Oligopoly and monopoly: essence, characteristics, advantages and disadvantages. Types of monopolies: natural, artificial, open, closed. Monopolies: examples in the world and in Russia Artificial monopoly occurs when

Classification of monopolies

Monopoly- the exclusive right to trade and other types of activity, which belongs to one person, group of persons or the state.

By the degree of coverage of the economy : - CLEAN (at the scale of 1 industry)

- ABSOLUTE - on a state scale (monopoly on foreign trade)

By the nature and reasons of occurrence :

– NATURAL monopoly (owned by owners of unique natural resources)

– LEGAL- a monopoly recognized by the state and protected by law.

a) patent system or licensing- the exclusive right of the state to allow someone to engage in a certain type of activity. Eg all utilities.

v) trade mark or brand name- the exclusive right of the company to produce its own branded products and use the trade mark.

– ARTIFICIAL monopoly - an alliance of firms, concluded with the aim of suppressing competitors and obtaining super-profits.

The mechanism of formation of monopolies:

1) Several firms are merged into one super firm;

2) This superfirm sets prices for its products below cost;

3) Competitors do not stand these prices and go bankrupt;

4) This combined firm becomes a monopoly and sets monopoly high prices.

Types of artificial monopolies:

CARTEL- an alliance of firms of the same industry, which do not merge into one firm, but only agree among themselves on joint prices, quotas for products, and divide sales markets.

SYNDICATE- an alliance of firms of the same industry, in which separate ownership of the means of production remains, but joint ownership of the products is formed(produced separately, sold together through a common trading company).

TRUST- an alliance of firms of the same industry, in which joint ownership of both the means of production and the manufactured products is formed.

CONCERN- an alliance of firms from different industries, including trade, transport companies, banks, controlling the entire chain from the extraction of raw materials to the sale of finished products.

With the formation of concerns, monopoly weakens and competition intensifies, because the concern cannot maintain a monopoly in several industries at once.

If the period of trusts corresponds to a monopoly, then the period of concerns corresponds to an oligopoly.

The rules of conduct for a monopolist firm.

1. Monopoly sets monopoly high prices for manufactured products.

2. The monopoly sets monopoly low purchase prices for products.

3. The firm, which is both a monopoly and a monopsony, sets monopoly low purchase prices and monopoly high sales prices.

4. Technological progress is artificially constrained.

The main directions of antimonopoly legislation.

Realizing the economic danger of monopoly, the state is fighting monopoly.

Directions: 1. the monopolization of the market is limited, 2. the merger of large firms for the purpose of creating monopolies is prohibited, 3. the establishment of monopoly high prices is prohibited, 4. competition in civilized forms is encouraged. ...

There is an anti-monopoly committee, which sounds the alarm in case of negative manifestations.

Features of monopoly in modern conditions

There are currently no pure monopolies. Now a monopoly is considered to be a company that produces more than 60% of the industry's output. They are at the forefront of technological progress, investing heavily in research and development.

Output: in the modern economy there are no shortest manifestations of the market (pure monopoly and perfect competition), but there is a peculiar combination of elements of competition with elements of monopoly in the form of oligopoly and monopolistic competition.

LECTURE No. 8. COSTS AND PROFITS IN THE FIELD OF PRODUCTION

Syndicate- This is an association of a number of enterprises manufacturing homogeneous products; here the ownership of the material conditions of management is retained by the members of the association, and the finished product is sold as a common property through the office created for this.

Cartel - this is an association of several enterprises of one branch industry, in which its participants retain their ownership of the means and products of production, and the created products themselves are sold on the market, agreeing on a quota - the share of each in the total output of products, on sales prices, distribution of markets, etc.

Artificial monopoly

An artificial monopoly that has grown on a production base is distinguished by a high efficiency in the production of goods and services. This is due to the fact that, having overcome the competition, enterprises equipped with the most advanced technical base, which have a low level of operating costs, enter the market. Examples of this type of artificial monopoly are found in real life, but not very often. Here we can talk about companies that have reached such a level of material and technical base and management, which allows them to reduce the cost of manufacturing products. Accordingly, its cost for the end customer is reduced so much that there is simply no point in other enterprises in the industry to manufacture such goods.

Since the 1890s. Russia has entered a period of industrial growth. The bourgeoisie did not have access to power and was not free to make decisions. On the positive side: many banks were created. 3. Foreign capital can bring achievements of scientific and technological progress and advanced management experience to the country.

In a market economy, profit occupies a central place, expressing versatile economic ties in the reproduction process and acting as the goal of entrepreneurial activity. In modern conditions, when international monetary circulation operates without a single basis - gold, two types of exchange rates are used: fixed and floating.

- natural monopoly, when an economic entity occupies a privileged position in the market;

- pure monopoly, when there is only one supplier of a certain type of services or goods;

- a conglomerate is several entities of a heterogeneous type, but mutually financially integrated (ZAO Gazmetall can serve as an example in Russia);

- a closed monopoly that has protection from competition in the form of legal restrictions, patents and copyrights;

- an open monopoly, which differs in that there is only one supplier of the product on the market that does not have special protection against competition.

This concept is very capacious. According to some experts, the natural monopoly described above is one of the subspecies of economic (artificial) monopoly. In this case, we are talking about such companies that were able to gain a leading position in the market.

Artificial monopolies examples in russia

Among modern monopolistic unions of this type, there are contract with a large number of participants. An example is the agreement on the construction of an oil pipeline, which is planned to run from Marseille through Basel and Strasbourg to Karlsruhe. This union includes 19 concerns from various countries, including the Anglo-Dutch Royal Dutch-Shell, the English British Petroleum, the American Esso, Mobil-Oil, Caltex, the French Petrofina and four West German concern.

As long as monopoly markets exist, they cannot be left without government control. Thus, the elasticity of demand becomes in this situation the only factor, but not always sufficient, limiting monopoly behavior. For this purpose, an anti-monopoly policy is being pursued. It can be divided into two directions. The first includes the forms and methods of regulation, the purpose of which is to liberalize markets. Without affecting monopoly as such, they aim to make monopoly behavior disadvantageous. These include measures to reduce customs tariffs, quantitative restrictions, improve the investment climate, and support small businesses.

Monopolies: examples in the world and in Russia

So, in the UK there is no legal definition of the term `` natural monopolies ''. Examples of societies that everyone needs include railway structures, power transmission and distribution, water supply and sanitation. And in France, the term "natural monopolies" is enshrined in the concept of "commercial and industrial public services." These are organizations working in the field of communications, rail transport and electricity supply.

Artificial monopolies are now widespread. Examples of such associations are concerns, trusts, syndicates and cartels. Every entrepreneur strives to conquer a monopoly position. It allows you to eliminate a number of risks and problems associated with competitors, as well as to gain a privileged position in the market. At the same time, the monopolist is able to influence other market participants and impose their own conditions on them.

Monopolies in Russia

A cartel is an amalgamation of several enterprises of one sphere of production, the participants of which retain ownership of the means of production and the produced product, production and commercial independence, and agree on the share of each in the total volume of production, prices, and sales markets.

150-200. Several dozen of them were in transport. Many of the largest banks turned into banking monopolies, whose penetration into industry, along with the processes of concentration and combination of production, contributed to the strengthening and development of trusts, concerns, etc. (Russian Oil General Corporation, "Triangle", "Kolomna-

Artificial (regulated) monopoly

For example, entry into an industry may be limited to the issuance of licenses for certain types of economic activity, such as the production of wine and vodka and tobacco products. A monopoly can be a company that owns rare natural resources. For example, De Beers has monopolized diamond mines in South Africa and controls the supply of diamonds to the world market. There is also a patent monopoly that protects intellectual property rights. Patents give a company the exclusive right to manufacture products. They have played a significant role in the development of companies such as Kodak, Gillette, Polaroid, Xerox and Sony.

An artificial monopoly of the second type arises due to the granting of patents and permits for the production of any product to only one enterprise. This can relate to various kinds of inventions, know-how or limited access to a specific resource. Such artificial monopolies have forms based on preferences, including from the state, and exist in most countries of the world.

Monopolies in Russia (pp.

The history of monopoly reaches deep antiquity. Monopolistic tendencies in different forms and to varying degrees are manifested at all stages of the development of market processes and accompany them. But their recent history begins in the last third of the 19th century, especially during the economic crisis of 1873. The interconnectedness of phenomena - crises and monopolies - indicates one of the reasons for monopolization, namely, the attempt of many firms to find salvation for crisis shocks in monopolistic practice. It is no coincidence that the monopolies in the economic literature of that time were called "children of the crisis."

2) To begin with, let's give a definition of the concept of "monopoly". Monopoly is the absolute predominance of the sole producer or seller of products. This is an economic entity that personifies the industry, which determines the market price of a product and the volume of its supply for sale.

Natural monopoly

- sale, lease or other transaction, as a result of which an economic entity acquires the right of ownership or possession and (or) use of part of the fixed assets of a natural monopoly entity intended for the production (sale) of goods, in respect of which regulation is applied in accordance with the Law “ On natural monopolies ”, if the book value of such fixed assets exceeds 10% of the value of the equity capital of a natural monopoly entity according to the last approved balance sheet.

oligopolistic with a small number of producers - markets for individual durable goods (cars, computers, household appliances). They are especially difficult to demonopolize, because in the formal absence of domination by any of the producers, favorable opportunities are created for a monopoly conspiracy, which is quite difficult to legally prove;

24 Jul 2018 2312An artificial monopoly is a situation in which there is no reason for a natural monopoly, but there is only one firm in the industry, since one entrepreneur in some way gains control over the entire industry.

The reasons for this may be financial, if one wealthy entrepreneur can (honestly or cunningly) buy up all the other firms in the industry and become the only manufacturer of this product.

The reason could be the possession of a unique resource or technology. For example, if one firm owns the only source of mineral water on the farm, it becomes the only seller of this good. Or if only one firm possesses the knowledge of the technological secret necessary for the production of some good, and others do not. The reasons for possessing such a secret can be different: a firm can discover this technology itself or it can buy an exclusive right from its inventor.

In any case, under natural or artificial monopoly, other firms in the industry cannot emerge, and the only firm in the industry is the complete master of the situation.

So what will the firm that owns the entire industry do? How is equilibrium established under monopoly conditions?

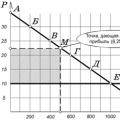

In essence, the choice of a monopolist is reduced to the choice of a point on the demand curve for its product. Suppose that in Fig. 2.7. depicts the demand curve for the product of the monopolist. The monopolist can choose points A, B, C or any other point on the demand curve. Points lying above the demand curve are inaccessible to him. Why doesn't he pick a point that lies under the demand curve? Of course, he can choose such a point = for example, point G = produce the quantity Q1 and sell it at the price P1. But this will contradict his desire to get the maximum profit, because he can easily raise the price to the value of P2 and increase his revenue by the area of the shaded rectangle. Whatever quantity of the product the monopolist decides to put on the market, he will try to set the highest possible price on it.

Therefore, if the monopolist wants to get the maximum profit, then he must choose one of the points on the demand curve.

What point?

Rice. 2.7

The answer to this question depends on the shape of the demand curve and the shape of the monopolist's average cost curve.

For the sake of simplicity, assume that the demand curve for the monopolist's products is a straight line (see Figure 2.8). Let us also assume that we are dealing with an artificial monopoly, which was formed in the following way.

Consider the example of the match industry, there was competition between several dozen roughly the same firms that had the same average cost of producing a box of matches. There was a long-term equilibrium in the industry, in which all factories produced 1 million boxes, sold at a price equal to the average cost, and the economic profit of all firms was zero. Suddenly, an entrepreneur bought up all the firms in the industry and became a monopolist. What will he do?

In this case, the average production costs of the monopolist's matches can be considered the same for any output, since in order to change the output, it will simply close individual factories, leaving others to work in a "normal" mode.

To determine the price and volume of output that will bring him the greatest profit, the monopolist must go through all the points on the demand curve, calculate the profit in each of them, and choose the point at which the profit is maximum.

Fig 2.8

If the monopolist begins to gradually reduce output, he will find that this increases profits. For example, the release of 800 thousand boxes per week, he will be able to sell at a higher price of 15 rubles per box (point D on the chart). His revenue will thus amount to 12 million, the average cost is 8 million, and the profit will grow from zero to 4 million rubles!

If the monopolist decides to reduce the output a little more to 600 thousand boxes per week, he will be able to raise the price to 20 rubles per box (going to point D) and his profit will already be 6 million rubles.

But if he reduces his output by another 200 thousand boxes and moves to point B, he will find that his profit has not changed, even though the price of a box has increased to 25 rubles. And if he further reduces the output and moves to point B, he will find that his profit has decreased to 4 million rubles.

Thus, it is unprofitable for the monopolist to go beyond the boundaries of the VG segment and should look for the optimal point within it. After going through all the possible options, he will find that the maximum profit is reached at point M and is equal to 6.25 million rubles. Any adjacent point will mean a decrease in profit. Since point M is the most profitable for the monopolist, he will install the production of 500 thousand boxes per week and will sell them at a price of 22.5 rubles.

Fig 2.9

The monopolist's profit at this point is equal to the area of the shaded rectangle (the product of the output Q and the difference P = v = AC). And the monopolist could solve this problem "in a geometric way" = for this he just needs to find a rectangle with the largest area, inscribed in the figure formed by the D curve, the AC curve and the vertical coordinate axis.

But can a monopolist reduce output easily without changing its average costs? In our case, with an artificial monopoly resulting from the amalgamation of many small firms, the monopolist simply closes some of the factories, leaving others to work in an optimal mode, giving a minimum of average costs. Therefore, reducing the output from 1 million to 500 thousand boxes per week = this is just the closure of half of the factories.

It can be noted that such an increase in the price of a box of matches by more than 2 times (from 10 to 22.5 rubles) is completely unprofitable for consumers, who, as a result, are forced to cut the consumption of this good by half.

Since the monopolist has reduced the output of the industry by 2 times, this means a 2-fold decrease in the volume of demand of this industry for all resources that it acquires for the production of matches (raw materials, equipment, labor of workers). And this is not profitable for the suppliers of these resources = producers of intermediate goods are unable to sell their products, workers are forced to look for a new job.

Thus, an artificial monopoly acts contrary to the interests of practically the entire economy (perhaps, with the exception of manufacturers of lighters or other substitutes for the good of a "match", for whose products demand may increase).

Will a monopolist always benefit from drastically reducing output and raising the price? It depends on the shape of the demand curve and the shape of the average cost curve.

If, for example, the demand curve is very inelastic (Fig. 2.9.), Then the monopolist will really benefit from drastically reducing output and raising the price, since an increase in price will be accompanied by a slight increase in the volume of demand. The largest area under such a demand curve would have a rectangle with a small base and long sides (shaded in Figure 2.9.)

If the demand for the monopolist's product is highly elastic and the demand curve is flat (Figure 3.6.6), it will not be profitable for the monopolist to significantly increase the price, since this will greatly reduce the volume of demand, and a decrease in the volume of demand will destroy all the benefits from the increase in price. In this case, the monopolist will choose point A (namely

Figure 2.9.1. the demand curve is elastic, this point corresponds to the rectangle under the demand curve with the maximum area). At the same time, the price grows very insignificantly (on the chart = only by 20 or 30%).

34 The main features of monopoly. Optimization of monopoly activities in the TC-TR and MR-MC models. Socio-economic consequences of the monopoly ..

Pure monopoly(from the Greek monos - one, polio - I sell) is a market in which one seller opposes many buyers. Monopoly assumes that one firm is the only manufacturer of any product that has no analogues. Therefore, buyers have no choice and are forced to purchase these products from a monopoly firm.

The purpose of the monopoly- obtaining super-profits by controlling the price and volume of production in the monopolized market by creating the most favorable conditions.

The main features of pure monopoly:

a) the only seller is the manufacturer;

b) there is no product differentiation, therefore, the absence of substitute products;

c) the seller has almost complete control over prices;

d) very difficult conditions for new enterprises to enter the industry - the entrance is blocked by finance, technological, resource, legal conditions;

e) the process of leaving the industry is also difficult;

f) the presence of economic and legal barriers to entry and exit from the industry.

Distinguish two types of monopolies by the way of formation (occurrence) - natural and artificial.

1. Natural monopoly - is presented in the form of private owners and organizations that include rare and freely non-reproducible economic resources (rare metals).

2. Artificial monopolies - these are associations created for the sake of obtaining monopolistic benefits. Artificial monopolies appear in the form of various monopoly associations. Artificial monopoly arises from collusion or suppression of competitors.

There are also types of monopoly from the point of view of the possibility of penetration into the industry due to the presence of protection from the state :

1. Open monopoly –Monopoly, in which one of the firms (at least for some time) becomes the only supplier of the product, but does not have special protection from competition.

2. Closed monopoly - a monopoly protected by legal norms that restrict competition: patents, licenses, copyright institute.

The firm's goal is to maximize profits, i.e. increase in the difference between gross income and gross costs:

P = TR-TC

To determine the level of output at which profits will be maximized, it is necessary to compare the firm's gross income and gross costs, or marginal income and marginal costs.

Comparing gross income and gross costs

In the interval of output from point K to point N, the firm receives economic profit, since income exceeds costs, maximizing it at the release of OM, where the maximum gap between the two curves. Points C and D - production critical points, since at these points the economic profit is zero, that is, the firm only reimburses costs from its income.

Comparison of marginal revenue and marginal cost.

When marginal cost is less than marginal revenue (MS< МR), каждая добавочная единица продукции увеличивает прибыль. Прибыль будет увеличиваться до точки Е, где растущие предельные издержки начинают превосходить предельный доход. Когда МС >MR (marginal cost exceeds marginal revenue), each additional unit of output decreases profit. Therefore, to maximize profits, the firm must expand output as long as marginal revenue exceeds marginal cost, and reduce production when marginal cost begins to exceed marginal revenue. The maximum profit is achieved when the marginal revenue, price and marginal cost are equal:

MR = P = MC

At point E, the firm reaches the optimal level of output and enters a state of equilibrium. It is not profitable for the company to either reduce or expand production. In the event of a reduction in production, it will not receive a part of the profit that it could have, and in a situation of expansion of production, it will incur losses.

Socio-economic consequences of monopoly.

Economic implications- depreciation of the learning process, the cost of helping the unemployed, loss of qualifications, a decline in living standards. Advantages - creation of a labor force reserve, stimulation of the growth of labor intensity and productivity.

Social implications- exacerbation of the crime situation, increased social tension, increased social differentiation. Pros of increasing the value of the workplace.

Price discrimination- setting different prices for the same product, provided that the differences in prices are not associated with different costs. The goal of price discrimination is to maximize the total revenues of the firm at a constant level of total costs.

Antimonopoly policy of the state is a set of economic and administrative measures aimed at promoting and protecting competition and limiting monopoly manifestations. It includes both measures to prevent the emergence of new monopolies and measures against existing monopolies.

Antitrust Law- a set of normative acts aimed at limiting the freedom of entrepreneurial activity and the freedom of contract of economically influential companies.

State regulation of natural monopolies carried out by various executive authorities. For example, in the fuel and energy complex, regulation of the activities of subjects of natural monopolies is carried out by the Federal Energy Commission of the Russian Federation; rail transportation; transportation to remote areas of the Russian Federation; services of transport terminals, sea and river ports and airports are regulated by the Ministry of Antimonopoly Policy and Business Support.

35 Antitrust policy against artificial monopolies.

1. Monopoly concept

2. Unlike natural, artificial (or entrepreneurial) monopoly develops in those industries where a single producer does not have increased efficiency compared to several competing firms . Establishment of a monopoly type market therefore, it is not inevitable for such an industry, although in practice it may develop if the future monopolist manages to eliminate competitors.

3. The use of the term "artificial (entrepreneurial) monopoly" in the economic and legal literature is distinguished by one more feature: this concept also unites dominance, which is quite rare on the market. the only one monopolist, and the more common situation of the predominance of several cooperating firms in one form or another, that is, if we use the terminology (see topic 8), we are talking about a pure monopoly and two types of oligopoly ¾ cartel and cartel-like market structure ... This broad interpretation of the term "monopoly" is justified by the fact that in all of the above cases, the dominant firms in the market, to one degree or another, are able to act as a whole, that is, they show signs of monopolistic domination of the market.

4. Objectives and Means of Antitrust Policy

5. The main goal of every antitrust policy is the suppression of monopolistic abuse. Towards natural monopolies these goals are achieved through direct government intervention in their activities, in particular, through compulsory pricing.

6. In case artificial monopoly the main direction of regulation is to counteract the formation of such monopolies, and sometimes the destruction of existing ones. To do this, the state uses a wide range of sanctions: these are preventive measures (for example, a ban on mergers of large firms), and various, and often very large, penalties for improper market behavior (for example, for an attempt to collusion with competitors), and outright demonopolization, i.e. That is, the compulsory splitting of the monopolist into several independent firms.

36Antimonopoly Policy Against Natural Monopolies

6. The main way to combat the negative consequences of natural monopolies is state control over the pricing of natural monopoly goods and / or over the volume of their production (for example, by defining the circle of consumers subject to mandatory service).

7. The establishment by the state of economically feasible prices (for example, minimizing the intersectoral outflow of capital, ᴛ.ᴇ. taking into account the average profitability of enterprises in the country, correlated with real GDP growth) will contribute to an increase in the volume of production corresponding to the intersection of the marginal cost curves (MS ) and marginal revenue (MR) (rule MC = MR).

8. If the price level set by the state is not associated with average costs, then the receipt of economic profits or losses may be consolidated. Both options are undesirable. The presence of permanent economic profits is tantamount to a tax on consumers (the demand for their products will decrease). Consolidation of losses leads to ruin, or the receipt of government subsidies (if the goods are socially significant).

9. The socio-economic efficiency of natural monopolies should be increased by changing the form of ownership and demonopolization (unbundling.).

10. Economic science has not developed an unambiguous assessment of these approaches. In many developed market states, natural monopolies are nationally owned, but no less countries where they are private.

11. Conventional Arguments for Nationalization˸ It is easier for a state-owned enterprise to pursue government policy on prices and output; state property excludes monopoly abuses with the aim of enriching the owners. Arguments in favor of privatization are associated with fears of a decrease in the efficiency of a natural monopolist (there are dependent sentiments at a state enterprise (there is nothing to be afraid of losses, everything will be covered by the budget)) and an increase in the possibility of corruption

37. What are the advantages and what are the disadvantages of the method of price regulation of natural monopolies, focused on marginal costs? Explain and graph.

Maximizing the level of production (focus on marginal costs

)

Price regulation of the activities of natural monopolies presupposes the compulsory fixing of the maximum value of prices for the products of the monopolist. Moreover, the consequences of this regulatory measure directly depend on the specific level at which prices will be fixed.

In fig. 10.4 shows a common regulation option, in which the highest acceptable price is fixed at the level of the intersection of marginal costs with the demand curve (P reg = MC = D).

The main consequence of setting the maximum price from the point of view of the behavior of the monopolist firm is the change in the marginal revenue curve. Since the monopolist cannot inflate the price above the named level, even with those volumes of production where the demand curve objectively allows it to do so, its marginal income curve from the MR position shifts to the MR 1 position (highlighted in the graph by the bold line), which coincides with the maximum allowed price value P reg. Indeed, if the maximum price of electricity is fixed at 80 kopecks. for 1 kW / h, then each additionally sold kilowatt will bring income equal to this amount, and the marginal income curve will degenerate into a horizontal line passing at this level.

Rice. 10.4. Regulation of prices for products of a natural monopoly in order to maximize production

Further, the rule MC = MR comes into force. Like any other firm, the monopolist himself, without any government coercion (which is a large plus

of this regulation technique!) will strive to bring the volume of production to Q reg, corresponding to the point of intersection of the curves of marginal income and marginal costs. In fig. 10.4, other advantages of this method of limiting monopolistic prices are clearly visible: a significant increase in production is achieved (Q reg> Q M) and prices are reduced (P reg< P М). Таким образом, главным плюсом данной методики регулирования является создание рыночного механизма, без дополнительного принуждения и контроля заставляющего монополиста увеличить производство и полностью покрыть спрос, который существует на товар при установленном государством уровне цен. По существу, миссия государства состоит лишь в том, чтобы верно выбрать потолок цен. Остальное сделает сам монополист. В результате принятых государством мер полностью исчезает мертвый груз монополии, т.е. удается устранить состояние, когда производителю выгодно продать, а покупателю – купить некий товар, но сделка не совершается из-за практикуемого монополистом недопроизводства.

But the described regulation method has and flaw: the price level set by the state has nothing to do with average costs, i.e., it can, by the will of the state, also secure the receipt of economic profits (Figure 10.4 a), and incurring losses (Fig.10.4 b). Both options are undesirable. Having a natural monopolist has permanent economic profits is tantamount to a consumer tax. By paying inflated prices, they increase their costs with all the ensuing negative consequences (reduced demand for their products, reduced competitiveness). But even more dangerous, perhaps, is the consolidation of losses. A natural monopolist can cover them in the long-term aspect only through government subsidies, otherwise it will simply go bankrupt. And this opens up a wide road for extravagance. As soon as there is no hope for profit one way or another, and the state will cover the losses anyway, the monopolist can benefit only by squandering public funds. The highest salaries for managers, bloated staff, huge hospitality costs are all hidden forms of enrichment at the expense of the treasury. In this case, x-inefficiency reaches its highest level.

What is the similarity and what is the difference in the behavior of a monopolist who pursues a policy of price discrimination and does not implement it? When would the impact of a monopoly market on public welfare be more adverse?

The profit received by the monopolist is equal to the area of the track PmMAPa, and it is also the maximum, but only if the monopolist sets a single price.

The net loss of profit is the "dead weight" - the MCN trip. Also, the loss of profit will be trag-to PbPmM.

Differences: Hence, 1 difference:- loss of part of the profit due to the establishment of a single price. Conditions for price discrimination: 1) the existence of different individual demand curves for different buyers; 2) the ability to separate groups of consumers with different demand curves; 3) the isolation of consumer groups.

2 difference: Effects price discrimination 1 degree: Expansion of production output; Increase in income and profits of the monopolist; Overpricing; The increase in the number of buyers is all persons who are able to cover the marginal cost and bring the seller at least some profit from each unit of production.

first degree price discrimination- the sale of each unit of product at the price of its demand, at the maximum price that consumers are willing to pay. Consequently, the situation becomes like perfect competition. Then the total amount of profit increases, the number of buyers increases, the output of products expands.

Price discrimination degree 2(non-linear pricing) - a monopolist sells goods at different prices, but everyone who buys more pays less. The seller cannot determine the buyer's solvency, therefore, it gives the consumer the opportunity to choose the amount of the purchase himself. The most popular versions of price discrimination of the 2nd degree: quantity discounts, cumulative discounts, fractional discounts.

Price discrimination 3 degrees consists in the fact that the manufacturer sells goods to different buyers at different prices, but each unit of production sold to a given customer always has the same price. For example, overpricing at elite points of sale, reduced travel on public transport for schoolchildren and pensioners

When the impact of the monopoly market on society will be more unfavorable, with or without price discrimination, it is impossible to say unequivocally. On the one hand, buyers pay more, on average, when prices are discriminated against, which is why additional profits for the monopolist arise. But, on the other hand, firstly, price discrimination creates more favorable conditions for poor people, since they do not have to pay a single price, and the goods get cheaper. And also in case of price discrimination of the third degree, the principle "the poor pay less" applies, for example, upon presentation of an official document, students, pensioners are given discounts. And secondly, when prices are discriminated in the second degree, discounts are made for consumers who make large purchases and are therefore sensitive to price differences, i.e. "Buy more, pay less."

38. How is the degree of concentration of production measured? What indicators are used? Name and describe them.

To measure the level of market concentration, it is used concentration factor. It shows the percentage of sales in the total sectoral volume of a particular type of product for a certain number of the largest firms (usually four or eight). Metallurgical, automotive, defense, oil production and some other industries are characterized by a high level of concentration.

The disadvantage of the concentration ratio is that industries with different degrees of market monopolization can have the same ratio. For example, 24 firms can operate in one industry, one of which sells 77% of the total volume of products on the market, and the remaining 23 - 1% each. In another industry, there are five firms, each of which sells 20% of the products. The concentration ratio, calculated from the share of sales of the four largest firms, will be the same in both industries - 80%. However, in reality, the level of market monopolization in the first industry significantly exceeds the degree of concentration of sales in the second.

To eliminate this drawback, we use Herfindahl - Hirschman Market Concentration Index(//). It is determined by summing the squares of the market share of each firm in the industry. So, if the industry has NS different firms, the formula is as follows:

where R- market share of each of the firms in the industry,%;

NS- the number of firms in the industry.

As market concentration increases, the Herfindahl-Hirschman Index increases. So, if there are 100 identical firms in the industry, then H= 100. If there are 10 identical enterprises in the industry, then H = 1000. The index acquires the maximum value under the conditions of pure monopoly when there is only one firm in the industry: # = 10,000.

In our previous example in the first industry H = 5952, in the second I = 2000, which indicates a higher level of market concentration in the industry where one firm sells 77% of all products.

One of the indicators of market concentration is also the Lerner Monopoly Power Index (//.). This coefficient is based on the fact that monopoly power in the market is inversely proportional to the elasticity of demand for the firm's products, and is determined as follows:

![]()

where E- coefficient of elasticity of demand for products;

Rt- monopoly price; MS - marginal cost.

39 Describe the policy of price discrimination. Give a graphic interpretation and practical examples. - 40. Describe price discrimination and its types. Give a graphic interpretation.

Pigou in 1920 proposed to divide the well-known price discrimination schemes into three types. Price discrimination can be of the first, second and third degree.

A.S. Pigou distinguishes three degrees of price discrimination:

1. Price discrimination of the first degree (perfect discrimination).

In the first degree discrimination, each unit of the product is sold at its starting price in such a way that the minimum amount that he is willing to spend on the purchase of the desired product is drawn from each buyer, while the buyer will consider that he has made a bargain purchase. In other words, perfect discrimination prevents the consumer's surplus from being received and appropriates it entirely in the form of the producer's surplus.

In practice, perfect price discrimination occurs, as a rule, in the form of pricing of club goods. Club goods are goods, the consumption of which by one individual allows their simultaneous use by others, the main property of these goods is indivisibility in consumption. An example of a club good is, inter alia, a visit to a park, a golf course or playing tennis. In these cases, perfect pricing of the good includes two parts: payment by the consumer of a fee for the right to use the good (membership fee to the club that unites users of this good) and the price of direct consumption of the good. The price of a product is set at the level of marginal costs of its production (at the level of equilibrium between supply and demand for a product under conditions of free competition), and the amount of the contribution is determined as the amount of consumer surplus in the market. Thus, what the consumer gains in the form of a low purchase price of the good, he loses in payment for access to the source of the sale of the good.

Rice. 8.1 Price Discrimination First Degree

Let's assume that marginal cost is constant. When carrying out price discrimination of the first degree, the monopolist sells the first unit of goods Q 1 at its reserved price P 1 the same goes for the second (sold Q 2 at the price P 2), and subsequent units of goods. In other words, the maximum is squeezed out of each customer that he is willing to pay. Then the curve MR coincides with the demand curve D, and the profit-maximizing sales volume corresponds to the point Q n, since it is at the point E marginal cost curve (MS) intersects the demand curve D (MR) discriminatory monopolist.

Consequently, the marginal income from the sale of an additional unit of production in each case will be equal to its price, as in the conditions of perfect competition. As a result, the monopolist's profit will increase by an amount equal to the consumer's surplus (shaded area).

2. Price discrimination of the second degree.

In the case of price discrimination of the second degree, the prices of the goods depend on the purchase volume. The so-called non-linear pricing is observed, that is, a situation when the consumer's expenses for the purchase of goods are not proportional to the purchased volume, but depend on which price change scheme the seller has chosen.

The standard demand curve is represented by the DD "line, the marginal revenue curve by the DMR line. The marginal cost curve by the MC line. The average monopolist equates marginal cost to marginal revenue by setting uniform price OP M for all buyers selling OX m units. However, a price discriminating monopolist will be able to divide demand into ten parts as buyers' starting prices fall. There are buyers who want to buy P 1 K units at the highest possible starting price of OP 1; additional EF units will be purchased at a lower price of OP 2, and so on. The seller, setting for each group of goods a price approximately equal to the starting price, sees that it makes sense to expand the output of products until there are no such groups of goods, the starting price of which exceeds the marginal cost. Thus, the number of units of the OX D product will be sold at a total of seven different prices. The total profit is equal to the sum of the decreasing differences between the price and the average cost per unit of OS D for all units sold. This is shown in the shaded portion of the figure. The profit from selling at discriminatory prices is significantly higher than the profit earned by exercising a conventional non-discriminatory monopoly (this profit is shown in the figure as a rectangle with a CMP height M and a width OX m).

Rice. 8.2. Second degree price discrimination

3. Price discrimination of the third degree.

Forms of manifestation of price discrimination of the third degree

Here, different categories of buyers are faced with different prices, but each group of buyers pays the same price for any unit purchased. There are several types of third-degree price discrimination.

1. Zone prices. Zonal prices provide for price differentiation based on the time of purchase. Examples of zonal prices include higher rates during peak hours, discounts for customers during the busiest hours: afternoon dinners at restaurants versus evening dinners, cheap hotels in resorts in winter and expensive for kids.

2. Differentiation of prices depending on the status of the consumer. In this case, the status of the consumer serves as the basis for the appointment of a high or low price. For example, different prices can be set for the manufacturing and consumer sectors of the economy; for public and private enterprises; for internal and external consumers.

3. Differentiation of prices in relation to informed and uninformed consumers. The firm charges relatively high list prices for the item, but provides a discount if the buyer makes a complaint. The buyer's claims in relation to the value of the price (the quality of the service at such a price) characterize him as an informed buyer who knows the true situation on the market, therefore, worthy of implementing a special pricing policy.

4. Discrimination of consumers in relation to different estimation of time. The company provides for discounts on the price of the goods, but accompanies the price reduction with additional temporary conditions: you have to either wait for a long time to receive the goods (stand in line), or the purchase of goods is associated with a consumer's trip to a distant store of the company located in an inconvenient place. Consumers who are willing to pay more for the convenience of a nearby store and fast service face higher prices.

The essence of the manifestation of price discrimination of the third degree.

In fig. 8.3 shows the traditional graphical analysis of the discriminatory monopoly of the third degree in the A and B markets , the demand and marginal income curves of which are shown in graphs (a) and (b). The problem is that the last (unit of goods sold in market A , be sure to add the same amount to income as the last unit sold on the market V, those. is to equalize the marginal revenue in each market. To do this, plot (c) the combined marginal revenue function CMR, summing along the horizontal axis the values of the marginal revenue curves for each of the two markets. CMR turns out to be equal to the marginal cost of MC at the point corresponding to the profit-maximizing total output of OX C. To bring the marginal revenue to the value maximizing profit, we will draw horizontal line from the intersection of the MR and CMR curves. The volume of output in each market, therefore, will be determined by the point of intersection of the specified horizontal line with the MR curve of the corresponding market, and prices, as a rule, will be found using the corresponding demand functions linking the level of profit-maximizing output with a certain price level. Thus, in the market A with less elastic demand, the price will be set at the highest level of OR A, and in the more elastic market B, the lowest price of OR B will be established.

Rice. 8.3. Price discrimination of the third degree

41 Features of the formation of supply and demand in the resource market. Equilibrium in the resource market.

Factors of production are means that are used in the production of economic goods.

The classic factors of production are land, labor, capital .

The markets for the factors of production are, first of all, the markets for the services of these factors. When they are bought, it means that they are buying the services that they can provide.

Consider features of supply and demand of factors of production:

1. Demand for land, labor and capital is derived from consumer demand for a good or service, which are created using these factors. The more needed a given commodity and the larger the quantity required to meet the needs, the greater the demand for the resources from which this commodity is produced, and vice versa.

2. The factors of production are interchangeable that is, instead of one factor in a certain proportion, you can use others. The interchangeability of factors leads to the fact that with a change in the price of one product, other things being equal, the demand for others will change.

3. All factors of production are complementary , i.e. one factor involves the use of others. This means that the size of demand for each factor depends not only on the level of prices for it, but also on the level of prices for other resources.

Thus, the demand for resources is formed under the influence of a number of factors, the most important of which are:

Resource productivity (with an increase in resource productivity, the demand for this resource will increase, and vice versa);

The price of a product produced using a resource (if the price of a product rises, the demand for a resource increases, and vice versa);

The supply of production factors is formed under the influence of the characteristics of the factor being implemented:

1. Common to these markets is the limitation of all types of resources available in society in comparison with the needs of society. It is impossible to instantly increase the supply of a factor.

2. Different factors of production have unequal mobility and, as a consequence, different elasticity of supply.

3. Mobility of factors increases over time. The total supply of resources also increases over time.

If the interests of producers and consumers coincide, market equilibrium- the situation on the market, when the quantities of supply and demand coincide or are equivalent at a price acceptable to the consumer and producer. The economic meaning of this equilibrium lies in the fact that it reflects the unity of buyers and sellers, the equality of their opportunities and desires.

Due to an increase or decrease in demand and / or supply, changes occur in the equilibrium quantities of goods and equilibrium prices. As a result of the interaction of supply and demand, or the interaction of the demand and supply prices, the market price is established (Fig. 2.5).

Rice. 2.5. The equilibrium price and quantity of the product are determined

market demand and supply

It is fixed at the point at which the supply and demand curves intersect (point E). This point is called equilibrium point, and the price is equilibrium. Only at the equilibrium point, the price suits both the buyer and the seller at the same time. Indeed, it is unprofitable for producers to further increase prices and increase supply, since then the goods will not find demand. The consumer should also not count on a reduction in prices, since this is contrary to the interests of producers.

If the market price is below the equilibrium price, then deficit, in which the amount of demand exceeds the amount of supply. When the market price is higher than the equilibrium price, then excess of goods, at which the volume of supply exceeds the volume of demand. In other words, when the market price is higher than the equilibrium price, it leads to the formation of surplus and seller dissatisfaction. Underpricing, on the other hand, leads to scarcity and customer dissatisfaction. Inventories are increasing, overstocking is putting downward pressure on prices. This is the result of the fact that sellers have difficulty in selling products, which leads to a reduction in the supply and causes the seller to competitively lower the price to the equilibrium price.

Thus, equilibrium price Is the price at which the quantity of goods offered on the market is equal to the quantity of goods for which demand is presented.

If the price rises above the equilibrium point, it will stimulate an increase in production. Competition will begin between the producers of this type of product, as a result of which a surplus of goods is formed and the price for it will begin to decline, approaching the equilibrium point. On the contrary, if the price falls below the equilibrium point, it will intensify competition between buyers. This will lead to an increase in prices, expansion of production and a return of prices to the equilibrium price.

Perhaps each of us has come across the concept of monopolization in certain spheres of the economy at least once in our life. We know that in almost every state there is an anti-monopoly body designed to tirelessly monitor economic trends towards the emergence of monopoly enterprises on the market. We have also heard that natural and artificial monopolies are the subject of study by economists. In general, most of us have a fairly persistent attitude towards the topic of monopolization of anything as a negative phenomenon. So what is monopoly - natural and artificial, and what is it "eaten" with?

Signs of monopolization

The monopoly market from the point of view of economic theory is characterized by the following features:

- the presence within the same industry of a single manufacturer of any product or service;

- the products of the monopolist enterprise have unique properties, having no analogs and substitutes that are essentially close;

- the presence of barriers (artificial or natural) that prevent new manufacturers from entering the market;

- determination of the cost of products and volumes of its output by only one manufacturer.

In theory, it is quite possible to build such a model of economic relations, but it is almost impossible to meet in practice. That is why the forms of natural and artificial monopoly are considered conditional market structures.

What is the difference between an artificial monopoly and a natural one?

There are two main types of artificial monopolies:

- the former are based on an increase in the concentration of production;

- the latter are based on the granting of various patents, licenses and other intellectual property rights.

An artificial monopoly that has grown on a production base is distinguished by a high efficiency in the production of goods and services. This is due to the fact that, having overcome the competition, enterprises equipped with the most advanced technical base, which have a low level of operating costs, enter the market. Examples of this type of artificial monopoly are found in real life, but not very often. Here we can talk about companies that have reached such a level of material and technical base and management, which allows them to reduce the cost of manufacturing products. Accordingly, its cost for the end customer is reduced so much that there is simply no point in other enterprises in the industry to manufacture such goods.

An artificial monopoly of the second type arises due to the granting of patents and permits for the production of any product to only one enterprise. This can relate to various kinds of inventions, know-how or limited access to a specific resource. Such artificial monopolies have forms based on preferences, including from the state, and exist in most countries of the world.

Let's take a look at this situation as an example. In Moscow, as everyone knows, one of the  urban transport is the metro. This is a variant of natural monopoly, since it is simply impossible to create competition in this segment. Even if we ignore the huge costs for the construction of the second metro, it is practically impossible to do this due to the lack of such a technical possibility. On the other hand, land transport in the capital is provided by the Mosgortrans company, and this is a pure artificial monopoly. After all, it is quite possible to launch other competing carriers on the market, but the authorities do not give such permission. This is how artificial monopolies are being born today in Russia and in other countries of the world. And, you must admit, some of them have an objective meaning.

urban transport is the metro. This is a variant of natural monopoly, since it is simply impossible to create competition in this segment. Even if we ignore the huge costs for the construction of the second metro, it is practically impossible to do this due to the lack of such a technical possibility. On the other hand, land transport in the capital is provided by the Mosgortrans company, and this is a pure artificial monopoly. After all, it is quite possible to launch other competing carriers on the market, but the authorities do not give such permission. This is how artificial monopolies are being born today in Russia and in other countries of the world. And, you must admit, some of them have an objective meaning.

05 01 medical biochemistry where to work

05 01 medical biochemistry where to work Biochemistry who can work

Biochemistry who can work Types of monopolies: natural, artificial, open, closed

Types of monopolies: natural, artificial, open, closed