What is profit and. What is profit in simple words. Profit types and methods of their calculation

Profit in the economy is a monetary ratio between costs and costs. products sold... How it is analyzed, how it is formed, and how it is distributed under conditions market economy, we will talk in the article.

Accounting, normal and economic profit

There are three types of accounting in economics - this is what is the difference between the price of goods sold and the cost of its production. Reward entrepreneurial activity called normal profit, it is the cost of production. And the difference between normal and booked profit is economic. Real according to the main criterion - the size, since the profit in the economy is just the size of the enterprise's income.

It arises on the condition that the total revenue not only covers, but also exceeds all internal and external costs. This includes the normal return on capital interest. Striving for greater profit is an incentive for entrepreneurs to use resources as efficiently as possible, reduce costs, master new technological advances, use scientific potential, achieve technological progress and open new industries.

Under these conditions, the total amount of income from the listed types of activities, including the main ones, also grows, since profit in the economy is, first of all, the balance gain, which is the total amount from all available types of activities.

How businesses generate income

The profits for the enterprises come, of course, from the main production. Ancillary activities bring only some of them, formed after the performance of non-industrial services - transport, construction, from the work of ancillary farms and enterprises selling products. In the same way, revenues (profits) are replenished through the provision of paid services to the population.

There is also non-sales activity for almost every enterprise, regardless of its size and importance. She also makes a profit.

The difference is calculated between penalties, fines, forfeits, that is, the amounts paid and the amounts received: rent from renting out own premises, income from operating with packaging, and the like. This balance will be considered as profit from non-operating activities.

The financial result of the enterprise

The current conditions of the crisis, in which all enterprises of the country, without exception, are placed, forced to mobilize all available internal resources, which could, if not increase, then at least keep the existing profit at the same level. Calculation and planning economic activity are now the main components of the successful functioning of the enterprise. Analysis, which determines the further course of the economic process, plays a huge role in this. Including - competent identification of ways to use profits.

Profit and its value are shown by all weak and strengths the work of the enterprise, and the analysis of its activities helps to accept the optimal. For this, all economic processes and relations are scrupulously researched. The financial result of the enterprise, as well as the analysis of ways to generate income, determines the rational ways of structuring funds and their rational use. In the same way, the analysis of financial activity is a tool for forecasting both individual indicators and the entire economic profit as a whole.

Financial control

By means of financial analysis, the cash flow is monitored, the rationality of the use of profit is checked. The profit should be checked for compliance with the standards and norms for the expenditure of material and financial resources, according to the expediency of costs.

Financial analysis has a certain information base - accounting statements. Its results are operated by both internal users (managers and management) and external users - creditors, owners, buyers, suppliers, exchanges, consultants, lawyers and even the press.

Of particular importance is the distribution of the company's profits, the study of key parameters, the compilation of an accurate and objective picture of its state in financial plan... Such control has its own purposes, aimed at studying the methods of financial activities of the enterprise.

Goals

The main goal pursued by the financial analysis- is the receipt of information on losses and income, structure, with all its changes in liabilities and assets, settlements with creditors and debtors, as well as distribution of the company's profits. The analyst or manager in this case is interested in and current state, and a projection to the near or distant perspective. These are the expected parameters of the financial condition.

Such goals can be achieved together with the solution of a whole set of certain interrelated tasks. Analytical tasks will have to concretize all organizational, informational, technical, methodological possibilities. An assessment of the financial performance of an enterprise is always based on the results of the analysis. accounting statements.

Deductive method of analysis

The main principle of analytical reading of reports is deductive - from general to specific - which is repeatedly applied in the course of analysis. This is how the logical and historical sequence of events and economic factors is reproduced, the direction is revealed, the components of profit and the strength of their influence on overall results activities.

Basic methods

Six main methods of reading reporting documentation can be distinguished among the many existing ones:

- Horizontal analysis. With it, each reporting item is compared with the previous period.

- Vertical. The structure is determined by the final financial performance and the impact of each reporting item on the overall result is identified.

- Trend analysis. Each position is compared with a number of previous ones, whereby a trend is determined - the main trend, dynamics this indicator, cleared of the contingencies of influence and personality in the characteristics of certain periods. The trend forms quite possible future indicators, thus making a long-term forecast for the profit of production.

- Relative indicators and their analysis. This is a calculation of the interaction of individual report items or items in different forms reporting, defining their relationship.

- Comparative, on-farm analysis, where individual summary reporting indicators are studied for the entire company, for subsidiaries and divisions. In addition, inter-farm indicators of this enterprise are compared with those of competitors. So count on modern enterprises profit in a market economy.

- Factor analysis. The influence of individual factors on the result indicator is analyzed using stochastic or deterministic research methods. This reporting is direct, when the effective indicator is split into its component parts, and also synthesized (inverse), when individual elements of the report are merged into a general indicator of effectiveness.

External financial analysis

The features of external financial analysis are as follows:

- its subjects are multiple, a large number of users are interested in information about the company's activities;

- the goals and interests of the subjects of analysis are diverse;

- there are standard methods, accounting and reporting standards;

- the analysis is focused only on external, public reporting;

- his tasks are limited due to the previous factor;

- the results are open to users wishing to get acquainted with information on the activities of the enterprise.

However, there may also be underwater currents. If the financial analysis is based only on financial statements and by its nature looks like an external one, carried out outside the enterprise by the hands of its interested counterparties, government agencies or owners, it still does not allow revealing the secrets of the company's success, since the content of the external analysis is only certain factors. The components of profit and the ways to achieve them usually remain outside the analytical material, only it is known financial results activities.

The above analysis is carried out in a certain way:

- The absolute indicators of profit are analyzed.

- Considered relative indicators profitability.

- Checked financial condition, market stability, balance sheet liquidity, solvency of the enterprise.

- The effectiveness of the use of loans is analyzed.

- The financial condition of the enterprise is diagnosed and the rating of the issuers is made.

Internal financial analysis

The variety of economic information on the activities of enterprises is truly great; there are also many ways to analyze it. Data financial statements and the analysis carried out on their basis is called the classical method. Interior economic analysis finance - the main one, which is supplemented by other data from system accounting, data on industrial technical training, regulatory and planning information, etc.

The main value of this information is in optimizing control. For example, an analysis of advancing capital and its efficiency, the relationship between costs, profits and turnover is required. Interior management analysis delves into the data production accounting in order to conduct a comprehensive assessment of the economy and study all economic activities - whether its efficiency is high.

Features of management analysis:

- results are focused on their own leadership;

- all sources of information are used;

- cannot be regulated from outside;

- full complexity in conducting, the study of all the activities of the enterprise;

- accounting, analysis, planning and decision making are integrated;

- the results are as closed as possible to comply with commercial secrets.

Profit analysis

The activities of the enterprise in terms of financial results are reflected in a whole system of indicators that make up profit. Their systematic consideration presents a certain difficulty, since most of the indicators characterize not only the financial result, but have many differences in purpose. The choice for the participants in the commodity exchange becomes difficult, since the needs for information related to the real state of the enterprise are often not met. The administration is primarily interested in the mass and structure of the profit received, as well as the factors that influenced its value. Tax authorities want to receive information, as reliable as possible, about the balance sheet profit, which includes the sale of products, income after the sale of property and much more from the same series.

This means that the analysis of the terms of profit in the economy is not abstract, but quite specific analysis helping to develop a strategy of behavior aimed at minimizing losses, financial risks etc. Here, first of all, such elements of the enterprise's activity are studied as changes in indicators - each for a given analyzed period - their structure and changes are studied, the dynamics of changes for whole line reporting periods (naturally, in a generalized form).

The net profit remaining at the disposal of the enterprise - funds after the payment of all taxes and deductions - is spent, as a rule, on the needs of the enterprise itself, and here a detailed analysis is especially necessary. This is the expansion of production, and an increase in spending on non-production needs, and protection the environment, and training, and the creation of social funds.

Topic: Formation of the financial results of the enterprise.

Plan : 1. Profit of the enterprise, its essence, significance, formation and distribution.

2. Indicators of profitability of the enterprise.

The profit of the enterprise, its essence, significance, formation and distribution.

In a market economy, profit is central to the performance of an enterprise. She acts as the goal of entrepreneurial activity.

characterizes the economic effect obtained as a result of the activities of the enterprise;

incentive function of profit (the greater the mass of profit, the more opportunities for expanding production);

is one of the sources for the formation of budgets at different levels.

In market conditions, there are three main sources of profit:

* the first source is formed due to the monopoly position of the enterprise for the production of a particular product or the uniqueness of the product. Maintaining this source at a relatively high level implies constant product renewal, and the opposing forces are the state antitrust policy and competition;

* the second source is directly related to the production and business activities of the enterprise. The effectiveness of its use depends on knowledge of the market situation and the ability to adapt the development of production to its changes. The amount of profit in this case depends on the correct choice of the production direction of the enterprise for the production of products, on the creation of competitive conditions for the sale of goods, on the volume of production, on reducing production costs;

* the third source is associated with the innovative activities of the enterprise. Its use presupposes the introduction of new technologies, the achievements of scientific and technological progress, the use of new types of raw materials and materials.

The final financial result of the economic activity of the enterprise is profit before tax... Profit before tax (balance sheet profit) is the sum of the profits (losses) of the enterprise, both from the sale of products and income (losses) not related to production and sales.

Profit before tax includes three consolidated elements:

- profit from the sale of products (works, services);

- profit from other sales;

- non-operating income (expenses).

Profit from the sale of products (works, services) Is the financial result obtained from the main activity of the enterprise, which can be carried out in any form fixed in its charter and not prohibited by law. Profit from the sale of products is determined as the difference between the cash proceeds from the sale of products (works, services) excluding VAT and excise taxes and the costs of production and sale.

Profit (loss) from other sales represents a financial result not related to the main activities of the enterprise. It reflects the profit (loss) from other sales, which includes the sale to the side of various types of property on the balance sheet of the enterprise.

Financial results from non-operating transactions- this is a profit (loss) on transactions of various nature, not related to the main activity and not related to the sale of products (works, services). Non-operating income is income:

From equity participation in other organizations;

From property lease (sublease);

From transactions of purchase and sale of foreign currency;

Non-operating results include losses and expenses:

Non-reimbursable losses from natural disasters;

Negative exchange rate differences on foreign currency accounts and operations in foreign currency;

Losses on operations of previous years;

Lack of material assets identified during the inventory.

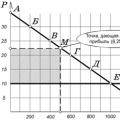

Scheme. Formation and distribution of profits.

The distribution object is profit before tax.... Its distribution is understood as the direction of profit to the budget and by items of use at the enterprise.

Profit distribution principles can be formulated:

the profit received by the enterprise as a result of production, economic and financial activities is distributed between the state and the enterprise, as an economic entity;

profit for the state goes to the respective budgets in the form of taxes and fees, the rates of which cannot be arbitrarily changed. The composition and rates of taxes, the procedure for their calculation and contributions to the budget are established by law;

the amount of the enterprise's profit remaining at its disposal after taxes should not reduce its interest in increasing production volumes and improving the results of production, economic and financial activities;

the profit remaining at the disposal of the enterprise, first of all, should be directed to accumulation, ensuring the further development of the enterprise, and only in the remaining part - to consumption.

When distributing profits and determining the main directions of its use, it is necessary to take into account the state of the competitive environment. Competitive struggle determines the need for a significant expansion and renewal of production potential.

For each organizational and legal form, an appropriate mechanism for the distribution of profits remaining at the disposal of the business entity has been determined. It is based on the peculiarities of the internal structure and regulation of the activities of business entities of the corresponding forms of ownership.

The procedure for the distribution and use of profits is fixed in the Charter and is determined by the regulation, and the basic principles of distribution are reflected in the accounting policy of the economic entity. Profit spending can be carried out either by direct financing of expenses from the profit, or by preliminary formation at the expense of the profits of various funds, the funds of which are then used for their intended purpose. In order to use the profit, funds are created:

Spare;

Production Development Fund;

Fund social development enterprises;

Material incentive fund;

Deductions from profits to repay bank loans.

Part of the profit can be retained - this is an additional financial reserve that can be used to replenish funds and increase the authorized capital. Retained earnings indicate the financial stability of the enterprise and the availability of a source for further development.

The amount of profit and its dynamics are influenced by the following groups of factors:

External factors do not depend on the activities of enterprises, but can have a significant impact on the amount of profit. These include: the level of prices for consumed resources, natural conditions, competitive environment, government regulation, tax system, etc.

Internal factors depend on the activities of the enterprise and are subdivided into production and non-production.

Non-production factors are not related to the production process, they include: supply and sales activities, environmental protection, working and living conditions of employees, etc.

Production factors characterize the availability and use of production resources, and in turn are subdivided into extensive and intensive.

Extensive factors affect the process of making a profit through quantitative changes in the amount of funds and objects of labor, financial resources, equipment operating time, number of personnel, working time fund, etc.

Intensive factors affect the process of making a profit through "qualitative" changes: increasing the productivity of equipment and its quality; the use of advanced types of materials and the improvement of their processing technology; acceleration of the turnover of working capital; improving the qualifications and productivity of personnel; reduction of labor intensity and material consumption of products, etc.

Indicators of profitability of the enterprise.

To assess the level of work efficiency, the result obtained - profit - is compared with the costs or resources used. Profitability characterizes the degree of profitability, profitability and profitability.

The indicators of profitability, used to assess the effectiveness of advanced resources and costs used in production, commercial and other activities, and indicators, on the basis of which the profitability and efficiency of property use are determined, are distinguished.

The estimated indicator of the production and economic activity of the enterprise is profitability of sales... It reflects the level of demand for products, works and services, how correctly the company determines the product range and product strategy. Profitability of sales characterizes the ratio of profit from sales to the amount of proceeds from sales, expressed as a percentage.

P sales = Profit from sales / Cash proceeds from sales * 100%

Property profitability enterprise characterizes the profit that the enterprise receives for each ruble invested in assets.

Rome = Profit at the disposal of the enterprise / Average assets * 100%

Profitability equity capital shows the effectiveness of the use of funds belonging to the owners of the enterprise.

Rsk = Net profit / Average equity * 100%

Product profitability characterizes the cost-effectiveness of production and sales of products.

Rpr = Profit from sales / Total cost of sales. products * 100%

This article is devoted to deciphering concepts that seem to be synonymous. It will be about profit, revenue and their types.

Definition and calculation formula

Profit it is customary to call the difference between the proceeds from the sale of goods / services and the costs of their production / provision.

Profit is important economic indicator, serving to display the effectiveness of entrepreneurial activity.

Profit and revenue are not the same thing. The formula for calculating profit is very simple:

Revenue - Expenses = Profit

Net profit

Net profit is the money that remains with the company after various deductions, taxes and other payments are deducted from the balance sheet profit. Net income is a source of funding production processes... It also forms reserve funds, and it is due to it that the working capital increases.

The main factors affecting the volume of net profit are:

- the amount of tax and other payments;

- company income from the sale of goods / services;

- cost price.

How to calculate net profit

The volume of net profit is calculated in several stages.

- 1. The first step is to calculate how much money was spent on the production of goods (the cost of the material is also taken into account).

- 2. Then the calculation should be made. Gross income is the result of deducting production costs from revenue (that is, funds received by an entity as a result of the sale of a product).

- 3.

This is enough to find out the amount of net profit:

To calculate the net profit, you need to deduct the mandatory deductions (taxes, etc.) from the gross income.

Gross profit

To calculate gross profit, you need to subtract the cost of goods from the amount received by the company as a result of its sale.

How, then, does gross profit differ from net profit? And the fact that the gross "includes" all tax and other deductions.

To correctly calculate the gross profit, it is necessary to accurately calculate the amount of expenses, including.

Cost price- these are the costs of the company for the manufacture of goods.

Factors affecting profit

Factors affecting the volume of gross profit are divided into two groups: internal and external. Internal ones depend on the management of the enterprise. Here they are:

- trading performance;

- improving the quality characteristics of the product;

- increase in production;

- reduction in production costs;

- rational (most efficient) use of production facilities;

- work to expand the range;

- effective advertising campaign.

Concerning external factors, then the management cannot influence them. Let's list them:

- location of the enterprise;

- ecological situation in the region;

- natural features;

- business support by the state;

- political situation in the country and in the world;

- features of the economy (country and world);

- provision of transport and necessary resources.

What is the revenue

Revenue is what an entity receives from the sale of goods or the provision of services. It is no wonder that any company seeks to generate revenue. Revenue and profit, as already mentioned, are not identical concepts, because profit is the difference between revenue and expenses.

The sources of revenue may vary. There are the following types of revenue (based on its source):

- 1. Revenue from the sale of a product or service. It includes all funds received by the enterprise as a result of the sale of its products within a certain period.

- 2. Investment proceeds.

- 3. Revenue from financial transactions.

total revenues Is the sum of funds received from all these sources.

About gross revenue

Gross revenue is the total income received by the company as a result of the sale of goods, as well as other operations not related to the sale. However, the main component of gross revenue is sales revenue. The following formula is used to determine gross revenue:

BB = Item Quantity * Unit Price

Since gross revenue does not take into account production costs, it cannot be considered the main indicator of the company's performance. But when it comes to a comprehensive performance appraisal, gross revenue is also taken into account.

To summarize, let's look at the formula again. So:

Profit = Revenue - Expenses

This formula shows that profit and revenue are not synonymous. When calculating profit, all expenses of the enterprise are taken into account, and not only the cost of goods. In addition, the profit can be negative.

Enterprises as individual producers receive cash proceeds from the sale of their products. This revenue does not indicate a profit. For the final activity of the enterprise, it is necessary to compare the proceeds with all the costs of production and sales attributed to the cost of production.

If the cost price is lower than the proceeds, then the financial result speaks of making a profit. If the revenue is equal to the cost price, then the financial result is equal to zero, that is, the company only managed to cover the costs of production and sales. If costs are higher than revenues, then the company remains at a loss. This indicates a negative financial result.

Thus, profit is the main goal of entrepreneurial economic activity. enterprises are related to each other as follows.

Enterprise income is an indicator of an increase in economic benefits, which is expressed in the form of receipts of assets or a decrease in liabilities, which together lead to an increase in the company's equity capital (except for cases of its increase due to contributions from owners).

Income is classified into the following groups: income from sales of products, other operating income (income from lease of assets, exchange rate differences), financial income(from participation in capital, investment activities, interest, dividends), other income from investments, sale of assets.

Profit enterprises- this is the main part of monetary savings, which is created by enterprises of all forms of ownership. It reflects the financial result of the economic profit of the enterprise as an indicator of production efficiency allows you to determine the volume and quality of products, the level of cost, labor productivity. On the other hand, the arrival stimulates the strengthening of commercial accounting and intensifies production.

According to the profit indicator, one can judge the plan and evaluate the economic activity of the enterprise.

3. The financial result is calculated from operating activities.

4. Profit (loss) from activities before taxation is calculated.

5. Profit (loss) from ordinary activities is taken.

6. Profit (loss) is deducted taking into account extraordinary activities.

The profit of the enterprise as the final financial result of economic activity is the difference between the amount of income and the costs of production and operations for the sale of products, taking into account losses from all types of business operations.

The enterprise for the reporting period is determined by adjusting profit from ordinary activities for the amount of income and expenses that occurs in extraordinary circumstances.

Subsequently, the net profit is allocated to the capitalized and consumable part. The capitalized part is the funds allocated for investment in the development of production and the formation of reserve and insurance funds. The consumed part is spent on the payment of corporate rights to the owners, material incentives workers and the formation of funds for social needs. The rest forms retained earnings, through which equity is financed.

It shows the efficiency of work, characterizes the solvency and liquidity of the company. The dynamics of the enterprise's development depends on the size of the profit received, since part of it is invested in expansion, modernization, production automation, and personnel training.

Any activity commercial organization aimed at making a profit. The company should at least cover losses, and the maximum should receive income that exceeds them. Net income is called profit. Do not confuse profit and sales income (revenue).

In the narrow sense, profit is the difference between the proceeds from the sale of goods (works, services) and the costs incurred by the enterprise in the production of these goods (works, services). If we consider profit from the point of view economic analysis, then its concept is much broader. The profit structure is taken into account. As a result, the head of the company can determine which type of activity is the most profitable, which is unprofitable, and identify the factors that affect the amount of profit. Based on this, he takes management decision, allowing you to increase the profit indicator.

Functions

To determine what effect profit has on the activities of the enterprise, it is necessary to study its main functions:

- Estimated - in a market economy, profit is an indicator showing the efficiency of the enterprise, this directly affects the market value of the company, its investment attractiveness.

- Stimulating - the higher the profit, the more resources the company can use for its development.

- Fiscal - the profit of an enterprise affects not only its development, but also the development of the state as a whole. The larger it is, the higher payments to the local and state budgets, respectively, this money in the future is directed to the development of infrastructure and social needs.

- Control - the absence of profit indicates that the company is operating ineffectively and incurs losses. Accordingly, it is urgent to take appropriate measures to get out of the situation.

The size of the company's profit indicates how efficiently the management uses resources and is one of the main financial indicators.

Distribution

The development of an enterprise depends not only on the size of the profit received, but also on its distribution. The success of the company largely depends on how effectively it will be used.

The distribution of profits should be structured in such a way that, as a result, it was possible to achieve an increase in production productivity. The distribution process itself implies the direction of a share of the profit for expansion, modernization of production, in the budget, payment of dividends to the owners of shares. When distributing profits, it is important to consider the following principles:

- The profit received by the enterprise is divided between this enterprise and the state.

- The amount of the part of the profit that should be redirected in favor of the state depends on the amount of taxes and fees established by the current legislation. This part cannot be arbitrarily changed by the enterprise.

- Regardless of the amount of profit received, the company should be interested in expanding production, increasing the financial result.

- First of all, the profit that remained at the disposal of the enterprise after paying taxes and fees should be directed to development, and the rest can be directed to consumption.

Since the size of the part of the profit that is transferred to the state has been established, the enterprise can distribute only the net part of the profit - which remained at its disposal after paying taxes and fees. Most of it is reinvested in the company to ensure its development. The enterprise itself decides how much to use for accumulation and how much for consumption. The task of management is to establish a distribution mechanism in such a way as to ensure dynamic and stable development.

05 01 medical biochemistry where to work

05 01 medical biochemistry where to work Biochemistry who can work

Biochemistry who can work Types of monopolies: natural, artificial, open, closed

Types of monopolies: natural, artificial, open, closed