Foundations of legal regulation of the common market. Methods and measures of regulation of the commodity market. Retail commodity market

Commercial law: lecture notes Gorbukhov VA

LECTURE No. 18. The structure of the commodity market. Legal support for the development of the commodity market

1. Structure of the commodity market

The structure of the commodity market is understood as a set of links that are involved in the promotion of goods from producers to consumers. The main links of the commodity market are:

1) manufacturers of goods;

2) wholesale trade and other intermediary organizations;

3) retail trade organizations;

4) consumers.

Manufacturer of goods - an organization, regardless of its organizational and legal form, as well as an individual entrepreneur, producing goods for sale to consumers.

Trade is an agreement by virtue of which one party (the seller) undertakes to transfer the thing (goods) to the other party (the buyer), and the buyer undertakes to pay a certain amount (price) for it.

Wholesale trade is the trade in goods for their subsequent resale or professional use. Wholesale parties are called counterparties. Wholesale trade:

1) at the place of performance - in the places of wholesale sales, in a trade establishment;

2) by the time of transfer of the goods - according to preliminary orders, with the immediate transfer of the goods;

3) by the date of payment for the goods - with advance payment, with payment on credit, in installments;

4) under the obligation to deliver the goods - with delivery, without delivery.

Retail trade is the sale of goods and the provision of services to customers carried out for personal, family, non-business use.

The parties to the retail trade are the seller, who is an individual entrepreneur, and the buyer, who can be any citizen. The subject of retail trade is things that have not been withdrawn from civil circulation. Types of retail trade:

1) the sale of goods subject to the acceptance of the goods by the buyer within a certain period of time; The seller does not have the right to sell the goods to another person within the period specified in the contract;

2) sale of goods according to samples. The contract is concluded on the basis of familiarization with the buyer's product or according to the catalog or description;

3) sale of goods using machines. The owner of the machine is obliged to inform the buyer about the seller, products and actions that must be taken to receive the goods by placing information on the machine or in any other way;

4) sale of goods with delivery conditions. At the conclusion of the contract, the seller undertakes to deliver the goods to the specified location and transfer to the specified person.

Consumer - a citizen intending to order or purchase, or ordering, purchasing or using goods exclusively for personal, family, household and other needs not related to entrepreneurial activity.

This text is an introductory fragment. From the book Business Law author Smagina IA From the book The Civil Code of the Russian Federation. Parts one, two, three and four. Text as amended on May 10, 2009 the author The team of authors From the book Commercial Law: Lecture Notes author Gorbukhov VA author Gorbukhov VALECTURE No. 17. Formation of the commodity market in Russia The commodity market in Russia is at the stage of its formation. This gives rise to a number of problems in its functioning at the initial stage of the transition from the command-administrative economic system to developed market

From the book Federal Law "On the Securities Market". Text with changes and additions for 2009 the author author unknown1. The structure of the commodity market The structure of the commodity market is understood as a set of links that are involved in the promotion of goods from producers to consumers. The main links of the commodity market are: 1) manufacturers of goods; 2) wholesale trade and other

From the book The Civil Code of the Russian Federation. Parts one, two, three and four. Text with amendments and additions as of November 1, 2009 the author author unknown2. Legal support for the development of the commodity market Currently, the development of regulatory documents, amendments to laws and other regulatory legal acts continues. Thus, in 2006, new legislative acts were adopted, which in one way or another relate to the development

From the book The Civil Code of the Russian Federation. Parts one, two, three and four. Text as amended on October 21, 2011 the author The team of authors From the book Jurisprudence the author Magnitskaya Elena ValentinovnaSection IV. INFORMATION SUPPORT OF THE VALUABLE MARKET

From the book Commercial Law the author Nikolay GolovanovArticle 1507. Registration of a Trademark in Foreign States and International Registration of a Trademark 1. Russian legal entities and citizens of the Russian Federation have the right to register a trademark in foreign countries or to exercise it

From the book Federal Law "On the Securities Market". Text with changes and additions for 2013 the author author unknownARTICLE 1507. Registration of a trademark in foreign countries and international registration of a trademark 1. Russian legal entities and citizens of the Russian Federation have the right to register a trademark in foreign countries or exercise it

From the book Commercial Law. Cheat sheets the author Smirnov Pavel YurievichChapter 12. Legal regulation of the securities market 12.1. Government loan concept. Types of securities Currently, a securities market has been established in Russia. In addition to civil circulation, securities serve the public interests of the state. With the release and

From the book European Union Law the author Kashkin Sergey Yurievich58. The concept of the structure and infrastructure of the commodity market The formation of market relations in Russia requires the formation of the structure of the commodity market and the infrastructure serving it. The structure of the commodity market is a set of links that are involved in promoting

From the author's bookSection IV. Information support of the securities market Chapter 7. On information disclosure in the securities market Article 30. Information disclosure 1. Disclosure of information on the securities market means ensuring its accessibility to all interested parties.

From the author's book26. The structure of the commodity market The basis of market relations is the commodity market, that is, the totality of socio-economic relations arising in the process of selling goods or commodity circulation, which is understood as the mass purchase and sale of goods created

From the author's book27. Infrastructure of the commodity market Under the infrastructure of the commodity market is understood the whole mass of organizations that ensure the normal functioning of manufacturers, resellers and consumers in the process of movement of goods. The more developed the infrastructure,

From the author's book134. What are the legal foundations for the formation and development of the internal energy market? The liberalization of the energy market of the Member States envisaged in the Commission Working Document 1988 began with the adoption on 26 June 1990 of Directive 90/377 / EEC,

Commodity market - the sphere of circulation of goods that have no substitutes, or interchangeable goods on the territory of the Russian Federation or part of it, determined based on the economic ability of the buyer to purchase the goods in the relevant territory and the absence of this opportunity outside of it.

The most important object of the market economy is a commodity - a product of labor that satisfies a particular social need through purchase and sale or exchange. It has two properties:

1) satisfy the need of people (this is a use value);

2) exchange (the proportions in which one commodity is exchanged for another is its exchange value).

The definition of a product is carried out according to indicators characterizing its consumer properties, the conditions of consumption (operation) of the product by buyers, the conditions for the sale of the product, the level of satisfaction of demand; the composition of these indicators is differentiated depending on the type and purpose of the goods. Initially, the belonging of the goods to the classification group is established using both the current classifiers of products (works, services), types of activities, and commodity dictionaries, directories of commodity experts, taking into account GOSTs for the relevant types of marketable products, data from commodity expertise, conclusions of industry independent experts, survey materials buyers.

The legislation contains such characteristics of goods as: interchangeability, identity and homogeneity. Interchangeable goods are those that can be comparable in their functional purpose, application, quality and technical characteristics, price and other parameters in such a way that the buyer actually replaces or is ready to replace them with each other in the process of consumption (including production).

Homogeneous goods are goods that, while not being identical, have similar characteristics and consist of similar components, which allows them to perform the same functions and (or) be commercially interchangeable (clause 7 of article 40 of the Tax Code of the Russian Federation), which makes them related to interchangeable goods. When determining the homogeneity of goods, in particular, their quality, presence of a trademark, reputation in the market, country of origin, manufacturer are taken into account.

Identical are goods that have the same, characteristic basic features. When determining the identity of goods, the physical characteristics, quality and reputation in the market, country of origin and manufacturer are taken into account, among others. Minor differences in the appearance of identical goods may not be taken into account (clause 7 of article 40 of the Tax Code of the Russian Federation).

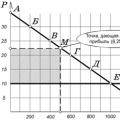

To fully characterize product markets and assess the state of the competitive environment in them, the following indicators are sequentially determined:

1) product (commodity) boundaries of the commodity market - a group (set) of interchangeable goods;

2) geographical (territorial) boundaries of the commodity market - the territory in which buyers acquire or can acquire the studied product (substitute products) and do not have such an opportunity outside of it;

3) market structure - a set of quantitative and qualitative indicators, which include: the number of economic entities (the number and composition of sellers and buyers) and the shares they occupy in this product market; market concentration indicators; conditions for entering the market; market openness for interregional and international trade;

4) barriers to market entry - circumstances that prevent opportunities for new economic entities to enter the commodity market;

5) the market potential of an economic entity - the economic (market) power of the enterprise.

The interaction of sellers and buyers takes place in certain forms, the content of which is specific socio-economic relations in the field of exchange. Through these relations, the sale of goods is carried out. It is on the market that entrepreneurs are recognized as commodity producers.

Section II. ORGANIZATIONAL AND LEGAL FRAMEWORK FOR REGULATING COMMERCIAL ACTIVITIES

Chapter 4. BASICS OF FUNCTIONING OF COMMODITY MARKETS

4.1. Definition and concept of commodity markets

The economy, as well as economic activity, constitutes a constant movement of massive flows of goods that are produced and delivered to consumers in the most distant points where people need them. Commodity movement in production and circulation is mediated by markets for money, securities, information, knowledge and the latest technology. L.V. Andreeva points out that “the commodity market consists of markets for a variety of goods that differ in their characteristics, properties, the degree of danger to life and health of the population, affecting their turnover. The study of the legal regime of various goods is one of the main tasks of commercial law "<1>.

———————————

<1>Commercial law of Russia: Textbook / L.V. Andreeva. 2nd ed., Rev. and add. S. 35 - 36.

The commodity market is the sphere of circulation of goods that have no substitutes, or interchangeable goods on the territory of the Russian Federation or part of it, determined based on the economic ability of the buyer to purchase the goods in the relevant territory and the absence of this opportunity outside of it.<1>.

———————————

<1>Order of the FAS Russia of April 25, 2006 N 108 "On approval of the Procedure for analyzing and assessing the state of the competitive environment in the commodity market" // BNA FOIS. 2006. N 32.

A close definition of the commodity market is given by the Tax Code of the Russian Federation.<1>, Whereby market of goods the sphere of circulation of these goods is recognized, determined based on the possibility of the buyer (seller) to actually and without significant additional costs to purchase (sell) the goods on the territory of the Russian Federation closest to the buyer or outside the Russian Federation. Thus, the market can be characterized as the sphere of performing compensated transactions between a buyer and a seller, the result of which is the sale of goods for a monetary equivalent or other property. The market implies a real opportunity for any buyer at a convenient time for him to purchase the desired product without significant additional costs, leading to a significant increase in total costs in the territory of the Russian Federation closest to his location or outside of it.

———————————

The main elements that determine the independence of the product market <1>and allowing to analyze and assess its competitive environment are:

———————————

<1>Clause 3 of the Order of the FAS Russia dated April 25, 2006 N 108 "On approval of the Procedure for analyzing and assessing the state of the competitive environment in the commodity market."

1. Product boundaries of the product market, the identification of which is a procedure for determining the consumer properties of a product or substitute products and forming a product group (a group of products whose markets are regarded as one product market) based on the opinion of buyers (and, in some cases, sellers) about the interchangeability of products that make up one product group. This opinion is determined as a result of a survey of buyers (sellers). The survey is carried out for groups of buyers (sellers), differing in the ways of participating in the turnover of goods (wholesale, small-scale wholesale buyer (seller), buyer of a single quantity of goods, retail trade, sale of goods under direct contracts).

2. Geographic boundaries of the commodity market, the establishment of which determines the demand for goods. The geographical border of the market expands with an increase in the degree of uniqueness of the product and its complexity and narrows with undeveloped and expensive communications, a limited service life and a high degree of product unification. In fact, it is an economically integrated area around a central or major city. Regular movement of people is the most powerful measure of integration. However, the main criterion for determining the regional boundaries of the market should be the demand of the population. Thus, the boundaries of the commodity market should be understood as the boundaries of the territory, beyond which the demand for the product and its demand are economically inexpedient from the standpoint of its potential consumers. When determining the geographical boundaries of the product market, many factors are taken into account, in particular, the possibility of movement of goods between territories, the availability of vehicles to move the buyer to the seller, the absence of administrative restrictions on the import or export of goods in a given territory, a comparable level of prices for relevant goods within the borders of this market. ... According to the criterion of geographical boundaries, the market can be divided into local, regional, interregional, and all-Russian.

3. The composition of economic entities operating in the product market, which include economic entities that constantly sell or produce within its boundaries a certain type of product within a certain time interval. The structure of economic entities operating on the market may include:

a) potential sellers- individuals and legal entities who, within no more than a year, can enter this commodity market under normal conditions of turnover, the absence of violations of the legislation of the Russian Federation and without additional costs;

b) sellers of goods, interchangeable with this product for production.

4. Share of business entities in the market, which is defined as the ratio, expressed as a percentage, of an indicator characterizing the volume of commodity mass supplied by a given economic entity to the commodity market under consideration, to an indicator characterizing the volume of the commodity market under consideration. Since clause 8 h. 1 of Art. 23 LZK prescribes the maintenance of a register of economic entities with a market share of a certain product in the amount of more than 35% or occupying a dominant position in the market for a certain product, the Government of the Russian Federation approved the Rules<1>formation and maintenance of a register of economic entities that have a market share of more than 35% of a certain product or occupy a dominant position in the market for a particular product, if in relation to such a market, federal laws establish cases of recognition of the dominant position of economic entities.

———————————

<1>Decree of the Government of the Russian Federation of December 19, 2007 N 896 "On approval of the Rules for the formation and maintenance of the register of economic entities with a market share of a certain product in the amount of more than 35 percent or occupying a dominant position in the market of a certain product, if in relation to such a market by federal laws established cases of recognition of the dominant position of economic entities "// SZ RF. 2007. N 52. Art. 6480.

5. The volume of the commodity market, the main indicator of the calculation of which is the volume of sales or supplies in the considered product market. Other indicators are used in cases where, due to industry-specific features, they make it possible to more accurately characterize the position of economic entities in the considered product market from the point of view of competition.

6. Concentration level of the commodity market is identified based on the analysis of concentration processes, determined using special statistical coefficients and indices. The information base for calculating concentration ratios is the commodity nomenclature, which approximately corresponds to the nomenclature of the main industrial production.

7. Barriers to entry into the commodity market- these are circumstances or actions that prevent or impede and restrict business entities from starting activities in the product market. As a rule, barriers to entry into the commodity market include some types of economic and administrative restrictions, the strategy of behavior of economic entities operating in the market, including investment in excess production capacity and an increase in costs for the buyer associated with a change of seller, the presence of business entities operating in the market. subjects of vertically integrated economic entities.

Fundamental functions of commodity markets are:

1) pricing, since the mechanism for setting market prices is a unique way of communication, dissemination of information and other important information necessary for a person in the economic sphere;

2) competition... The well-known statesman and politician of the Federal Republic of Germany Ludwig Erhard wrote that "the state should intervene in the life of the market only to the extent that it is required to maintain the operation of the competition mechanism or to control those markets in which conditions of completely free competition are impracticable."<1>.

———————————

<1>Erhard L. Welfare for all. M., 1991.S. 161.

4.1.1. Types of commodity markets

Commodity markets are classified on various grounds:

by the structure of the state economy: trade markets of countries with subsistence economies, countries - exporters of raw materials, industrially developing countries and industrialized countries;

by the level of income and the nature of their distribution in the state: countries and regions with a low level of income, countries and regions with a high level of income, countries with low, middle and high levels of income, countries with a predominantly middle level of income;

by territorial scope: domestic, national, regional, world;

by commodity and industry basis: machinery and equipment, mineral raw materials and fuel, agricultural raw materials, food and forest products;

in the sphere of social production: goods of material production (raw materials, food, machinery, equipment), goods of non-material production (achievements of science, technology, know-how, works of art, books, etc.);

by the nature of the end use of goods: markets for industrial goods and consumer goods;

by the term of use of goods: durable goods, short-term use and disposable goods;

by the organizational structure of commodity markets: world market (open and closed), domestic market (wholesale and retail).

For the purposes of commercial law, the organizational structure of trade markets is investigated, since, on the one hand, it underlies the legal regulation of relations in the field of trade and, on the other hand, serves as a qualifying feature of the separation of the subject of legal regulation of commercial activity.

Organizational structure of markets develops depending on the terms of trade in the commodity markets and the nature of the groups of buyers and sellers. In the domestic market, two sectors are distinguished: wholesale and retail. Wholesale market is one of the forms of commodity circulation, through which economic ties are carried out between economic entities in the field of promoting goods from the manufacturer to the retail trade network. It is a link between commodity producers and retailers. The characteristic features of wholesalers with manufacturers are the presence of credit relations and the absence of relations with end consumers. Retail market is a form of commodity circulation through which a variety of needs are satisfied end consumers goods based on retail prices.

The above classification of commodity markets makes it possible to deepen the nature of further research of a specific commodity market based on the specific characteristics of the product itself, the nature of its production and end use, the organizational structure of sales and the territorial affiliation of the enterprise and the market under study. However, it should be borne in mind that with any approach to the classification of markets, the boundaries between them are blurred and have a very conditional character. A fairly typical example is the existence in the markets of large wholesale and retail trade entities that simultaneously act as both wholesalers and retailers (for example, trading houses).

4.1.2. Structure and infrastructure of commodity markets

The structure of the commodity market is a set of links united by contractual and economic ties involved in the promotion of goods from manufacturers to consumers.<1>.

———————————

<1>See: B.I. Puginsky. Commercial law of Russia. M .: Yurayt, 2010.S. 110.

Infrastructure of the commodity market Is a complex of activities in the sphere of circulation of the relevant groups of enterprises, organizations, institutions and individual entrepreneurs, whose task is to optimize the channels of commodity circulation and market regulation of commodity-money turnover. The infrastructure of the commodity market creates the prerequisites and conditions for accelerating the turnover of funds in the economy, improving the market process for selling newly created products, strengthening the material and technical base of the circulation sphere, optimizing commercial and economic ties. Thanks to the infrastructure, the relationships between market entities are conducted on a coherent purposeful basis.

The functions of the infrastructure of the commodity market are: 1) assistance to market entities in the implementation of their economic interests; 2) organizational registration of commercial relations of the parties to the concluded contracts; 3) providing legal, financial, insurance and control services; 4) prompt response to any changes in market conditions, goods, as well as the composition of competitors, intermediaries and consumers; 5) the implementation of trade and other commercial activities directly related to trade; 6) mediation in the sale of goods and the establishment of commercial relations; 7) the provision of various services directly related to the maintenance of trading activities; 8) using the possibilities of transport, communications, storage facilities and the fuel and energy complex.

The infrastructure of commodity markets as a system is an interconnected complex of the following subsystems:

1) reseller subsystem- organizations that carry out intermediary activities and ensure the interaction of manufacturers and consumers in terms of the purchase (sale) of goods;

2) information support subsystem- organizations providing supervision of markets for goods, including consumer goods and products for industrial and technical purposes. The technical elements of this subsystem should be the appropriate communication facilities, software products, a computer system and a printing base;

3) packaging industry subsystem- regulatory and organizational measures and production structures that ensure an increase in the competitiveness of goods through the creation of packaging products that meet international standards;

4) transport support subsystem- all types of transport that ensure the delivery of products to consumers;

5) financial and credit subsystem- infrastructure of commodity markets as a subsystem participating in payment, settlement and credit support of commodity circulation;

6) organizational support subsystem- organizational measures to ensure the functioning and development of the infrastructure of commodity markets in cooperation with their performers, ensuring effective partnership, the development of competition between the structural elements of commodity markets and helping to reduce the cost of promoting products from producer to consumer;

7) subsystem of regulatory support- federal laws, decrees and orders of the President of the Russian Federation, resolutions and orders of the Government of the Russian Federation, regulations of federal executive bodies, executive bodies of the constituent entities of the Russian Federation and other acts regulating the relationship of the parties in the commodity markets<1>.

———————————

<1>For more details see: E.V. Trunina, Yu.V. Fedasova. Commercial law: Textbook. allowance. M .: Jurist, 2008.S. 102 - 103; Resolution of the Government of the Russian Federation of June 15, 1998 N 593 "On the Comprehensive Program for the Development of the Infrastructure of the Commodity Markets of the Russian Federation for 1998 - 2005" // SZ RF. 1998. N 25. Art. 2910.

4.1.3. Wholesale commodity market

The wholesale commodity market is the sphere of circulation of goods associated with their promotion from manufacturers to a retail trade network or for professional use by making repayable transactions for the resale of goods to wholesale retail consumers.

The main function of the wholesale trade, which is an area of legal regulation of commercial law, is the promotion of goods from manufacturer to consumer, which is achieved due to the availability of professional knowledge and skills of wholesalers in the sale of goods. The legal basis for the movement of goods from the manufacturer to the buyer is transfer agreements... Thanks to the legal mechanism, with the help of which the legal transfer of property from one subject of law to another is possible, all the tasks facing trade are solved. Such a mechanism is agreements on the transfer of the seller's property to the buyer's ownership (purchase and sale, delivery, exchange, etc.).

The main function of the wholesale trade is the promotion of goods from the manufacturer to the consumer and the uninterrupted provision of the retail trade network and mass catering with goods, the implementation of which largely depends on the contractual relationship for the supply of goods.<1>.

———————————

<1>See: N.K. Frolova. Problems of legal regulation of wholesale trade // Taxes (newspaper). 2006. N 39.

Federal Law of December 28, 2009 N 381-FZ "On the Basics of State Regulation of Trade Activities in the Russian Federation"<1>(FZ on GRTD) defines wholesale trade as a type of trading activity associated with the purchase and sale of goods for their use in business (including for resale) or for other purposes not related to personal, family, home and other similar use. This definition is based on the opposition of wholesale to retail. The main criterion feature of this difference is purpose of acquisition goods. In the wholesale trade, goods are sold for the purpose of making a profit, and not for their further use. In any case, the main difference between wholesale and retail trade is the purpose of the purchase and sale of goods by economic entities of the commodity markets.

———————————

<1>Federal Law of December 28, 2009 N 381-FZ "On the Foundations of State Regulation of Trade Activities in the Russian Federation" // SZ RF. 2010. N 1. Art. 2.

Wholesale trade, in accordance with clause 3 of part 2 of Art. 1 and part 1 of Art. 8 of the Federal Law on GRTD, can only be carried out by legal entities or individual entrepreneurs registered in the manner prescribed by the legislation of the Russian Federation, unless otherwise provided by federal laws, i.e. business entities of trade activities... This means that both parties to transactions in wholesale trade are professional entrepreneurs, which should form a special regime of legal regulation of this group of public relations. Accordingly, consumer citizens, as well as legal entities and individual entrepreneurs who purchase goods for purposes related to personal, family, household and other similar uses, are not wholesalers.

Wholesale trade also does not imply the sale of goods in single copies. The goods in this case are sold in batches, which is one of the essential features of the wholesale trade. In the field of wholesale, small wholesale trade, which is understood as a kind of wholesale trade associated with the sale of consignments of goods by manufacturers and resellers for subsequent resale in retail and other commercial turnover. The wholesaler is actually an intermediary between the producers of goods and their end consumers, operating, as a rule, in large consignments of goods. Wholesalers do not usually have direct contact with consumers.

Wholesale deals have a number of specific features: 1) wholesalers work mainly with resellers, and not with end consumers, so they pay much less attention to the psychology of sales; 2) wholesale transactions in terms of volume, as a rule, are larger than retail, the trade zone of the wholesaler is much wider than that of the retailer; 3) the legal regime of consumer protection does not apply to wholesale transactions, which fundamentally distinguishes the sphere of wholesale from retail; 4) the taxation regime for wholesale trade differs from retail trade.

To date, relations in the field of wholesale trade are mainly regulated by the Federal Law on the GRTD. The relationship of wholesalers, as a rule, is based on delivery agreement(Section 3, Chapter 30 of the Civil Code of the Russian Federation). In accordance with Art. 506 of the Civil Code of the Russian Federation, under a supply agreement, a supplier-seller engaged in entrepreneurial activity undertakes to transfer, within a specified time (time frame), the goods produced or purchased by him to the buyer for use in entrepreneurial activity or for other purposes not related to personal, family, domestic and other similar use. ... The legal definition of the supply agreement is practically literally reproduced in the definition of wholesale trade, contained in paragraph 2 of Art. 2 of the Federal Law on GRTD, which indicates the desire of the legislator to emphasize that the basis of relations in the field of wholesale trade is delivery contract.

In relations with agricultural producers, the basis is contracting agreement(Section 5, Chapter 30 of the Civil Code of the Russian Federation). Separate bylaws and departmental legal acts establish private rules regarding the regulation of wholesale markets for certain types of goods<1>, activities of individual wholesalers<2>as well as price regulation<3>.

———————————

<1>Decree of the FEC of Russia of December 29, 2003 N 111-e / 9 "On the approval of the technical parameters necessary to obtain the status of the subject of the wholesale market" // BNA. 2004. No. 5; Resolution of the Goskomstat of Russia of August 18, 1999 N 78 "On the approval of the forms of federal state statistical monitoring of wholesale and retail trade for 2000" // SPS "ConsultantPlus".

<2>Order of the Ministry of Agriculture and Food of Russia N 292, Roskomtorg N 95 of December 1, 1994 "On Approval of Model Rules for Trade in the Wholesale Food Market"; Resolution of the Government of the Russian Federation of July 12, 1996 N 793 "On the federal (all-Russian) wholesale market of electrical energy (power)" // SZ RF. 1996. N 30. Art. 3654 (with subsequent amendments); Order of the Ministry of Health of Russia dated March 15, 2002 N 80 "On approval of the Industry standard" Rules for the wholesale trade in medicines. Basic provisions "// BNA. 2002. N 13.

<3>Orders of the Federal Customs Service of Russia dated December 4, 2009 N 344-e / 1 "On Approval of Indicative Prices and Tariffs for Electric Energy and Power for Buyers - Subjects of the Wholesale Electricity (Power) Market" // Rossiyskaya Gazeta. 2009 December 21; of November 25, 2008 N 265-e / 1 "On approval of the wholesale price for liquefied gas for domestic needs" // Rossiyskaya Gazeta. 2008.31 December.

Taking into account the listed features of wholesale trade, it would be correct to define wholesale trade as a type of trading activity of economic entities of commodity markets associated with the acquisition of consignments of goods for their further use in entrepreneurial activities and their sale, in order to generate profit (including through resale) or for other purposes not related to personal, family, household and other similar use.

4.1.4. Retail commodity market

1. Features of retail chains... The activities of retail trade enterprises are associated with the sale of products to the end consumer, which is the final stage of its promotion from the production sphere. The subject of retail trade is not only the sale of goods, but also trade services and the provision of additional services to customers. For buyers, trade service is determined by the image of the enterprise, convenience and minimal time spent on making a purchase. The services provided are accompanied by the purchase of goods and, in addition, after-sales service of the goods sold. Consequently, the retail process consists of the targeted sale of goods, customer service, trade and after-sales services.

Retail functions are determined by its essence and are as follows: 1) meeting the needs of the population in goods; 2) bringing goods to buyers by organizing their spatial movement and delivery to the points of sale; 3) maintaining a balance between supply and demand; 4) impact on production in order to expand the range and increase sales; 5) improving trade technology and improving customer service<1>.

———————————

<1>See: Romanov A.N., Lukasevich I.Ya. Evaluation of the commercial activities of entrepreneurship. Moscow: Finance and Statistics, 1996.P. 186.

The main objectives of the commercial activities of retail enterprises are: 1) the study of requests and needs for goods with a focus on purchasing power; 2) determination of the assortment policy; 3) the creation of economic ties; 4) the formation and regulation of the processes of supply, storage, preparation for the sale and sale of goods in conjunction with the objectives of the enterprise; 5) providing a given turnover of material and labor resources.

Retail relations in the Russian Federation are governed by civil law... First of all it is Civilthe codeRF, in which the retail sales contract is defined as a public contract and its essential conditions are regulated in sufficient detail, the supply contract (as a wholesale contract) is not public, therefore its essential conditions are practically unlimited. Another important law that determines the legal regime of the retail trade network is the Law of the Russian Federation "On the protection of consumer rights" <1>, which regulates the relationship between the seller and the citizen-consumer, compensating for the legal, economic and professional inequality of the parties to the contract by establishing a preferential legal regime for consumers.

———————————

<1>SZ RF. 1996. N 3. Art. 140.

State supervision and control for retail trade are carried out on the basis of:

1) Federal law "On Protection of Competition", which determines the conditions under which commercial entities fall under the legal regime of antimonopoly regulation, and establishes its basic rules;

2) Federal Law "On the Protection of the Rights of Legal Entities and Individual Entrepreneurs during State Supervision (Control)"<1>establishing the procedure for conducting supervisory measures and limiting their frequency, including in the field of retail trade;

———————————

<1>SZ RF. 2001. N 33 (part I). Art. 3436.

3) Federal Law "On technical regulation" <1>and the technical regulations adopted in accordance with it, establishing mandatory requirements for goods offered by the supplier or seller for sale, aimed at ensuring the safety of life and health of buyers and preventing them from being misled about the essential consumer characteristics of the goods, and determining the procedure for confirming the compliance of goods with these requirements ;

———————————

<1>SZ RF. 2002. N 52 (part I). Art. 5140.

4) Federal laws "On the quality and safety of food products"<1>, "On state regulation of the production and circulation of ethyl alcohol, alcoholic and alcohol-containing products"<2>, "On restrictions on retail sale and consumption (drinking) of beer and drinks made on its basis"<3>, "On restricting tobacco smoking"<4>that establish restrictions on the rights of the supplier and the seller regarding the rights to sell and purchase goods with limited circulation, including those related to the placement of trading facilities that carry out retail sale of alcohol and tobacco products, and empower the state authorities of the constituent entities of the Russian Federation with powers to regulate their trade turnover;

———————————

<1>SZ RF. 2000. N 2. Art. 150.

<2>SZ RF. 1995. N 48. Art. 4553.

<3>Federal Law of March 7, 2005 N 11-FZ "On Restrictions on Retail Sale and Consumption (Drinking) of Beer and Beverages Produced on Its Basis" // SZ RF. 2005. N 10. Art. 759.

<4>Federal Law of July 10, 2001 N 87-FZ "On the restriction of tobacco smoking" // SZ RF. 2001. N 29. Art. 2942.

5) Federal Law "On the general principles of the organization of local self-government", in accordance with paragraph 1 of Art. 14 which, as one of the powers of local self-government bodies, is to create conditions for providing the population of the municipality with trade services.

Current retail law requirements are also contained in bylaws, the most important of which are rulessales of certain types of goods <1>, rulessales of goods by samples <2>, rulescommission trade <3>and other rules approved by decrees of the Government of the Russian Federation<4>... The listed Rules also establish the responsibility of sellers for violation of the mandatory requirements of the current legislation contained in the federal laws listed above, as well as in bylaws.

———————————

<1>Decree of the Government of the Russian Federation of January 19, 1998 N 55 "On approval of the Rules for the sale of certain types of goods, the list of durable goods, which are not subject to the buyer's requirement to provide him with a free provision of similar goods for the period of repair or replacement, and a list of non-food goods of good quality, not subject to return or exchange for a similar product of a different size, shape, dimension, style, color or configuration "// SZ RF. 1998. N 4. Art. 482.

<2>Decree of the Government of the Russian Federation of July 21, 1997 N 918 "On approval of the Rules for the sale of goods by samples" // SZ RF. 1997. N 30. Art. 3657.

<3>Decree of the Government of the Russian Federation of June 6, 1998 N 569 "On approval of the Rules of commission trade in non-food products" // SZ RF. 1998. N 24. Art. 2733.

<4>See, for example: Resolutions of the Government of the Russian Federation of December 15, 1998 N 1493 "On approval of the Rules for accreditation of organizations supplying alcoholic beverages for retail trade and public catering" // SZ RF. 1998. N 51. Art. 6307; dated June 6, 1998 N 569 "On approval of the Rules of commission trade in non-food products" // SZ RF. 1998. N 24. Art. 2733.

The current legislation does not contain any rules that would help to resolve problems in relations between sellers and manufacturers, as well as other suppliers of goods to sellers. Due to insufficient legislative support of the retail market, the legal regulation of the commercial activities of its subjects has a number of significant shortcomings:

1) the state authorities of the constituent entities of the Russian Federation do not have the authority to regulate the retail trade, with the exception of regulating the retail sale of alcoholic beverages, which relieves them of responsibility for solving infrastructure problems common to trade organizations in the region;

2) regulation exclusively from the federal level does not help to mitigate the inevitable conflicts between the interests of large trading business (network) and small or medium-sized trading networks that cannot withstand competition;

3) the problems of compensation for damages by way of recourse are not legally regulated in connection with the fulfillment by the seller of the legal requirements of the buyer, who acquired goods of inadequate quality from him from the wholesale seller, with whom he is bound by the contract for the supply of these goods;

4) lack of legal regulation of the "entry fee" set by retailers in retail trade networks. Their dominant position in the market may lead to discrimination against some wholesalers, which requires special legal regulation by competition law;

5) many bylaws (for example, the Rules of Sale) contain a number of restrictions on the rights of citizens, which, in accordance with paragraph 3 of Art. 55 of the Constitution of the Russian Federation should be established only by federal laws<1>.

———————————

<1>Explanatory note to the dossier on the draft Federal Law N 494404-4 "On retail trade" // ATP "Garant".

To eliminate the existing gaps and contradictions in the normative legal regulation in the field of retail trade, the State Duma was introduced the bill of the Federal Law N 494404-4 "On retail trade", which provides:

1) expanding the powers of the constituent entities of the Russian Federation and vesting local governments with powers to regulate retail trade;

2) the definition of the control function as partial in relation to supervision, which does not provide for the independent application of sanctions for violations;

3) determination of the procedure for municipal control and the procedure for public control in the field of retail trade;

4) the establishment of special, significantly lower than the general, thresholds for the dominance of economic entities and special measures of antimonopoly regulation in the field of retail trade;

5) vesting the seller with the right to compensation for damage by the manufacturer or other supplier in case of his fault without the existence of a contract for the supply of this product between them;

6) determination of the legal status of the service for the placement of goods by the seller in accordance with the application of his supplier;

7) raising to the level of federal law mandatory requirements for retail facilities, personnel, trade process, organization of certain forms of trade (self-service, commission trade, distance selling, etc.).

__________________

Chapter 4. BASICS OF FUNCTIONING OF COMMODITY MARKETS

4.1. Definition and concept of commodity markets

UDC 346.62 + 346.542

S.S. Tatarinova * LEGAL REGULATION OF DETERMINING THE BOUNDARIES OF THE COMMODITY MARKET **

The article deals with the issues of legal regulation of determining the boundaries of the commodity market. The importance of correct and accurate determination of boundaries for the purpose of analyzing the state of the competitive environment in the commodity market is emphasized. Changes in the normative regulation of the mechanism for assessing competition in the commodity market are analyzed. A comparison is made of the assessment mechanisms adopted in Russia and abroad, including at the level of the European Union. The conclusion is made about the possibility of using the experience of foreign countries to improve the mechanism for determining the boundaries of the commodity market in the Russian Federation.

Key words: legal regulation, commodity market, determination of the boundaries of the commodity market, assessment of competition, mechanism for assessing the competitive environment.

The concept of "commodity market" is one of the key categories in competitive legal relations. A precise definition of this concept is necessary for the purposes of antitrust law. It is through the category “commodity market” that many fundamental definitions of competition law are revealed.

As K.Yu. Totyev, “commodity market” is used as a legal concept in fourteen articles of the Federal Law “On Protection of Competition”, which is more than a quarter of the total number of its articles. Due to this, this concept is one of the most used legally significant categories of domestic antimonopoly legislation.

Closely related to the problem of defining the concept of "commodity market" is the problem of defining the boundaries of the commodity market. It is the identification of boundaries that helps to define one or another commodity market as a separate one, to separate it from other commodity markets. The mechanism for defining the boundaries of a product market is the tool that allows antimonopoly authorities to assess the state of competition in a specific product market.

Analysis and assessment of the state of the competitive environment in the commodity market is a necessary part of the implementation of the functions of state control over compliance with antimonopoly legislation, for example, when creating and reorganizing commercial and non-commercial organizations, suppressing violations of articles of the Federal Law "On Protection of Competition", etc. Each of the arising commodity markets are distinguished by their characteristics, primarily by the criteria of interchangeability and a set of interchangeable goods, geographical boundaries, the composition of sellers and buyers. In general, a complex volatile system of numerous local, regional, national sections of the world commodity markets operates on the territory of the country. On the one hand, each commodity market is relatively isolated due to a certain composition of participants (sellers and buyers), on the other hand, there are various connections between commodity markets. For example, buyers can switch from one market to another, sellers from other markets can come to the market, etc. Moreover, in each product market, different relationships between economic operators can develop.

* © Tatarinova S.S., 2014

Tatarinova Svetlana Sergeevna ( [email protected]), Department of Civil Procedural and Business Law, Samara State University, 443011, Russian Federation, Samara, st. Acad. Pavlova, 1.

** The research was carried out within the framework of the grant of the President of the Russian Federation for state support of young women at the expense of the federal budget (MK-5828.2012.6).

subjects. Accordingly, the situation in each product market must be assessed and monitored separately. The effectiveness of antimonopoly regulation largely depends on the reliability of the results of the analysis of the characteristics of the commodity market, primarily on the correct definition of its product and geographical boundaries (i.e., in which groups of interchangeable products and in which territories the goods are circulated).

The concept of "boundaries" has invariably been used in all definitions of the commodity market in various forms. In this regard, let us first turn to the definitions of the concept of "commodity market" that existed in Russian legislation from the 90s to the present day.

The first definitions of the term "commodity market" were formulated in the Law of the RSFSR of March 22, 1991 "On competition and restriction of monopolistic activity in commodity markets." In this normative act, two definitions were used, dividing the product market into two levels - republican and local. The republican commodity market was understood as the sphere of circulation of goods within the borders of the RSFSR, while the local commodity market was the sphere of circulation of goods within the borders of the republic, which is part of the RSFSR, an autonomous region, an autonomous district, a territory, a region.

The main problem with both of the above definitions was that commodity circulation could actually go beyond the boundaries of the commodity market outlined in the law. In practice, a situation is quite possible when along the border of a settlement on both sides of it there are shops selling exactly the same or interchangeable goods. However, based on the legal definition of a commodity market, such goods were to be considered circulating in different commodity markets, and therefore, competition between them was excluded. It became obvious that such a mechanism for delineating markets is biased and contributes to distorting competition in both neighboring markets.

An attempt to rectify the current situation was undertaken with the adoption of the State Program on Demonopolization of the Economy, approved by the Decree of the Government of the Russian Federation of March 9, 1994, No. 1991. The novella was to reduce the concept of a commodity market not to specific boundaries of a region, district, etc., but to introduce the concept of “geographical boundaries of a commodity market,” following a product, rather than tying a product to a territory defined by law.

When amendments were made to the Law of the RSFSR of March 22, 1991 "On Competition and Restriction of Monopolistic Activity in Commodity Markets" in 1995, the definition of a commodity market was changed and fixed in the following edition: substitutes, or interchangeable goods on the territory of the Russian Federation or part of it, determined based on the economic ability of the buyer to purchase the goods in the relevant territory and the absence of this opportunity outside of it. " However, this definition is also not perfect, since it only refers to “the territory of the Russian Federation”. The restriction of the commodity lynch to its "geographical" boundaries again did not receive legislative support.

The situation changes significantly only with the adoption of the new Federal Law No. 135-F3 of July 26, 2006 "On the Protection of Competition", in which a new concept of the commodity market was formulated. In paragraph 4 of Art. 4 of this Federal Law, the commodity market is defined as the sphere of circulation of goods (including foreign-made goods) that cannot be replaced by other goods, or interchangeable goods, within the boundaries of which (including geographical) based on economic, technical or other possibilities or expediency the purchaser can purchase the goods, and there is no such possibility or expediency outside of it.

Commenting on the novelties of the 2006 Law on the Protection of Competition, A.N. Varlamova points out that the definition excluded such a feature as the geographical location of a commodity market on the territory of the Russian Federation or part of it. In other words, there has been a globalization of this concept.

Despite all the changes in legislation that have occurred in recent years, the issue of the territorial boundaries of the commodity market remains very complex and insufficiently worked out today. At the same time, we must not forget that the establishment of product and geographical boundaries of the market is essential. If its boundaries are defined too broadly, the level of competition in the market may be overestimated, and the share of the dominant enterprise may be underestimated. On the contrary, an overly narrow definition of market boundaries leads to an overestimation of the share of the dominant enterprise and an underestimation of the characteristics of competition.

Normative consolidation of the procedure for assessing the state of competition on the commodity market is used in many foreign countries. For example, in the United States there are "Recommendations for horizontal mergers of companies", as well as for

vertical mergers, the unchanged fourth section of the previous 1984 Recommendations applies. In the countries of the European Union, there is a Notice to the Commission of the European Community on the determination of an appropriate market for the purposes of Community competition law. Similar regulations exist in the UK, Japan, Canada, Australia, Brazil and other countries.

Russian practice has also come to an understanding of the need for normative consolidation of mechanisms for assessing competition on the commodity market quite a long time ago. Order of the SCAP RF of October 26, 1993 No. 112, which approved the "Methodological Recommendations for Determining the Boundaries and Amounts of Marketable Market", became the first normative document in this area. Since 1997, the “Procedure for analyzing and assessing the state of the competitive environment in commodity markets” has been in effect, approved by Order of the Ministry of Aviation Industry of Russia dated December 20, 1996, No. 169. In August 2006, the Order of the FAS Russia from

April 25, 2006 No. 108 "On Approval of the Procedure for Analysis and Assessment of the State of the Competitive Environment in the Market Market", which is a new version of the previously existing document.

To date, to analyze the state of competition on the commodity markets of the Russian Federation, the Procedure for analyzing the state of competition on the commodity market is applied, approved by Order of the FAS Russia dated April 28, 2010 No. 220 (as amended on 03/12/2013). In accordance with clause 1.3 of this Procedure, the analysis of the state of competition in the commodity market includes the following stages: determination of the time interval for the study of the commodity market; determination of products and boundaries of the marketable market; determination of the geographical boundaries of the commodity market; determination of the composition of economic entities acting on the commodity market as sellers and buyers; calculation of the volume of the product market and the shares of economic entities on the market; determination of the level of concentration of the commodity market; determination of entry barriers to commodity market; assessment of the state of the competitive environment on the commodity market; preparation of an analytical report. Thus, the definition of the boundaries of the commodity market by the Russian legislator is recognized as one of the main mechanisms for assessing the state of the competitive environment.

A correct assessment of the specific factual circumstances, taking into account the above criteria, will make it possible to correctly determine the scope of the goods circulation.

It should be noted that recently the Russian practice of defining the boundaries of the commodity market

tends to converge with the practice of foreign countries. The experience of foreign legislation is successfully applied in the Russian mechanisms for determining the lynch. For example, in France, when determining the appropriate market, such components as the product boundaries of the market, its geographical boundaries, as well as the characteristic features of the demand for this product are taken into account.

As in the Russian Federation, there are different-level commodity markets in France. The geographic market can be national, regional or local. It is enough for it to cover a significant part of the territory of the state. One of the most important criteria for delineating a geographic lynch is transport costs. The more expensive the transportation, the narrower the market.

At the same time, drawing out the boundaries of commodity markets, as a rule, is the first step in considering almost any case. For this reason, the correct conduct of this procedure is the key to a well-founded anti-monopoly investigation. The boundaries of commodity markets are not set “at will” or “at the discretion” of the anti-monopoly authority, but on the basis of a balanced economic analysis. Moreover, the standards of evidence should be high enough. Otherwise, there is a significant risk that the anti-monopoly policy will lose its objectivity.

Similar national rules and regulations for the analysis of the competitive environment are applied at the level of the European Union (hereinafter referred to as the EU). The procedure for determining the boundaries of the product market is the basis for the application of competition rules in the EU. In European practice, for the purpose of analyzing the competitive situation at the market, the hypothetical monopolist test, also known as SSNIP (small but significant non-transistory increase in price), is widely used.

It should be noted that the judicial system plays a significant role in the correct definition of a commodity market in the EU. At the same time, the courts of the European Union, when considering specific cases of violation of competition, take into account not only formal or legal grounds, but also examine the economic arguments put by the anti-monopoly authorities as the basis of one or another of their decisions.

The EU Court of Justice in its decisions does not define the concept of a commodity lynch, however, when studying it, it also uses the category of interchangeability of goods.

At the same time, considering the issue of interchangeability of goods, the EU courts are guided by both legal and economic criteria,

stipulated by regulatory enactments, and analysis of the specific situation on the market, including the use of criteria such as price, physical properties of the product and its application.

An example is the case of United Brands, when the EU Court of Justice concluded that the special appearance, taste and physical properties of bananas made it possible to distinguish a separate banana market, thus separating it from the general fresh fruit market. In another case, ICI and Commercial Solvents v Commission, the court ruled that there were no substitutes for nitropropane supplied to another company, Zoja, as raw materials for the production of medicines, citing the fact that Zoja's use of other raw materials would have required additional costs.

Similar examples of court decisions can be found in Russian judicial practice. For example, in the case of OJSC Shaturtorf, the decision of the Moscow Arbitration Court, upheld by the appellate instance, invalidated the inclusion of the company in the Register of business entities having a share of more than 35% in the market of a certain product with the motivation for the conclusion that peat can be replaced by any of the fuels included in the "Fuel" product group. However, the court of cassation overturned the decision of the arbitration court and the ruling of the appellate instance on the grounds that the existing boiler house of the Zhilep MP could not use other types of fuel besides milled peat. The case also contains a letter from the Institute of Microeconomics dated June 15, 2000, which states that the transition to other types of fuel for the consumption of substitutes for milling peat will require technical re-equipment of production facilities.

By the relevant geographic market, the EU Court of Justice means an area within which certain economic entities are involved in the supply and consumption of the relevant goods and services, the conditions of competition within which are homogeneous and which can be separated from the neighboring geographical area, since, in particular, the conditions of competition in these areas differ significantly. However, as noted by A.N. Golomolzin, the Nordic countries do not agree with the procedure for determining the market used by the European Commission, since, in their opinion, this procedure can lead to discrimination against small countries. The so-called discrimination lies in the fact that when defining the national market in a small state, the merger of companies in that state can be difficult. This is primarily due to the fact that due to the small coverage of the commodity

market, companies reorganized through a merger risk immediately becoming dominant in the national market. Moreover, the level of their competitiveness in the world market can be extremely low. For large states, this problem is not so urgent due to the many times greater coverage of the national market.

In conclusion, we note that representatives of the judiciary can play an important role in raising the standards of evidence used by antitrust authorities. It is not uncommon for a judicial body to overturn a decision of the European Commission not on formal or legal grounds, but due to insufficient convincing economic reasoning. It seems that the use of such an approach would be timely on the part of the Russian judicial community. Russian law enforcement practice knows many examples when courts overturned decisions of antimonopoly authorities. However, this did not always happen due to gaps in the economic logic of the latter. Closer attention to the validity of economic arguments in the course of the proceedings will allow bringing to a qualitatively new level not only the work of the judicial system, but also the antimonopoly authorities themselves. Such a development of events would be positively welcomed among practitioners of antimonopoly regulation in the Russian Federation.

Summing up, we note that today one of the key points in the regulation of the commodity market is the question of defining the boundaries of the commodity market in each specific case. To date, this issue is quite complex and legally insufficiently worked out. In our opinion, unified clear criteria for determining the boundaries of the commodity market are necessary for the uniformity of law enforcement practice, in order to clarify the transparency of the application of antimonopoly legislation for all participants in market legal relations.

Studying the law enforcement practice of the European Union, one cannot fail to note the significant role played by the EU court in the process of assessing the state of competition in the commodity market, as well as in the formation of standards for the application of criteria for assessing the competitive environment by antimonopoly authorities. Considering the ever-increasing role of the Russian judicial system in the application of antimonopoly legislation, the study and analysis of such practices of foreign states can be useful for improving the practice of analyzing competition in the commodity market in the Russian Federation, in particular, regulating such a difficult issue as defining the boundaries of the commodity market.

Bibliographic list

1. On protection of competition: federal law from

2. On competition and limitation of monopolistic activity in commodity markets: the law of the RSFSR of March 22, 1991 // Bulletin of the SND and the Supreme Council of the RSFSR. 1991. No. 16. Art. 499.

3. On amendments to the Law on Competition and Restriction of Monopolistic Activity in Commodity Markets: Federal Law of 25.05.1995 No. 83-FZ // SZ RF. 1995. No. 22. Art. 1977.

4. On the approval of the State program on demonopolization of the economy: Decree of the Government of the Russian Federation of March 9, 1994, No. 1991 // Collection of acts of the President and the Government of the Russian Federation. 1994. No. 14. Art. 1052.

6. On approval of the Procedure for analyzing and assessing the state of the competitive environment in commodity markets: order of the Ministry of Aviation Industry of Russia dated December 20, 1996, No. 169 // Bulletin of normative acts of federal executive authorities. 1997. No. 3.

7. On approval of the Procedure for analyzing and assessing the state of the competitive environment in the commodity market: order of the FAS Russia dated April 25, 2006 No. 108 // Bulletin of normative acts of federal executive bodies. 2006. No. 32.

8. On approval of the Procedure for analyzing the state of competition in the commodity market: order of the FAS Russia dated April 28, 2010 No. 220 // Bulletin of normative acts of federal executive bodies. 2010. No. 34.

9. Case 27/76 (1978) ECR 207, (1978) CMLR 429.

10. Case 6, 7/73 (1974) ECR 223, (1974) CMLR 309.

11. Aleshin D.A., Polozhikhina M.A. Modern approaches of the FAS Russia to the analysis of the state of the competitive environment in commodity markets // Modern Competition. 2007. No. 5.

12. Buryakova L.E. European Union legislation on abuse of dominant position // Journal of Russian law. 2000. No. 9.

13. Varlamova A.N. New Competition Law // Legislation. 2006. No. 11.

14. Galitsky A.E. Abuse of the dominant position in the commodity market under the legislation of Russia and France: comparative legal analysis: dis. ... Cand. jurid. sciences. M., 2007.

15. Golomolzin A.N. Foreign experience of methodology and practice of market determination // Bulletin of the Ministry of the Russian Federation for antimonopoly policy and support of entrepreneurship. 2002. No. 1.

16. Pruzhansky V. The role of courts in determining the boundaries of commodity markets: European experience // Competition and law. 2012. No. 6.

17. Stepanova M.N. Legal regulation of competition in the modern commodity market: dis. ... Cand. jurid. sciences. M., 2010.

18. Totyev K.Yu. Competition law: textbook. M .: Publishing house RDL, 2003.

19. Totyev K.Yu. The commodity market and its boundaries in the practice of applying antimonopoly legislation // Laws of Russia: experience, analysis, practice. 2010. No. 6.

20. Conseil de la concurrence, Rapport annuel pour 1996.

21. Malaurie-Vignal M. Droit de la concurrence, L.G.D.J. 2003.

S.S. Tatarinova *

LEGAL REGULATION OF DELIMITATION OF COMMODITY MARKET

The problems of legal regulation of delimitation of boundaries of the commodity market are regarded in the article. The importance of correct and precise delimitation for the analysis of state of competitive environment in the commodity market is emphasized. Analyzes alteration of normative regulation of mechanism of evaluation of competition in the commodity market. The comparison of mechanisms of evaluation admitted in Russia and abroad, including the European Union, is carried out. The conclusion about the possibility of applying foreign experience for the improvement of mechanism of delimitation of commodity market in the Russian Federation is made.

Key words: legal regulation, commodity market, delimitation of commodity market, evaluation of competition, mechanism of evaluation of competitive environment.

* Tatarinova Svetlana Sergeevna ( [email protected]), the Dept. of Civil Procedural and Enterpreneurial Law, Samara State University, Samara, 443011, Russian Federation.