Comparison with competitors in sales. Competitor Analysis: A comprehensive guide to online and offline analysis. Competitive advantages of the company

The company receives information about the market from three sources: from the clientele - which is quite obvious to everyone; from suppliers who themselves supply this information and even impose, and from competitors. So, this third source of market information is clearly underestimated.

entrepreneurs.

True, it is available less than the first two. Competitors not only do not send such information, but also hide it, it is often difficult or impossible to obtain.

Meanwhile, comparison with a competitor now becomes

an independent and very important task in developing a business plan and analyzing competitive advantages. In world use, there is even the concept of bench-marking, that is, "designation of a place on a bench among their own kind."

Comparison with competitors is necessary for the following reasons:

a) helps to more accurately determine the competitive advantages of our business;

b) the same - about competitive disadvantages;

c) makes it possible to borrow valuable innovations;

d) helps to assess the threats posed by competitors.

How does it work in practice? I will list the necessary steps.

First: gather a team with which you are going to start a business, explain the meaning of the upcoming work, at least in the above terms.

Second: invite everyone independently to compile a list of their closest competitors, and then rank them according to their strength in the market.

Third: then invite each to name three main competitors in decreasing importance of these competitors, write them down on a flip chart (or on a large sheet of paper) in the order in which they will be called team members. Naturally, some competitors will repeat themselves more than once.

Fourth: invite your team members to supplement this list with those competitors who have not yet made it to the mainstream. It is desirable that the general list of competitors does not exceed 10-12 names of firms, otherwise it will become boundless. The normal number is usually 6-8.

Fifth: invite the team members to approach this sheet one at a time and place the numbers in Arabic numerals with a red marker, reflecting the place of each competitor, that is, to conduct a continuous ranking of the overall list. But this procedure is not democratic and does not involve voting. Therefore, the one whose personal risks in this business are the greatest, let him sum up the ranking.

Sixth: arrange the names of competitors on the sheet along the top edge from left to right.

Seventh: now we need to develop criteria for comparing competitors. This task is much more difficult and is best done in group work mode. However, in order for each of the team members to contribute to the solution of this problem, first invite everyone to write on a separate sheet of paper those criteria that he considers especially important, i.e.

useful, informative for comparison. Allow 5-6 minutes for this procedure.

Eighth: pair the participants and offer to agree on the lists of criteria (10-15 minutes). If disagreements arise on any point, suggest not to extinguish them, but to keep them until the next stage of work.

Ninth, have each group present to the team's general meeting a sheet with their own ranked list of comparison criteria and the dissenting opinions of a colleague. Compare these lists and complete the ranking.

The final decision is made by the one whose risks in this business are maximum. Let the number of these criteria be no more than 12-16.

So, you have a list of competitors (horizontally at the top) and comparison criteria, located vertically on the left side of the sheet with decreasing importance. It is important that the criteria for comparison have some sort of coordinate system for the assessment. For example, if we take such a criterion as quality, then we must definitely decide for ourselves what quality we mean: the quality of the product, packaging, service, etc. How is it expressed, by what criteria will we compare it, etc.

In the same command mode, it is proposed to assess the positions or capabilities of these organizations in mutual comparison on a 10-point scale. Simply put, we set points from 1 to 10. Of course, these are purely expert judgments, sometimes based on accurate, sometimes on approximate knowledge of the actual state of affairs.

In some cases, information has to be collected. Where? There are special organizations that are engaged in the legal extraction of information about various organizations. But it is unlikely that at the initial stage of the business you will have extra money for such an order. A good way to get information from general customers like wholesalers who buy products from our competitors. They just have the ability to compare, but only according to the parameters they are interested in. Another way to obtain information is the so-called. partnerships or associations formed for manufactured products, for joint marketing, there are sales partnerships, there are also for general investments. There is a voluntary or involuntary exchange of information. It happens that very ordinary employees find themselves in a sea of valuable information about competitors. Let's say the forwarders of a wholesale company take the ordered products from the manufacturer. Of course, they spend some time waiting there. And gradually, over the course of several years, the forwarders of different companies got to know each other. For them, the competition is a distant and not very interesting thing. But purely for human reasons, they show interest in working conditions, each other's earnings, relations with their superiors; clothes. And now they are driving old pick-up trucks, "then they put the goods neatly on the shelves, and now they throw them in bulk." Of course, they are curious - why, what happened. Such dandy personnel working on the line of contact with competitors' employees can also make very interesting observations.

A very traditional way is to become a client of your competitor for a while or for a long time in order to experience the advantages and disadvantages of the service there.

One way or another, we gradually fill in the table. Among the list of competitors, we can single out a column for our (not yet existing Company). We can either based on the existing experience, or hypothetically, we can also give marks according to the comparison criteria of our company, based on those development priorities that we plan to form. But here it is very important to be as critical of your own assessments as possible. As often aspiring entrepreneurs, getting carried away, begin to exaggerate their capabilities, which have not yet manifested themselves in any form.

Let us now recall that the comparison criteria are not equal to each other - we have carefully ranked them - and, therefore, the upper ones are more weighty than the lower ones. You can change the procedure and for the upper group of criteria apply not a 10-point system, but, for example, a 15-point system, for the second group - 12-point, and for the third - a 10-point system. So there are options, but the goals are the same - to express the most important comparison scores.

Then it's time to analyze the completed table. Since the points that we set for ourselves and our competitors are of an expert nature, and as experience shows, we do not always know our competitors, then our points may not quite accurately reflect the existing market reality. So you shouldn't focus too much on certain numbers, especially when the difference between them is not so great. Points are only valuable when the gaps between them are fairly obvious. The problem lies elsewhere - the main thing here is the COMPARISON PROCESS. And even if the procedure is not completed to the end or its results are controversial, you have rich food for thought, which will allow you to comprehend the prospects for the development of your business.

Method of comparison with competitors (bench-marking)

| competitors criteria | A | B | V | G | D | WE | F | Z | AND |

| QUALITY | 15 | 7 | 6 | 6 | 8 | 11 | 9 | 7 | 6 |

| REPUTATION | 15 | 11 | 10 | 8 | 9 | 3 | 8 | 7 | 6 |

| SALES ORGANIZATION | 13 | 8 | 9 | 7 | 11 | 4 | 12 | 6 | 8 |

| DELIVERY TIME | 12 | 11 | 11 | 11 | 10 | 9 | 11 | 8 | 11 |

| FULFILLMENT OF CONTRACTUAL OBLIGATIONS | 10 | 12 | 9 | 10 | 8 | 5 | 10 | 8 | 10 |

| TECHNICAL SUPPORT | 10 | 8 | 8 | 8 | 8 | 12 | 9 | 8 | 7 |

| PRODUCT INNOVATION | 10 | 5 | 6 | 3 | 4 | 10 | 5 | 4 | 6 |

| GEOGRAPHICAL COVERAGE | 9 | 7 | 5 | 5 | 7 | 3 | 8 | 5 | 8 |

| VOLUME OF PRODUCTION | 10 | 8 | 5 | 6 | 8 | 4 | 4 | 6 | 6 |

| TOTAL | 104 | 77 | 69 | 64 | 73 | 61 | 76 | 59 | 68 |

| A PLACE | 1 | 2 | 5 | 7 | 4 | 8 | 3 | 9 | 6 |

This example analyzes the competitive environment of manufacturers of hot water boilers in the Russian small industrial heat power market. In the horizontal line, we have listed the main competitors (from A to I) that are represented in this market segment. The vertical column shows the comparison criteria. The first three criteria are the most important for us, so we evaluate them on a 15-point system. The following criteria are evaluated on a 12-point system, and, finally, the last three criteria - on a 10-point assessment.

Among the competitors, we have entered ourselves as a potential player in this market, who is going to take his place under the sun. If we rated our competitors on the basis of the available information, then we assessed ourselves, focusing on the strengths of our products, due to which we plan to compete in this market.

Analyzing the table, the following conclusions can be drawn:

There is a clear leader on the market (company A), which has practically no weaknesses at the moment;

It is quite possible to compete with the rest of the group of players, since the scatter of points is not so high;

Among our potential excellent differences are the quality of our hot water boilers, the availability of high-quality technical support of products and its innovation;

Strengths and weaknesses of our competitors.

The consumers of our products are the following groups

clients:

Installation organizations (purchasing various types of boilers and building turnkey boiler houses to order);

Private customers (buy boilers for heating existing cottage settlements, holiday homes, small industries, etc.);

Corporate customers (Gazprom, Sibneft, etc. - for heating and maintenance of existing and under construction oil / gas pipelines).

The focus of our clients' competition is as follows:

Comparing the focus of competition and our potential excellence, we have:

Our potential UCPs are the quality of products and the availability of high-quality technical support for their operation. We are potentially ideal suppliers for private customers.

Depending on what ratio in terms of customer priority we are going to develop in the future (for example, dependence on a corporate customer may negatively affect in the future if he leaves us), we should think about the formation and development of such competitive advantages as:

For installers:

Pricing policy (flexible system of discounts);

Timeliness of deliveries.

For corporate customers:

Strict fulfillment of contractual obligations;

Increase production volumes.

And, of course, you should constantly think about your business reputation, form the so-called goodwill. This word means something that we had in Russia until recently, there was very little, or maybe not at all (some believe that it still does not - but this is already on the conscience of "some"!).

The literal translation from English is "goodwill". It would seem that you can express these words? What is such a concept that is absent in the Russian language?

And here's what: an honest name, a respected brand of an enterprise or business. All of this is collectively referred to as goodwill. It is called so because Western economists calculated that goodwill, invisibly present in a product / service, adds a certain added value to the product / service. This cost arises, of course, not just like that, but as a result of the company's long and hard work on the quality of its products, as a result of the fact that all the combined efforts of the company to give its product the highest quality, its "goodwill" in the performance of its work, begins be appreciated by everyone around (mainly buyers). As the saying goes: "Take care of your honor from a young age."

Well, our excellent difference as product innovation is more of our strategic trump card than operational. And he, undoubtedly, should be given special attention. But it is not necessary to focus on this at this stage, since in our market it is not in the focus of competition.

More related methods of comparison with competitors (bench-marking):

- Copyright - Legal profession - Administrative law - Administrative process - Antitrust and competition law - Arbitration (economic) process - Audit - Banking system - Banking law - Business - Accounting - Property law -

APPEARANCE OF THE PRODUCT. Compared to competitive products (or substitute products), the appearance of the new product will obviously be perceived as: very bad - no interest on the part of the consumer; bad - consumer interest is low; identical to pro du ktu - show jumping (substitute product); good - the consumer likes it; very good - the consumer likes it very much.

The first two answers mean that the product needs to be redesigned to better meet the social norms and expectations of the consumer segments it is targeting. The rest of the answers express a more acceptable assessment of the appearance. In general, the richer the consumer segment and the more often the product will be used in public places, the more important its appearance becomes, because the product gives the appearance to its consumer as well. The same thing often happens with industrial products for organizations as well. It should not be assumed that engineers and scientists are not interested in style or appearance.

In many cases, none of the above answers will work; this means that an idea or invention at an early stage of its development may not have received a satisfactory physical form and therefore it is impossible to form an opinion about it. This does not mean, however, that in the future it will not be necessary to pay attention to the appearance.

FUNCTION. Compared to competing and (or replacing) products, services or processes, the function performed by a new product can be assessed as: very poor - has major disadvantages compared to a competing product; bad - has certain disadvantages compared to a competitor; identical to the co-current product (substitute); the best one has certain advantages over a competing product; much better - it has significant advantages over a competing product.

Evaluating a product's ability to perform its intended function requires that it be judged against its competing (substitute) products and the extent to which it serves its “basic” and “aesthetic” functions.

The first two answers indicate that the product does not meet its functional requirements (“basic” and / or “aesthetic”). From a social point of view, the question can be asked whether similar ideas, inventions or products should be developed and introduced. Functionally defective products require psbol'nm * resources and more

further exacerbate the confusion arising from the increasing release of products. From the standpoint of an entrepreneur, the development of such ideas or inventions is questionable due to the higher degree of risk regarding market acceptance of this new product. The risk is especially high when there are competing products that can be easily compared in performance. For example, suppose that inventions have been introduced to the market — better quality tires and higher quality gasoline (both produce better mileage). If the functional benefits of both products are "exaggerated", the new gasoline will sooner and more categorically be rejected in the market, for the consumer can easily establish the truth by using several cans of gasoline. If, on the contrary, the benefits to the consumer are real and large, one of the two products with the most visible benefits is likely to be more accepted in the marketplace. In addition, the cost of introducing this product is likely to be lower. A similar situation develops when a product on the market satisfies a real or perceived need. So the question of function takes on added meaning when both the need and the visibility of the product's benefits are high. It is important to note, however, that this factor is a double-edged weapon, as extreme responses to a question tend to either precipitate a product's failure in the market or greatly contribute to market acceptance.

DURABILITY. Compared to competing products and / or substitute products, this product is likely to be perceived as: much worse quality - has certain disadvantages compared to the competitor; Poor quality - there may be some flaw in comparison with a competing product; identical to a competitor's product (substitute); better quality - can be introduced on the market as an improvement; much better quality - easy to market as a big improvement.

The first two answers indicate that the product should be sold *] with an emphasis on other characteristics (convenience, appearance, etc.) and / or should be redesigned to meet consumer expectations. The choice depends on how important product durability for a given innovator's chosen consumer segment. Other answers relate to acceptable levels of product durability. Two

recent responses indicating super-durability should be included in the firm's advertising messages. In addition, the first two responses are indicative of the higher risk (and possibly costs) associated with the introduction of a new product that is ranked in this way. In contrast, products ranked higher carry less risk and are likely to have lower costs.

PRICE. Compared to competing and / or substitute products, the selling price is likely to be: much higher - a clear disadvantage in a competitive environment; higher - a lack in a competitive environment; identical to competing products (substitute products); below - advantage in a competitive environment; much lower - a decisive advantage in a competitive environment.

Under normal circumstances, a higher price is a definite disadvantage in the face of competition. This situation is not critical and should not impede further product development - especially if a potential new product receives a large number of assessment points for the rest of the competition factors specified in this section. A high score is, however, an indicator of greater risk (or an indicator of market aversion), as well as a higher cost to introduce a product to the market.

EXISTING COMPETITION. The competition for this innovation is likely to be: very high - entering the market for a new product can be difficult and / or relatively expensive; high - the probability of getting only a small share of the market profit; moderate - the market can be penetrated with moderate effort and cost; small - it is possible to get a fairly large share of the market profit;

... ¦ very small - the market can be entered easily and / or relatively cheaply.

The responses are indicative of both the relative risk and difficulty of approving a new product in the market, reflecting varying degrees of competition. None of these answers are critical. However, if there is already high enough competition in the market, any new product must have some significant competitive advantages that will establish its position in the market. If there are none, the risk of failure will be great. Therefore, the products that get the first two answers should not be introduced to the market by innovators who do not accept the likelihood of a long period of time between the introduction of the product to the market and the achievement of a sales volume that yields sufficient profit. Conversely, products that face little or no competition can, with the right marketing, quickly gain market leadership. In addition, they are more suitable new products for starting a new business.

It should be noted that having very little competition does not automatically translate into low costs or easy market penetration. This question only reflects the impact of existing competition on the product's entry into the market.

NEW COMPETITION. Competition due to the entry of new applicants to the market or due to competitive reaction is assumed: very high - the product will occupy a leading position for a very short period of time; high - the product will occupy a leading position in the market for a relatively short period of time; moderate - you can keep a certain share of the profit in the market; small - the product will occupy a leading position in the market for a relatively long time; very small - a big chance to get a large share of the profit in the market.

The sequence of responses is consistent with the risk of a competitive reaction to the introduction of a new product. The first two answers indicate that the evaluator expects a fairly quick response from competitors. Other responses indicate that the evaluator expects less intense response from competitors. As the reaction of competitors becomes more intense, the entrepreneur (IT innovator) must become increasingly concerned with the problem of * how quickly a new product will be accepted in the market and how soon it will start to make a profit.

Competition is likely to be fierce where profit opportunities are high, investment costs are low, product is easy to manufacture, and patronage is strong. Conversely, the absence of any of these conditions will erect barriers to new competition and are likely to lengthen the period during which a new product can generate relatively high profits.

PROTECTIONISM. Given the existence of patents (or copyrights), technical complexity or secrecy, the prospects for protectionism are as follows: legal protectionism or secrecy is impossible; legal protectionism is not possible, but some degree of secrecy is acceptable; a new product can be patented, obtain copyrights, and / or secrecy for a short period of time is possible; a new product could be firmly patented, copyrighted, and / or secret for a long time.

It is sometimes assumed that a product must be patented or some other form of protectionism in order to be sold. This is not always true. Many new products are sold without any form of patenting, professional secrecy, or technical complexity that protects them from competition. However, if an inventor wants to transfer technology, protectionism can play a very important role. In different industries, the situation is, of course, different. In general, protectionism is considered more important in the initial development and testing of a new product, as in this case the costs are very high and the costs of copying the innovation are relatively small. The pharmaceutical industry is a classic example of this situation. Chemical composition determination and verification can be very expensive, but such products are relatively easy to replicate.

Protectionism also becomes important in cases where the risk of competition is high and the potential for protectionism is low. Then the innovator has the prospect of sharing a share of the market profit with competitors. The answers to this question in most cases are not YAMWGSA SHTOETM ”The answer“ legal protectionism or secrecy is impossible ”will not impede further development. However, before undertaking further development, it is necessary

it is necessary to carefully analyze the situations in which patent protectionism is impossible.

After the selection of a set of factors, the construction of their qualitative scales, the assessment of the innovation becomes a "matter of technology." For example, a quantitative scale for a social impact factor might look like this.

SOCIAL IMPACT. In terms of the impact (benefits) on the general welfare of society, the use of a new product can have: a significant negative effect; a certain negative effect; have no impact when used correctly; have no impact on society; have a positive impact on society.

Thus, the most negative answer is coded with the number "1", and the most positive - with the number "5".

If several experts take part in the assessment of the innovation, then the average estimates of the significance for each of the factors are calculated. In addition, the values of the standard deviation are calculated, which is a measure of the variance between the answers of individual experts. Thus, if there is a significant discrepancy between expert estimates, the standard deviation will usually be relatively large.

In other words, the standard deviation is a measure of agreement or disagreement between experts. In general, the level of risk (or likelihood) that experts collectively made the wrong decision increases as the value of the standard deviation increases. Suppose, for example, that out of four experts, two gave a highly positive assessment (5) of the functional feasibility of an innovation, and two others rated the same functional feasibility extremely negatively (1). Obviously, the average significance score for this factor is 3.0. But the standard deviation will be very high (2.0), indicating a lot of disagreement among the experts. Such disagreement does not contribute to the reliability of the average estimate. On the other hand, if all experts had the same opinion, then the error would be less likely.

Concluding this question, we note that the function of experts ends with the measurement (assessment) of the degree of risk when developing a new idea or invention. Those responsible for the development must decide the fate of an idea or invention. They must determine the level of risk they can take.

Rejection of an idea or invention should not automatically decide their fate. Inventions with predominantly low scores probably should not be re-analyzed. However, if they were rejected for some special reason, for example due to lack of technical feasibility or high costs, then they should be periodically reassessed if conditions such as technological and economic development do change. In some cases, limited or targeted development is correct. This is especially true for ideas and inventions of questionable technical feasibility, but otherwise with great market potential. A significant portion of electrical equipment falls into this product category. In such cases, further general development is not recommended until critical issues are resolved. Further general development, such as technology transfer, can undermine the market and destroy confidence in the hardware offered. In other words, it is better to step back and wait until the main obstacles are removed. For example, most electric vehicles introduced to the market in the 1970s were not successful because both the market and the technology were not yet ready. Changing market conditions and technical improvements are greatly improving the future prospects for electric vehicles.

As noted above, if the technical feasibility is questionable, then before transferring the equipment to other hands or paying great attention to the establishment of mass production, it is necessary to resolve this issue. Likewise, if profitability or price is in doubt, it may be wise to conduct a financial analysis to reduce costs. The questionable safety of the use of an innovation or its environmental impact may direct further product development efforts in one of these areas. If a product is unsatisfactory, the evaluation will indicate a need for design consideration, and a lack of expiration date may direct efforts towards engineering issues or finding new and better materials.

The strategies proposed are not limited to research and development. For example, independent inventors or

entrepreneurs with limited financial resources may, due to a long payback period, choose to transfer a new technology or device, rather than undertake their development and launch into mass production.

In cases where a decision is made to start batch production internally, a short product lifecycle may necessitate the use of external manufacturing facilities and / or sales resellers until a new production facility is built and / or new sales personnel for the new product are added. ... As shown above, low scores on product learning indicate that the cost of market adoption will be high and that the introductory period (with its modest sales and negative margins) will be quite long. An innovator who cannot invest sufficient financial resources in such a venture is likely to fail — very often just before the success of a new product. The presence of pre-existing competition may indicate that a low initial price should be set that will allow the product to enter the market, while little direct or indirect competition will allow the innovator to set high initial prices for the product. If there is any kind of protectionism, a similar pricing policy will be correct. On the other hand, minor patronage may indicate the need for low initial prices or “blitz” advertising at the introductory stage, perhaps in conjunction with the strategy “quickly enter the market - quickly leave the market”.

The results of evaluations by factors go beyond the problems outlined above; indeed, each factor can have multiple influences on subsequent development strategies and serial product organization. The factors do not lose their significance at the end of the assessment stage; they even continue to shape the direction of further development and, ultimately, activity in the market.

In our opinion, an important problem is the selection of factors and the assessment of their significance. The fact is that, firstly, it is clear that not all factors can influence the assessment and selection of innovations (for example, when a defense order is fulfilled, the factors of recognition in the market are hardly significant); secondly, the significance of the factors in relation to a specific innovation is different. Therefore, in the next section, a procedure will be considered that allows one to obtain estimates of the significance of factors. Assessing the significance of factors for evaluating and choosing innovations

It is clear that the larger the value of k, the better the weight of the k-ro order shows the true weight of the factor. We introduce the concept of the weight P (X) of the factor a (.

According to the Perron-Frobenius theorem, such a limit exists. According to Yel's theorem, the vector P = * (Pi, P2, ..., Pn) is an eigenvector of the matrix A = (af nxn corresponding to its smallest eigenvalue.

Thus, the problem of finding the factor weights is reduced to finding the eigenvector of the dominance matrix.

As a result of using this procedure for each expert, we obtain a vector of "weights" of factors, reflecting the individual opinion of a particular expert in relation to the ordering of factors.

The next task is to bring several (according to the number of experts) vectors of "weights" into a vector of group assessment.

Let 7n be the number of experts. As a result of using the algorithm, m "-dimensional vectors are transformed into one" -dimensional vector of "weights".

Let (/? K) be a set of m vectors of "weights".

The calculation procedure consists of 6 steps. In each vector R№ there is a maximum component R ^ lx "and normalization is carried out according to the formula: ![]()

We get m normalized vectors. The preference matrix P- (Pf according to the formula:

3. Find the elements of the matrix z = (rf by solving equations containing the elements of the matrix P = (Pf:

(resolved with respect to ^.). Average values are calculated

The w-dimensional vector P obtained at the sixth step with components P; is the desired common vector of "weights" of factors. These "weights" reflect the collective opinion of the experts regarding the ordering of factors.

The obtained "weights" of factors can, firstly, serve as a basis for selecting factors when solving the problem of assessing and choosing innovations and, secondly, playing the role of correcting factors when solving the problem of obtaining average estimates of the significance of factors.

15.04.2016 |

This material is a step-by-step guide for analyzing competitors on the Internet.

Depending on the goals and objectives of a particular study, you can limit yourself to individual objects (for example, study only the product range, only positioning) or conduct a comprehensive analysis of the competitive environment. Let's take a look at six basic steps you need to follow when doing this kind of analytics.

Define the goals of competitor analysis

Of course, every company needs to monitor the competitive environment in which it operates. However, the goals of monitoring are always different: determination of pricing policy; development of a positioning strategy, unique selling proposition (USP); choice of distribution channels; expansion of the product range and so on. For example, if the goal is to develop USP, then you need to first study the USP and positioning of competitors, not their advertising budgets (and vice versa).

Therefore, the first step is to determine a specific goal so as not to load yourself with unnecessary information in the future.

Identify competitors

Once the purpose of the analysis has been formulated, it is necessary to select competitors based on different marketing characteristics. One of the most important is “Target audience and its needs”. This characteristic is refined based on the questions:

Whether your products / services are aimed at the same audience as the offers of this competitor,

Do the products / services of the competing company solve the same needs that you solve,

Do members of your audience meet the products / services of the competitor in question when looking for ways to meet their needs?

If the answer to all questions is yes, then the company is your competitor. It is important to know that products may differ from each other, but solve similar needs, so you need to carefully consider this stage.

Other criteria are also important (price / quality ratio, market share, product range, etc.), and it's okay if you analyze a competitor that is far ahead of you in all respects (that is, choose not quite close). Such an audit will give you a lot of useful information. The main thing is not to research those who are significantly behind you.

How to find competitors? Possible sources are listed below.

- Search on the Internet. You can enter the role of a consumer and search for products by thematic queries in Yandex / Google search engines, as well as in Yandex.Direct and Google Adwords. Search for several queries, select those competitors that you meet again, make a list.

- Sales managers survey. Check with managers which competitors they've heard of or encountered. Add the names of these companies to the list.

- Interviewing several representatives of the target audience. Whenever possible, interview consumers who fit the profile of the target audience.

- Industry ratings. Monitor ratings, find market leaders, add them to the list.

- Online services. The most convenient are similarweb.com, serpstat.com and spywords.ru. All services are paid, but free versions also allow you to identify similar competitors.

How to identify the strongest competitors?

Once you have a complete list of companies, research their sites to identify the ones that are worth analyzing. After the initial selection, compare them on similarweb.comwith your site to determine how similar you are to each other and which of you is stronger.

Then analyze the semantic core, visibility and traffic from each competitor's search in... Just enter its domain into the service and study the summary report.

The "Visibility" parameter determines how strong the competitor is. That is, how many pages of his site (products) are there in Google / Yandex. The more pages of a site are in the top of search engines, the higher the visibility. Be sure to thoroughly research the sites with the highest visibility in your niche.

Don't forget to unload the competitor's key phrases for which they rank in search and get customers to complement the semantics of their site.

Leave the TOP 5-10 competitors for analysis.

Define criteria for competitor analysis

Once a list of competitors has been drawn up, you need to define the analysis criteria. We repeat: the criteria depend on the objectives of the study.

There are 2 types of criteria:

- conditionally quantitative,

- high-quality (we will consider in more detail below).

Start analysis (filling in tables)

Start by analyzing each competitor for each criterion. Add all information to the table “in real time”.

At this stage, you should have a table something like this:

- Provisionally quantitative criteria / indicators... Here are criteria that can be quantified (for example, on a 10-point scale). Such parameters can be: convenience of ordering a call back on the website, reflection of the company's positioning on the main page, quality of service description etc. Fill in the table for all the criteria and give marks (it is recommended to determine the significance of the criteria in advance), after which you will receive a rating that will show by what parameters the company lags behind competitors, what needs to be improved and what qualities need to be emphasized.

- Qualitative criteria / indicators. This part of the analysis is the most fun. Here you need to study such parameters that cannot be quantified, for example: features of brand packaging, features of communications, accentuated competitive advantages etc. In this case, you will get something like the following table:

Compare the received data

After you have selected all the data, the monitoring of competitors is done according to the selected criteria, you need to correctly compare the data obtained. The clearer the infographics are, the easier it will be to draw the right conclusions. The most common and convenient formats are presented below:

Radar Chart

The first figure shows the frequency of mentioning a specific factor by competitors using a specific example (how many of the 8 competitors mention the characteristic in question).

A diagram like this is useful in at least two cases (for quantified data):

- to track the frequency of mentioning certain properties from competitors,

- to assess the severity of certain properties in competitors (comparison, second figure: here you can swap “properties” and “competitors” or add any other criteria).

Positioning map

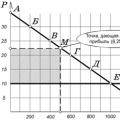

Depending on the objectives of the study and the chosen criteria, the map axes may differ. For example, you can build a map based on value for money, competitors in terms of product value and target audience (for adults and young people), as illustrated by the example of cosmetics, or based on other parameters. This visual form gives a clear idea of the company's position in the competitive environment.

Draw conclusions

This is sometimes the most important step in the analysis. Here, the data obtained is supported by knowledge in the field of classical marketing, experience, cases, a general idea of the market situation. All this together makes it possible to correctly complete the analysis and achieve the goal.

After that, it remains to implement the already chosen strategy based on the conclusions from the analysis.

Related article:

Marketing manager

Competition (from lat. concurrere - to collide) - rivalry, the struggle to achieve the best results in any field. Market competition - this is a rivalry between producers, as well as between sellers of goods (services) for the best satisfaction of consumers' requirements; on the part of buyers it is a struggle to acquire the most useful and desirable goods for them on the most favorable terms. Competition is based on the sovereign right of each business entity to pursue its economic interests within the framework of applicable law. It is the key to the continuous progress of a market society, but inevitably leads to a clash of interests of the subjects of market relations, gives rise to instability, conflict, bankruptcy.

There are two main groups of market competition methods: price and non-price.

In the first case, rivalry is conducted by reducing the price of the product. Additional profit is obtained as a result of reducing the costs of production and sales of goods, increasing sales without changing the range and quality. It is believed that the price method of competition complicates the planning and management of the enterprise, allowing competitors to take similar retaliatory steps. Most often it is used to enter promising markets.

Non-price methods of competition include:

- changing the properties of a product in order to distinguish it from a number of competitors' products;

- giving the product new properties for the consumer;

- individual response to consumer requests;

- improvement of services related to the product.

Non-price methods, in comparison with price ones, require significantly higher financial costs and organizational efforts, but they are more effective, since competitors cannot quickly take symmetrical reciprocal steps. In the conditions of modern competition, there is a predominance of non-price methods of competition over price ones.

as many authors note, it is a complex, multidimensional concept. A single definition of it in the domestic and world scientific literature has not yet developed.

The substantive basis of the concept of competitiveness in a specific sense is made up of two fundamental elements: the aggregate quality and the price of the product, subject to other regulatory requirements. Relatively higher quality and more affordable prices determine the advantage of one product over another, reflect its commercial attractiveness. There are supporters of presenting, as a first approximation, the competitiveness of a product in the form of such a characteristic as its buyability. However, this feature is necessary, but not sufficient, since there may be cases of sale of goods at dumping prices for opportunistic political considerations.

Competitiveness of goods, as it seems to us, this is a set of quality and cost characteristics of a product that contribute to the creation of superiority of a given product over competing products in satisfying the specific needs of the buyer in certain markets during a given time. The competitiveness of a product is determined by four essential elements:

- properties of this product;

- properties of competing products;

- characteristics of consumers;

- implementation time.

Competitiveness assessment methods

In most cases, the calculation methods for assessing the competitiveness of a product contain two groups of characteristics: technical quality indicators and economic parameters.

The evaluation procedure begins with the selection of a comparison base. It can be:

- customer needs;

- the size of the beneficial effect;

- the competing product itself;

- hypothetical sample;

- group of analogs.

The competitiveness is assessed by comparing the parameters of the analyzed product with the parameters of the comparison base. The comparison is carried out separately for groups of technical and economic characteristics.

As a rule, the assessment of the competitiveness of a product is carried out by a differential, complex or mixed method.

Differential method based on the use of single parameters of the analyzed product and the comparison base and their comparison.

If, when assessing by technical and economic characteristics, the base values are established by regulatory and technical documentation or contracts, then the unit indicator may be less than or equal to 1. In the case when the analyzed product has a characteristic whose value exceeds the needs, the specified increase will not be assessed by the consumer as an advantage , a single indicator for this parameter cannot have a value greater than 1 and the calculations should use the minimum of two values: 1 or the actual value of this indicator.

When evaluating according to normative parameters, a single indicator takes only two values: 1 or 0. If the analyzed product meets mandatory norms and standards, the indicator is 1, if not, then the indicator is 0. If the technical parameters of the product do not have a quantitative assessment, to give these parameters quantitative characteristics are used by expert assessment methods in points.

In most cases, the differential method allows only stating the fact of the competitiveness of the analyzed product or its shortcomings in comparison with the analogue product. It does not take into account the influence of each parameter on consumer preference when choosing a product. To eliminate this shortcoming, a comprehensive method for assessing competitiveness is used.

Complex method assessment of the competitiveness of a product is based on the use of complex indicators or comparison of specific beneficial effects of the analyzed product and the sample.

A complex indicator for technical parameters is the sum of the products of technical parameters and their weightings. To determine the significance of each technical parameter in the general set, expert estimates based on the results of marketing research are used. This complex indicator characterizes the degree of compliance of a given product with the existing need for the entire set of technical parameters. The higher it is, the more fully consumers' demands are satisfied.

The calculation of the complex indicator by economic parameters is based on the determination of the total costs of the consumer for the purchase and operation of the goods.

The total cost of the consumer is defined as the sum of the one-time costs of purchasing the product and the cost of all operation over the period of service. The value of the service life for industrial products is taken equal to the amortization period. For consumer products, the assessment of the service life should be based on information about the actual service life of similar products, as well as the rate of obsolescence of goods of this class.

Mixed method assessing the competitiveness of a product is a combination of differential and complex methods. In the mixed method, a part of the parameters calculated by the differential method and a part of the parameters calculated by the complex method are used.

The above methods for assessing the competitiveness of a product are commonly used and are often found in domestic literature. They have a number of limitations. It should be noted that they are used to calculate the competitiveness of one object relative to another, and not the level of competitiveness of the object in general. It is impossible to assess the degree of influence on the competitiveness of a product of factors that cannot be quantified. There is a certain difficulty in choosing a comparison base, especially in cases where it is necessary to take the best of the existing samples as such. To do this, you must either first compare the samples with each other, or make an intuitive choice. You can take a sales leader as a comparison base, but information about him is often difficult to collect, especially when it comes to consumer goods that are distributed through many distribution channels.

A significant drawback of these methods is also that the consumer properties of the product and their set are determined without taking into account the opinion of the consumer. In accordance with them, it is assumed that the improvement of any of the characteristics of the product automatically increases its competitiveness. However, improving the characteristics of a product in comparison with the base sample does not always guarantee the emergence of competitive advantages, since in real life the consumer plays a decisive role in assessing the advantages or disadvantages of a product.

It should also be borne in mind that consumers in the market do not act as a single whole - they react differently even to the same product. This is important when assessing the competitiveness of goods.

In some cases, the matrix method is used to assess the competitive position of individual products in the markets. For this, two indicators are used: quality and price.

- 1. The analyzed goods and goods of the main competitors in the investigated market are evaluated according to two criteria: an integral indicator characterizing the level of consumer properties of the goods, and the price. In the case where there is a limited number of leading indicators, it is possible to use separate indicators of quality and price.

- 2. All researched goods are put on the matrix field: "quality - price". If necessary, you can use the third coordinate - the volume of implementation (radius of the circle).

- 3. For the entire set of analyzed goods, the average value of the indicator characterizing the level of consumer properties of the goods and the price is determined. Lines are then drawn to represent these averages.

- 4. A similar procedure applies to all major markets.

- 5. The severity of competition in individual markets and in the aggregate market is determined by the degree of concentration of goods of competing organizations in different quadrants of the matrix.

- 6. The production and marketing policy of the organization is being adjusted in terms of the quality and price of products. The sales market is determined on the basis of the principle of preference for activities in the markets where the severity of the competition is the least.

From the editor

No organization can afford to grow in an information vacuum. Such development is possible, but ignoring market trends and competitors' actions leads to dire consequences.

How to effectively conduct a competitor analysis, what information and how to collect, how to work with it and use it to get value in your marketing activities, for example, when developing a marketing strategy or when determining your competitive advantages? Our checklist prepared by Anna Larina, project manager of the Tekart group.

When should you conduct a competitive analysis?

- When you are only planning your business... At this stage, knowing your competitors will allow you to develop a product, determine its key product characteristics, develop a product policy, determine a price, predict a sales plan, and develop a promotion strategy.

- When conduct holistic marketing research... Competitive analysis is part of it. In the study, the information obtained is used further for SWOT analysis, for the subsequent choice of a competitive strategy and the marketing strategy of the company as a whole.

- When monitoring of competitors has become a regular event... It is important to treat competitor analysis not as a project, but as a process. In this case, you will always have at hand the answer to questions such as: "How do your competitors' products differ from yours (product characteristics, price)?" retention of existing customers? " This knowledge and benchmarking (adoption of the best industry practices) will contribute to the optimization of resources for marketing activities.

Periodicity analysis depends on the specifics of the business, in dynamic, highly competitive markets, we usually recommend to carry out work once every three months, in quieter markets - once every six months or a year.

If you are doing this for the first time, then identify two or three main competitors and analyze them completely. Next time update information about already known companies, add 1-3 new companies, revise the list of criteria for comparison.

The analysis is conveniently done in a spreadsheet. In this file, on one axis, we postpone the names of competing companies, on the other - the comparison criteria. It is convenient to use such a table to compare data and track dynamics and general industry trends.

Direct and indirect competitors

Competitors can be direct or indirect. You need to watch both those and others.

Direct competitors- these are companies whose characteristics of activity (product, geography) largely coincide with the characteristics of your business. Such companies are usually well-known, and their activity is monitored at an informal level.

First of all, you need to decide on the geography of the analysis. If you have a veterinary clinic, then the geography will be limited to your area of the city or settlement with the adjacent territory. If you work on a federal scale, then for each priority region you need to consider both your federal colleagues and regional players.

Indirect competitors- this is:

- Foreign companies, from which you can often adopt non-standard marketing moves, of course, with a discount on the national characteristics of your consumers.

- Indirect competitors are companies operating in a different price segment or producing alternative goods and services. For example, for a beauty salon, professional cosmetics stores will be indirect competitors.

- Potential competitors are companies that can become direct competitors under certain conditions. This condition can be optimization of a unique selling proposition (USP), changes in the economic situation and any other events that make the competitor's product relevant to your client.

How to find competitors?

- Through search engines at the request of its semantic core or with the help of new queries typical of indirect competitors.

- If we are talking about products - on the commodity aggregators Yandex.Market, [email protected]; on the marketplaces TIU, Wikimart, etc.

- Among the organizers and participants of industry exhibitions, seminars, events.

- From open analytical sources of information, which are named leaders, newcomers, outsiders of the market.

- From business directories Yandex, Google, 2GIS, etc., especially when it comes to regional business like dentistry or grocery retail.

- Through review sites: irecommend.ru, otzovik.com, otzovy.ru and others.

- Through discount sites: Biglion, Groupon, etc.

At the same time, it is always advisable to monitor not only the names of competing companies, but also the mentions of the brands they promote.

The following sections provide groups of criteria for analyzing competitor marketing. It is advisable to put each of the criteria on a separate tab in the spreadsheet.

Comparison criteria

General marketing analysis

After the list of companies and products has been compiled, you need to determine in what areas we will analyze them.

First, you need to get general marketing data about your competitors. If a company monitors its image and reputation, this information can be easily obtained on its website.

I will note two points:

- prices are usually available on the website, otherwise they can be requested during the project (although in the case of complex b2b products it is very difficult to get them);

- The degree to which the company and the product are known can be assessed using the Yandex.Wordstat service. For example, by entering the phrase "toothpaste" into the service, you will quickly find out which is more popular - Splat or Lacalut.

Site analysis

To evaluate usability, you can use by the method of characters and scripts- we imagine ourselves as a consumer of the company's goods / services and evaluate how quickly and easily the target action can be performed on the site.

If the target audience often uses gadgets, the site should render well on mobile devices... It is useful to assess which triggers are used to stimulate purchases.

Reviews play an important role in shoppers' buying decisions, so you need to see if they have been posted on your site. cases, recommendations, portfolio, photographs of completed projects.

For topics with a wide assortment, it is useful to see how the competitor presents the catalog, which filters and segments... For example, on the website of an online store of children's goods, these are filters by gender, age, height, by brand, by season (winter, spring, summer, autumn).

The next criterion is the use feedback forms: online consultant, Skype, Viber, Whatsapp. Perhaps the site uses non-standard services, convenient calculators, a personal account, which makes the user's interaction with the site more convenient.

SEO

It is advisable to start analyzing the marketing activity of competitors with SEO analysis. Of course, a complex technical usability audit is the lot of specialists, but you can quickly assess the degree of attention to SEO by two parameters - positions in search engines, which are checked manually or using automatic services, and traffic.

Of course, the counters are now closed for everyone, but attendance can be estimated in the following ways:

- if you have installed Liveinternet, Mail.Ru or Rambler counters, you can use them to see the place in the rating and daily traffic;

- if the site is relatively popular, traffic can be estimated with a certain margin of error thanks to the SimilarWeb service;

- You can estimate the attendance by indirect signs:

- by the number of views of videos posted on the site;

- by the number of views of the material, which is displayed in some modes, mainly on news sites;

- by the difference in the identification numbers of orders, which are automatically assigned when filling out the feedback forms and come in written notification to the author of the application.

Developments

Information that the company organizes an event or participates in it can be found either in its news feed or on thematic resources.

Competitors can also host unusual events, the experience of using which it is sometimes advisable to learn... For example, the home Internet provider Dom.ru last summer organized children's parties in the courtyards. There was music, animators worked, and upon completion, parents were asked to fill out a connection questionnaire.

Industry resources

When analyzing the work of competitors with industry resources, it is necessary to assess what resources the company uses, what content and how often it publishes, whether it works with paid resources and discount services.

Email Marketing

To evaluate email marketing, a company needs to subscribe to a newsletter. Analysis criteria:

- Do you generally receive letters after subscribing to the newsletter?

- Is it possible to unsubscribe from the mailing list?

- Is there a segmentation of the target audience? This becomes clear at the time of subscription, when the author of the mailing list asks to clarify your interest in products or your socio-demographic characteristics.

- What algorithm does the competitor use in terms of the logic of the sequence of letters? For example, is there a chain of welcome emails; trigger emails accompanying the conversion, etc.

- What content does the newsletter contain and how interesting and useful is it for customers?

- Is the mailing list targeted (in the body of the letter, you are addressed by your name)?

- Does the newsletter offer unique bonuses and discounts that cannot be found in other information channels of the company?

- What service does your competitor use for mailing?

- How does the company collect customer addresses, how are the forms posted on the site, and what bonuses does the company promise in case of a subscription?

Blogs and social networks

Questions to analyze a competitor's blogs and social media activity:

- What networks are used by the company? Are these traditional networks like Vkontakte and Facebook or specialized networks for special content - Slideshare for presentations, professional network Linkedin, Instagram for photos, Youtube- for videos, etc.

- Is the target audience segmented on social media?

- What is the content topic for each of the networks?

- What is the quality of the content and how often is it posted?

- What are the quantitative indicators of work: the number of subscribers, likes, how often users share the company's posts?

- To what extent is the company committed to engaging subscribers in communication? How do you respond to comments? Does it offer participation in competitions and does it conduct surveys?

- How does it work with negativity and how is it neutralized?

- Does the company use non-standard social media capabilities, such as creating individual menus in Facebook and merchandise showcases on Vkontakte.

Advertising

It is advisable to evaluate contextual advertising using services that show requests for which a competitor is being advertised, they will give, with a certain margin of error, estimates of the budget and traffic volume: Serpstat, SEMrush, ADVSyo.RU, SpyWords. It is problematic to do this manually because the campaign can be targeted so that you will be excluded as a target audience.

Media campaigns and special projects are more likely to come automatically into your field of vision when you review thematic resources.

Non-standard activities

Other non-standard activities of competitors worth noting:

- viral videos;

- signs of guerrilla marketing;

- black PR;

- owning their own thematic portals and resources, which are positioned as independent, but at the same time promote the products or services of a competitor;

- product placement.

Reputation analysis

You can understand the reputation of a competitor, its products and services based on online reviews. You can find them:

- a simple search or according to a previously compiled semantic core;

- in product aggregators, there is usually an opportunity to leave a review about the company and the brand;

- by subscribing to notifications about new mentions in the service Google Alerts; as a reference, in addition to the name of the company and brand, e-mail, telephone, names of managers (if not too common) can be used;

- if the competitor is a fairly well-known company, it makes sense to monitor news aggregators such as Yandex.News;

- on sites with reviews of employers.

If there are a lot of reviews and it is difficult to monitor them, you can use special services that will automatically find them and sort them into positive, negative and neutral. Examples of services are YouScan, IQBuzz.

In addition to the fact that after this work, a general impression of the competitor's reputation will be created, you will be able to fix its weaknesses, so that you can then use them to optimize USP and create scenarios to convince customers of sales managers.

Sales department audit

Sales department audits are usually performed using the mystery shopping method. To do this, it is necessary to develop purchase legends and launch them through all forms of contact: a call, a request from the site, a dialogue with a consultant, etc. Next, you need to record the speed of reaction to the appeal, whether the stated condition on the site corresponds to the real conditions, how the manager communicated with you: was he polite, interested, was there a desire to sell, was he too intrusive.

Other criteria:

- the quality of the design of commercial materials and their effectiveness; individual approach to registration of commercial proposal in case of complex procurement;

- discipline and adherence to the work schedule by managers: check by phone 5 minutes before the end of the working day and five minutes after the start.

Analysis and use of results

After the information on competitors is collected, according to the same criteria, you must honestly evaluate your company and products.

What conclusions can and should be drawn based on the analysis performed?

Operational actions

First, it is necessary to assess the feasibility of taking over certain marketing moves of competitors: add something to the site's functionality, consider new channels and types of activities, revise and refine the content. For example, if the warranty period for your products is 1 year, all competitors indicate it, but you do not have this indication on your website, then you should add this information.

To eliminate such "white spots", you can develop a calendar of events.

Secondly, the information received makes it possible to competently compose a script for working with objections for sales managers in order to respond to customer replies like "I can buy similar products from a competitor for 10% cheaper." Managers must be prepared for such situations, must be able to describe the advantages of their products and, conversely, competently neutralize the advantages of competitors' proposals.

SWOT analysis

Information about competitors can be aimed at conducting a SWOT analysis, that is, a situational analysis that assesses the current and current competitiveness of the company's products, based on external and internal factors. Internal factors are the strengths and weaknesses of your company and product relative to competitors, external factors are the opportunities and threats that the market is preparing.

The factors are entered into a table of four quadrants and ranked in descending order of importance, that is, the degree of influence on the business KPI. SWOT analysis allows:

- identify or develop the main competitive advantage of the product based on the strengths;

- Describe how the business can grow by leveraging its strengths;

- find ways to transform weaknesses into strengths, threats into opportunities; if this is not possible, come up with ways to minimize weaknesses and threats;

- make the benefits obvious to the consumer and hide weaknesses;

- realize opportunities and neutralize threats.

Competition strategy and marketing strategy

SWOT analysis gives an idea of the position relative to competitors in the market. After that, in classic marketing, you need to decide on a competitive strategy. You can use the classic approach of Michael Porter, who proposed three types of struggle:

- minimization of costs - all other things being equal, the company is more profitable due to the fact that it minimizes costs;

- differentiation - the company offers non-standard conditions for the market, detaches itself from competitors, forming its own unique selling proposition, which should distinguish it from competitors in an advantageous way;

- focusing - the company works with a narrow target audience, fully satisfying its needs.

Competition strategy is an important part of the overall marketing strategy of a company or a separate direction, that is, a long-term plan to achieve business goals through marketing tools.

Anna's presentation for the report at the seminar for Techart clients.

05 01 medical biochemistry where to work

05 01 medical biochemistry where to work Biochemistry who can work

Biochemistry who can work Types of monopolies: natural, artificial, open, closed

Types of monopolies: natural, artificial, open, closed