Loyalty of staff is a correct, sincere and respectful attitude towards management and employees. Formation, assessment and methods of increasing loyalty. Ideas for analyzing a retail customer incentive program Analyzing consumer attitudes

Customer loyalty assessment methods

The management of most companies understand the need to assess the loyalty of their customers, since it is an indicator of the company's success in the market and the main long-term and mutually beneficial relationship with consumers. Studying the degree of customer loyalty is the basis of development management decisions within the framework of the customer relationship system.

Remark 1

There is no one-size-fits-all method or way to measure customer loyalty. There are a number of techniques developed at different times by economists who have done research on loyalty.

All methods are classified in terms of the focus of loyalty and in terms of the disciplinary area that investigated loyalty.

Figure 1. Classification of methods for assessing loyalty. Author24 - online exchange of student papers

The method of sharing needs was developed by D. Aaker, J. Hofmeir, B. Rice in the 1950s. It is based on determining the ratio of the frequency of choosing a particular product / brand to the number of purchases made in general. If a customer 7 times out of 10 buys the same product or brand, then the degree of his loyalty is 70%. Experts have determined that a customer is considered loyal if the degree of his commitment is above 67%. Customers with a loyalty level below this indicator are called deserters. This technique is not effective, since it does not take into account the ulterior motives of customers, as well as global drivers that affect customer loyalty.

The essence of D. Aaker's methodology consists in measuring the following indicators:

- monitoring of customer behavior patterns (re-purchase rates, percentage of purchases, number of brands purchased, etc.);

- accounting for switching costs (the buyer does not purchase another brand because he does not want to risk changes;

- good attitude to the brand (trust, respect);

- satisfaction is the main factor in assessing loyalty;

- loyalty (the number of interactions of loyal customers with other buyers for their favorite brand).

This technique is used by many companies, various surveys are used for this.

Definition 1

The traditional approach is to determine the buying intentions to purchase a product / service. If the intention is high, it speaks of customer loyalty. But the intentions of customers can be different and affect the activities of the company in different ways.

There are three types of intentions:

- the customer makes repeat purchases, which has an impact on sales growth;

- the client recommends the product // brand to other people, which increases the growth of the number of the company's clients;

- the client intends to buy more more goods, which affects the average revenue per customer.

Sociologists R. Merton and R. Kendall proposed using the focus group method to assess customer loyalty. This is an in-depth interview in the form of a series of group discussions, during which the participants focus on the questions of interest to the researcher in order to obtain the necessary information. This technique allows you to assess the effectiveness of advertising and the attitude of customers to the company, its products or brand.

According to the method of J.J. Lamben's research on customer loyalty takes place in several stages:

- studying the quality of the main advantages of a product or service;

- research of the process and quality of service;

- study of the perceived value of a product or service.

The conversion model of J. Hofmeir and B. Rice is aimed at measuring the level of commitment. They used four metrics:

- satisfaction with the brand;

- availability of options;

- importance of choice

- the level of uncertainty in the attitude, hesitation when buying.

SERVLOYAL model as a comprehensive way to assess loyalty

The SERVLOYAL model has combined all approaches to determining the level of customer loyalty. The concept of the model is the interaction of the following parameters:

- behavioral aspects;

- aspects of the relationship;

- cognitive aspects;

- conative aspects;

- affective aspects;

- aspects of trust;

- aspects of commitment.

Remark 2

The SERVLOYAL model is designed to measure the gap between customer expectations and perceptions. The data obtained is used as an indicator of the company's success.

The main advantage of this method is that it fits all modern requirements, since the model evaluates various indicators in a complex.

But some researchers note the controversy of this model. It is argued that customer trust and commitment metrics are more predictors of loyalty creation than loyalty elements. In addition, the difficulty of assessment arises in the fact that the behavior of buyers can be assessed over a specific period of time, while the elements of loyalty (relationship parameters) are assessed at a specific point in time. This indicates the need to harmonize these components.

Customer loyalty assessment based on the NPS model

The NPS technique was developed by F. Reicheld. In his opinion, a truly loyal customer is one who actively advertises a product / brand to his friends and acquaintances, leaves positive reviews and attracts new customers. At the same time, recommendations are a certain responsibility that a loyal client assumes before his environment, since he personally guarantees the quality of the goods and the level of service.

Remark 3

The essence of this model is that customers are asked only one question: Rate on a scale from o to 10 what is the probability that you recommend our company and products to your friends and acquaintances? The answers to this question help to predict the potential for repeat purchases and further recommendations.

Decoding answers:

- 9-10 are promoter clients;

- 7-8 - neutral clients;

- 0-6 are critical clients.

The NPS index is calculated using the following formula:

NPS = Percentage of Promoters - Percentage of Critics

This indicator is calculated as a percentage and the optimal value is 40%. Unlike other valuation methods, the NPS model is widely used by many companies, including large multinational corporations.

Customer loyalty should be viewed as a set of parameters that characterize their behavior (volume and consistency of purchases) and the perception of the supplier of goods and services. Measuring these parameters requires not only the accumulation of significant amounts of information about sales and customers, but also the use of various data processing tools. As a result, suppliers software products they build in various mechanisms that allow accumulating and generalizing information necessary for analyzing customer loyalty and forming the necessary management decisions. Let's consider them on the example of the new (10.2) edition of the "Trade Management" configuration of the "1C: Enterprise 8.0" software system.

E. Shuremov, Doctor of Economics n.

Behavioral loyalty

The basis for measuring behavioral loyalty is sales credentials. The Trade Management configuration has various tools for accumulating and summarizing such data. In this regard, it is necessary to highlight the tools for carrying out ABC- and XYZ-analysis implemented in it.

ABC analysis is used to classify customers into three groups according to their importance. The first group includes those that together bring the bulk of the proceeds (arrived). The second group includes those clients purchases which relatively small , but still generate a significant portion of the revenue. The third group includes clients who carry out minor or one-time purchases. The division of clients into groups can be used as a guideline for making decisions on differentiating the discounts provided to them, the size of the product credit, setting special bonuses, etc.

Customers can also be classified according to the stages of the relationship with them, for example, potential, one-time, regular and lost customer.

If the client made a small number of purchases during the analyzed period, then he belongs to the "One-time customer" class. When a certain threshold of purchases is exceeded, the client goes to the class regular customers... By means of XYZ analysis implemented in the configuration, regular customers are divided into three subclasses depending on the value of the coefficient of variation of the selected indicator (revenue, profit, number of purchases, etc.), calculated for a certain period of time. Small values of the coefficient of variation indicate the stability of purchases and, therefore, high behavioral customer loyalty over the selected time interval. High values, on the contrary, indicate certain problems in the relationship with this client.

From the point of view of assessing customer loyalty, it is especially interesting to study relationship history with him. So, for example, according to XYZ analysis data obtained for different periods, it is possible to trace the dynamics of the movement of customers from one category to another. Someone becomes regular customer- his loyalty rises, while for someone, on the contrary, loyalty decreases, and purchases become less stable. In the latter case, it is necessary to take additional measures to increase the client's interest in the relationship with the company.

In order to make it easier for users to solve the problems of controlling the dynamics of changes in the behavioral loyalty of customers in new edition configuration "Trade Management" built in the ability to documenting and storing the history of changes in the ABC and XYZ classification of buyers. This allows accumulate information about changes in customer behavioral loyalty directly in the information base of the system and facilitates its analysis at long time intervals.

Perceived loyalty

When assessing this type of loyalty, the main tool is special methods of consumer survey and processing of relevant personal data ... The use of such tools, for example, the SERVQUAL service quality assessment methodology and its varieties, can provide interesting and practically important conclusions. So, for example, according to the data various studies satisfaction does not directly affect loyalty: dissatisfaction guarantees disloyalty, but only maximum satisfaction ensures loyalty. At the same time, partially satisfied customers are highly likely to change suppliers. And this is despite the fact that their behavior (volumes and consistency of purchases in this period) seems to indicate loyalty.

Customer survey requires the collection and processing of significant amounts of information. Therefore, the regular use of methods like SERVQUAL is possible only when the questionnaire process is put on an industrial basis and is supported by information technology.

Considering this circumstance, special tools are built into the new edition of the Trade Management configuration, for example, tools for automating the formation of questionnaires, their distribution and receiving results by e-mail... To do this, there is a possibility of forming and storing lists of questions and standard questionnaires, automatic distribution of questionnaires according to specified lists, sampling questionnaires sent by clients from the e-mail flow, registering them and analyzing the results of the questionnaire.

Thus, the "Trade Management" configuration of the "1C: Enterprise 8.0" software system provides marketing services enterprises have developed tools necessary to analyze customer loyalty and develop management decisions aimed at improving the efficiency of interaction with them.

Nowadays, almost all companies recognize high value loyal customers. Many (from bulk commodity companies to banking and transportation and logistics providers) are trying to implement loyalty programs because it is generally accepted that retaining old customers is cheaper for a company than attracting new ones. Costs are saved on advertising, on various promotions for the promotion of goods and services, on the remuneration of sales agents who are encouraged to attract new customers, etc. And loyalty itself turns into one of the main criteria for business success.

The importance of loyalty as a factor of competitiveness is confirmed by specific statistical data. According to FF Reikheld (curator of the "Loyality Practice" program of the consulting company Bain & Company and the author of the book "The Loyalty Effect"), a low level of loyalty in the business environment reduces performance indicators economic activity by 25 - 50%, and sometimes more. A 5% increase in loyal customer retention rates, depending on the industry, translates into a 25% to 100% increase in the value of purchases made by the average shopper. And in most industries, the profit from each client grows as their relationship with the company increases. As a rule, to compensate for the losses from one old client who has left, it is necessary to attract several new ones.

However, there are few places where there is a full-fledged working program to retain customers and attract new ones. In most cases, all actions of companies come down to the so-called direct methods of incentives addressed to all customers: the accrual and write-off of bonuses, the distribution of discounts, and one-time promotions. Obviously, in all these cases, the desired goal is not fully achieved. Single transactions do not allow working with loyalty on a regular basis, and the distribution of discounts to everyone without taking into account the needs and interests leads to losses. Discounts must be provided to clients based on their value to the company, or the cost of retaining them may exceed the revenues from working with them. Moreover, the commitment of customers to a particular company is in fact determined not only active action trading companies on their retention and useful personal offers, but also completely different factors, among which we can note: the location of the store, the price of goods, their quality, the level of service, etc. And, as the experience of foreign companies has shown, methods of direct customer reward often lead to making one-time purchases and do not motivate the consumer to remain a client of one particular company in the future.

The following story can be cited as an example. The airline giant British Airways once launched a promotion and gave out 5,000 award tickets for June 10th. Its competitor Virgin Atlantic thwarted all efforts by advertising: "Flying to London at the lowest price is common for Virgin. Take a British Airways flight on June 10th. We look forward to seeing you aboard Virgin Atlantic the rest of the day."

The complexity of launching a loyalty program

When the management of any company comes to the conclusion that something needs to be changed in their work with clients and decides to launch a loyalty program, then for its start and subsequent full-fledged functioning it is necessary to answer many difficult questions:

- Who is your client, what segments are they broken into and what makes one segment different from another?

- What factors influence behavior, what is the consumption pattern?

- Through what channels can they be influenced, what is the return from this?

- How to measure loyalty, what factors indicate a change in trends?

- and much more...

The complexity of this problem is such that any attempt to solve it with improvised means, "on the knee", is doomed to failure. As mentioned above, at the moment companies actually solve the problem of loyalty only by simplifying the algorithm as much as possible, for example, by charging discounts to all customers. However, in this case, simpler does not mean better.

According to "Maritz Loyalty Marketing", operator of customer loyalty programs, the constant decrease in the selling price in order to increase the number of sales brings retail more harm than good. Traditional “price wars” are now ineffective because the consumer wants more from the seller than just low prices. Low prices, mass advertising and traditional marketing do not guarantee successful sales.

Therefore, the use of modeling methods is the only way to put the process on stream, that is, to solve not a one-time problem, but to launch a mechanism for systematic increase in loyalty.

Let's consider the situation using the example of customer segmentation - one of the most important decisions of any enterprise. The idea is pretty simple: categorize your customers and interact with them in different ways. After that, you will be able to present to different customers the goods and services that better meet their needs. Today, segmentation of the consumer market is no longer an auxiliary marketing tool, it is becoming key to a company's success.

If we want to form offers that are interesting for the company and attractive to customers, then we need to take into account the peculiarities of each group-segment. Even for a small project to increase loyalty, it is necessary to take into account the interests of hundreds different groups that are very different from each other.

For example, when segmentation is performed by the criterion "Gender", we will get two segments - "Men" and "Women". If we add the attribute "Age" (say, 5 groups), then we get 2 * 5 = 10 segments. If we enter the criterion "Income" (5 more groups), we get 2 * 5 * 5 = 50 segments. It is not difficult to imagine how the number of segments increases when at least one more criterion is added and how much the labor costs of this operation increase, especially for trade enterprises, which accumulate huge amounts of information about actual consumption that can and should be used to promote goods. Moreover, technological progress and the availability of Data Mining methods at the moment make it possible to do this.

Data Mining in Direct Marketing

Let's take a closer look at the use of Data Mining methods using the example of one of the most popular approaches to increasing loyalty - Direct Marketing. Generally speaking, Direct Marketing is the formation of targeted offers to clients, taking into account their preferences. The idea behind this marketing line is simple: offer the right product the right people v the right time and in the right place.

You can divide the conduct of a direct marketing campaign into the following stages (see Fig. 1):

Let's consider how you can and should use Data Mining at each of these stages.

1. Segmentation of the customer base

Since one of the main benefits that companies can derive from a loyalty program is the ability to focus on a specific group of customers who are providing the most value, then important point for the effectiveness of their incentive programs, there is a procedure for segmenting the customer base and selecting the most attractive consumers. And then you can build relationships with customers in certain segments that have common characteristics. This allows you to create custom marketing programs.

In other words, segmentation target audience and researching its needs - must-have items. If you fail to attract customers, then the loyalty program simply won't work.

But segmentation of the customer base based on primitive rules, such as gender + age, does not reflect the real complex structure of customers. It is clear that preferences are influenced by many other factors in very complex combinations, ranging from the geography of customers and ending, for example, their average annual income. To build high-quality segmentation models, it is necessary to move away from primitive grouping methods and use adequate multidimensional and preferably self-learning Data Mining segmentation algorithms, for example, Kohonen maps, which allow not only segmenting objects, but also visualizing its results using multidimensional projection. In Figure 2, you can see the built maps, on which customers are divided into 4 segments (clusters), depending on their preferences in food, alcohol and tobacco and the time of shopping.

2. Choosing the target audience

When selling goods and services, it is very important to understand who will be the end consumer, therefore the key point of direct marketing is creating a list of customers who may be interested in a particular product or service, that is, choosing the target audience for specific actions. Right choice can give excellent results, i.e. the effectiveness of measures can increase several times.

Therefore, after identifying the segments, it is necessary to analyze them:

- Estimate dimensions and statistical characteristics.

- Calculate the financial characteristics of segments, their potential, attractiveness, prospects.

- Understand what characteristics define interesting segments, how they differ from the rest.

- Determine which strategy is best to apply to each segment: cost cutting, cross-selling, up-selling, or something else.

Data Mining tools allow not only performing segmentation, but also interpreting the results obtained using specialized visualization mechanisms (see Fig. 3).

3. Formation of targeted offers

Obviously, the more accurately you can predict which product or service will be of interest to representatives of each segment, the greater the effect can be expected from targeted calls. Well-formed offers increase loyalty and profitability, and illiterately prepared ones not only do not benefit, but also irritate customers. Data Mining tools include algorithms, such as association rules, to automatically find relationships between products and generate offers that a customer is likely to respond to (see Figure 4). In Figure 4, you can see an example of how association rules work: the goods specified in the "Investigation" window will be purchased together with the already selected goods (the "Condition" window) with the probability specified in the "Confidence" column.

4. Analysis of customer response

Customer satisfaction scores are another important component of any marketing program. Tracking responses allows you to identify the most productive methods. After all, the mere presence of targeted proposals, even those formed with the help of very high-quality analysis algorithms, does not guarantee the desired response. any economic process is influenced by a huge amount of facts. Therefore, after each marketing action, it is necessary to analyze the response to it, to identify the reasons that influence the process. Even negative answers and reasons for refusal should be taken into account in order to avoid mistakes made in the future. In the arsenal of Data Mining there are algorithms that allow you to evaluate the influence of factors, to find patterns, for example, decision trees.

5. Evaluation of the effectiveness of the loyalty program

There are quite a few unsuccessful loyalty programs. But the main problem is not that the program is unsuccessful, but that often no one really monitors its work. And already no one knows how effective it is and whether there is any sense in it at all, since there is no full control and analysis of its implementation.

In other words, it is not enough for an enterprise to have a developed system for increasing loyalty; it also needs means of monitoring its effectiveness, since loyalty assessment is a difficult task that cannot be reduced simply to calculating the average check. The necessary statistical data should be accumulated in the management system so that in the future the company's management can receive an analysis of the effectiveness of the system, expressed in monetary terms and in increasing the number of customers.

To assess the effectiveness of a loyalty program, it is necessary to apply methods that take into account various aspects of behavior: the frequency of purchases, the time of the last transaction, the response to offers, the structure of consumption, etc. Using Data Mining methods in conjunction with different methods analysis and statistical processing of data to assess efficiency allows you to apply subtle criteria of loyalty, for example, the transition of a customer from the segment of "loyal customers" to "disloyal" and back.

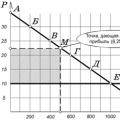

For example, the figure below shows an assessment of loyalty using RFM analysis (RFM analysis is based on the following characteristics customer behavior: Recency - the prescription of any action by the client, Frequency (frequency or quantity) - the number of actions that the client performed, Monetary (money) - the amount of money that the client spent).

Success factors

So, at present, achieving sustainable growth rates of the company and the planned profitability of sales is impossible without creating a large group of regular customers. The reasons for this are quite simple: intense competition and an increase in the number of offers in the service and trade sectors impose special requirements on doing business. And correspondingly, customer base- one of the valuable assets of the company. Therefore, customer loyalty turns into one of the main criteria for business success.

Nowadays, in almost every sector of the industry, companies strive to have loyalty programs for all or some of their customers, they are marketing tool, which is aimed at optimizing the relationship of companies with customers. But, on the other hand, loyalty programs require processing large amounts of data, fine tuning for the client, accounting and analysis of heterogeneous data (it is not always even clear what to analyze and whether there is at least some relationship between the ongoing customer retention program (or programs) and fluctuations in turnovers, sales volumes, etc.), automatic generation of relevant proposals and much more, which can really be achieved only when using Data Mining methods.

Therefore, in order to achieve a good result, small companies can do without complex tools, but it is desirable for large organizations to actively use Data Mining. In their case, only simple, primitive methods of accounting for customer needs are not effective enough.

Naturally, building loyalty is a complex and complex task that goes far beyond model building and analysis. It is necessary to solve many other tasks: from the correct accounting of data (for example, taking into account the history of relationships with customers) and ending with monitoring and evaluating the work of personnel, not to mention the competent development of the very concept of the loyalty program.

However, it is analysis that is the "brains" of the whole complex. In the absence of proper analytics, all the information collected will lie dead weight and will not allow turning customer data into knowledge about them that can bring additional income. And it is unlikely that the created loyalty program in such conditions will become a tool that can become the most effective in the marketing mix of your company.

Measurement and evaluation are the foundations of any business. Evaluation shows what the company is thinking and doing. And the choice of indicators for measuring the level of loyalty predetermines the thinking of employees and further actions of managers.

The study of personnel loyalty is dictated by the need to resist the negative trends of recent years, associated with, which entails loss of profit and competitiveness of the enterprise. It is extremely important to understand this especially for Russian companies.

Since a competitive environment has not yet been formed in the Russian economy, encouraging owners and employers to make the necessary efforts to assess and strengthen staff loyalty.

However, world experience shows that in conditions of unstable market economy, it is precisely those enterprises that survive that constantly take care of the loyalty of their personnel. Devotion, understood as the highest personnel to the company in which they work, and the willingness to support it in difficult moments is an integral and main result of the work of the entire management and especially the personnel department.

The main tools for researching staff loyalty.

Three methods have become the main tools for researching personnel loyalty:

1. The scale for measuring the loyalty of the organization's personnel L.G. Pochebut and O.E. The Queen.

2. The scale of "organizational loyalty" D. Meyer - N. Alain.

The methodology "Scale of organizational loyalty" was proposed by John Meyer and Natalie Allen (Meyer J. P. and Allen N. J.) in 1990 in a version consisting of three subscales in accordance with the author's three-component model of eight questions each.

In accordance with the model, the authors distinguish three approaches to loyalty that explain the nature of the relationship between the employee and the organization, which reduces the likelihood of voluntary employee leaving the organization: emotional attachment to the organization, awareness of the costs associated with leaving the organization, and a sense of commitment to the organization.

ENPS Employee Net Loyalty Index

The eNPS or employee Net Promoter Score is an index of net employee loyalty, allowing to assess their satisfaction with the company.

In other words, are employees satisfied with their work in your company and are committed to joint development, or are they disappointed with cooperation and are ready to switch to another employer as soon as a better offer appears on the market.

Reference:

The Net Promoter Score is a relatively young methodology for assessing business success. In 2003 it was presented as very simple and quick way identifying customer loyalty. Frederick Reicheld, an American marketer who has published many works on customer loyalty, proposed measuring customer loyalty by asking them about their willingness to recommend a product, service or brand to their friends and relatives. An innovation in this technique is that the client is asked to rate how confident he is in the product in order to "put on the line" his reputation in the eyes of those whose opinion is important to him.

Over the past ten years, this method has gained worldwide fame, it has been adopted by such international companies as American Express, Procter & Gamble, Amazon, Apple, Philips, Sony.

Among Russian companies NPS is measured by telecommunications companies (MTS, Beeline, MegaFon, Dom.ru), Insurance companies(Ingosstrakh, Rosgosstrakh), banks (Alfa-Bank, Home-Credit), many restaurant and hotel businesses.

More and more companies are implementing this index as a key indicator of their performance and also in assessing the loyalty of company employees to the company.

How is the eNPS Index calculated?

Employee satisfaction is assessed by questioning employees on two issues.

The second is "What is the main reason for this assessment?"

After the survey, the results are analyzed.

For the analysis of an employee, companies are conditionally divided into three groups:

Promoters - employees who gave a rating of 9 or 10. That is, employees who are loyal to the company, act in its interests and are ready to recommend it to their friends.

Neutrals are employees who gave a score of 7 or 8. That is, those who are not in the mood to recommend it to their friends or acquaintances. The neutrals are most often passive employees, who are, in principle, ready to change the company.

Critics are employees who rated it in the range from 1 to 6. That is, those who are disappointed with the work in the company are more likely to be actively looking for an alternative and will never recommend it to their friends.

ENPS score is the difference between the percentage of Promoters and Critics. Accordingly, the more your employees are Promoters, the stronger the “foundation” of your company and the more prerequisites it has for active growth and development.

Simply put, the formula for calculating eNPS is as follows:

(number of promoters - number of critics) divided by (number of respondents) and everything multiplied by 100.

Example: You have received 100 responses to your survey.

10 responses ranged from 0 to 6 (“critics”);

20 responses ranged from 7 to 8 (“neutrals”);

70 responses ranged from 9 to 10 (“promoters”).

Calculating the percentages for each of the groups gives you 10%, 20% and 70%, respectively.

Subtract 10% ("critics") from 70% ("promoters") and you get 60%. Since the eNPS is always displayed as a whole number and not as a percentage, your NPS is just 60.

What information does the NPS index provide?

An index with a plus sign indicates the prevalence of loyal employees over critics.

Consequently, the higher the index, the less staff turnover you will have and the likelihood that "strong" personnel will come to the company, based on the recommendations of existing employees.

If the index is 0 or takes a negative value, the situation becomes critical. Active and valuable employees may leave soon, and then there will be problems with hiring new staff, based on possible negative feedback about your company.

Please note that often problems in the company arise due to the low loyalty of employees, whom the company has instructed to maintain direct contact with the Clients.

The eNPS index will allow you to objectively assess how your company is ready for active development and growth at one time or another of its existence.

Trending answers to the second question allows you to respond quickly to questions corporate culture, motivation tools, job satisfaction, etc.

Regular measurement of the eNPS level will give you an idea of the mood within the team, allow you to assess the stability of the company and employees, employee satisfaction with your company's policy, the level of payment, social package etc.

Analysis of the eNPS index contributes to the high-quality construction of a culture of relationships within the company, the organization of a clear team structure and the development of a strategy in the field of personnel development.

A low loyalty score for the participation of company employees in decision-making indicates a high probability of resistance to changes that the company's management will try to carry out;

With a low loyalty index, employees are not so loyal to the company as to share with it the risks associated with choosing an active competitive position for business growth / expansion in the near future;

The personnel development program must be coordinated with strategic objectives enterprises.

Conclusions:

Regular measurement of the eNPS level will allow you to objectively assess the loyalty and satisfaction of your company's employees and, as a result, the willingness of the team to go along with you to long-term goals.

Which is directly related to the increase in profits and the increase in business efficiency!

1. Employee loyalty is not an abstract indicator, but a powerful driving force!

2. Staff loyalty must be measured and monitored!

Reference:

According to the research results of the NAFI Analytical Center, conducted in 2016, only 15% of employees of Russian companies are ready to recommend their employer to friends, and 62% are not satisfied with their place of work. The average NPS is -47 points.

Practical recommendations for the formation of employer attractiveness in the labor market.

1. Formation of an internal image with the help of corporate values, rituals, mission and the formation of a single community "We".

2. Development of measures to improve the in-house communication system, constant monitoring of the level of conflict.

3. Development of measures to promote the company's services, building up long-term consumer preferences, developing marketing campaigns and campaigns aimed at generating demand.

4. Using the potential of the mission, values and norms of the company in creating the image as a resource capable of creating the individuality of the organization, increasing the efficiency of the image in order to form the loyalty of both company employees and external target groups.

Tips for working with the NPS Customer Loyalty Index: how to sample users, what tools to use to conduct surveys, and how to analyze the results.

In my last year at LinkedIn, I became a real evangelist for using the NPS Consumer Loyalty Index as a Key Performance Indicator (KPI). NPS perfectly complemented our standard set acquisition, retention, and monetization indices and has become a metric that helps improve product quality and value to consumers.

Who invented NPS

The Net Promoter Score (NPS) in 2003 was invented by Fred Reicheld of Bain & Company. I recommend everyone who is interested in this issue to read his article The One Number You Need to Grow, published in the magazine Harvard business Review.

Fred argued that the NPS Index performs just as well as lengthy customer satisfaction surveys. Firstly, NPS implies only one question, and secondly, it correlates well with the long-term growth of the company.

How NPS is calculated

You need to ask your clients a simple question: "How pleasant is it for you to recommend our company to your friends or colleagues?" The answer is a number from 0 to 10. As a result, the respondents are divided into supporters of your product (9-10 points), neutral consumers (7-8 points) and critics (0-6 points).

To get the NPS index, subtract the percentage of critics from the percentage of supporters. The number can range from -100 (if all users surveyed are critics) to +100 (all supporters). An NPS greater than zero is considered good, and a +50 score indicates excellent loyalty.

Additional questions

In addition to the main question, you can ask clients open-ended questions such as: "Why did you give the company such an assessment?" This method makes NPS not only a metric of your current success, but also a basis for improving future performance.

It can also be helpful to ask buyers how willing they are to recommend similar or alternative competitor products. This will allow you to correlate your NPS with the indices of other manufacturers. Just keep in mind that these results will not be objective enough: instead of polling a random sample potential consumers(including those that choose competitors), you are considering already established own users.

You should think carefully before asking your customers additional questions about the reasons for their ratings: of course, this will help you better understand the situation, but at the same time it will significantly reduce the speed of response. In any case, you have to compromise.

Methods for collecting estimates

For online products, NTS evaluations usually either conduct email surveys or enter reminder hints into the product receipt process. To increase your response rate, it's important to cover both desktop and mobile versions of your product. You can create a survey tool yourself, but I usually recommend using one of the following ready-made solutions that support the collection and analysis of responses received across all channels and across all interfaces, such as SurveyMonkey.

One of the problems with such surveys is the obvious bias towards more engaged buyers, because those who are dissatisfied with the product, most likely, will not respond to newsletters either. Below we'll talk about how to deal with this.

Sampling for NPS

It is very important that each NPS survey is conducted on a random, representative sample of consumers. We often came across the fact that the respondents were not really random. For example, there is a strong correlation between NPS results and engagement or time that a customer uses a product. Try to sample the engagement and product lifespan across your entire user base.

Polling rate

At first, great importance is the size of your user base. The smaller it is, the larger the sample you will have to poll and the longer it will take until you get enough answers. This imposes limits on the start time of the next poll.

Second, the frequency of surveys can be related to the product development cycle. It is product improvements that drive NPS growth, so your survey frequency should depend on how quickly you iterate.

NTS is a lagging indicator. After you've implemented the changes to the user experience, it takes some time for customers to feel them, and then reflect them in their ratings.

We at LinkedIn found that the best survey frequency is quarterly, which is in line with our quarterly product planning cycle. This allowed us to get the most fresh assessments before starting the next quarterly planning. We could quickly respond to the results of our surveys when drawing up the next roadmap.

Analytical team

If you are using NPS to improve your user experience, it makes sense to share the survey data with everyone involved in product development.

At LinkedIn, we included in the core NPS team not only product managers, but also those who were involved in product marketing, marketing research and business operations. Every quarter, we shared our discoveries with the entire R&D team. Of course, a lot depends on how your product development is organized, but it is still important that the right stakeholders are involved in this process from the very beginning.

Comment analysis

Examining user comments and responses to open-ended questions is the most useful part of the NPS analysis. Once a quarter, after each survey, we read the responses of clients and categorized all the pros and cons that were encountered in them.

Based on this categorization, we have compiled suggestions on how to improve the user experience and eliminate pain points. Reading every comment can seem daunting, but it’s no substitute for listening to each customer’s voice and learning how they formulate their experience with the product.

Supporters behavior

We spend quite a lot of time researching negative feedback and solving the problems associated with it, but we have found it just as useful to understand the specifics of positive user experience.

When comparing NPS results with customer behavior strategy (registration, search, profile view), we saw a significant correlation between certain actions with the product and higher NPS. This is how we highlighted the moments when customers really enjoyed using the product. And then we focused on product optimization in order to bring as many users from our base as possible to this point.

The easiest way to accomplish this is to examine each major activity with your product and see if there are clear correlations with the NPS scores.

Methodology

We found the NPS to be sensitive to methodological changes. Therefore, it is important to be very consistent in the survey methodology. The order of the questions and the list of competitors you ask about matters. The sampling approach itself matters too. Change your methodology as little as possible.

Seasonality

NPS results are influenced by seasonal factors. We have seen this for ourselves and have heard that this is true for other businesses as well. To minimize the effect of seasonality, it makes sense to compare annual rather than quarterly changes. At the very least, you should be aware of how it can affect your grades.

NPS limitations

NPS is an effective metric for understanding user loyalty and developing an action plan to increase it, but this method has limitations to keep in mind.

1. The relatively low frequency of NPS results makes it a poor operational metric for tracking your daily activities. Therefore, keep using your current acquisition, retention, and monetization tools to track regular performance, conduct A / B tests, and other types of optimization.

2. The margin of error for NPS results depends on your sample size. It is important to be aware of this and not to worry about small discrepancies in the results of two consecutive tests. Classic tools like engagement metrics do not impose large sample requirements and have a much smaller margin of error.

3. NPS analysis is by no means a substitute for your product strategy. This tool only provides an understanding of how customers perceive the product and what exactly to optimize in order to better implement an existing strategy.

05 01 medical biochemistry where to work

05 01 medical biochemistry where to work Biochemistry who can work

Biochemistry who can work Types of monopolies: natural, artificial, open, closed

Types of monopolies: natural, artificial, open, closed