General strategies for porter. Competitive strategies according to M. Porter Porter what is strategy

How to compete in the market according to Michael Porter?

In this article we will consider the concept of competitive strategy according to M. Porter.

Almost all marketers say that “ Competitive strategy: A Methodology for Analyzing Industries and Competitors ”, written by Harvard Business School professor Michael Eugene Porter back in 1980, is still relevant today. What are the strategies proposed? What is their essence? Can they be combined?

1) cost leadership (also known as cost minimization);

2) differentiation (earlier this concept was associated with the term USP - a unique selling proposition);

3) concentration (otherwise - focusing). It does not apply on its own, but acts according to Porter constituent element strategy 1 or 2.

In defining competitive strategy in general terms, Porter mentions the “five competitive forces” that a company must overcome in order to achieve a higher return on investment and a stable position in its industry. Let's list these forces, they can act both together and separately:

1) market competition- the rivalry of sellers working in this market;

2) the influence of potential competitors, that is, the threat of other sellers entering the market who will offer a similar product (service);

3) product competition - the influence of substitute goods (analogs);

4) the influence of consumers (buyers) - the possibility of economic impact on the company from their side (demand, change in purchasing power, etc.);

5) the influence of suppliers - the possibility of pressure on the company from suppliers by economic levers.

The basic strategies proposed by Porter are aimed precisely at minimizing the negative impact of these five forces and ensuring a sustainable income for the company through leadership in any area: price, product or "niche".

Let's see how it looks in practice in the context of each of the three competitive strategies.

1. Cost minimization (cost leadership): price competition

The lower the costs, the lower the cost of production, and ultimately the profit from its sale. According to Porter, companies that have adopted a strategy of minimizing costs in comparison with the costs of competitors ensure themselves market leadership by protecting themselves from the negative influence of all five competitive forces, because low costs:

- protect the company from competitors: the struggle for the most favorable terms of the transaction will reduce its profits, but only until the profits of the competitor occupying the next most efficient position in the market are exhausted. It is clear that less efficient companies will be the first to leave the game in a cost war;

- protect the company from the most influential buyers: all that remains for them is to bring down the prices of the goods of this company to the price level of the nearest competitor;

- protect the company from suppliers: when prices for purchased resources rise, it can flexibly change countermeasures to suppliers;

- give rise to a high "entry threshold" for new competitors to enter the industry, which consists of cost advantages and / or economies of scale;

- as a rule, they put the company's products in a more advantageous position relative to analogue substitutes.

2. Differentiation strategy: product competition

A company working with this strategy strives first of all to ensure that its product is somewhat unique ( specifications, the highest reliability, exclusive material, the absence of controversial ingredients used by competitors, etc.).

And since different products can have different unique characteristics, several companies working according to this strategy can coexist at the narrow top of the competitive “pyramid”. Note that it automatically excludes the first strategy, because differentiation requires an increase in R&D costs, directly on production technology, on services, on marketing, etc.

How does this strategy help to counter the five forces?

- protection from competitors: consumers loyal to this particular trade mark, are unlikely to "go to another" (a classic example - "fans" of the Apple brand);

- uniqueness is often protected by patents, but even if this is not the case, a “differentiated” product raises serious barriers to new players;

- protection from suppliers: differentiation means more high profitability, which, in turn, allows you to accumulate financial reserves for the search for other sources of supply of resources;

- protection from analogues: it is difficult or almost impossible to find a replacement for a unique product;

- and, consequently, the choice of consumers is shrinking, and they are deprived of the opportunity to bring down prices for this product.

3. Concentration strategy: competition in the "niche"

This is work in a very narrow segment, not to be confused with a “small group of consumers”: a certain assortment, market, a specific group of buyers, etc. For example, everyone loves to take pictures, but company X produces exclusively professional photographic equipment, which costs accordingly. Thus, without attracting buyers with a low price or uniqueness of the product, the company works with a narrow range of extremely specific needs, satisfying the needs of buyers of a certain narrow group.

The concentration strategy, it is important to note, is combined with one of the previous ones: in its niche, a company can become either a leader in reducing costs, or in terms of the characteristics of a product that has no analogues and therefore (unambiguously) is preferred by consumers of this narrow segment.

“In order for a company to generate stable, growing income, it needs to achieve leadership in one of three areas: in product, in price, or in a narrow market niche,” said Michael Porter, presenting his theory of effective competition to the whole world. In this article, we will look at the basic competitive strategies of an enterprise according to Porter and offer an action plan for a company that has not yet determined a strategic direction for business development. Each type of competitive strategy we have reviewed is actively used in marketing around the world. The presented classification of competition strategies is very convenient and suitable for a company of any size.

The leading competitive strategy professional is Michael Porter. Throughout its professional activity he was engaged in the systematization of all models of competition and the development of clear rules for conducting competition in the market. The figure below shows the modern classification of competitive strategies according to Porter.

Let's understand the concept and essence of a competitive strategy for a business. Competition strategy is a list of actions that a company takes to generate higher profits than its competitors. Thanks to an effective competitive strategy, the company attracts consumers more quickly, incurs lower costs for attracting and retaining customers, and receives a higher rate of return (margin) from sales.

Porter identified 4 types of basic competitive strategies in the industry. The choice of the type of competitive strategy depends on the capabilities, resources and ambitions of the company in the market.

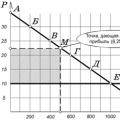

Figure 1 Michael Porter's Competitive Strategy Matrix

The matrix of Porter's competitive strategies is based on 2 parameters: the size of the market and the type of competitive advantage. Market types can be broad (large segment, whole product category, the whole industry) or narrow (a small market niche that accumulates the needs of a very narrow or specific target audience). The type of competitive advantage can be of two types: low cost of goods (or high profitability of products) or a wide variety of assortments. Based on this matrix, Michael Porter identifies 3 main strategies for the company's competitive behavior in the industry: cost leadership, differentiation and specialization:

- Competitive or differentiation means creating unique product in branch;

- Competitive or price leadership means the ability of the company to achieve the lowest cost level;

- Competitive or niche leadership means focusing all the company's efforts on a specific narrow group of consumers;

There are no “middle” strategies

A firm that does not choose a clear direction for a competitive strategy - “gets stuck in the middle”, does not work efficiently and functions in an extremely unfavorable competitive situation. A company without a clear competitive strategy loses market share, ineffectively manages investments, and receives a low rate of return. Such a company loses buyers interested in a low price, so it is not able to offer them an acceptable price without losing profits; and on the other hand, it cannot get buyers interested in the specific properties of the product, since it does not focus on the development of differentiation or specialization.

Action plan

If your company has not yet decided on the vector of a competitive strategy, then it is time to rethink the key goals and objectives of the business, assess the resources and capabilities of the company and go through 3 consecutive steps:

Michael Porter was born on May 23, 1947 in the state of Michigan in the family of an officer of the American army. He graduated from Princeton University, then received an MBA and a Ph.D. from Harvard University, completing each stage with honors. Since 1973 he has been working at the Harvard University Business School, since 1981 as a professor. Lives in Brooklyn, Massachusetts.

Throughout his scientific career, M. Porter was engaged in the study of competition. He has been a consultant to many leading companies such as T&T, DuPont, Procter & Gmble and Royl Dutch / Shell, rendered services to the directorate lph-Bet Technologies, Prmetric Technology Corp., R&B Flcon Corp. and ThermoQuest Corp... In addition, Porter has served as a consultant and advisor to the governments of India, New Zealand, Canada and Portugal, and is currently a leading regional strategy development officer for presidents of several Central American countries.

Being one of the most influential specialists in the field of management, Porter largely determined the main directions of research of competition (primarily in a global context), proposed models and methods of such research. He managed to connect the issues of developing enterprise strategy and applied microeconomics, which were previously considered independently of each other.

He has written 17 books and over 60 articles. Among the most famous: "Competitive strategy: a methodology for analyzing industries and competitors" ( Competitive Strtegy: Techiques for nlyzing Competitors) (1980), "Competitive advantage: how to achieve a high result and ensure its sustainability" ( Competitive dvntge: Creting nd Sustining Superior Performnce) (1985) and "Competitive Advantages of Countries" ( Competitive dvntge of Ntions) (1990).

In his main book, Competitive Strategy, Porter proposed revolutionary approaches to the development of strategy for the enterprise and individual sectors of the economy. This book is based on a careful study of hundreds of companies in various business areas. According to Porter, the development of a competitive strategy comes down to a clear formulation of what should be the goals of the enterprise, what means and actions will be needed to achieve these goals, what methods the enterprise will use to compete. Managers and consultants often use different terminology when talking about strategy. Some talk about "mission" or "task" meaning "purpose", others talk about "tactics" meaning "current operations" or " production activities". However, in any terms the main condition in the development of a competitive strategy is the differentiation of goals and means.

On picture 1 competitive strategy is presented in the form of a scheme called by Porter "The Wheel of Competitive Strategy":

- the axle of the wheel is goals companies, including a general definition of its competitive intentions, specific economic and non-economic objectives, the results that it plans to achieve;

- wheel spokes are funds(methods) by which the company seeks to realize its main goals, key areas of business policy.

For each point of the scheme, the key points of the business policy are briefly identified (depending on the nature of the business, the formulations can be more or less specific). Together, goals and directions represent a concept of strategy that guides a company through its development and market behavior. As with the wheel, the spokes (methods) come from the center (s) and are connected to each other; otherwise, the wheel will not roll.

In general, the development of a competitive strategy is associated with consideration of the key factors that determine the boundaries of its capabilities for the organization ( rice. 2). The strengths and weaknesses of the company are in the structure of its assets and competencies in comparison with competitors, including financial resources, technological state, brand recognition, etc. The individual values of the organization include the motivation and demands of both top managers and other employees of the company who are implementing the chosen strategy. Strengths and weaknesses, combined with individual values, determine the internal constraints on strategy choices.

It is equally important when developing a competitive strategy to take into account factors external to the company and set by its environment. The concept of "environment" is understood by Porter very broadly, it includes the action of both economic and social forces. Key element external environment the company is the industry (industry) in which it competes: the structure of the industry largely determines the rules of the game, as well as the acceptable options for competitive strategies. Insofar as external factors tend to affect all companies in the industry at the same time, taking into account the forces acting outside the industry is relatively less important in developing a successful competitive strategy, more important than the ability of a particular company to interact with these forces.

The intensity of competition in the industry is far from accidental. It is determined by the economic structure of the industry, and not by subjective factors (for example, luck or the behavior of existing competitors). According to Porter, the state of competition in an industry depends on the action of five major competitive forces (rice. 3). The cumulative impact of these forces determines the ultimate potential for profitability in the industry, measured as a long-term measure of return on investment. Industries differ significantly in their potential for profitability because of the different competitive forces at work. With intense exposure (for example, in industries such as the production of car tires, paper industry, ferrous metallurgy) companies are not making impressive profits. With relatively moderate exposure, high profits are common (in the production of oilfield equipment, cosmetic products and toiletries; in the service sector).

Michael Porter proposed a revolutionary approach to developing enterprise strategy - using the laws of microeconomics. He began to view strategy as a basic principle that can be applied not only to individual companies but also to entire sectors of the economy. The analysis of strategic requirements in various industries allowed the researcher to develop five forces model (rice. 3), taking into account the effect of five competitive factors:

- The emergence of new competitors. Competitors inevitably bring new resources, which requires other market participants to attract additional funds; accordingly, profit decreases.

- The threat of substitutes. The existence of competitive analogs of products or services in the market forces companies to limit prices, which reduces revenue and reduces profitability.

- The ability of buyers to defend their own interests. This entails additional costs.

- The ability of suppliers to defend their own interests. Leads to higher costs and higher prices.

- Rivalry between existing companies. Competition requires additional investment in marketing, research, new product development, or price changes, which also reduces profitability.

The impact of each of these forces varies from industry to industry, but collectively they determine a company's long-term profitability.

Porter offers three basic strategies: absolute leadership in costs; differentiation; focusing... By using these strategies, companies will be able to counter competitive forces and achieve success. For the effective implementation of the chosen basic strategy, it is necessary: the development of targeted strategic plans (organizational measures), coordination of actions of all divisions of the company, well-coordinated team work. Based on the basic strategy, each company develops its own own version strategy. Achievement of specific companies in comparison with competitors in some industries can lead to an overall increase in the level of profitability for all. In other industries, the very ability of a company to receive an acceptable profit depends on the success of a competitive strategy.

Porter makes it clear that no single “best” strategy exists in any industry: different companies use different strategies, and the same five competitive forces operate in each industry, albeit in different combinations.

Another significant contribution of Michael Porter to management theory is the development of value chain concepts... It takes into account all the actions of the company that lead to an increase in the value of a product or service. The researcher highlights the main activities related to the production of goods and their delivery to the consumer, and subsidiary that either directly contribute to value creation (such as technological development) or enable the company to operate more efficiently (through the creation of new lines of business, new procedures, new technologies, or new inputs). Understanding the value chain is essential: it allows you to understand that a company is more than a set. different types activities, since all activities in the organization are interrelated. In order to ensure the achievement of competitive goals and successfully respond to external influences from the industry, the company must decide which of these activities should be optimized, which trade-offs are possible.

In his work "Competitive Advantages", Porter moved from analyzing the phenomenon of competition to considering the problem of creating lasting competitive advantages. Later, he concentrated his efforts on applying the developed principles of competitive strategy analysis on a global scale.

In Competition in Global Industries (1986), Porter and colleagues applied these principles to companies operating on international markets... Based on industry analysis, Porter highlighted two types of international competition... According to his classification, there are multi-internal industries in which there is internal competition in each individual country (for example, private banking), and global industry. Global is “an industry in which the competitive position of a firm in one country is largely dependent on its position in other countries, and vice versa” (for example, automotive and semiconductor technology). According to Porter, the key difference between the two types of industries is that international competition in multi-domestic industries is optional (companies can decide whether to compete in foreign markets or not), while competition in global industries is inevitable.

International competition is characterized by the distribution of activities that form a value chain between several countries. Therefore, in addition to choosing the space for competition and the type of competitive advantage, companies must develop options for their strategy, also taking into account the characteristics included in the value chain of activities:

- geography of distribution and concentration (where they are carried out);

- coordination (how closely they are related to each other).

There are four possible combinations of these factors:

- High concentration - high coordination (simple global strategy: all actions are carried out in one region / country and are highly centralized).

- High concentration - low coordination (strategy based on export and decentralization of marketing activities).

- Low concentration - high coordination (strategy of large foreign investment in geographically dispersed but well coordinated operations).

- Low concentration - low coordination (country-oriented strategy in which decentralized subsidiaries focus on their own markets).

There is also no single “best” strategy for companies in the struggle in international markets. Each time, the strategy is chosen depending on the nature of the competition in the industry and the actions of the five main competitive forces. Porter points out that there are cases when there is a "scattering" of some activities that determine the value chain, and the "concentration" of others. It is important to remember that competitive advantage is determined primarily by how this or that type of activity is carried out, and not where .

In the book "Competitive Advantages of Countries" (1990), Porter deepens the analysis of the phenomenon of competition: reveals determinants determining the action of competitive forces at the national level:

- working conditions (the presence in the country of such factors necessary for the production of products as a skilled labor force or industrial infrastructure);

- demand conditions (features of the market for a specific product or service);

- the presence of supporting or related industries (internationally competitive suppliers or distributors);

- nature of the company's strategy (features of rivalry with other companies, including factors such as organizational and management climate, as well as the level and nature of internal competition).

The impact of these determinants can be found in every country and in every industry. They determine the action of the forces of competition within industries: “Determinants national advantage reinforce each other and grow over time to enhance the competitive edge in the industry. ” The emergence of such a competitive advantage often leads to an increase in concentration both in individual industries (mechanical engineering in Germany, electronics industry in Japan) and in geographical areas (in northern Italy, in the Rhine regions in Bavaria).

Porter places particular emphasis on the importance of national competitive advantage often occurs under the influence initially unfavorable conditions when nations or industries are forced to actively respond to a challenge. “Selected factor deficiencies, powerful local buyers, early market saturation, skilled international sourcing, and intense domestic rivalry can be critical to creating and maintaining an advantage. Pressure and adversity are powerful drivers of change and innovation. ” When new industrial forces try to change the existing order, nations go through ups and downs - in terms of having a competitive advantage. The author makes an optimistic forecast: “Ultimately, nations will succeed in certain industries, because their internal environment is the most dynamic and most active, and also stimulates and encourages companies to increase and expand their advantages ”.

The significance of Porter's contribution to management theory is not disputed by anyone. At the same time, some of the shortcomings of his work provoked a number of just criticisms. For example, the distinction he introduced between multi-domestic and global industries may disappear when demands for free trade and growing exports bring elements of international competition to the domestic markets of virtually all industries.

The main advantage and appeal of Porter's models is their simplicity. He encourages readers to use the proposed models as starting points for their own analysis of the relationships between various elements. These models provide extremely flexible opportunities for choosing the direction of movement, developing a strategy (especially international).

Michael Porter suggested effective methods to analyze the phenomenon of competition and to develop a company's strategy (both in domestic and international markets). He demonstrated the benefits of joint exploration of strategic and economic challenges, thus making an important contribution to the development of understanding of strategy and competition.

The article is provided to our portal

editorial office

Relationship. Almost all countries of the world participate in them to one degree or another. At the same time, some states receive large profits from foreign economic activity, constantly expand production, while others can barely maintain the available capacities. This situation is determined by the level of competitiveness of the economy.

The urgency of the problem

The concept of competitiveness is the subject of numerous discussions in the circles of people who host corporate and government management decisions... The growing interest in the problem is due to various reasons. One of the key is the desire of countries to take into account the economic requirements that are changing within the framework of globalization. Michael Porter made a great contribution to the development of the concept of state competitiveness. Let's consider his ideas in more detail.

General concept

The standard of living in a particular state is measured in terms of national income per capita. It increases with the improvement of the economic system in the country. Michael Porter's analysis showed that the stability of the state in the external market should not be viewed as a macroeconomic category, which is achieved by the methods of fiscal and monetary policy. It should be defined as productivity, efficient use of capital and labor. formed at the enterprise level. In this regard, the welfare of the state economy must be considered in relation to each company separately.

Michael Porter's theory (briefly)

For successful operation, enterprises must have low costs or endow products with differentiated quality at a higher cost. To maintain their position in the market, companies need to constantly improve products and services, reduce production costs, thus increasing productivity. Foreign investment and international competition are a particular catalyst. They form a strong motivation for businesses. Together with on international level can have not only a beneficial effect on the activities of companies, but also make certain industries completely unprofitable. This situation, meanwhile, cannot be considered absolutely negative. Michael Porter points out that the state can specialize in those segments in which its enterprises are most productive. Accordingly, it is necessary to import those products in the production of which companies show results worse than foreign firms. As a result, the overall level of productivity will increase. Import will be one of the key components in it. You can increase productivity by establishing affiliated enterprises abroad. Part of production is transferred to them - less efficient, but more adapted to new conditions. The profits from production are channeled back to the state, thus increasing the national income.

Export

No state can be competitive in all areas of production. When exporting to one industry, labor and material costs are increased. This, accordingly, negatively affects the less competitive segments. Constantly increasing exports cause an appreciation of the national currency. Michael Porter's strategy assumes that the normal expansion of exports will be facilitated by the transfer of production abroad. In some industries, undoubtedly, positions will be lost, but in others they will get stronger. Michael Porter believes that they will limit the possibilities of the state in foreign markets, slow down the rise in the standard of living of citizens in the long term.

The problem of attracting resources

And foreign investment can certainly significantly increase national productivity. However, they can also provide Negative influence at her. This is due to the fact that in each industry there is a level of both absolute and relative productivity. For example, a segment can attract resources, but export from it is not possible. The industry is not able to withstand competition in the field of imports if the level of competitiveness is not absolute.

Five Forces of Competition by Michael Porter

If the country's industrial sectors, which are yielding to foreign firms, are among the more productive in the country, then its overall ability to provide an increase in productivity is reduced. The same is true for firms that move more profitable activities abroad, since there are less costs and earnings. In short, Michael Porter's theory links several indicators that determine the country's stability in the foreign market. There are several methods for increasing competitiveness in each state. Working with scientists from ten countries, Michael Porter has formed a system of the following indicators:

Factor conditions

Michael Porter's model suggests that this category includes:

Clarifications

Michael Porter points out that key factoring conditions are not inherited, but created by the country itself. In this case, it is not their presence that matters, but the pace of their formation and the mechanism of improvement. One more important point consists in the classification of factors into developed and basic, specialized and general. It follows from this that the stability of the state in the foreign market, based on the above conditions, is strong enough, albeit fragile and short-lived. In practice, there is a lot of evidence supporting Michael Porter's model. An example is Sweden. It capitalized on its largest low-sulfur iron deposits until the metallurgical process changed in the main Western European market. As a result, the quality of the ore ceased to cover the high costs of its extraction. In a number of knowledge-intensive industries, certain basic conditions (for example, cheap labor and abundant natural resources) may not provide any advantages at all. To increase productivity, they must be tailored to specific industries. It can be specialized personnel for processing industrial enterprises which are problematic to form elsewhere.

Compensation

Michael Porter's model assumes that the lack of certain basic conditions can act as strong point motivating companies to improve and develop. So, in Japan, there is a shortage of land. The absence of this important factor began to act as the basis for the development and implementation of compact technological operations and processes, which, in turn, became very popular in the world market. The lack of certain conditions must be compensated for by the advantages of others. So, for innovations, appropriate qualified personnel are needed.

State in the system

Michael Porter's theory does not include it among the basic factors. However, when describing the factors that influence the degree of stability of the country in foreign markets, the state is assigned a special role. Michael Porter believes that it should act as a kind of catalyst. Through its policy, the state can influence all elements of the system. At the same time, the influence can be both beneficial and negative. In this regard, it is important to clearly formulate the priorities of the state policy. As general recommendations advocate development promotion, stimulation innovation activities, increased competition in domestic markets.

Spheres of influence of the state

The indicators of production factors are influenced by subsidies, policies in the field of education, financial markets, etc. The government determines the internal standards and norms for the production of certain products, approves instructions that influence consumer behavior. The state often acts as a large buyer of various products (goods for transport, army, education, communications, health care, and so on). The government can create conditions for the development of industries by establishing control over advertising media, regulating the operation of infrastructure facilities. The policy of the state is able to influence the structure, strategy, peculiarities of enterprise rivalry through tax mechanisms, legislative provisions. The influence of the government on the level of the country's competitiveness is quite large, but in any case it is only partial.

Conclusion

An analysis of the system of elements that ensure the stability of any state allows us to determine the level of its development, the structure of the economy. The classification of individual countries was carried out in a specific time period. As a result, 4 stages of development were identified in accordance with four key forces: production factors, wealth, innovation, investment. Each stage has its own set of industries and its own lines of business. Highlighting the stages allows you to illustrate the process of economic development, to identify the problems that companies face.

Harvard professor Michael Porter presented three of his strategies for strengthening the company's competitiveness back in 1980 in his book Competitive Strategy. Since then, Porter's strategies have not lost their relevance. Of course, many entrepreneurs believe they have enough general form... But wait, Michael Porter is a professor, a consultant - his task is precisely to collect general methods and present them to the public at large. Practical subtleties are a private matter for every businessman.

Porter described his strategies at a time when the concept of positioning, described by Jack Trout and Al Rice, was just gaining popularity. The main essence of Michael Porter's strategies is that for the successful functioning of the company, it needs to somehow stand out from the competitors, so as not to appear in the eyes of consumers as everything for everyone, which, as you know, means nothing to anyone. To cope with this task, the company must choose the right strategy, which it will subsequently adhere to. Professor Porter identifies three types of strategy: cost leadership, differentiation and focus. At the same time, the latter is divided into two more: focusing on differentiation and focusing on costs. Let's consider each strategy in detail.

Cost Leadership

This strategy is extremely simple. To be successful, a company must reduce costs and become a leader in this indicator in its industry. Usually, this type of strategy is understandable to absolutely all employees of the company, especially if its activities are related to the production of any goods. But being the most economical company in the industry is not an easy task. Firstly, for this you will have to use all the most modern equipment and try to achieve maximum process automation. Accordingly, a company trying to become a cost leader needs the highest quality personnel who will do their job faster and better (while getting more).

In order to have low costs, the company will have to serve many different market segments. This is logical, since the larger the scale of production, the lower the cost of it. This, according to Michael Porter, is the most important aspect of this strategy.

In order to remain the leader in terms of costs all the time, the company will have to constantly look for new opportunities to save money by introducing new technique management, the most recent technical developments... In addition, the principles of differentiation cannot be ignored, as there is the possibility that buyers will find the quality of the company's products not worthy of them. And therefore, one must understand that low costs are not synonymous with low-quality products, and are not even synonymous with cheap products. With proper positioning, no one bothers to sell products at the same price as competitors. And at the expense of low costs, the company will be able to get higher profits.

The cost leadership strategy involves constant monitoring of the current situation. This strategy is very dangerous, since there is a high probability that sooner or later there will be competitors who can make their costs even lower. All this is possible, both due to better marketing and due to such factors as: distribution network, technological progress, management know-how, external factors in the country and the world, the arrival of larger global players on the market, loss of employee motivation and etc.

One of the main temptations for the cost leader is the expansion of the product range. But it is worthwhile to resort to it 10 times thinking, since such an expansion can destroy all the cost advantage, thereby ruining the company. Another factor that shouldn't be overlooked is consumers. They can be the factor that can force the company to lower prices, leading to the destruction of the leader's entire cost advantage.

Differentiation

Differentiation was previously based on the concept of a unique trade offer... This is no longer the case. In principle, with proper marketing, a company's product may be typical of the industry, but in the minds of consumers it will be special. Differentiation is precisely about taking a unique place in the minds of consumers, I operate with some unique property product.

Differentiation, however, can refer not only to the product itself or marketing, but also to the distribution system (for example, credit cards of Tinkoff Bank can only be obtained through direct mail) and so on. This strategy allows you to create products that will cost end users much more expensive than competitors' products. (we are talking about luxury goods) But do not get carried away, when differentiating, it is very important to keep track of finances all the time, since if it is mismanaged, it may turn out that the company is going to the bottom.

Among the successful examples of differentiation should be noted the strategy of the company 7Up, which presented its drink as "not Cola". 7Up had an overwhelming success, which would only have developed if the company, for no one understandable reasons, for some time did not abandon its “no-cola” strategy and switched to “America chooses 7Up”. Volkswagen "Beetle" is one of the best examples differentiation. This car was introduced at a time when large, beautiful and often expensive cars were in vogue in the United States. The Beetle did not fit any of these definitions and quickly became the best-selling car in the United States. However, then there was a failure. This was due to the fact that Volkswagen decided to become everything to everyone by changing its differentiation strategy.

Companies pursuing a differentiation strategy can fall prey to problems such as large cost differentials with an industry leader. This may lead to a situation that the company will become irrelevant, despite all its positioning. Also, there is a high probability that the company's product will be copied by competitors. In this way, all the differentiating advantages of the company (if it is associated with the product) can be lost. Finally, it's worth noting that a company pursuing a differentiation strategy must keep a close eye on costs. The appearance of the Japanese luxury car under the Lexus brand has hit the big US and European giants such as Cadillac and Mercedes. The Japanese also positioned themselves as a luxury car, but due to lower costs, it was much cheaper than similar Cadillacs.

Focusing

A focusing strategy is to target a specific segment in the industry and target it exclusively so that that specific group of buyers will differentiate the company from the competition. Accordingly, the company's task is to look attractive for this particular segment of buyers. Michael Porter divides the focusing strategy into two parts. The first is the focus on costs. Moreover, it is associated with focusing on costs in working with one segment of the industry allocated by the company. At the expense of lower costs, the company will be able to achieve a high competitive advantage in the eyes of its target group. The second offshoot of the strategy is focusing on differentiation. In this case, the company's task is to present its product as attractive as possible for a specific target audience. In this case, it is important to choose a narrow target audience (not in quantity), which will differ significantly from the rest of the audience.

The problem with this strategy is that when working with a small target audience, the company will have higher costs than one that works for the entire industry. Finally, Michael Porter highlights another important threat - competitors can find a narrow segment of the market in the segment in which the company operates, thereby seriously complicating its life.

According to Michael Porter, any of these strategies gives the company a competitive advantage. The worst thing is if the company is delayed halfway to the choice of strategy. In this case, it will gradually lose its market share, its costs will grow, which will not allow working with large buyers. Also, the company will not be able to grasp narrow niches and compete with other products that have bypassed it due to differentiation. When choosing one of basic strategies It is very important for Porter to represent what the company ultimately wants to achieve. After all, focusing and differentiating strategies can even lead to a serious decrease in income (but not profit). All this leads to the fact that when choosing a strategy for an operating company, a full-fledged reorganization may be necessary, which will inevitably entail dismissals.

Michael Porter's basic strategies are management classics and have served as the basis for many of the current strategies. I hope this article was helpful for you as well.

05 01 medical biochemistry where to work

05 01 medical biochemistry where to work Biochemistry who can work

Biochemistry who can work Types of monopolies: natural, artificial, open, closed

Types of monopolies: natural, artificial, open, closed