed assets to the cost of the organization's gross output:

Fe = OC / V (2)

The efficiency of using fixed assets is also characterized by the return on assets ratio, which is defined as the ratio of profit before tax to the average annual cost of fixed assets:

Roc = PDN / OC × 100% (3)

Where PIT is profit before tax, thousand rubles.

Improving the efficiency of using fixed assets affects the financial results of the organization by:

- increasing production output;

- cost reduction;

- improving product quality;

- reduction of property tax;

- increase in balance sheet profit.

Thus, when assessing the possibilities of increasing the efficiency of the use of fixed assets, it should be remembered that its level and dynamics are influenced by numerous factors: the specifics of the raw material base, forms of organization and location of production, organizational and economic mechanism, scientific and technological progress, etc.

Bibliography

- Alekseycheva E. Yu. Economics of the organization (enterprise): Textbook for bachelors / E. Yu. Alekseycheva, M. D. Magomedov, I.B. Kostin. - 2nd ed., Rev. and add. - M .: Publishing and trade corporation "Dashkov and K °", 2013. - 292 p.

- Volodko O.V. Economics of the organization: textbook. allowance / O.V. Volodko, R.N. Grabar, T.V. Glyuy; ed. O.V. Volodko. - Minsk: Vysh. shk., 2012 .-- 399 p.

- Analysis and diagnostics of the financial and economic activities of the organization: Textbook. pos. / P.F. Askerov, I.A. Tsvetkov and others; Under total. ed. P.F. Askerova - M .: NITs INFRA-M, 2015 .-- 176 p.

- Analysis and diagnostics of the financial and economic activities of the enterprise: Textbook / A.P. Garnov. - M .: NITs INFRA-M, 2016 .-- 365 p.

- Economic analysis: Textbook / G.V. Savitskaya. - 14th ed., Rev. and add. - M .: NITs INFRA-M, 2014 .-- 649 p.

Introduction ……………………………………………………………………… ..................... ......

1. The concept of fixed assets (funds): types and indicators characterizing them ………… ...

2.Evaluation of the availability, condition, movement and efficiency of use of fixed assets …………………………………………………………………………………………

2.1. Characteristics of the internal and external environment of the enterprise ……………………………………………………………………………………

2.2. Assessment of the availability, condition and movement of fixed assets …………………………… ..

2.3. Evaluation of the efficiency of using fixed assets ………………………………

3. Ways to improve the efficiency of using fixed assets (funds)

3.1 Information technologies in assessing the efficiency of using fixed assets ………………………………………………………………………………………

3.2. Ways to improve the efficiency of the use of fixed assets …………………… ..

Conclusion………………………………………………………………………………………

Appendices …………………………………………………………………………………

INTRODUCTION

To carry out their activities, enterprises must have the necessary means of production and material conditions, which are the most important element and determine the development of productive forces. The means of production are divided into means of labor and objects of labor. In a market economy, these two components appear in the form of production means that ensure the continuous process of both production and marketing of products, as well as the development of the social sphere.

In most organizations, fixed assets account for 50% of all property. Consequently, the main production and non-production means, consisting of buildings, structures, machines, equipment and other means of labor, are the basis of the enterprise.

One of the most important factors in increasing the efficiency of production at industrial enterprises is the provision of fixed assets in the required quantity and range and their fuller use.

Given the relevance of the issue of fixed assets at industrial enterprises of the Republic of Belarus at the present stage of economic development, the topic of the course work is "The efficiency of using fixed assets of the enterprise (on the example of the Minsk Wheel Tractor Plant)".

The purpose of this work is: analysis of the state and efficiency of the use of fixed assets on the example of the Minsk Wheel Tractor Plant.

The objectives of this work are:

1) consider the economic essence of fixed assets and determine the value of their effective use for an enterprise in market conditions;

2) analyze the level of use of fixed assets at the enterprise;

3) to determine the reserves for increasing the efficiency of the use of fixed assets at the enterprise.

The subject of the course work is:

When writing this work, the documentation of the Minsk Wheel Tractor Plant, educational, scientific literature, as well as sources of periodicals was used. The subject of the research is the accounting and analytical processes associated with the accounting of fixed capital and the analysis of the effectiveness of its use, taking place at DGUP military trade No. 103, which is the object of the study.

1. The concept of fixed assets (funds): types and indicators characterizing them.

The fixed assets of an enterprise are a set of material and material values used as means of labor and acting in kind for a long time both in the sphere of material production and in the non-production sphere. Its financial condition and competitiveness depend on the efficient use of fixed assets. The rational composition of funds, their effective use affects the technical level, quality, reliability of products. In addition to production, fixed assets include non-production fixed assets that are on the balance sheet of an enterprise, residential buildings, clinics, child care facilities and other objects designed to satisfy personal and cultural and household needs of workers. Outwardly, they are similar to the first: they are durable, wear out gradually and require compensation. However, unlike production means, they do not participate in the production process and do not transfer their value to the product. Basic production assets are production assets that participate in the production process for a long time, while maintaining their natural form, their value is transferred to finished products gradually, in parts, as they are used. To carry out their activities, industrial enterprises must have the necessary means of labor and material conditions. They are the most important element of the productive forces and determine their development. The fixed assets of an enterprise are a set of material and material values that act in kind for a long time both in the sphere of material production and in the non-production sphere.

Fixed assets include: buildings, structures, including departmental roads; transmission devices, working and power machines, mechanisms and equipment; vehicles; measuring and control devices and devices; computers, office equipment; tool; production and household inventory and accessories; working cattle; perennial plantings; buffer gas; objects of the housing stock, external improvement and others. in accordance with the Provisional Republican Classifier of Depreciable Fixed Assets and Standard Terms of Their Service, approved by the Resolution of the Ministry of Economy of the Republic of Belarus dated November 21, 2001, No. 186, with amendments and additions. dated September 10, 2002 No. 208.

Fixed assets do not include:

1) means of labor that have served for less than one year, regardless of their value;

2) the means of labor are lower than the cost per unit (set) established by the government, regardless of their service life, with the exception of agricultural machines and tools, construction power tools, as well as working and productive livestock, which are classified as fixed assets, regardless of their value;

3) fishing gear (trawls, seines, nets, nets and others), regardless of their cost and service life;

4) petrol-powered saws, delimbers, drift rope, seasonal roads and temporary branches of forest roads, temporary buildings in the forest with a service life of up to 2 years (mobile heating houses, boiler stations, pilot workshops, gas stations, and so on);

5) special tools and special devices (tools and devices for special purposes, intended for the serial and mass production of certain products or for the manufacture of an individual order), regardless of their cost;

6) special clothing (including uniform), special footwear and bedding, rental items, regardless of their cost and service life;

7) individual building structures and parts, parts and assemblies of machines, equipment and rolling stock, intended for construction, repair purposes and assembly, included in circulating assets;

8) equipment and machines listed as finished products (goods) in the warehouses of manufacturing enterprises, supply and sales organizations, as well as equipment requiring installation and listed on the balance sheet of capital construction;

9) machines and equipment, completed by installation, but not operated and listed on the balance sheet of capital construction;

10) temporary (non-title) structures, fixtures and fittings, the construction costs of which are attributed in accordance with the current procedure to the cost of construction and installation work as part of overhead costs;

11) young animals and animals for fattening, birds, rabbits, wild animals, families of bees, as well as experimental animals;

12) perennial plantings grown in nurseries as planting material.

According to their functional purpose, fixed assets are subdivided into the assets of the main type of activity, other production branches and non-production branches. The means of the main type of activity include those that are directly involved in production, with the help of a worker or automation means, on objects of labor in the manufacture of products, performance of work or provision of services.

In turn, the means of the main type of duration according to their natural-material composition are classified into the following groups:

1. Buildings are architectural and construction objects intended for labor, housing, social and cultural services for workers and storage of material values

2. Structures - these are engineering and construction objects for the implementation of the production process by performing certain technical functions that are not associated with a change in the subject of labor.

3. Transfer devices, which are designed to transfer electrical, thermal or mechanical energy from machine-engines to working machines, as well as transfer liquid and gaseous substances from one inventory object to another.

4. Machinery and equipment. These include: power machines and equipment - machines-generators that generate heat and electrical energy, and motor machines, working machines, apparatus and equipment.

5. Vehicles . These include such means that are intended for the transport of people, goods, as well as for the transport of liquid and gaseous substances from suppliers to the place of their consumption.

6. Tools, industrial and household inventory and accessories. This includes: tools, mechanized and non-mechanized implements, and items attached to vehicles.

7. Working cattle used as means of labor (horses, oxen, camels, donkeys and other animals).

8. Productive livestock. This includes: cows, breeding bulls, buffaloes and yaks, breeding boars and sows, ewes, goats and others.

9. Perennial plantings. This group includes all artificial perennial plantings, regardless of their age: fruits and berries of all types, landscaping and decorative plantings on streets, squares, parks, gardens, squares, on the territory of enterprises, hedges and others.

10. Other types of fixed assets - library funds (regardless of their value), including those exhibits (objects of art, antiquity and folk life, as well as scientific and technical equipment). on the loading and efficiency of use of fixed assets, the possibility of replacing worn-out assets, taking measures to transfer or sell unnecessary funds to other enterprises, as well as the correct calculation of depreciation to be included in production costs. Those in stock are intended to replace those that are in use during repair, modernization or complete disposal, inactive are those that, for various reasons, are not used.

By ownership, fixed assets are subdivided into own and leased assets. Own ones are wholly owned by this enterprise, and the leased ones are the property of other enterprises and are used in this enterprise in accordance with the lease agreement.

2. Assessment of the availability, condition, movement and efficiency of the use of fixed assets.

2.1 Characteristics of the external and internal environment of the enterprise.

By order of the director of the Minsk Automobile Plant No. 15 of 23.07.54 in pursuance of the Resolution of the Council of Ministers of the USSR dated 25.06.54. and the orders of the Minister of Automotive Industry of July 1 and 5, 1954, a special design bureau No. 1 was organized as part of MAZ to create and produce multi-axle wheeled all-wheel drive tractors of high carrying capacity designed for various heavy weapon systems. The use of such tractors gives the systems the ability to move in rough terrain and weak-bearing soils. On the chassis developed by the design team, various consumers have created and manufactured more than 150 models of special units of the USSR, but the need for powerful wheeled vehicles remains. And not only in the army of the Republic of Belarus, but also in the Russian army. Today, the Minsk Wheel Tractor Plant remains a military enterprise within the Ministry of Defense of the Republic of Belarus and continues to produce automotive traction equipment for military purposes. However, orders for them became much smaller, and we had to seriously think about increasing the output of “dual-use” products at the plant, that is, adapted for both the army and civilian needs.

Today, the production republican unitary enterprise "Minsk Wheel Tractor Plant" is an enterprise specializing in the production of road and off-road heavy-duty vehicles and trailers for them, as well as special wheeled chassis for the installation of a wide variety of equipment for enterprises and transport organizations of construction, oil and gas and machine-building complexes.

The production activity of the Minsk Wheel Tractor Plant is focused on the manufacture and sale of special automotive equipment to consumers, its export to foreign countries and the CIS, as well as the production and sale of spare parts for cars and consumer goods.

In terms of the cost of production assets, the number of employees and the volume of production, the plant occupies one of the leading places among the machine-building enterprises of the Republic of Belarus.

The production capacity of the plant is at the level of technology of the MAZ-543 type and its modifications, which had the nature of mass production, and taking into account the use of the areas currently occupied by the Minsk Automobile Plants in the delivery building for bus production. Currently, the plant has a stable portfolio of orders and occupies its own niche among manufacturers of similar products.

In order to increase production and stabilize economic results by expanding markets for goods in non-CIS countries for 2008 and in the near future, the plant has developed measures for the technical re-equipment of production, which will preserve and increase the competitiveness of tractors and other automotive equipment in the world market. The basis for the implementation of the envisaged measures for the development of the production of new technology is the development of the experimental base. According to calculations, the cost of technical re-equipment of the plant's production base in 2008 was determined in the amount of 1.68 billion rubles. The amount of capital investments for the next period of 2009-2011 should amount to 130 billion. rubles, or about 45 million. dollars.

According to sources of financing, own funds are provided in the amount of 92% (depreciation charges 50% and profits 42%), and borrowed funds 6.7%. The plant will need to attract a loan of 4.1 billion rubles annually. The increase in production is accompanied by an increase in the volume of working capital associated with the formation of inventories and stocks of finished products. Within 30%, the need for working capital is provided at the expense of the plant's own resources. According to calculations in 2009, the additional need of the plant for a short-term loan for the formation of working capital will amount to 2.157 billion rubles. In subsequent years, it will increase in proportion to the growth in production and sales of products.

According to estimates for 2008, the share of taxes and deductions to extra-budgetary funds for the enterprise is 25% of all proceeds from sales of products, while material costs account for 41%, and wages 19% of the income received. 33% of the total amount is transferred from the profit to the budget. Excessive taxation does not allow the plant to develop and update the material and technical base of production at the expense of its own resources.

The study of the world market of automotive equipment shows that already in 2009, the plant can double its sales volume and bring the share of product exports to 50%. The assessment of the plant's financial results for 2008 suggests that the volume of sales should be 42 billion rubles, with a profitability level of 10% achieved at the plant, a profit of 4.2 billion will be received. rubles.

In connection with the export orientation of the production of goods, it is planned, along with bank loans for investments in fixed assets, to apply for tax credits. The benefit of the state from the provision of loans will be expressed in their payback due to the receipt of foreign exchange funds from the export sales of automotive equipment.

Due to the high cost of automotive equipment, not all consumers are able to pay the full price. The development of the supply of goods on leasing terms is an effective direction of commercial activity, as it provides a guaranteed flow of funds, in accordance with the concluded contracts.

2.2 Assessment of the availability, condition and movement of fixed assets.

Fixed assets must have initial, replacement, residual and actual value and are accepted for accounting at their original cost.

The historical cost of fixed assets acquired for cash is the amount of actual costs for the acquisition, construction, manufacture, delivery and installation, including: 1) services of third-party organizations (supplier, intermediary, contractor and other organizations) related to the acquisition of fixed assets; 2 ) customs payments; 3) transportation insurance costs; 4) interest on a loan; 5) loading and unloading operations; 6) taxes, unless otherwise provided by law; 7) other costs directly related to the acquisition, construction and manufacture of an item of fixed assets.

General business and other similar expenses are not included in the actual costs of the acquisition, construction or manufacture of fixed assets, unless they are directly related to the acquisition, construction or manufacture of fixed assets.

Assessment of fixed assets, the cost of which upon acquisition is expressed in foreign currency, is made in Belarusian rubles by converting foreign currency at the official exchange rate of the National Bank of the Republic of Belarus in effect on the date of the business transaction.

The initial cost of fixed assets, contributed by the founders on account of their contributions to the statutory fund of the organization, is established in the monetary value agreed upon by the founders (participants) on the date of signing the constituent documents, in cases stipulated by law, the fixed assets are subject to expert assessment.

Assessment of fixed assets, contributed by the founders on account of their contributions to the statutory fund of the organization, the value of which is expressed in foreign currency, is carried out in Belarusian rubles by converting foreign currency at the official rate of the National Bank of the Republic of Belarus in effect on the date of signing the constituent documents, unless otherwise established legislation.

The initial cost of fixed assets received from other organizations and individuals free of charge, as well as a subsidy from the Government of the Republic of Belarus, is estimated at market value as of the date of their entry. Data on the current price on the date of capitalization of fixed assets must be confirmed by documents or by expert evidence.

The initial cost of fixed assets acquired in exchange for other property is the cost of the property being exchanged, at which it was reflected in the accounting records, unless otherwise provided by law.

Capital investments in perennial plantings, for the radical improvement of land are included in fixed assets annually in the amount of costs related to the areas accepted in the reporting year, regardless of the date of completion of the entire complex of works.

The results of the revaluation of fixed assets carried out in accordance with the decisions of the Government of the Republic of Belarus are reflected in the balance sheet of the organization on the first day of the month following the date of revaluation, unless otherwise provided by law. The amount of revaluation of fixed assets (revaluation or depreciation) is credited by the organization to increase or decrease its own sources. In organizations financed from the budget, the amount of revaluation of fixed assets (revaluation or markdown) is attributed to an increase (decrease) in the fund in fixed assets.

An item of fixed assets owned by two or more organizations is reflected by each organization as part of fixed assets, in the corresponding share in common ownership.

There is also the concept of "replacement value". The replacement cost of fixed assets is the cost of their reproduction (construction or acquisition) in modern conditions.

To determine the replacement cost by government decree, the original cost is adjusted by revaluation. Revaluation of fixed assets at replacement cost is carried out annually as of January 1.