Business valuation by revenue. Express valuation model of the company. Choosing an appraisal company

In this article, you will learn:

- What is the value of a company and what is it for

- What are the types of company value

- How to calculate the value of a company

- How to quickly calculate the value of a company

- What are the features in managing the value of a company

- How to increase the value of the company

A business exists not only to receive funds for goods or services, for the sake of which it was created. Business is also an investment. Many entrepreneurs make money by organizing and launching new companies with the aim of further selling them. Although this is far from the only reason for selling a business. When a firm goes bankrupt or cannot solve its problems on its own, there is often a need to assess the value of the company before selling. In this article, we will talk about how to understand everything related to the value of your business and avoid difficulties.

Why you need to know the value of the company

Now the overwhelming majority of firms in Russia do not consider the appraisal of the company's value to be something necessary, and their owners often do not see the point in this until the business reaches high turnover and the public arena. Until then, the appraisal was perceived as a reason for the owner's personal pride.

The economic goals of calculating the value of the company are actually about twenty, but the most important are only three:

- This provides objective data on the state of the business and the effectiveness of the management apparatus in it. By reacting to them, the owners can always correct the course in time.

- It is impossible to apply for additional cash injections to investors without information about the real value of the company, otherwise you risk not getting what you came for.

- Evaluation allows for the extremely correct and competent accounting of assets that arose during economic activity firms.

Of course, it is necessary to estimate the cost not only for the purchase or sale of a ready-made business. This indicator is important for strategic management

company. A clear understanding of the value of your business will also be required when issuing securities, shares and entering the stock market. It is also significant that not a single investor will agree to invest their money in a place where the company's value has not been assessed.

Enterprise business valuation (business valuation)- nothing more than the determination of the value of the company as non-circulating and current assets that can bring profit to the owners.

When conducting an appraisal examination it is necessary to assess the value of the firm's assets:

- real estate,

- equipment and machines,

- stocks in warehouses,

- all intangible assets,

- financial investments.

Business is an investment commodity. Any investment in a company is made only with a long-term focus on the return of funds with a profit. Since quite a lot of time passes between investments and income in business, to determine the real value of the company, a specialist analyzes its activities over a long period and separately evaluates:

- past, present and future income,

- the efficiency of the entire work of the enterprise,

- business prospects,

- market competition.

After receiving this data, the evaluated company is compared with other similar firms. Only a comprehensive analysis helps to calculate the real value of the company.

Assessment of the value of an enterprise or company Is the process of finding out the maximum likely price of a business as a commodity when it is sold to other owners. Moreover, any enterprise can be sold as a whole or in parts. The company as the property of its owner can be insured, bequeathed or used as collateral.

What are the types of company value

The appraiser's activities are regulated by the federal standard "Purpose of valuation and types of value"(FSO No. 2), which determines several main types of value for any object of appraisal:

- Market price.

The market value of an appraised object, for example a business, is the most probable price at which it can be sold on the day of appraisal under the following conditions: the alienation takes place in an open market with existing competition, the parties to the transaction act reasonably and have complete information about the subject of sale, and its value is not affected by any force majeure circumstances.

The market value of the company is needed in the following cases:

- when the property of the company or the enterprise itself is seized for state needs;

- when the price of outstanding shares is determined, which the company buys by decision of the meeting of shareholders or the supervisory board;

- when you need to determine the value of a company acting as collateral, for example, with a mortgage;

- when the size of the non-monetary part of the authorized capital of the company is determined;

- when the owner goes through bankruptcy proceedings;

- when it is required to determine the amount of property received free of charge.

The market value of the company applies in all situations where tax issues, both federal and local, are being resolved.

It is this type of value that is always determined in the sale and purchase of a business or any part of it, since the market value is the most objective indicator and does not depend on the wishes of the participants in the process, it corresponds to the real economic situation.

- Investment value- such a value of the company, which is related to the profitability of the enterprise for a particular investor in the existing conditions.

This type of value depends on personal investment requirements. Every investor invests his money in a business in order to get a profit in excess of the amount of invested capital, and not just the return of this "debt". So investment value companies calculate based on the expected income of the investor and the capitalization rate of these investments. This view the value of the company must be calculated when buying and selling a business, mergers, acquisitions of firms.

- Liquidation value.

This cost option is calculated in a situation where the end of the company is expected for any reason (for example, reorganization, bankruptcy or division of the company's property). By determining the liquidation value of the company, they find the most probable amount of the price at which the company can be sold for shortest time exposition, provided that the owner of the object of sale is forced to make a deal to alienate his property.

- Cadastral value.

This is the market value approved and established by the legislation in the field of cadastral valuation of real estate. It is to this indicator that the methods of mass appraisal should come in the case of the cadastral value of the object. This type of value is calculated most often for property taxation.

What documents are needed to hold the estimated value of the company

- Duplicates or copies of the constituent documents of the enterprise.

- Documents for the inventory of the company's property.

- Written confirmation of the structure of the company and the types of its economic activities.

- For joint stock companies, duplicate reports on the issue of securities and copies of prospectuses will be required.

- Fixed asset documentation.

- If there is real estate for rent, then you need to submit copies of contracts.

- To assess the value of the company, it is required financial statements for 3-5 years - about all the profits and losses of the business.

- The final conclusion of the audit, if it was carried out at the enterprise.

- A detailed list of all assets: tangible and intangible, in shares, bills of exchange, etc.

- Deciphering of receivables and payables.

- If the company has subsidiaries, then it is necessary to collect information about them and submit financial documentation for them.

- A ready-made business development plan for the next 3-5 years, containing potential gross revenues, investments, expenses and calculation of net profit for each next year.

This is a preliminary list of documents that an appraiser will need to conduct an examination of the company's value, but it can be shortened or supplemented at the request of a specialist.

How to find out the value of the company

Obviously, one of the most objective indicators of work efficiency operating business is its cost. It makes it possible to calculate the price at which an enterprise can be sold on the open market in a competitive environment, or to assume future value the benefits of the firm. The question of how a company's value is assessed is a serious one. practical task of high importance for any entrepreneur.

To get an adequate assessment, first of all it is worth define the main goal cost calculation procedures. The following options are most likely:

- Determining the value of the company was required to perform some legal actions. In this case, they turn to a licensed independent appraiser, who draws up his opinion in the "Appraisal Report", regulated Federal law № 135.

- You need to find out how much your business is really worth in the market; in this situation, the official "Assessment Report" is no longer needed.

The fundamental difference in carrying out these procedures is not in the quality of the appraiser's work, but in the cost of services and in the form of an opinion. In the first case, the specialist is obliged to comply with the requirements of the current legislation governing his licensed activity, and usually these requirements significantly increase the price for the work.

In the second case, you will need to independently develop and clearly formulate the assignment for the appraiser, listing all the procedures you are interested in, the factors of the company's value and parts of the business that are subject to examination. So as a result, you will receive only the information that you need.

Business valuation means the calculation of its value as a property complex, which leads to a profit by the owner.

To calculate the value of a company, you need to take into account all of its assets, intangible and tangible: real estate, technical equipment, cars, warehouse stocks, financial injections. Further, the past and potential incomes, plans for the development of the enterprise, competition and the economic environment are necessarily calculated. At the end of the due diligence, the data are compared with information about similar companies, and only after that the real value of the company is formed.

In these calculations, the following applies. three methods:

- profitable,

- costly,

- comparative.

However, in fact, there are so many situations that they are segmented into classes, each of which requires its own approach and corresponding method.

To use the most appropriate calculation method, you must first analyze the situation, circumstances of the moment of assessment and other conditions.

For some types of business, the valuation of the company is carried out, as a rule, based on commercial potential.

For example, in the case of hotel business we deal with guests as a source of income for the firm. In a method called profitable, it is this source that will be compared with operating costs to assess the profitability of the enterprise. This method is based on discounting the profit from the rental of the company's property. Finally, after the appraisal, both the value of the buildings and the land are included.

The valuation of the company is carried out using cost method when it comes to a business that cannot be bought or sold, as is the case with government agencies or clinics. This estimate takes into account the construction cost of the building, depreciation and depreciation of the property.

Comparative method used when there is a market for such a business. It is a market-based valuation method that relies on the analysis of similar properties already sold in other markets.

Hypothetically, all of the above approaches must give the same amount of value... But actually market conditions are not perfect, businesses are often ineffective, and information is inadequate and imperfect.

Determining the value of the company in each of these approaches allows usage different methods appraisals:

- For a profitable approach, these are:

- the capitalization method, which is used in the case of established companies that managed to accumulate assets in previous periods;

- a method of discounting cash flow for a young business, which will develop in the future. Used when a company has a potentially promising product.

- For the cost approach, the following are used:

- method of net assets - when it comes to reducing the volume of issue or closing a business at the initiative of the investor;

- and the method of the company's residual value.

- For a comparative approach, these are the methods:

- transactions that are used in situations similar to those for the application of the net assets method;

- industry ratios, evaluating operating enterprises that do not plan to close in the period after the examination;

- capital market. This method is also intended for "live" companies.

Please note that the last three methods are valid only if there is a similar business, which is the same type as the subject of assessment, otherwise the analysis will not be indicative. Next, we will briefly talk about the use of the named methods by which the value of the company is calculated.

If you need an estimate of the cost for the forecast period, then it will be determined discounted cash flows... The discount rate is applied to bring the potential return to its current value.

In this scenario, the calculation of the value of the company is carried out according to the following formula:

- P = CFt / (1 + I) ^ t,

where P- price,

I- discount rate,

CFt- cash flow,

t Is the number of the time interval at which the evaluation takes place.

Do not forget to take into account that in the period after the forecast, your company will continue its work, which means that future prospects will determine the most diverse options - from explosive growth of the enterprise to bankruptcy.

It happens that calculations are carried out using Gordon's model, implying a stable and systematic growth in sales and profits of the company, as well as equal amounts of capital investments and the amount of wear.

For this situation, the following applies. formula:

- P = СF (t + 1) / (I- g),

wherein CF (t + 1) Is the cash flow in the first year following the forecast period,

I- discount rate,

g- the rate of growth of the flow.

The Gordon model is most convenient to use when calculating the value of a company if the object of valuation is a large business with a large market capacity, stable supplies, production and sales, which is in favorable economic conditions.

If the bankruptcy of the enterprise and the further sale of property are predicted, then this formula is required to calculate the cost:

- P = (1 -L cf) × (A -O) -P liquor,

where P- the value of the company,

P liquor- costs of liquidating it (such as insurance, appraisal services, taxes, employee benefits and management costs),

O- the amount of liabilities,

L Wed- discount provided in connection with the urgency of liquidation,

A- the total value of all assets of the company after their revaluation.

The results of calculations using the current formula are also influenced by the location of the enterprise, the quality of assets, and the situation in the market as a whole.

Quick calculation of company value using express appraisal

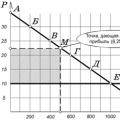

Express valuation model, which we will talk about in more detail, is based on the method of discounting cash flow for an enterprise already known to us. For convenience, we will abbreviate this term as DDP method For the company. These concepts, as we remember, operate in the profitable approach to the valuation of the company.

This approach is subdivided into the following most common in it assessment methods:

- method of calculating economic profit;

- DDP method;

- method of real options.

According to a lot of information, both direct and indirect, the DCF method is the most adequate in determining the value of a company. Provided that the criterion for the effectiveness and appropriateness of the method, we choose to display the behavior of the stock market (for example, the capitalization of an enterprise according to its data).

Important, that the DDP method has several varieties, corresponding to different purposes and differing in the techniques for calculating both the flow itself and the discount rate. Let's list the most popular varieties:

- DDP for equity capital joint stock company(Free Cash Flow to Equity);

- discounting DP for the company (Free Cash Flow to Firm);

- and one more type of cash flow discounting - for capital (Capital Cash Flow);

- Adjusted Present Value.

At the same time, the entire DCF method for an enterprise is based on this formula:

In which indices i and j the ordinal numbers of periods (years) are indicated,

EV(Enterprise Value) - the value of the company,

D(Debt) - the cost of short-term and long-term debt,

FCFF stands for "free cash flow for the company", which does not take into account debt financing remaining after taxes (or operating cash flow),

E(Equity) is the amount of equity capital of the organization,

WACC(Weighted Average Cost of Capital) is translated as "weighted average cost of capital", which is calculated as follows:

r d- the cost of the company's capital, which is borrowed,

t- income tax rate,

r e- the amount of equity capital.

When calculating the value of companies in Russia, often the following simplifications are introduced:

- Weighted average cost of capital WACC can be designated as the discount rate - r... This move does not destroy the adequacy of the formulas, since for business in Russia the calculation WACC is not always possible. Because of this, analysts resort to other computation options.

- And let's say that the variable r throughout the years is constant. This is due to the fact that the definition this indicator in Russia, even for one specific year, it causes big problems and leads to a methodological stupor. So, if we do not introduce such a simplification, then we will unnecessarily complicate the entire model of express valuation of the company.

As a result of all the above transformations we get the expression kind

The factors of the company's value within the described valuation model are any scalars and vectors that affect the value of the enterprise in the calculations.

Please note that predicting free cash flow for a firm for each year of an infinitely long period is quite difficult and this action makes little sense. This happens because the value of the terms with the index i too small because of the denominator, and an imperfect calculation of the numerator has almost no effect on the final result of this calculation. For this reason, the following popular practice is used. an approach:

- the company's value is split into the forecast period and the post-forecast period;

- in the first period, cost factors are predicted based on assumptions and plans for the further development of the enterprise;

- on a post-forecast period of time, cash flows are estimated based on the hypothesis of a fixed rate of their growth throughout the entire period.

Valuation of the company: typical mistakes

Everyone who has come across an appraisal service knows very well that how it was calculated has a significant effect on the market value of one and the same business being appraised. The resulting amounts may differ several times. Such results often lead to serious financial damage, conflict and even litigation.

Let's call there are several main reasons for the variation in the value of the subject of assessment:

- Methodological errors.

Inadequate value is obtained as a result of calculation errors, as well as due to methodological inconsistencies in assessing the value of the company. Study the experience carefully and professional level appraiser.

- Intentional misrepresentation of value.

Unfortunately, to this day, a certain share of the market of services for the assessment of various objects is occupied by “custom” examinations. That is, the real cost can be underestimated or overestimated in the expert's opinion at the request of the customer.

- Subjective expert opinion.

Despite the fact that the assessment procedure is based on specific values and economically sound assumptions, this process remains largely subjective. So the result may depend on the personal view of the appraiser on the future of the market, on financial capabilities and other factors of the company's value. The decision on how to relate to economic conditions has to be made by the expert conducting the analysis. And he will not always be able to predict even the most seemingly predictable things. Judge for yourself: who could have predicted the development of the oil market at 66 dollars a barrel two or three years ago, and not at 25 or even optimistic 30 dollars per unit?

- Incorrect statement of the problem.

The size of the total cost that will be obtained as a result integrated analysis and calculations, largely depends on the correct formulation of the problem, on the accuracy and adequacy of the choice of the type of value and on the ultimate goals for which the whole procedure is carried out. It is not surprising that the same security can be valued in amounts that differ by 20 or even 50%. This is influenced, for example, by whether it is in a minority or controlling stake. Depending on the purpose of determining the value of the company, the calculation process is carried out in different ways.

- Distortion of official reporting.

The management of some enterprises deliberately goes to the discrepancy between real and official reporting. And the distortion of this factor of the company's value inevitably leads to incorrect valuation results. This problem is even more aggravated in the case when it is necessary to make a settlement for a business, the share of which is pledged when receiving credit funds. Banks prefer to work not with management reporting, but only with the official one, which significantly changes the assessment indicators.

- Deficiencies in legislation.

Nowadays, valuation experts turn to the three main methods of this procedure - cost, income and comparative. Official assessment standards state that in the final calculation, it is necessary to take into account the results obtained in all three approaches. But these methods do not always correspond to the purposes of the examination.

List of factors to look out for, in order to clarify their meaning and receive comments from an expert assessing the value of the company:

- Cash flow forecast based on the results of the analysis and the discount rate reflecting the cost of attracting third-party capital - with a profitable approach.

- The cost of all intangible assets (including those that are not included in this category under the law Russian Federation) – with a costly approach.

- The adequacy of the multipliers (price ratios) and the comparability of the analogue company with which the comparison is made - with a comparative approach.

Business value factors

If a person is able to evaluate an apartment or a car himself, then when buying a business you cannot do without a qualified appraiser. And the point is not only that special knowledge is required here, but also that information about the state of affairs at the enterprise must be correctly extracted and correctly interpreted.

In the "Shop of Ready Business" they believe that the main factor in determining the value of an enterprise is its net profit, and not accounting, but the money that the owner can withdraw from the enterprise.

1. “First of all, the buyer should pay attention to cash flows and net profit,” says Sergey Kharchenko, head of the appraisal department of the Ready-made Business Store.

If there is no profit even in management reporting, you should think about it. "

According to the observations of experts, the discrepancy between "white" and "management" accounting is absolutely in all enterprises. Of course, firms strive to operate as legally as possible. But even the smartest manage to bring no more than 80% of their business into the white.

2. The second most important indicator that affects the value of a business, Sergei Kharchenko considers the period during which the business will bring money.

After all, products may lose relevance, competitors may appear offering the best product, lease agreements may end, or they will plan to build an overpass across the territory of the production facility, as in the movie "Garage".

Business in leased territories is cheaper and "fights back" faster, but it has more risks associated with the unreliability of the lease.

If the business is done on its own premises and equipment, then it is more expensive, "fights back" longer. But equipment, and especially real estate, is itself a liquid asset. They can be sold with a profit even in the event of a business collapse.

Intangible assets.

Experts differ in their assessment of such a phenomenon as goodwill - the intangible assets of a firm, consisting of a brand, business connections, employee talent, own know-how, etc.

For small businesses, of course, goodwill is not as significant as in large corporations that spend huge amounts of money on brand promotion.

The share of goodwill in the cost of, say, a bakery is small, although there is still - reputation, culinary skills, recipes.

But there are times when goodwill is a significant part of the value of a business. For example, the value of a firm developing software, fundamentally little depends on the rented space or own computers. In this case, the most important thing is bright minds, the names of developers and managers, as well as their connections.

In other words, the firm may not have large tangible assets, the book value of its property will be small, but it is able to generate significant financial flows. This often applies to information, consulting enterprises. Such firms are worth much more than the sum of their assets.

The difference between the selling price of a firm and the price of its tangible assets is precisely the value of this very goodwill. The only problem is that it is extremely difficult to determine goodwill in any other way - except in the circumstances of the sale of the company.

Business staffing.

An important factor in the formation of goodwill, the total value, and even the viability of the business is labor collective enterprise, its qualifications and manageability. The whole business can hang on one person, and this is a huge risk.

There is a known case in the insurance business when general manager on sales left the company after the change of ownership, and 40% of clients left with him, that is, almost half of the business. It was enough for him to establish his own insurance company.

But this is not only about top managers, who can switch to another concern and take away the clientele. No less serious problems are fraught with the whims of the chief car mechanic Uncle Vanya with golden hands, on which the whole car service business is held.

It's funny, but the fate of dry cleaning can be decided by a stain remover with a salary of 6 thousand rubles. The profession is very rare, and without such a specialist, dry cleaning loses both its meaning and customers.

Business valuation methods.

Evaluators use sophisticated techniques, the essence of which is simplified as follows:

1. Market method - an analysis of similar transactions on the market is made, the necessary discounts-markups are made depending on the specific circumstances of the business, and thus the value of the enterprise that you want to buy is determined.

This is the method that everyone uses when buying a home or a car - to bounce off the prices of a similar product on the market.

2. Recovery method - a business is estimated at the amount that would be required to develop a similar business from scratch.

3. Income method - in this case, the income that the enterprise gives or will begin to bring is considered.

Here, the estimate is influenced by the period for which you can "recoup" the funds invested in the purchase. Now the payback period of the acquired enterprise, equal to one and a half years, is recognized as normal for a small business.

No one will sell a working business for less than 7-8 months of profit.

Rarely does a business sell for more than two or two and a half annual profits.

According to the manager of the investment banking department of the investment holding "FINAM" Alexander Butov:

first of all, the value of a business determines the position of an enterprise in the market and its revenue

followed by profitability and accounts payable

the factor of profitability is important - the forecast of cash receipts for the future and the period for which the acquisition can pay off.

But in practice, says Alexander Butov, buyers often use their naive method: revenue is multiplied by profitability and by the number of years for which the new owner wants to recoup the deal.

For some reason, three years are considered a normal period. "

The procedure for transferring "business ownership".

The most delicate and difficult question is how to give away the money and take over the right to own a new business. I really want there to be no too great or even insurmountable distance between these two acts.

It must be said that there are indeed risks, including criminal ones. There are risks of non-compliance with agreements, swindle - some intermediary firms even offer clients physical security services. But, as the experience of recent years shows, the machinations in this area are becoming less coarse and more elegant.

The general tendency is that everyone tries not to violate the legislation, especially the criminal one. Which, however, requires even more diligence from the intermediary consultants who monitor the purity of the transaction.

Sergey Samsonov, Director of the Legal Department of the Ready-Made Business Store, considers the following as the main risks:

Hidden off-balance sheet liabilities of the sold enterprise.

Under some sale schemes, old debts that the previous owner managed to hide - for example, bills of exchange not accounted for in the balance sheet, some kind of surety, guarantees - can come out after the transaction. And the new owner will not get away from them;

The risk of non-fulfillment of obligations under a business sale and purchase transaction, that is, non-payment of money or non-receipt of rights to a business, with a competent intermediary with a good reputation, in principle, is minimized.

A normal intermediary studies the credit history of the enterprise, collects information from the field of security. He is usually responsible for all documentation related to the appraisal - after all, he must have an appraiser license.

In some cases, the intermediary may take upon himself, by agreement with the parties, financial guarantees upon the transaction, but this is extremely rare.

Money transfer procedure.

1. First, an agreement of intent is signed between the buyer and the seller, then the buyer hands it over to the seller against receipt or makes an advance payment to his account.

2. After that, there is a check of all the stated business circumstances.

3. When the decision is made, the buyer opens a letter of credit in favor of the seller.

4. Then a contract of sale and purchase of 100% of the share or shares is signed, depending on the organizational and legal form of the enterprise.

5. The bank admits the seller to the funds of the letter of credit only on the basis of a signed and certified sales contract and registered in tax office new constituent document.

Sometimes, instead of a letter of credit, the buyer rents a safe deposit box, which is used for payment according to the same mechanism: the bank gives the seller access to the safe deposit box when the buyer transfers documents certifying his ownership of the business.

Money is easy to transfer.

Purchase and sale procedure

From a legal point of view, there are four forms of buying and selling a business.

1. The first and foremost is the replacement of founders in an LLC or a CJSC - as in a legal entity that owns a business. This is a fairly simple way.

Its minus is that the legal entity retains its old credit history under the new owner.

Unknown off-balance sheet liabilities may emerge.

There is also a significant plus: replacing the founders does not require obtaining the entire package of permits, licenses, if the business is licensed.

It is only necessary to register the changes in the composition of the founders with the tax office.

The business remains intact, as it were, with its pros and cons. It's just that the founders and owners are different people.

2. The second method is the creation of a new legal entity and the transfer of assets related to the purchased business to it.

Assets can be either sold or transferred in another way.

When selling property from one legal entity to another, taxes naturally arise, which, however, can be minimized. The method is also simple, but also has a significant drawback.

The new legal entity must re-obtain the entire set of permits and licenses, if required. And this is a very troublesome business.

According to experts, a couple of years ago it took three weeks to get all the documents for a beauty salon. A year later, it took five weeks. Now it is almost three months. These are the results of a campaign to combat administrative barriers announced just two years ago. For three months, the finished enterprise will be idle and incur losses for no business reason. Due to bureaucratic harassment.

Knowing the situation, intermediary consultants act as follows. They create a legal entity ahead of time and receive all the necessary documentation for it. This keeps downtime to a minimum. But in some cases, two permits for one case cannot be obtained, you have to first disavow the old, and then wait for a new one.

3. The third form offered by the law is the sale of an enterprise as a property complex. But there are few such cases when an enterprise would be registered as a property complex.

On the contrary, often on one legal entity "hang", for example, a car wash, two restaurants and a gas station, and only a gas station is sold.

Business sale and purchase transactions under this option are extremely rare. Although experts consider this method to be optimal, it practically removes all the risks described above associated with hidden off-balance sheet liabilities or the need to obtain a bunch of new permits.

The described three methods are suitable for the sale of normally functioning enterprises. 4. There is a fourth - for the endangered. This is a sale through liquidation. This is, of course, a friendly bankruptcy. Relatively speaking, the buyer and the seller agree, the seller initiates the liquidation of the enterprise, their property is described, sold at auction, where the new owner acquires it.

True, there is a risk that another bidder will come and beat the price. But experts say that if everything is done correctly, then the transition of the business to the right buyer is guaranteed. This mechanism is suitable for small businesses, medium and large businesses.

Why are intermediaries needed

The most important thing in this area is consultation, assessment, information, support. Not a single sane investor will buy a business relying only on his ingenuity.

The acquaintance factor for Russian business remains very important. And the buyer and seller often need recommendations from third parties who are personally familiar with the parties.

A fairly large proportion of transactions go through without it. That is, a normal market situation becomes common, when the seller and the buyer initially do not know anything about each other.

The middleman brings them together, helps with pre-sales, often acts as a business consultant and helps clean up the business.

He also evaluates the enterprise, inquires about the high contracting parties in the interests of each of them, provides legal support and sometimes even resolves security issues.

The services of an intermediary consultant cost 2-15% of the transaction amount - all intermediaries emphasize that their approach is purely individual. Moreover, the seller pays for them.

The fact is that sales are made from the set of offers that are formed by the sellers, and therefore you have to pay the middleman. However, no one bothers the buyer to pay for the services of an intermediary either.

The costs incurred in the course of the transaction should also include taxes. A smart middleman will certainly help minimize them. The very fact of buying and selling a business is not subject to taxation.

Taxes arise if property was transferred during the transaction. Or if the business was sold by buying shares or stocks and the purchase price exceeded par - this difference is considered the seller's income and is subject to income tax - 13%, if we are talking about natural person.

It is clear that in the case of an LLC, a 100% share of an enterprise can be valued at 10 thousand rubles at the nominal value of the authorized capital, but a business can cost 100,000 dollars. That is, the difference between par and market price would be $ 99,700 and should be taxed as the seller's income.

Often the parties go to legal risk, understating the formal value of the business, or agree to share the burden of taxes.

Now on the market there are dozens and even hundreds of proposals for the sale of a business. Not only factories and steamships are being sold, but also small businesses that can be managed by an ordinary person who has at least some business sense.

This market can also be interesting for existing entrepreneurs who want to diversify their business.

When buying and selling a ready-made business, everything happens in the same way as in the grocery market: the seller praises his product and wants to sell it at a higher price, while the buyer evaluates it critically and tries to lower the price. The conflict arises due to the fact that the cost of a ready-made business is difficult to assess "by eye". Usually, the assessment is carried out by experts who provide a justification for the value in monetary units. But you can evaluate the business yourself in order to understand whether the owner is overpricing and whether the appraiser is underestimating the value of your business.

Who and how estimates the value of a business

This is done by a third-party expert who is not related to either the seller or the buyer. The appraiser analyzes not only financial side, but also how the business is conducted, how profitable it is, how much is the company's reputation in the market, its intellectual property.

Companies evaluating a business are subject to Law No. 135-FZ “On Valuation Activities in the Russian Federation”. It says that setting the market price is necessary in a situation of fair competition. An expert must be an independent person, rely on documentary evidence and a number of principles that take into account the interests of all parties and do not infringe on their rights.

The appraiser sets a fair price that should not be affected by extraordinary circumstances. The cost is determined based on how much revenue the business can generate. The expert also takes into account the future benefits that the current business owner can receive if he does not sell it.

Business valuation methods

1. Costly

The most obvious and simplest method. A business is evaluated based on the costs of creation, development and operation. All operating costs are taken into account, including the wage bill. Calculations must be documented.

This method is not suitable when the company has intangible assets: reputation in the market, new ideas and developments. In addition, this assessment can be biased if the business owner was ineffective in managing funds. The method is used in conjunction with others.

2. Method for assessing the value of a business by assets

The entire business is a collection of assets. The owner adds up their value and gets the aggregate price of the object. This method is difficult to transfer to businesses that involve intellectual property or have a complex structure. Also, a situation may arise that assets are expensive and the profitability is low.

3. The method of discounting the estimated cash flows of income

The method relates to the valuation of a business based on the income of the enterprise. How more income can bring an object, the higher its value. At the same time, the expert takes into account the economic risks and costs that the owner will incur to create income.

The discounting method is based on the notion that the amount of money that the object brings now, by default, will be worth less in the future. The reason is inflation, market changes, force majeure. The method is suitable for objects whose cash flows change over time (for example, depending on the year or season). The main thing in this method is to correctly estimate future cash flows and calculate the discount rate.

To do this, a business plan is drawn up. It calculates the prospects for business development and the time when the investment will pay off (on average, it is 5 years). A plan of profitability is drawn up by years. The income for each year is divided by the discount rate. For example, for a business to pay back within 5 years, the rate must be at least 20%. For the entire cash flow, the discount rate is equal to the weighted average cost of capital.

The cost of the object is equal to the amount of income for all years of the expected payback, taking into account discounting.

4. Income capitalization method

Another way to assess the market value of a business is through future earnings. It is suitable for those companies that bring the same profit at equal intervals (in a stable market where there is no seasonality).

To estimate the value, the company's income is divided by the capitalization rate. The estimated or average figure for recent years is taken as the amount of income. The capitalization rate is calculated using an asset pricing model.

5. Comparative method for assessing the value of the enterprise

The valuation is carried out by analogy with a similar enterprise, the market price of which is known. A simple but dangerous method: although a business looks like one another at first glance, in reality it may turn out that its profitability is lower. To calculate the cost, the prices of the company's shares, financial and production indicators are compared, and industry coefficients are used.

conclusions

Evaluate a business before selling or buying should independent expert... It is difficult to make a true assessment without special education and understanding of the basics of investing. You can independently assess the value of the enterprise using cost and comparative methods. They will give approximate information about the cost, but cannot be used as the main methods of setting prices.

The value of the operating business is an objective indicator of the functioning of the enterprise and reflects the current value of the benefits in the future from its functioning. This allows you to calculate the most likely price at which it can be sold on the open market. The question of how to assess the value of a business is practical in nature and is of great importance for every entrepreneur at various stages of the functioning of the company.

How the business is evaluated

First of all, you need to determine the main goal that the process of calculating the value of the business has. Two options are possible here.

First option- the cost is necessary for the implementation of certain legal actions. That is, you need to obtain an official opinion in the form of an "Appraisal Report", which will be prepared by an independent appraiser licensed to carry out this procedure.

Second option- an assessment is carried out to determine how much the real value of your business is. For this, you no longer need the "Assessment Report", in accordance with the requirements of Law No. 135-FZ.

These options have a fundamental difference not in the quality of the work that the evaluator performs, but in terms of the results obtained. Appraisal activity is a licensed activity. For this reason, certain requirements are imposed on it by the current legislation. Fulfillment of these requirements in the process of drawing up the Assessment Report, as a rule, causes an increase in the cost of the specialist's work.

If the results of the work are drawn up not in the form of an official Report, but as a Conclusion, in the course of negotiations, a detailed development and approval of a clearly formulated assignment for assessment takes place. According to this assignment, the appraisers will perform only the procedures you specified that are required to resolve certain issues.

Business valuation is a procedure in which it is required to calculate the value of a business as a property complex that provides its owner with a profit.

During the assessment, the value of all assets of the company is taken into account: machinery, real estate, equipment, financial investments, warehouse stocks, intangible assets. It is also necessary to take into account the past and future income, possible prospects for the further development of the company, the competitive environment and the state of the market as a whole. On the basis of a comprehensive analysis, the company is compared with similar companies. After that, information about the real value of the business is already formed.

Methodology

Three methods are used to calculate the value of an enterprise: costly, profitable and comparative. In practice, there are different situations, and each class of situations uses its own recommended methods and approaches.

For an adequate choice of the method, it is necessary to classify the situations in advance, determining the type of transaction, the specifics of the moment at which the assessment is carried out, and so on.

Certain types of enterprise are most often evaluated on the basis of commercial potential. For example, for a hotel, guests are a source of income. This source is then compared with the cost of operating expenses to determine the profitability of the business. This approach is called profitable... This method is based on discounting the profit earned from the lease of the property. The valuation results under this method include both the value of the land and the value of the building.

If a business is not bought or sold, a developed business market in this direction does not exist, for example, a hospital or a government building is being considered, then assessment can be carried out on a cost basis, that is, it will take into account the cost of building the building, taking into account depreciation and depreciation cost.

If there is a market for a business that is similar to the one being assessed, market or comparative method can be used to determine market price enterprises... This method is based on a selection of comparable items that have already been sold on the market.

Ideally, all three methods used should yield the same amount of value. But in practice, markets are imperfect, manufacturers may be inefficient, and users may have imperfect information.

These approaches involve the use of different assessment methods.

The income approach includes:

- a method of discounting cash flow, focused on the assessment of an existing business, which will continue to function. It is more often used to evaluate young companies that have a promising product, but have not yet managed to earn enough income for capitalization.

- the capitalization method is used for those enterprises that, during capitalization, have accumulated assets in previous periods.

The cost approach includes:

- method of residual value;

- the method of net assets, applicable in cases where the investor plans to significantly reduce the volume of issue or to close the enterprise altogether.

The comparative approach includes:

- method of industry coefficients, focused on the assessment of operating companies, which will continue to function in post-reporting periods.

- method of transactions, applicable in cases where it is planned to reduce the volume of output or close the enterprise.

- capital market method, also focused on the operating enterprise.

Comparative approach methods are applicable only when choosing a similar company, which must be of the same type as the company being valued. Below we will briefly review the use of the main methods of calculating the value of a business.

Brief instruction

To calculate the value of your case in the forecast period, you need to use the discounted cash flow method. The discount rate is used to bring future income to present value.

Then, according to the forecast, the value of the business is calculated using the following formula:

P = CFt / (1 + I) ^ t,

where I- discount rate, CFt denotes cash flow, and t Is the number of the period for which the estimate is made.

At the same time, it is important to understand that in the post-forecast period your enterprise will continue to function. Depending on the further prospects business development, various options are possible from complete bankruptcy to rapid growth. For the calculations, the Gordon model can be used, which assumes stable growth rates of profits and sales and equality of depreciation and capital investments.

In this case, the following formula is used:

P = СF (t + 1) / (I-g),

where CF (t + 1) reflects the cash flow for the first year after the forecast period, g- the rate of growth of the flow, I- discount rate.

This model is most appropriate when calculating indicators for a business with a significant sales market capacity, stable supplies of materials and raw materials, as well as with free access to financial resources and a generally favorable market situation.

If the bankruptcy of the enterprise and the further sale of property are predicted, then, to calculate the value of a business, you need to use the following formula:

P = (1-Lav) x (A-O) - Plikv,

where P liquor- expenses for the liquidation of the enterprise, L Wed- discount for urgent liquidation, O- the amount of liabilities, A- the value of the company's assets, taking into account the revaluation.

Costs include insurance, tax, appraisal fees, administrative expenses, and staff benefits. The value of the liquidation value also depends on the location of the company, the quality of assets, the general market situation and other factors.

In the course of assessing domestic enterprises, the date of the assessment is of great importance. Especially great importance the settlement is tied to the date in a market oversaturated with property in a pre-bankruptcy state, experiencing a shortage of investment resources.

The Russian economy is characterized by an excess of asset supply over demand. This imbalance affects the value of the property offered for sale. The price of property in a balanced market will not match the value in a depression. But investors and business owners will be primarily interested in the real value in a particular market under certain conditions. And buyers are focused on reducing the likelihood of loss Money so they require guarantees. When assessing the value of a business, it is required to take into account all risk factors, including bankruptcy and inflation.

In conditions of inflation, at first glance, it is best to use the discounted cash flow method for calculations. This is only true if inflation rates are predictable. However, it is difficult to predict the flow of income in the context of instability for several years ahead.

2. Romanov V.S."The problem of company value management: a discrete case" // Control problems. - 2007. - No. 1.

3. Romanov V.S."The problem of managing the value of a company - a discrete case" // Management of large systems: Collection of articles. Art. / IPU RAS - M., 2006. - P. 142-152. http://www.mtas.ru/Library/uploads/1151995448.pdf

4. Romanov V.S."Influence of information transparency of the company on the discount rate" // Financial Management - 2006. - No. 3. - P. 30-38.

5. Romanov V.S."Success among investors" // Journal of Company Management ". - 2006. - No. 8. - S. 51-57.

6. Romanov V.S., Luguev O.S."Assessment of the fundamental value of the company" // "Securities market". - 2006. - No. 19 (322). - S. 15-18.

7. Dranko O.I., Romanov V.S."Choosing a growth strategy for a company based on the criterion of maximizing its value: a continuous case." Electronic journal"Investigated in Russia", 117, pp. 1107-1117, 2006 http://zhurnal.ape.relarn.ru/articles/2006/117.pdf

8. Copeland T., Kohler T., Murin D."The value of companies: valuation and management." - Second edition, stereotyped - M .: "Olymp-Business", 2000.

9. Damodaran A. Investment Valuation (Second Edition) - Wiley, 2002.http: //pages.stern.nyu.edu/~adamodar/

10. Damodaran A. Estimating Risk free Rates // Working Paper / Stern School of Business. http://www.stern.nyu.edu/~adamodar/pdfiles/papers/riskfree.pdf

11. Fernandez P. Company valuation methods. The most common errors in valuations // Research Paper no. 449 / University of Navarra. - 2002.http: //ssrn.com/abstract=274973

12. Fernandez P. Equivalence of ten different discounted cash flow valuation methods // Research Paper no. 549 / University of Navarra. - 2004.http: //ssrn.com/abstract=367161

13. Fernandez P. Equivalence of the APV, WACC and Flows to Equity Approaches to Firm Valuation // Research Paper / University of Navarra. - August 1997.http: //ssrn.com/abstract=5737

14. Fernandez P. Valuation Using Multiples: How Do Analysts Reach Their Conclusions? // Research Paper / University of Navarra. - June 2001.http: //ssrn.com/abstract=274972

15. 2006 Uniform Standards of Professional Appraisal Practice // The Appraisal Foundation. - 2006.http: //www.appraisalfoundation.org/s_appraisal/sec.asp?CID=3&DID=3

16. International Valuation Standards 2005 // International Valuation Standards Committee. http://ivsc.org/standards/download.html

17. Business Valuation Standards // American Society of Appraisers. - November 2005.http: //www.bvappraisers.org/glossary/

18. "Appraisal standards obligatory for application by the subjects of appraisal activity", approved by the Decree of the Government of the Russian Federation of July 6, 2001 No. 519

19. Pavlovets V.V."An Introduction to Business Valuation". - 2000.

21. Kislitsyna Yu.Yu. Some modeling techniques financial development enterprises: Dis. Cand. those. sciences. - M., 2002.

22. Dranko O.I., Kislitsyna Yu.Yu."A multilevel model of financial forecasting of enterprise activities" // "Management of socio-economic systems: Collection of works of young scientists" / IPU RAS. - M .: Fund "Problems of Management", 2000. - P. 209-221.

23. V.V. Kovalev"Introduction to financial management"- M .:" Finance and Statistics ", 1999.

24. Modigliani F., Miller M. How much does a firm cost ?: Collection of articles. - M .: "Delo", 1999.

25. Leifer L. A., Dubovkin A. V... "Application of the CAPM model for calculating the discount rate in the Russian investment market." http://www.pcfko.ru/research5.html

26. Kukoleva E., Zakharova M."Risk-free rate: possible calculation tools in Russian conditions" // "Assessment questions". - 2002. - No. 2.

27. Sinadsky V."Calculating the discount rate", Magazine " CFO". - 2003. - No. 4.

28. Rachkov I.V."Cost calculation share capital using the Goldman Sachs model ”.

29. Shipov V., "Some features of assessing the value of domestic enterprises in a transitional economy" // "Securities market". - 2000. - No. 18. http://www.iteam.ru/publications/article_175/

30. K. V. Rozhnov"Variant of calculating the discount rate in business valuation based on the cumulative construction method" // "Valuation Issues - 2000". - No. 4. http://oot.nm.ru/files/1.pdf

31. Jennergren L. P. A Tutorial on the McKinsey Model for Valuation of Companies - Fourth revision // Stockholm School of Economics - August 26, 2002.

32. Brailey R., Myers C."Principles of corporate finance" - M., "Olymp-Business", 2004.

33. Goriaev A. Risk factors in the Russian stock market // New Economic School - Moscow: 2004.http: //www.nes.ru/~agoriaev/Goriaev%20risk%20factors.pdf

34. Humphreys D. Nickel: An Industry in Transition1 http://www.nornik.ru/_upload/presentation/Humphreys-Dusseldorf.pdf

35. Deputy Speech Director General- T. Morgan, member of the Management Board of MMC Norilsk Nickel, at the BMO Capital Markets 2007 Global Resources Conference. Tampa, Florida (USA), February 26, 2007 http://www.nornik.ru/_upload/presentation/2007%2002%2026%20BMO%20February%202007%20Norilsk%20Nickel_final.pdf

36. Speech by the Deputy General Director of OJSC MMC Norilsk Nickel D.S. Morozov at the UBS conference. Moscow, September 13-15, 2006.

05 01 medical biochemistry where to work

05 01 medical biochemistry where to work Biochemistry who can work

Biochemistry who can work Types of monopolies: natural, artificial, open, closed

Types of monopolies: natural, artificial, open, closed