Opportunity cost theory was developed within. Examination: The Opportunity Cost Concept. Von Wieser's Opportunity Cost Theory

Opportunity cost is the possible benefit from using capital in a different way than what was actually used. Sometimes such costs are also called imputed costs.

In fact, opportunity costs answer the question - how much money we would earn (or how much we would spend) if we acted in a different - alternative way.

Opportunity Costs of Keeping Money in Cash

Let's take for example that you have 1000 rubles. If you keep this money just at home ("in the box"), then they will not generate income. Those. in a year you will have the same 1000 rubles.

Another way to keep money is to deposit in a bank. In this case, depending on the type of deposit and the term for which the deposit is open, the yield will be from 5 to 10%. Let's take, for example, 5% per annum. In this case, in a year you will have 1,050 rubles, i.e. 50 rubles more.

Opportunity costs will be 50 rubles.

Opportunity Costs of Student Education

If a student went to study at a university, then we will assume that he does not work, i.e. does not make money itself. Parents pay for his education (i.e., we will consider the opportunity costs of paid education).

If you don't go to study, then:

- firstly, you do not need to pay tuition fees (alternative 1)

- secondly, you can go to work and get paid (alternative 2).

The student loses these two alternatives.

Thus, the opportunity cost of obtaining higher education are equal - the cost of training + earnings for 5 years of work (which was not received).

At the same time, it is important to understand that the opportunity costs of paid education do not include, for example, the cost of buying food or clothes, since you will need to eat and dress in any of the options - both during training and if not studying.

Opportunity cost of building a new stadium

When building a new stadium, alternative options for capital investment will be, for example:

- construction of schools, kindergartens

- construction of residential buildings in this area

- or construction shopping center or office building

It turns out that the opportunity cost of the stadium will be the difference in price between these facilities and the new stadium, which is obviously one of the most expensive construction projects.

The process of making a managerial decision involves comparing several alternative options among themselves in order to choose the best one. The indicators compared in this case can be divided into two groups: the first remain unchanged for all alternative options, the second vary depending on the decision... It is advisable to compare only the indicators of the second group with each other. These costs, which distinguish one alternative from another, are called relevant. Only they are taken into account when making decisions.

In the process of control, the control system must influence the control object. The actual cash flows that are reflected in the accounting of the enterprise act as a result of the previously adopted management decisions... Information about these flows is an element of feedback between the subject and the controlled object. It has significant value for justifying management decisions, but the result of these decisions will change not today's cash flows, but future ones. To assess the financial and economic efficiency of management decisions taken, it is necessary to compare future cash inflows with future outflows Money due to the adoption and implementation of these decisions.

For example, in order to decide on the release of a new type of product, it is necessary to calculate the amount of costs incurred by the enterprise in connection with the production and sale of a new product, and compare this value with the expected income from its sale. At first glance, it may seem quite natural to use for these purposes the calculation of the total cost of one product, and, multiplying its amount by the planned sales volume, to obtain the total cost of new products... But this approach overlooks the fact that a significant part of the total cost is associated with cash flows that took place in the past, even before adoption. this decision... The implementation of the solution will not have any impact on the corresponding cash flows in the future. If it is planned to direct the stocks of materials already available at the enterprise for the production of a new product, and their quantity is sufficient to cover the entire planned demand and no new purchases of these materials are foreseen, then it is necessary to determine what the cost of purchasing these materials has to do with the release of a new product, whether it will reduce the amount of these costs, the refusal to produce it, as well as what real cash outflows the company will incur when using these materials in the process of implementing this management decision. Lytnev O.A. The basics financial management... Part. I: Textbook / Kaliningrad University. - Kaliningrad, 2000.

It can be argued that the material costs for the production of new products for the enterprise will be equal to the amount that it could have gained by selling the stock of materials, since the enterprise has no other alternative to using them. A more general definition of economic costs (opportunity costs) refers to them as payments that the firm is obliged to make, or the income that the firm is obliged to provide to the supplier of resources in order to divert these resources from use in alternative industries. V this example the release of new products will be expedient for the enterprise in the event that the price that the buyer will offer for it will cover the opportunity costs of both raw materials and materials, as well as all other resources spent on the production of the product.

The make-or-buy decision is needed to explore ways to better utilize existing production facilities. Solution options can be:

1. Keeping production facilities free;

2. Transition to the purchase of components and lease of unused funds;

3. Purchase of components and transfer of spare capacities to the production of other products.

To produce on your own or to buy from outside is a strategic decision related to long-term optimization of the production program. This decision is complex and must be carefully considered and justified. It should be assessed not only from an economic, but also from a technological, qualitative, organizational position. At the same time, many conditions must be taken into account: the degree of capacity utilization, the quality of products and services, the creation or reduction of jobs, fluctuations in demand, and so on.

In the presence of free production capacity, buying on the outside is more profitable if the total acquisition costs are lower than variable costs own production.

If own production assumes the expansion of production capacity, then it can be opened only under the condition of stable demand and its growth in the future. Otherwise, with the onset of a recession in market demand, capacities become excessive with all the ensuing consequences.

When making this type of decision, there are qualitative relevant factors (which are important in making decisions):

supplier reliability;

supplier quality control;

the relationship between employees and administration in the supplier's company;

supplier price stability;

Internal:

ownership of facilities;

technological changes.

Another type of similar solution, but, as it were, on the contrary, is to sell or process further, which is associated with the possibility of selling products at a certain stage of production or continuing processing in order to generate additional income.

Focusing on cash flows that are generated by management decisions allows you to define opportunity costs as the amount of cash outflow that will occur as a result of a decision. The decision to launch a new product into production entails a loss of proceeds from the sale of materials available at the enterprise. The cost of these materials at the prices of their possible sale will be the amount of material costs, which is taken into account when justifying the corresponding decision.

When planning its activities, an enterprise must form such a portfolio of orders so that their combination covers all fixed costs and ensures profit. If this cannot be achieved, then it is necessary to reduce fixed costs that are not directly related to the production and commercial activities of the enterprise. It cannot afford to invest its own financial resources development of potential that does not bring real returns. In any case, we are talking about qualitatively different decisions that have nothing to do with making a decision on the implementation of a specific order. If a business has a choice, then of course, it should choose the more profitable option that provides maximum coverage of fixed costs. But the lack of choice cannot serve as a reason for refusing to manufacture products, the price of which is higher than their opportunity cost.

Refusing to manufacture products that fully cover their opportunity costs in the hope of getting more profitable orders, which recoup the full cost of each product, the enterprise misses real cash inflows, hoping for the expected higher cash inflows in the future. This behavior is contraindicated when doing business. Business owners (investors) pay their managers for the only service - a real increase in invested capital. The manager should not give up the opportunity to provide at least a minimal increase in capital, if he does not have a real alternative opportunity for a more profitable use of the assets of the enterprise.

The following forms of practical manifestation of the concept of opportunity costs can be distinguished:

When justifying financial decisions, one should focus primarily on the cash flows that are generated by these decisions. Those and only those cash flows that are directly related to this management decision should be taken into account. Receipts and expenditures of funds, regardless of the time of their occurrence, which are not related to the decision made, should not be taken into account. In other words, there are incremental cash flows, and the opportunity costs accounted for in it are marginal. If, as a result of making a decision on the release of a new product, it is necessary to employ additional employees on the staff of the enterprise, then the marginal costs of maintaining new employees should be included in the composition of the costs of the product being mastered, while the costs of maintaining the same amount are not related to this decision and to the composition opportunity cost cannot be included.

The decision made cannot affect the expenses already incurred or the income received earlier. Therefore, when justifying this decision, it is necessary to take into account only future cash flows. All past payments and receipts, including the cost of purchasing equipment, are historical in nature, they can no longer be avoided or prevented.

Projects that provide cash inflows, the present value of which exceeds the value of the associated opportunity costs, increase the value of the enterprise. Increasing the capital of the owners is the main goal of any company and its managers. We can say that such an abstract concept of "opportunity costs" gives the manager a powerful, fairly simple, understandable and very practical tool for monitoring the effectiveness of his work: by implementing solutions and projects for which cash inflows exceed cash outflows, it contributes to the growth of the enterprise value, thus performs its functions in the most appropriate way. This can be formulated in a slightly different way: an enterprise should only invest in projects with a positive net present value. The task of the manager is to ensure the selection of just such projects and solutions. Lytnev O.A. Fundamentals of Financial Management. Part. I: Textbook / Kaliningrad University. - Kaliningrad, 2000.

The application of the concept of opportunity costs poses serious challenges to the information management subsystem. Obviously, data from traditional accounting alone is not enough in this case. There is a need to create an accounting system focused on a more complete and accurate identification of opportunity costs - a system management accounting... The cornerstone of such a system is the division of all expenses of the enterprise into conditionally constant and variable parts in relation to the volume of output (sales) of products. Planning and accounting of costs in this context allows them to be more closely related to the consequences of specific management decisions, to exclude the possibility of "imposing" on financial results this decision is influenced by unrelated factors (for example, plant-wide overhead costs). Another distinguishing feature of such systems is the wide coverage of enterprise costs by rationing. This allows you to more accurately predict future cash inflows and outflows. The third feature of management accounting systems is the personification of information, that is, linking accounting objects with the areas of responsibility of specific managers, which makes it possible to even more clearly delineate the costs that depend on specific decisions from all the others that have no relation to costs.

These features are reflected in such accounting systems as the normative method of accounting for production costs (standard cost system), variable cost accounting (direct costing), cost center accounting, as well as profit centers and responsibility centers.

On Russian enterprises all these systems take root rather slowly, despite the fact that the introduction of the normative method of cost accounting has been going on for quite a long time. It seems that one of the reasons for this situation is the underestimation of the management of enterprises of the management and financial functions of these methods. It is still believed that they are just varieties of general accounting and the solution of emerging issues is given to the accounting personnel of enterprises. But the accounting workers are faced with a completely different task - the timely and reliable determination of the full cost price in terms of costs, for the solution of which it is quite enough traditional methods calculation. For ordinary bookkeeping, dividing costs into variable and fixed parts is much less important than dividing them into direct and indirect costs. Solving fundamentally new tasks in comparison with financial management, the accountant also perceives the task set before him in a different way. For him new method accounting is, first of all, a different way of distributing indirect costs between products (or rejection of such distribution in the case of the direct costing method). And since the introduction of any new method is associated with additional costs, then not seeing a significant benefit from such a replacement, the accounting worker subconsciously opposes changes that can bring him nothing, except for additional inconvenience and unnecessary work.

The company is interested in creating a management accounting system that will focus on controlling alternative costs. In terms of a number of properties, this system should differ significantly from traditional accounting.

On the example of opportunity costs, it becomes obvious the influence that can (and should) have at first glance the most abstract provisions. economic theory on the practice of specific enterprises. In the end, the enterprise will suffer quite tangible, real financial losses caused by the operation of abstract categories, the existence of which the heads of analytical departments did not know or simply did not want to know.

In many cases, the opportunity cost is not measurable at all or very roughly estimated due to the need to take into account the huge amount of losses and gains as a result of choosing one or another option. Here are some of these cases. Choosing one strategy of functioning and development, the company loses the opportunity to develop in another direction; the country chooses one area of socio-economic development, while sacrificing others. In both cases, the alternatives available to the enterprise and the state are very difficult to compare due to their heterogeneity and the impossibility of bringing them to a common denominator. It is even more difficult to make a cost, monetary assessment of alternatives when it is necessary to take into account the impact of an alternative solution on public welfare. Paliy V.F. Management accounting of costs and incomes with elements of financial accounting: Textbook. - M .: Infra-M, 2008 ..

In the practical application of the concept of the cost of lost opportunities, an imputation procedure is used. The concept of "imputation", or imputation, was one of the first to be used by Austrian scientists K. Menger and F. Wieser. It means the procedure for linking certain actions of an economic entity with the benefits that he could receive if he took other actions. To carry out the imputation procedure, it is necessary to bring costs and benefits to a comparable form. If the benefit is fixed as a goal, then only costs are compared. For example, you can get to work by trolleybus or by route taxi... In this case, when evaluating alternatives, the time and cost of travel to work are compared. In other cases, when costs are stable (certain budgetary constraints), benefits and results are compared.

It should be noted that when comparing alternatives, in a number of cases, not average, but incremental cost-benefit ratios should be used (additional costs are compared with additional benefits). In medicine, one type of intervention should be compared not only with other types of intervention, but also with non-intervention.

Difficulties arise when using the imputation procedure. The main obstacle is that it is far from always possible to reduce to a common denominator all the losses that the subject bears when making this or that decision. Ivashkevich V.B. Management accounting: a textbook for universities. - M .: Economist, 2006.

It is believed that the alternative may be the cost arising from not taking advantage of the best available opportunity. But what is lost may not be the optimal, the best opportunity, but, say, the so-called second best, third, etc. the best option, we lose the opportunities associated with the use of sub-optimal options.

Another problem in assessing lost opportunities is its subjective nature. In some cases, the ranking of alternatives according to the degree of their attractiveness is subjective; selection of costs and benefits (effects) that are taken into account when comparing different options economic shares, resource use.

Processes related to alternative assessments, as a rule, affect the interests of different economic actors. An increase in the alternative price of a resource is beneficial to its sellers and unprofitable to its buyers. The use of a resource in one direction and non-use in another may meet the interests of one group (person) and not meet the interests of another group (person).

In addition, the decision to choose from several alternatives is in some cases made by a group of people (in economic policy, at an enterprise). Therefore, the problem arises of assessing the costs of lost opportunities for this group and for each of its members separately. The owner of a large block of shares in an enterprise can block an alternative, which, according to him, entails high opportunity costs for the enterprise as a whole, for all shareholders, but in fact, only for him. In the future, the subjective nature of the costs of lost opportunities may become a subject for joint research by representatives of the economic, psychological and sociological sciences.

Taking into account the above and recognizing the difficulty of assessing alternative costs, it is possible to propose an algorithm for assessing the opportunity costs of one of the key economic entities - an enterprise: Trubochkina M.I. tutorial... - M .: Infra-M, 2008.

1) determination of the non-alternative part of the enterprise's costs (administrative and managerial costs, insurance payments, etc.) and the alternative (part of the cost of wages, procurement of materials, etc.);

2) the promotion of alternatives within the alternative part of the costs;

3) comparison of discounted flows of "expenses-income" for each alternative, placing them according to the level of profitability, the effect obtained, etc .;

4) the implementation of the imputation operation and the assessment of losses when choosing a non-optimal alternative.

Thus, the abstract concept of "opportunity costs" gives the manager a powerful, fairly simple, understandable and very practical tool for monitoring the effectiveness of his work: by implementing solutions and projects for which cash inflows exceed cash outflows, he contributes to an increase in the value of the enterprise, thereby fulfills its functions. In this regard, there is a need to create an accounting system focused on a more complete and accurate identification of opportunity costs - a management accounting system.

opportunity cost economic resource

Opportunity cost is the missed possible income from the alternative use of resources.

Analyzing accounting statements firm, it is impossible to draw any conclusions about the alternative costs. Opportunity costs are those costs incurred by a firm by abandoning many other options for using resources in favor of the only one it chooses.

If resources can be more efficiently used in another project, they must be moved. If such a reallocation of resources does not occur, then the firm loses potential income. The costs incurred by the firm in reallocating resources between projects should also be taken into account. If they exceed the difference between the profitability of alternative projects, then the regrouping of resources between them is not advisable.

For financial management, data on the company's future cash flows arising from the adoption of a particular management decision are of greatest interest. In the process of control, the control subsystem must influence the control object. The actual cash flows reflected in the accounting of the enterprise result from previously made management decisions. Information about these flows is an element of feedback between the subject and the controlled object. It has significant value for informing management decisions, but the result of these decisions will change future, not today's cash flows. To assess the financial and economic efficiency of the decisions made, it is necessary to compare future cash inflows with future outflows due to the adoption and implementation of these decisions.

For example, in order to make a decision on the release of a new type of product, it is necessary to calculate the amount of costs incurred by the enterprise for the production and sale of a new product, and compare this value with the expected income from its sale. At first glance, it may seem quite natural to use for these purposes the calculation of the total cost of 1 product, and, multiplying its amount by the planned sales volume, to obtain the total cost of the new product. However, this approach overlooks an important fact: a significant part of the total cost is associated with cash flows that took place in the past, even before this decision was made. The implementation of the solution will not have any impact on the corresponding cash flows in the future. If it is planned to direct the stocks of materials already available at the enterprise for the production of a new product, and their available quantity is sufficient to cover the entire planned need and no new purchases of these materials are foreseen, then the questions arise: what does the cost of purchasing these materials have to do with the release of a new product? Will the refusal to produce it reduce the amount of these costs? What real cash outflows will the company incur using these materials in the process of implementing this solution?

To answer these questions in financial management, the concept is widely used opportunity costs... In economic theory, alternative (imputed or economic) costs are understood as the quantity (value) of other products that should be discarded or donated in order to obtain a certain amount of this product. Returning to our example, it can be argued that the material costs for the production of new products for the enterprise will be equal to the amount that it could have gained by selling the stock of materials, since the enterprise has no other alternative to using them. A more general definition of economic costs interprets them as payments that the firm is obliged to make, or the income that the firm is obliged to provide to the supplier of resources in order to divert these resources from use in alternative industries. In our example, the release of a new product will be expedient for the enterprise if the price that the buyer will offer for it will cover the opportunity costs of both raw materials and materials, and all other resources spent on the production of the product.

The focus of financial management on cash flows generated by management decisions allows you to define opportunity costs as the amount of cash outflow that will occur as a result of a decision. The decision to launch a new product into production entails a loss of proceeds from the sale of materials available at the enterprise. The cost of these materials at the prices of their possible sale will be the amount of material costs that should be taken into account when justifying the appropriate decision.

Distinguish internal and external opportunity costs. If the company did not have stocks of the necessary materials, it would have to purchase them, while incurring direct cash costs. In this case, one speaks of external opportunity costs. The enterprise will have to incur the same costs if, in order to manufacture a new product, it needs to hire an additional number of employees of appropriate qualifications. Wage(with all charges on it) of these workers will represent an additional cash outflow, the value of which will characterize the level of external opportunity costs. If you plan to use an internal resource. already available at the enterprise, and paid earlier, regardless of the decision taken, then they talk about internal costs. Their size is also determined by the size of future cash outflows, but the nature of these outflows will be different. As a rule, we will not talk about cash expenses, but about the loss of additional income. In case of material reserves Is the price of their possible implementation. If, instead of hiring new workers, the enterprise wants to use the labor of existing personnel in the production of a new product, then the value of internal opportunity costs will be determined by the amount of income that the enterprise will lose as a result of the diversion of workers from their previous occupations. The total opportunity costs of any management decision are equal to the sum of its internal and external opportunity costs

The term denoting lost profit (in a particular case, profit, income) as a result of choosing one of the alternative options for using resources and, thereby, rejecting other opportunities. The amount of lost profit is determined by the utility of the most valuable of the discarded alternatives. Opportunity cost is an integral part of any decision making. The term was introduced Austrian economist Friedrich von Wieser in the monograph "The Theory of Social Economy" in 1914.

Opportunity cost theory is described in the 1914 monograph "The Theory of Social Economy". According to her:

The contribution of von Wieser's opportunity cost theory to economics is that it is the first description of the principles of efficient production.

Opportunity costs are not costs in the accounting sense, they are just an economic construct to account for missed alternatives.

Example

If there are two investment options, A and B, and the options are mutually exclusive, then when assessing the profitability of option A, it is necessary to take into account the lost income from not accepting option B as the cost of a missed opportunity, and vice versa.

A simple example is given by the well-known anecdote about a tailor who dreamed of becoming a king and at the same time "would have been a little richer, because he would have sewed a little more." However, since being a king and a tailor simultaneously is impossible, then the income from the tailoring business will be lost. This should be considered lost profits upon accession to the throne. If you remain a tailor, then the income from the royal office will be lost, which will be opportunity costs given choice.

Notes (edit)

Wikimedia Foundation. 2010.

See what Opportunity Cost is in other dictionaries:

- (opportunity costs) Benefit lost due to non-use of an economic resource in the most profitable of all possible activities. For example, for a self-employed small owner, the opportunity cost is ... ... Financial vocabulary

opportunity cost- Income lost by the economic agent as a result of making any decision (although it could have been otherwise). The opportunity cost of a good or service is the cost of goods and services that had to be abandoned in order to ... ... Technical translator's guide

- (opportunity costs) Benefit lost due to non-use of economic resources in the most profitable of all possible spheres and sectors of the economy. For example, for an independent owner, the opportunity cost is the highest ... ... Business glossary

- (opportunity cost) The number of goods and services that could be obtained instead of any other good. If it was not produced, the resources used to make it could be used to produce other goods and services. If… … Economic Dictionary

Opportunity Cost- see Alternative costs ... Terminological dictionary of a librarian on socio-economic topics

Opportunity Cost- (OPPORTUNITY COST) economic costs of any type of activity, the value of which is determined by the size of the maximum income from the most effective alternative activity ... Modern money and banking: a glossary

Opportunity Cost- The difference between the efficiency of real and desired investments, taking into account fixed costs and transaction costs. The efficiency differential is the consequences of not being able to execute all desired trades. The most valuable of ... ... Investment Dictionary

Opportunity Cost- income that is possible in an alternative option, but lost due to the fact that these resources are used in accordance with another option ... Glossary of terms for the examination and management of real estate

Opportunity cost, opportunity cost- [(opportunity cost] Costs (often called imputed) that the owner of the resource can incur by choosing a specific option for its use and - thereby - rejecting all available alternatives. Numerically defined as ... ... Economics and Mathematics Dictionary

The expected return on the best of the investment alternatives that are discarded for this project (See RETURN OF RETURN) Glossary of Business Terms. Academic.ru. 2001 ... Business glossary

Books

- The economic way of thinking, Heine P., Bouttke P., Prichitko D .. The economic way of thinking is one of the most popular courses in economic theory in the world. Book 15 describes not only the basic principles of micro- and macroeconomic analysis, but also ...

In conditions of limited economic resources, each subject of economic relations is faced with the issue of optimal use of available resources in order to obtain the maximum. But in the process of selection, the so-called opportunity cost, which will be discussed below.

What are Opportunity Costs?

Since in most cases we are dealing with limited resources, the question of their alternative use always arises. Of all the possible alternatives, there is always the best alternative that provides the maximum benefit. If, as a result of the choice of alternatives, the preference was given to the not the best alternative, then there are “opportunity costs” or “lost profits”.

Opportunity Cost(the term “loss of profit” or “opportunity cost” is also used) - economic term, denoting the lost profit (in a particular case - profit, income) as a result of choosing one of the alternative options for using resources and, thereby, rejecting other opportunities. The amount of lost profit is determined by the utility of the most valuable of the discarded alternatives.

Opportunity Cost represent the loss of potential benefit from other alternatives when choosing any other alternative. That is, opportunity cost is the benefit, profit, or value of something that must be given up in order to get or achieve something else. Since every resource (land, money, means of production, labor resources, time, etc.) can be used for alternative use, each action, choice or decision is associated with opportunity costs.

The concept of opportunity cost is critical in trying to make efficient use of scarce resources. Opportunity cost is not limited to monetary or financial costs: The real value of lost (underproduced) production, wasted time, pleasure, or any other benefit that provides some utility should also be considered an opportunity cost. Opportunity cost of a product or service refers to the income that can be obtained through its alternative use. The meaning of the opportunity cost concept can be explained using the following examples:

- opportunity cost of money invested in own business, Is the rate of return (or profit adjusted for the difference in risk) that can be obtained by investing these funds in other enterprises;

- the opportunity cost of the time a person spends on his job is the salary (or other income) that he could receive by working in other companies or in other positions (adjusted for the relative moral satisfaction from the two professions).

- the opportunity cost of using equipment to produce one product is the income that could be obtained from the production of other products.

Opportunity costs are fundamental costs in economics and are used in calculating the costs and results of project analysis. Such costs, however, are not reflected in, but are taken into account when making management decisions by calculating cash costs and their resulting profit or loss.

Opportunity cost is a broader concept than the estimated cost, and therefore it is it that is used when making investment decisions when calculating the associated costs and potential profits from them. For example, if it is necessary to choose from several competing and mutually exclusive options, the choice will be based on an estimate of the opportunity costs equal to the income that could be obtained as a result of the second most optimal option.

Opportunity Cost History

The term "opportunity cost" was originally used in 1894 by David L. Green in his article "Pain Cost and Opportunity-Cost" in the Economics Quarterly. However, the idea of opportunity cost is also found in the work of earlier authors, including Benjamin Franklin and Frederic Bastiat. The famous phrase "Time is money", published in "Advice to a Young Merchant" (1748) is based on the idea of opportunity cost.

Later, the term "opportunity cost" was also used by the Austrian economist Friedrich von Wieser in The Theory of Social Economy (1914). Specifically, his opportunity cost theory suggests the following:

- productive goods represent the future. Their value depends on the value of the final product;

- limited resources determine the competitiveness and alternativeness of the ways of their use;

- are subjective in nature and depend on alternative opportunities that have to be sacrificed in the production of a certain good;

- the actual value (utility) of any thing is the lost utility of other things that could have been produced with the resources spent on the production of this thing. This provision is also known as Wieser's law;

- imputation is carried out on the basis of opportunity costs - the cost of lost opportunities.

The contribution of von Wieser's opportunity cost theory to economics is that it is the first description of the principles of efficient production.

Opportunity Cost: Explicit and Implicit

Explicit costs

Explicit costs Are the opportunity costs that include direct cash payments... The explicit opportunity cost of factors of production that do not yet belong to the producer is the price (value) that the producer must pay for them. For example, if an enterprise purchases equipment for $ 100,000, then its apparent opportunity cost is $ 100,000. These cash expenses represent a missed opportunity to acquire something else for $ 100,000. (for example, raw materials and supplies).

Implicit costs

Implicit costs(also called implied, imputed or contingent costs) are opportunity costs that are not recorded as cash outflows, but which are supported by the firm's choice not to allocate its existing (own) resources or factors of production in favor of more profitable options for their use. For example: if a company placed the available free funds on a deposit in a bank, it would be able to receive income in the form of accrued interest. If the company rented out the existing warehouses, you would be able to receive rent payments. The amount of such payments is the implicit opportunity cost.

How do you calculate the opportunity cost?

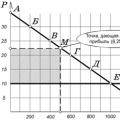

Opportunity costs can be calculated as the difference between the most optimal (profitable) option and the chosen (realized) option; therefore, they are often called “opportunity costs”. The cost of lost opportunity is precisely the result of comparing this choice with the best available option. Thus, the opportunity cost can be calculated using the formula:

Opportunity Cost = Result of the Best Alternative - Result of the Selected AlternativeOf course, this formula is very simplified, since in some cases it will be necessary to carry out an additional “wind correction”, to take into account various economic factors and parameters. However, it follows from the above formula that:

- The choice is optimal if its opportunity costs are minimal. A rational economic agent minimizes opportunity costs.

- Opportunity costs cannot be less than zero... Opportunity cost is zero if the most optimal option is used, i.e. the variant is compared with itself.

An example of calculating opportunity costs

Example 1. The investor evaluates the options for investing funds. the first investment project is 9.5%, and the second - 7.3%. In this case, for the second investment project, the opportunity costs will be:

Opportunity Cost = 9.5% - 7.3% = 2.2%Thus, if the investor chooses the second project, then his lost profit (lost profit) will be 2.2%.

Example 2. Have natural person there was a need to receive. Bank A offers a symbolic loan of 0.1%. Bank B offers loans at 14% per annum. In this case, bank B additionally charges a commission for issuing a loan, while bank A charges whole line additional commission fees. How to deal with this situation?

To begin with, the cost of the loan must be brought to a "common denominator", i.e. calculate. Let us assume that the effective interest rate on a loan from bank A is 24% per annum, while on a loan from bank B it is 15% per annum. In this case:

Opportunity Cost = 24% - 15% = 9%That is, taking a loan from bank A, the client will incur opportunity costs (overpay on the loan) in the amount of 9% per annum, despite the fact that bank A declared a nominal interest rate of 0.1% per annum!

05 01 medical biochemistry where to work

05 01 medical biochemistry where to work Biochemistry who can work

Biochemistry who can work Types of monopolies: natural, artificial, open, closed

Types of monopolies: natural, artificial, open, closed